Learn how to adjust a pay run in Payroller

Learn how to adjust a pay run in Payroller with our simple guide below.

To learn how to edit a pay run and submit an update event to the ATO, visit this page.

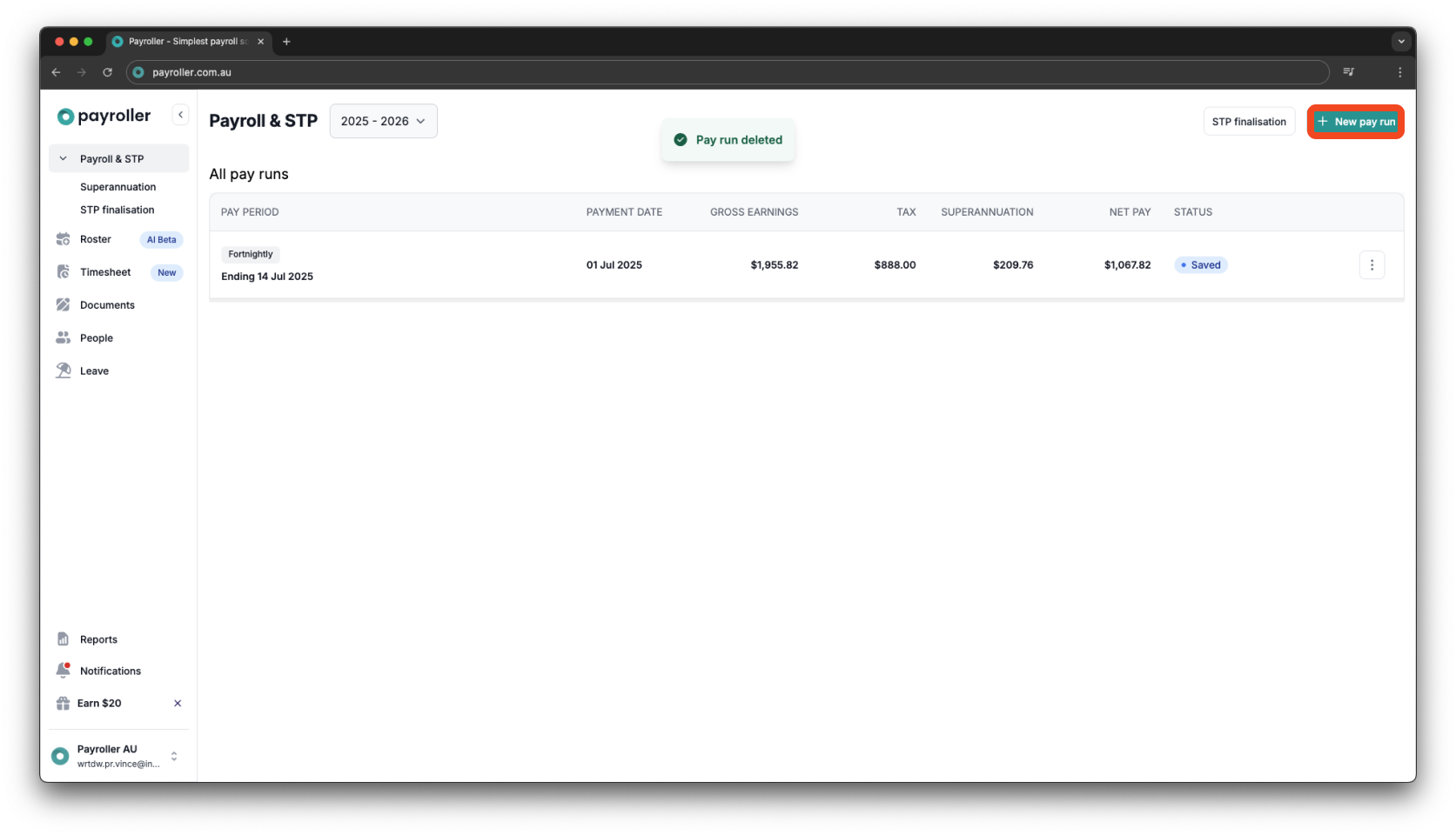

Step 1: Select ‘+ New pay run’.

