Payroll for retail stores & shops

Introducing Payroller, the ultimate payroll solution for retailers and e-commerce businesses.

Managing your business payroll is easy and hassle-free with Payroller.

By clicking Try for Free, you agree to our terms of service and privacy policy.

Click and collect your payroll with ease

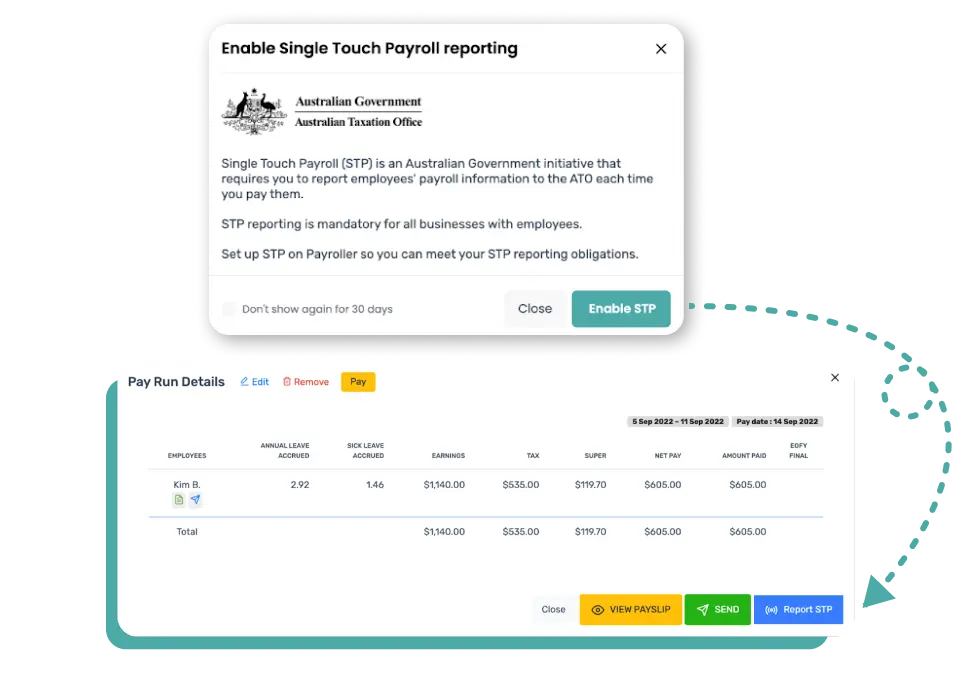

Manage your payroll easily and effortlessly with Payroller’s Single Touch Payroll (STP) software. Retailers want to focus on everyday business operations. Let’s help you eliminate payroll administration with just a few clicks.

Our payroll system suits retail stores that need to make pay runs for different employment types. Log hours worked and customise pay rates for casual, full-time, part-time or seasonal workers. Payroller automates gross and net pay calculations, employee entitlements, deductions and reimbursements.

You can also generate payslips for employees directly from your payroll. Meet Fair Work laws with our combined payroll and payslip solution.

ATO Compliant

STP-approved by the Australian Tax Office (ATO)

Fast Setup

Simplify and automate all your payroll and STP processes

Reliable Reporting

Keep clear records of who’s been paid in real-time

Don’t just take our word for it.

EXCELLENTTrustindex verifies that the original source of the review is Google. easy to use payroll systemTrustindex verifies that the original source of the review is Google. easy to use once set upTrustindex verifies that the original source of the review is Google. Best app ever, works well very very easy to use recommend it for any one, Luv IT! Well done. Cheers Baz The Weed Terminator. Esperance WA.

Payroll made accessible

- 5 minute setup

- No credit card needed

- No contract period

Create your free account now!

*By clicking “Try For Free“, you agree to our terms of service and privacy policy.

