Payroll for consultants

Introducing Payroller, the ultimate payroll solution for consultants and firms offering consulting services.

Managing your business payroll is easy and hassle-free with Payroller.

By clicking Try for Free, you agree to our terms of service and privacy policy.

How to consult your way through payroll

Consulting businesses need to track consultants’ pay and ensure timely pay runs.

It’s easy to adjust pay periods and pay rates for different consultant contracts and projects using Payroller. Configure different pay rates, consulting hours, allowances, and deductions with a few clicks. Payroll processing is fast with our automated calculations of consultant pay rates.

As a consulting business, you can also manage leave entitlements and make superannuation payments. Meet Fair Work laws and generate payslips directly. Payroller is an integrated software for payroll and HR, ideal for consultants.

ATO Compliant

STP-approved by the Australian Tax Office (ATO)

Fast Setup

Simplify and automate all your payroll and STP processes

Reliable Reporting

Keep clear records of who’s been paid in real-time

Don’t just take our word for it.

EXCELLENTTrustindex verifies that the original source of the review is Google. easy to use payroll systemTrustindex verifies that the original source of the review is Google. easy to use once set upTrustindex verifies that the original source of the review is Google. Best app ever, works well very very easy to use recommend it for any one, Luv IT! Well done. Cheers Baz The Weed Terminator. Esperance WA.

Payroll made accessible

- 5 minute setup

- No credit card needed

- No contract period

Create your free account now!

*By clicking “Try For Free“, you agree to our terms of service and privacy policy.