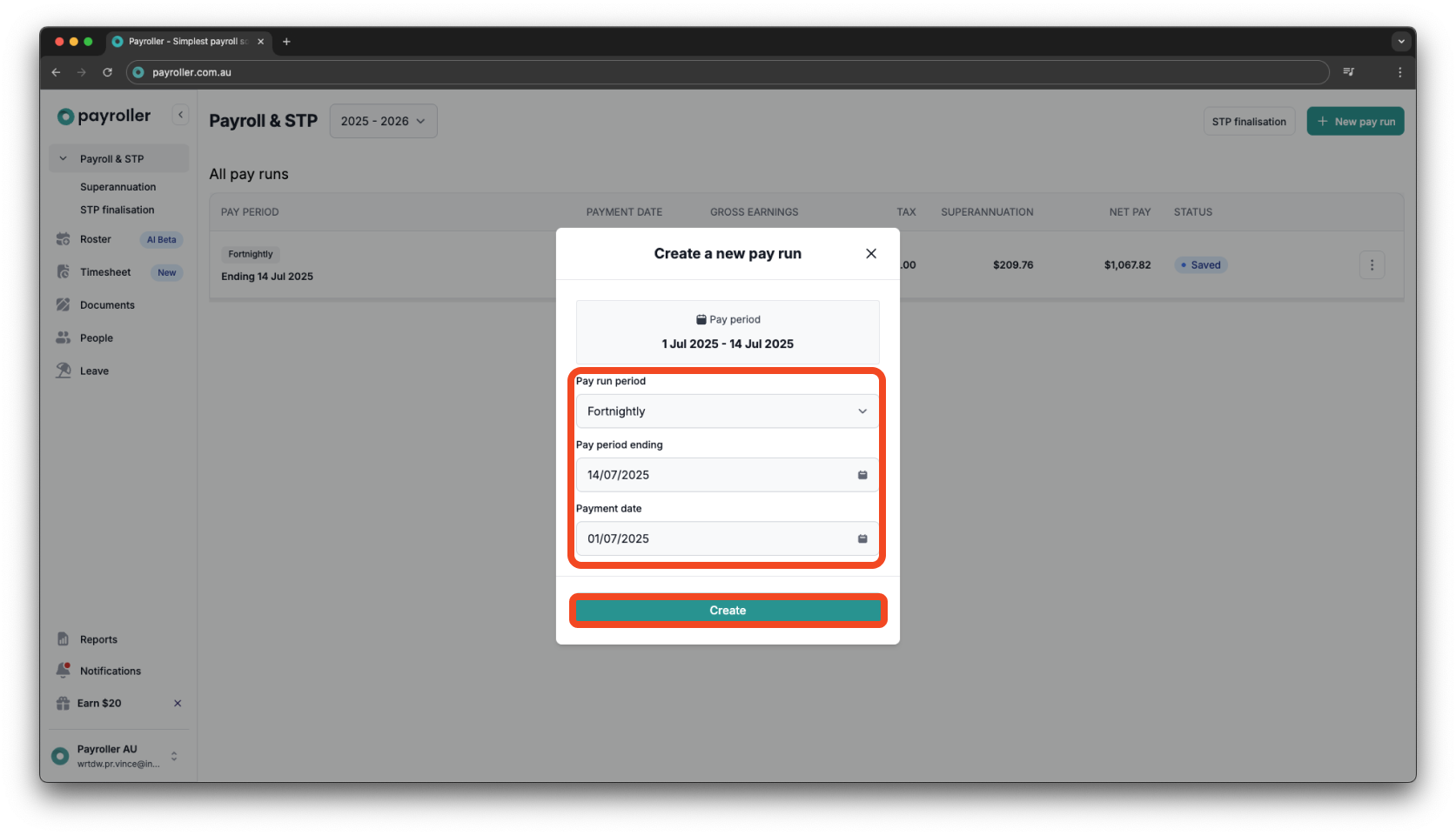

Step 2: Enter the Pay run period, Pay period ending, and Payment date for your pay run then select ‘Create’.

Once you have entered the dates, you will be directed to the ‘Adjust’ page.

