Payroll made accessible.

- 5 minute setup

- No credit card needed

- No contract period

Create your free account now.

*By clicking “Try For Free“, you agree to our terms of services and privacy policy.

Introducing Payroller, the ultimate payroll solution for for social workers and carers.

Managing your business payroll is easy and hassle-free with Payroller.

Create your free account now.

Payroll made accessible

STP-approved by the Australian Tax Office (ATO)

Simplify and automate all your payroll and STP processes

Keep clear records of who’s been paid in real-time

ExcellentBased on 3027 reviews

Marika Martinez25 June 2024easy to use payroll system

Marika Martinez25 June 2024easy to use payroll system Karen Coatsworth28 May 2024easy to use once set up

Karen Coatsworth28 May 2024easy to use once set up Barry Howat16 May 2024Best app ever, works well very very easy to use recommend it for any one, Luv IT! Well done. Cheers Baz The Weed Terminator. Esperance WA.

Barry Howat16 May 2024Best app ever, works well very very easy to use recommend it for any one, Luv IT! Well done. Cheers Baz The Weed Terminator. Esperance WA.

Payroll management is easy with Payroller. It doesn’t matter how many permanent employees or contractors you have in your disability, NDIS, social care or aged care business.

Maintain accurate employee records for your casual, part-time or full-time workers. Track working hours, leave, benefits, withholdings and allowances for different jobs. Improve accuracy and on-time wage payments with our automated calculations including pay and leave.

You can also make Fair Work compliant payslips straight from your payroll with one click.

Payroll made accessible.

Create your free account now.

*By clicking “Try For Free“, you agree to our terms of services and privacy policy.

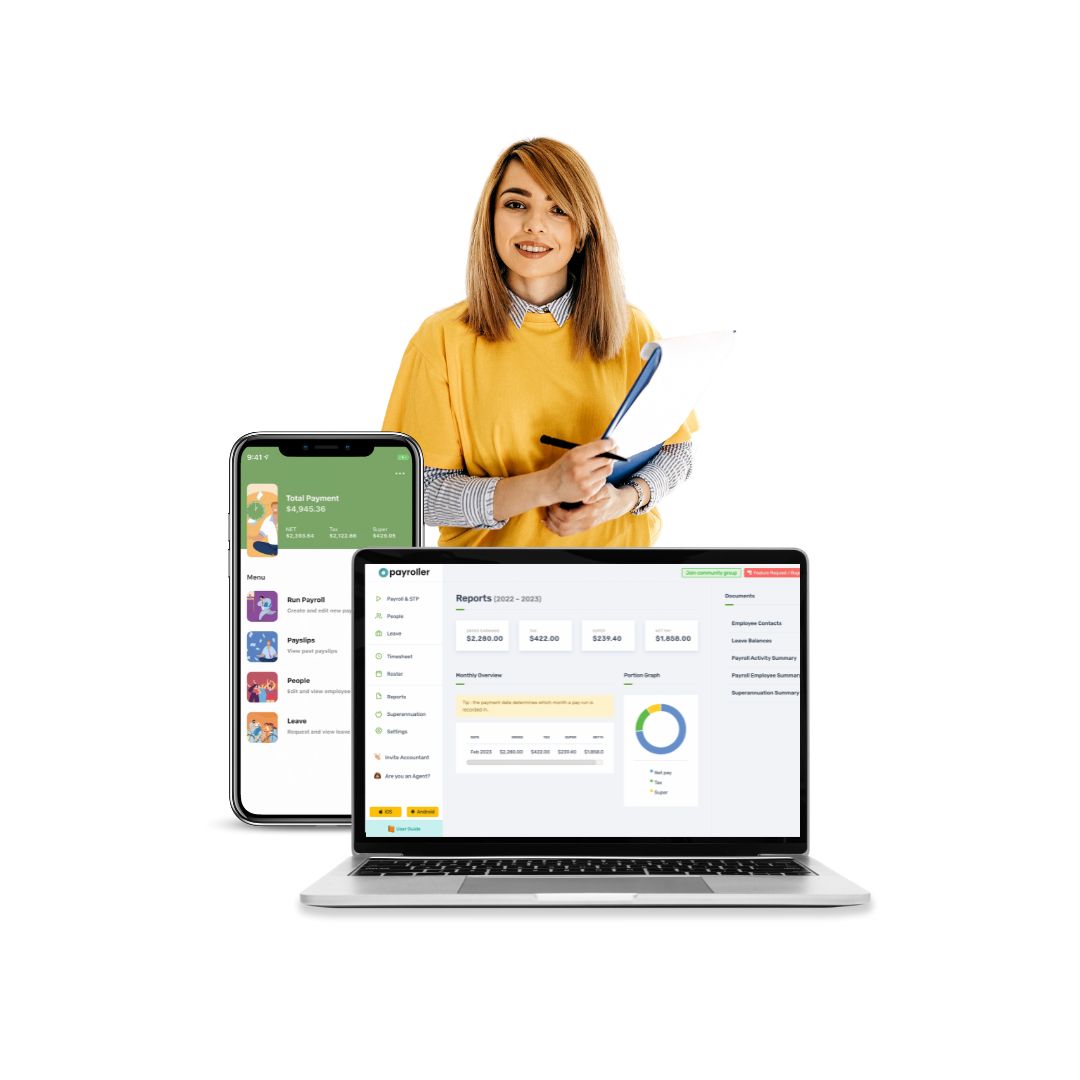

With Payroller, you can get payroll done quickly and accurately no matter where you are. Access Payroller on desktop and mobile devices including mobile app.