Make pay runs on the go in seconds

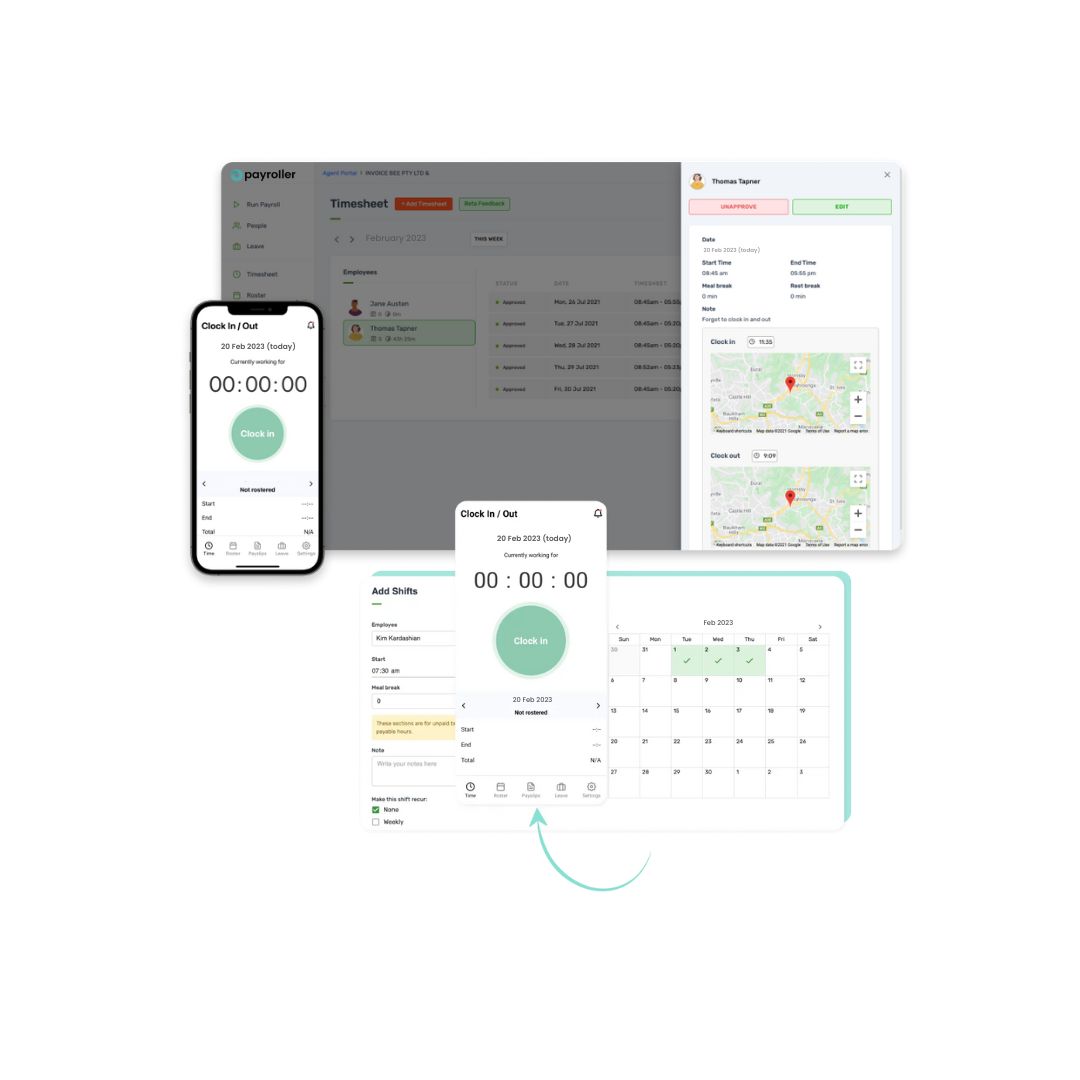

Payroller makes managing payroll and staffing in different stores easier than ever. Onboard new retail assistants and staff as needed.