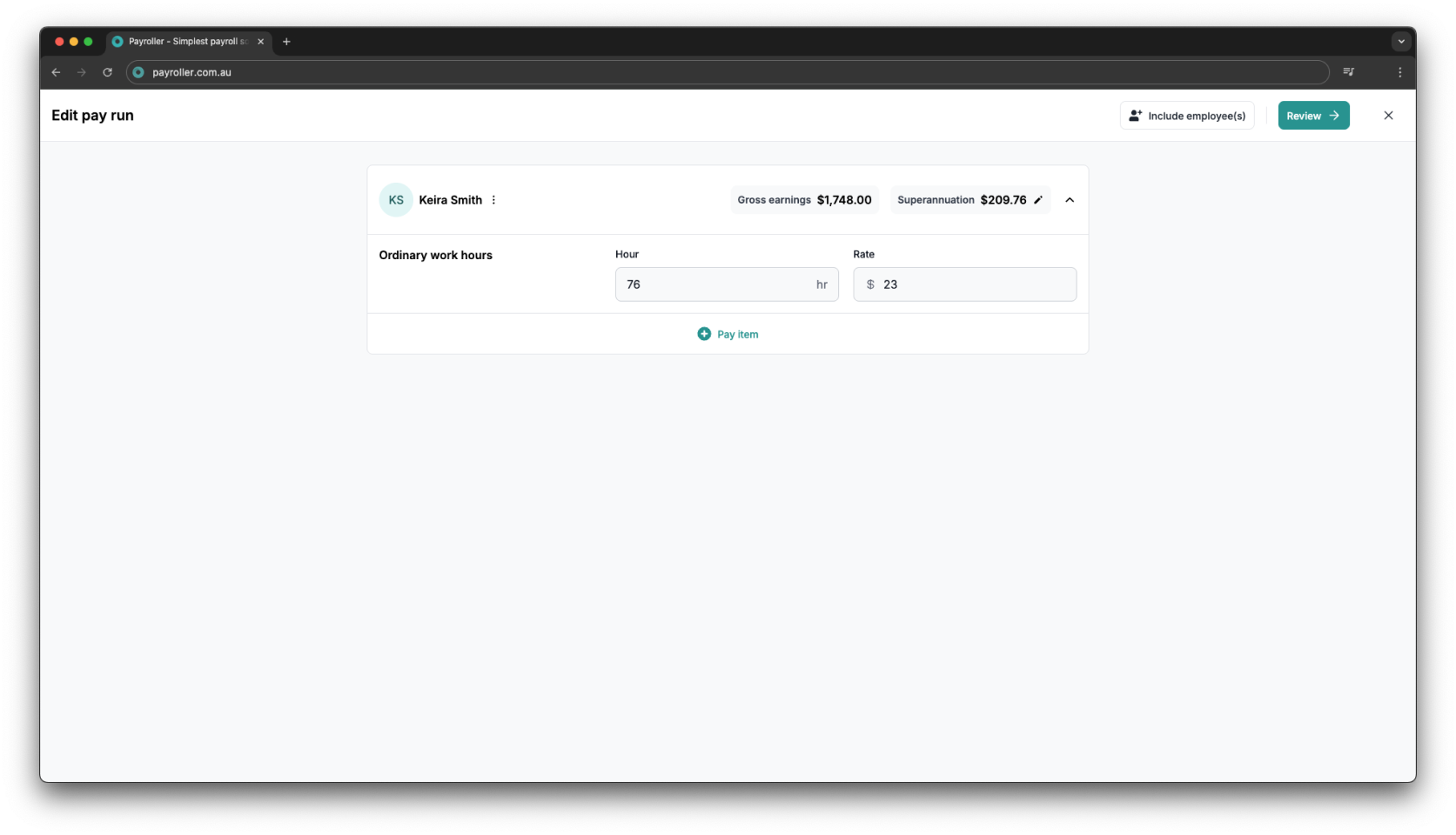

All active employees and their pay run details will be shown here.

Tax won’t be visible on the Adjust page, but you can view and edit it on the next page, Review.