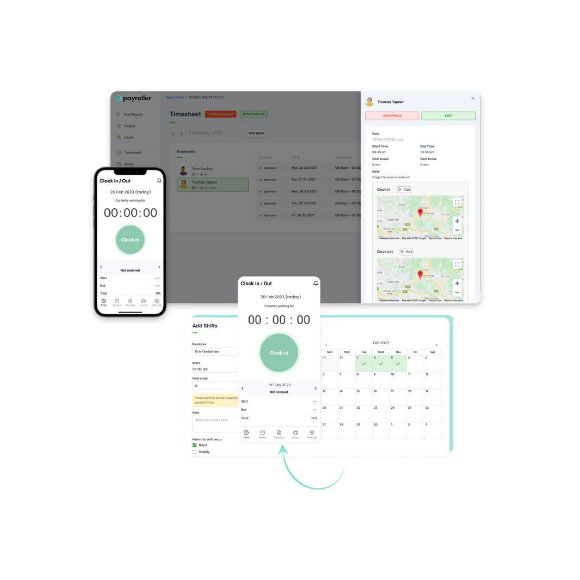

Our payroll system also includes integrated staff scheduling, time tracking and timesheets. This is helpful when managing a diverse workforce that may include contractors, casual or part-time workers. Keep an eye on employee timesheets from a distance to keep track of staffing.

Your employees can also view payslips, view leave and manage their rostered shifts with our dedicated Employee mobile app.

Payroller is a user-friendly payroll system designed to be self-service for anyone to streamline payroll and tax procedures. However, you can save more time to focus on caring for others by sharing your payroll with your bookkeeper in real-time.

Invite your tax accountant to Payroller so that they can help manage your payroll and tax obligations. Avoid lengthy emails or security concerns about manual data exports.

Payroller is STP-approved software used by thousands of social workers and carers across Australia. Your business or organisation can organise and maintain employee information in one place with our cloud payroll. This makes tax time easier and less stressful.

Using our simple payroll solution means you can meet your legal obligations to the ATO (Australian Tax Office) in an affordable way. Get flexibility in your payroll processes so your business and staff can focus on caring for people.

“Try for free” allows you to discover if Payroller is the right software for you and your business before you commit to our platform. “Try for free” is cost and commitment-free and we do not require any credit card details to sign up. So give Payroller a try, it only takes a few minutes to get set up.

While the Payroller mobile app is completely free – fees will apply to use the Payroller web app, Xero integration, and to make super contributions through our integrated super clearing house (Beam).

You can, especially for a small team. However, payroll software can save significant time, avoid manual input errors, and ensure compliance with complex NDIS regulations and tax requirements.

NDIS work can involve irregular hours. Clearly communicate award rates and ensure you’re paying staff correctly for overtime, weekend, and public holiday work according to the relevant award (e.g., Social, Community, Home Care and Disability Services Industry Award 2020). Payroll software can help with these calculations.

Additionally, mobile allowances may be included in some social worker awards or negotiated in individual contracts. Ensure you understand the rules around tax implications and record-keeping for any mobile allowances paid.

You need to keep detailed records for at least seven years, including timesheets (especially for flexible schedules), payslips, tax reports, and other payroll documentation related to NDIS work. This ensures compliance with NDIS regulations and tax requirements.

Payroller is an STP-enabled software that automatically submits payroll information to the Australian Taxation Office (ATO) – through a secure cloud network – whenever you perform a payrun. Payroller helps you to track, manage and record your payroll while safely sharing that information (and staying compliant) with the ATO.

As a truly one-stop payroll solution, you can manage staff roster, invite your accountant, bookkeeper or BAS agent and even make Super contribution (Beam) on Payroller.

Absolutely, you may share your account and even set different access permissions.

Only a few minutes. The majority of our customers get up and running within 15 minutes. If you do need more help in getting set up, simply reach out to our capable live agents and they will have you using Payroller like a seasoned user in no time. Check out our handy user guides.

Yes, Payroller is integrated with Xero. By connecting your Xero account to Payroller, you can easily export and share payroll information cross-platforms.

Payroll made accessible.

Create your free account now.

*By clicking “Try For Free“, you agree to our terms of services and privacy policy.