With Payroller, you can also create work schedules and rostered shifts. Our time tracking tools make it easy to create and approve timesheets for retail workers. All of our features can be accessed in real time on our web and mobile apps.

Your retail assistants and staff can also see payslips, request leave, accept rostered shifts, and submit timesheets with their own Employee mobile app. With Payroller, you can improve staff communication in your retail business.

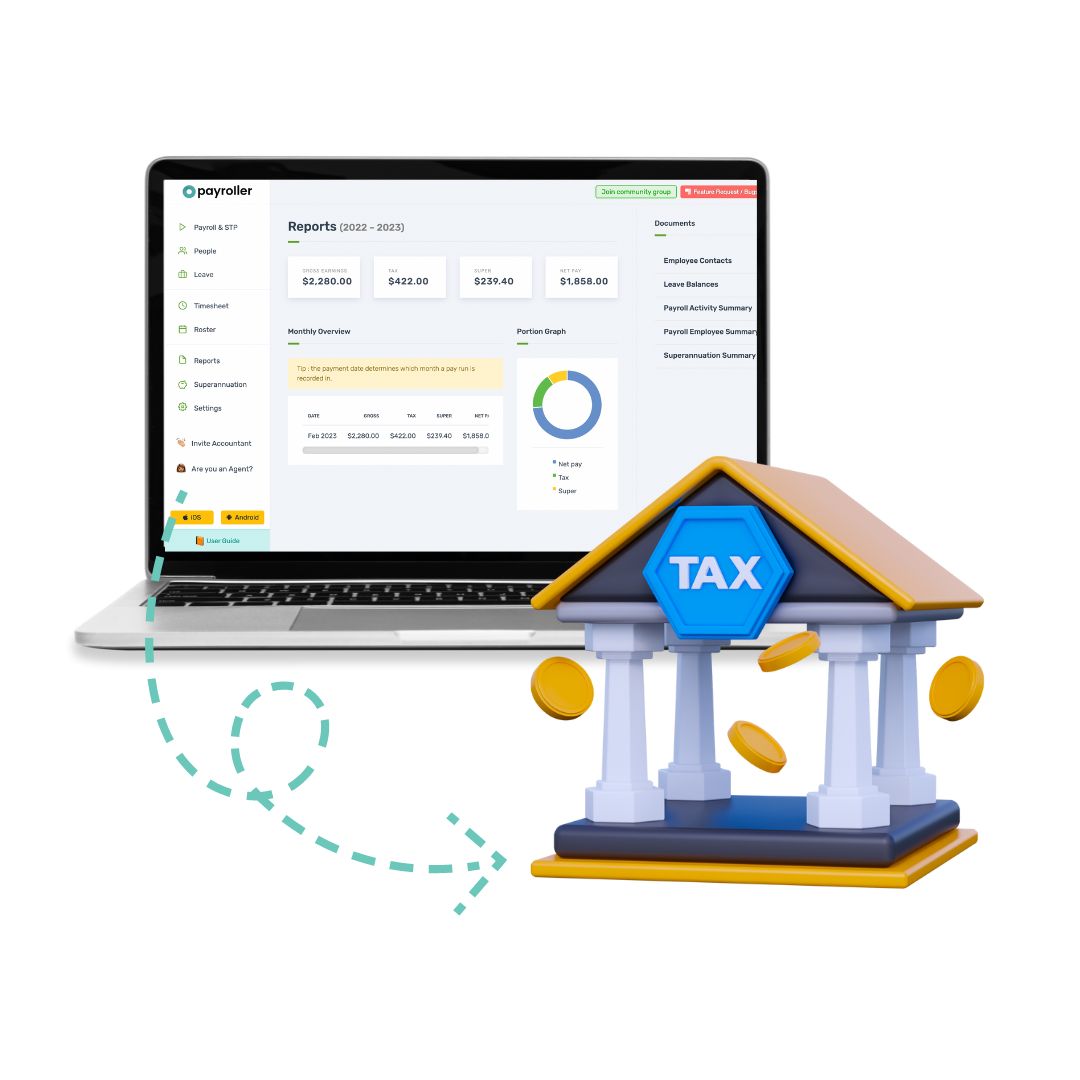

Click & send your payroll to the experts

Invite your tax accountant to Payroller at no extra cost. Focus on growing your retail store’s sales when you grant your bookkeeper access to your business payroll.

