Agent Resources

Home » Agent Resources

Manage payroll and tax compliance with expert guidance

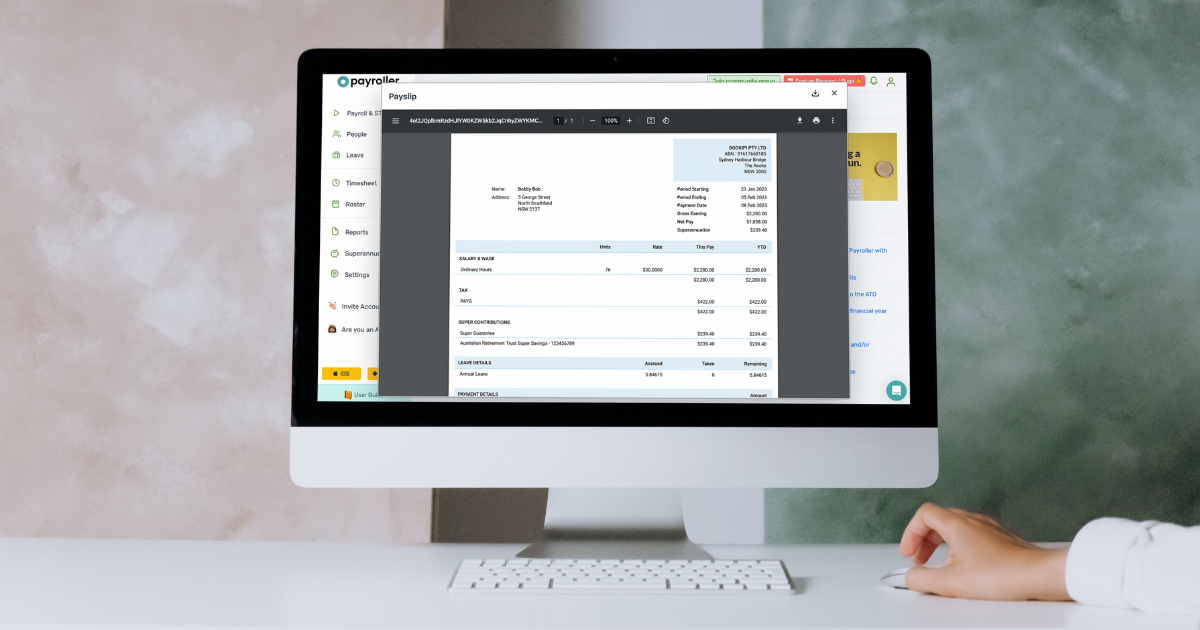

Here, you’ll find helpful financial reporting information, quick tips, and tools to help you manage your clients’ payroll. Stay up-to-date, improve productivity, and enhance skills with our resources on tax compliance, bookkeeping, and more.

Agents and bookkeepers resources

Get access to information, tips and tools to assist you in managing payroll and guaranteeing compliance for your clients. Keep yourself updated, stay productive, and enhance your skills with our resources that are tailored to meet the requirements of agents and bookkeepers.

How to perform a business valuation: 5 methods to find out how much a business is worth

How to evaluate and manage the financial risks of a business

How to measure the financial performance of a company

Are you ready to start a bookkeeping business? The complete 8-step roadmap

What is cloud accounting? 9 reasons to move your accounting practice to the cloud

How to start an accounting practice: A guide to building your own firm

Cash flow management for small businesses: a guide for accountants

Should accountants run workshops for their clients?

Should you provide payroll services as an accountant?

Are your clients’ payslips easily accessible?

The agents checklist for tradies in NSW

Tax compliance for agents

Explore our dedicated Tax Compliance for Agents section to easily navigate the challenges of tax compliance. Get access to specialised resources, expert insights, and actionable tips tailored to your specific requirements and challenges as an agent. Stay up-to-date, compliant, and confident in your role with our comprehensive tax compliance guidance.