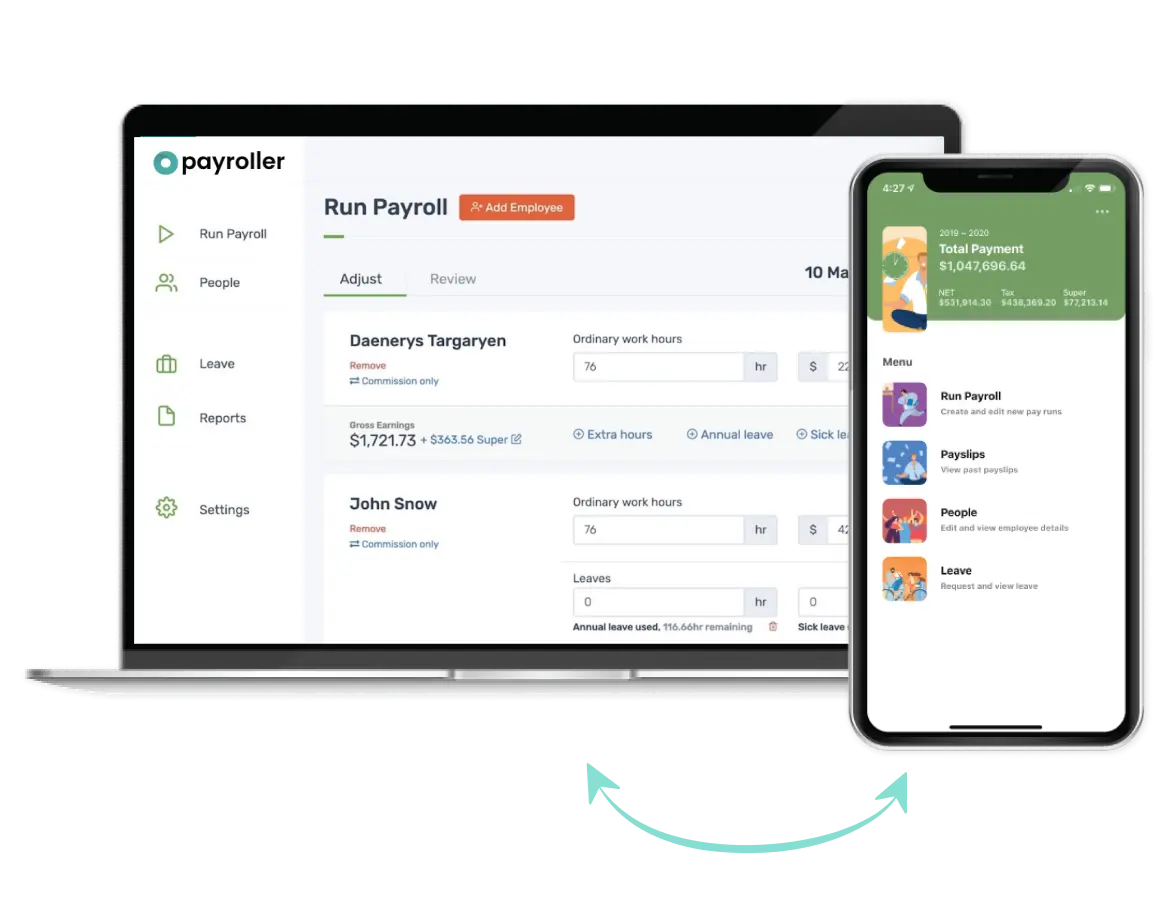

Convenient & on-the-go payroll for consultants

Maintaining individual consultants’ details and running payroll has never been easier with Payroller. Organise your staff of consultants from anywhere. All it takes is a few clicks to onboard new staff, manage employee details, make pay runs and generate payslips for consulting employees.

Use Payroller across multiple devices, including desktop and mobile app. Your team of consultants can also use a dedicated Employee mobile app to view payslips, see scheduled rosters and submit timesheets.