Find our summary of the adjustments you can make to pay runs easily in Payroller, below:

Editing pay runs (work hours and pay rates)

-

How to add extra hours for employees in a pay run (ordinary hours or overtime hours)

-

How to add overtime for employees in a pay run (extra hours worked)

Adding and editing leave for employees

Adding other pay run items

Adding super

Other

-

How to add directors fee

-

How to add child support

-

How to add Family and Domestic Violence Leave

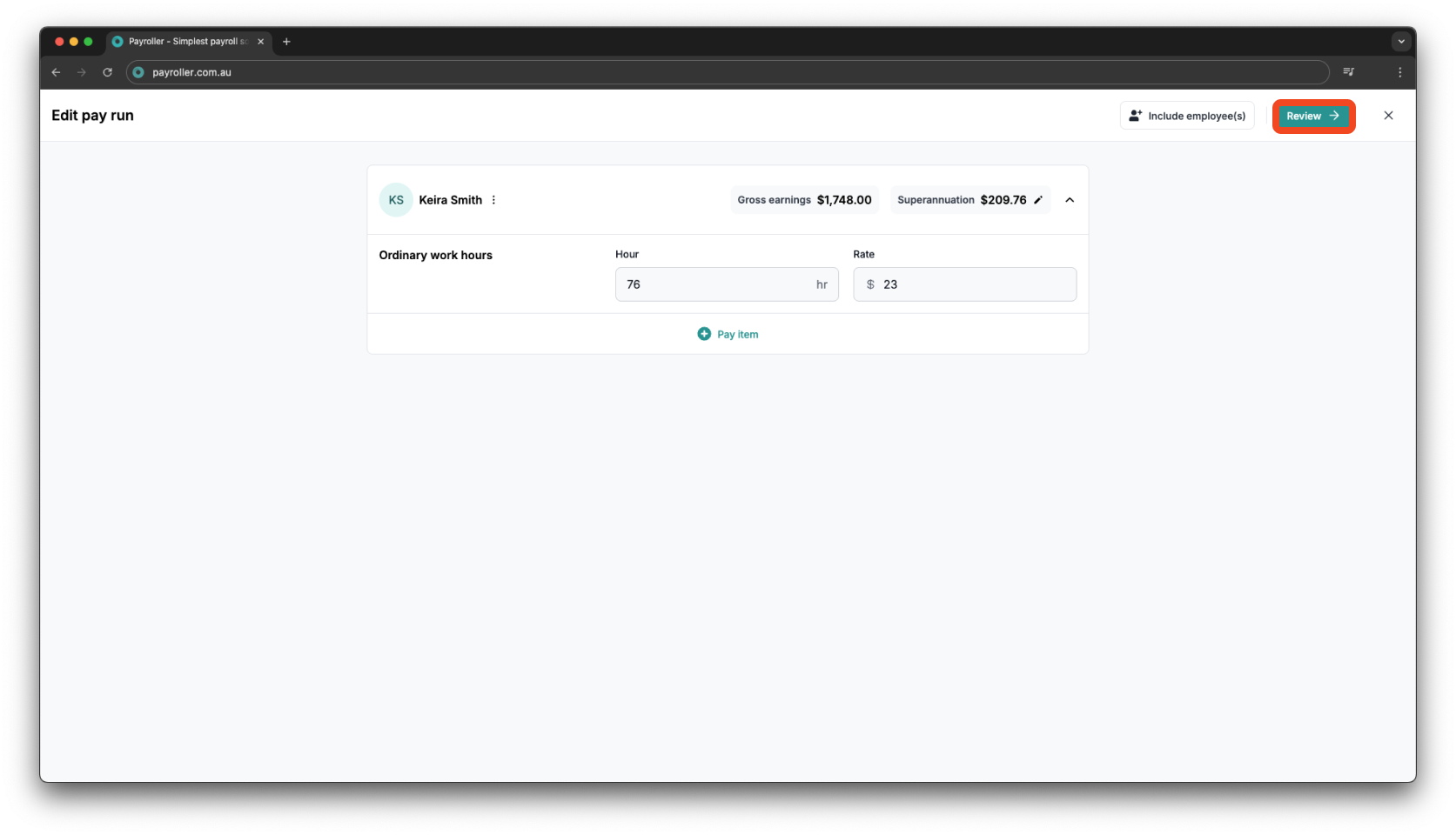

After making all necessary adjustments, scroll down and click ‘Review’‘.

This will take you to the Review page.

Learn how to make changes to pay runs relating to pay rates and extra hours with our other simple guides below:

-

How to add extra hours for employees in a pay run (ordinary hours or overtime hours)

-

How to add overtime for employees in a pay run (extra hours worked)

Discover more tutorials & get the most out of using Payroller

Learn more about easily creating and editing pay runs with our simple guides.

Want access to full Payroller features on web and mobile app? Sign up for a Payroller subscription for synced payroll across all devices. Read up on our Subscription FAQs.