Connecting your accountant to your payroll and communication is streamlined with Payroller. No more messy email threads and manual file exports when it comes to tax reporting.

STP approved by the ATO & used by retailers across Australia

Payroller is approved for STP (Single Touch Payroll) reporting by the Australian Tax Office (ATO).

With Payroller, it’s easy to stay compliant without deep accounting knowledge. Our payroll solution is simple and safe for retailers. Our user-friendly interface and cost-effective payroll solution is used by thousands of retailers in Australia.

85 % of our users run their first payroll in under 15 minutes.

Frequently asked questions about payroll for retail

How does “Try for free” work?

“Try for free” allows you to discover if Payroller is the right software for you and your business before you commit to our platform. “Try for free” is cost and commitment-free and we do not require any credit card details to sign up. So give Payroller a try, it only takes a few minutes to get set up.

While the Payroller mobile app is completely free – fees will apply to use the Payroller web app, Xero integration, and to make super contributions through our integrated super clearing house (Beam).

Can I do my own payroll for my retail business?

You can, depending on the size and complexity of your business and your finance team. For a small shop with a few employees and a simple pay structure, manual payroll might be manageable. However, it’s time-consuming and error-prone. Payroll software can save you time, minimise errors, and ensure compliance with tax regulations.

What are the main payroll taxes I need to consider for retail employees?

When it comes to payroll taxes for your retail staff, there are a few key ones to remember. You’ll need to withhold income tax from their salaries through PAYG Withholding and remit it to the ATO. Additionally, you’re responsible for contributing a percentage of their ordinary earnings (OTE) towards their superannuation fund. Finally, depending on your location and if your business surpasses a wage threshold, you might also be liable for payroll tax on the wages you pay your employees.

What are STP requirements for retailers?

STP is a government initiative requiring most employers to report their employees’ salary and super information electronically to the ATO each time they pay their employees. While not all retailers may be mandated yet, it’s good practice to be familiar with STP and its potential future implementation.

What payroll records do I need to keep for my retail business?

You need to keep detailed records for at least seven years, including timesheets, payslips, tax reports, and other payroll documentation. This ensures you can demonstrate compliance with regulations in case of an audit.

How does Payroller work?

Payroller is an STP-enabled software that automatically submits payroll information to the Australian Taxation Office (ATO) – through a secure cloud network – whenever you perform a payrun. Payroller helps you to track, manage and record your payroll while safely sharing that information (and staying compliant) with the ATO.

As a truly one-stop payroll solution, you can manage staff roster, invite your accountant, bookkeeper or BAS agent and even make Super contribution (Beam) on Payroller.

Can I share my Payroller account?

Absolutely, you may share your account and even set different access permissions.

How long does it take to set up retail payroll with Payroller?

Only a few minutes. The majority of our customers get up and running within 15 minutes. If you do need more help in getting set up, simply reach out to our capable live agents and they will have you using Payroller like a seasoned user in no time. Check out our handy user guides.

Does Payroller integrate with other platforms?

Yes, Payroller is integrated with Xero. By connecting your Xero account to Payroller, you can easily export and share payroll information cross-platforms.

Resources for retail businesses

Get started today and experience the many benefits of Payroller.

Try it now for free!

Payroll made accessible

- 5 minute setup

- No credit card needed

- No contract period

Create your free account now!

*By clicking “Try For Free“, you agree to our terms of service and privacy policy.