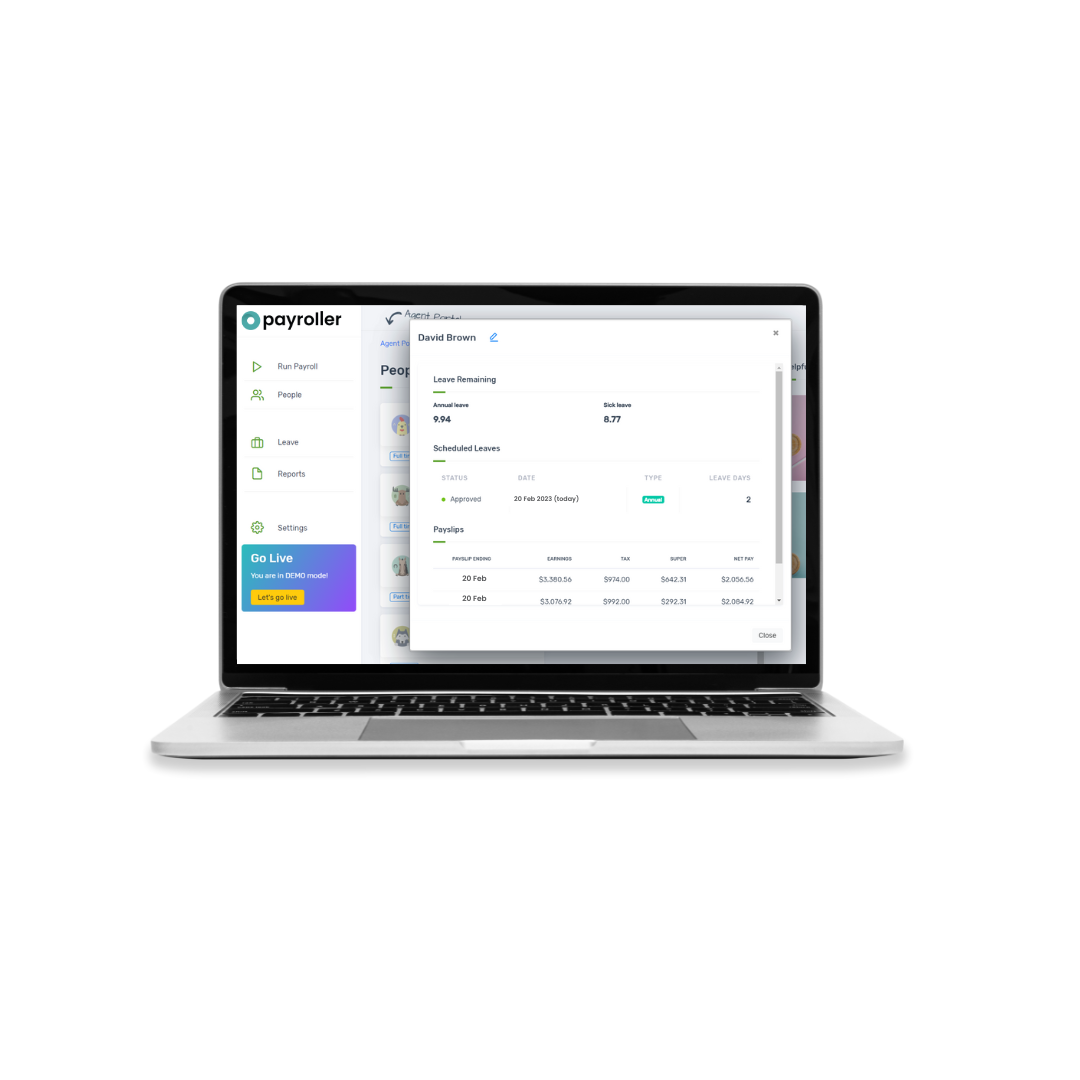

Instant payroll access for your tax accountant

You don’t need to be an accounting expert to use Payroller software. However, as a consultant, you might need help from an accounting professional, especially when you don’t have much time.

Connect your payroll to your accountant or bookkeeper safely with Payroller. Avoid manual file transfers to keep your confidential employee and payroll data secure. Through our free Agent portal, your accounting professional can manage your payroll and tax affairs on your behalf.

STP software backed by thousands of consultants

You may manage multiple consultants on different contracts or projects. You would need to adjust pay rates, pay periods, pay frequencies, and more. Payroller is designed to be simple for consultants to manage all these tasks and run payrolls on our STP software.

Payroller takes the headaches out of pay runs so that you can focus on growing your consulting business.

85 % of our users run their first payroll in under 15 minutes.

Frequently asked questions about payroll for consultancy firms

How does “Try for free” work?

“Try for free” allows you to discover if Payroller is the right software for you and your business before you commit to our platform. “Try for free” is cost and commitment-free and we do not require any credit card details to sign up. So give Payroller a try, it only takes a few minutes to get set up.

While the Payroller mobile app is completely free – fees will apply to use the Payroller web app, Xero integration, and to make super contributions through our integrated super clearing house (Beam).

Can payroll software handle different consultant pay structures?

Absolutely! Payroll software can manage various pay structures, whether you pay your consultants an hourly rate, a daily rate, a fixed project fee, or even a combination. It can also simplify managing recurring retainer payments for consultants. It can also handle performance-based bonuses, ensuring accurate calculations and timely payouts.

For travel costs, consultants can submit claims electronically, attach receipts, and receive reimbursements efficiently. The software can also ensure proper tax deductions for approved expenses.

How does consultancy payroll software handle fluctuating project budgets and payroll forecasting?

Consulting projects can have variable budgets. Payroll software with forecasting features can help you estimate payroll costs based on project timelines and consultant rates. This allows for better financial planning and resource allocation.

What mobile functionalities should I look for in payroll software for consultants?

Mobile access is crucial for consultants who are often on the go. Look for software with a mobile app that allows consultants to submit timesheets, approve expenses, and access payslips. Additionally, mobile onboarding features can streamline the hiring process for new consultants.

How does Payroller work?

Payroller is an STP-enabled software that automatically submits payroll information to the Australian Taxation Office (ATO) – through a secure cloud network – whenever you perform a payrun. Payroller helps you to track, manage and record your payroll while safely sharing that information (and staying compliant) with the ATO.

As a truly one-stop payroll solution, you can manage staff roster, invite your accountant, bookkeeper or BAS agent and even make Super contribution (Beam) on Payroller.

Can I share my Payroller account?

Absolutely, you may share your account and even set different access permissions.

How long does it take to set up consulting agency payroll with Payroller?

Only a few minutes. The majority of our customers get up and running within 15 minutes. If you do need more help in getting set up, simply reach out to our capable live agents and they will have you using Payroller like a seasoned user in no time. Check out our handy user guides.

Does Payroller integrate with other platforms?

Yes, Payroller is integrated with Xero. By connecting your Xero account to Payroller, you can easily export and share payroll information cross-platforms.

Get started today and experience the many benefits of Payroller.

Try it now for free!

Payroll made accessible

- 5 minute setup

- No credit card needed

- No contract period

Create your free account now!

*By clicking “Try For Free“, you agree to our terms of service and privacy policy.