Learn how to add a deduction to a pay run in Payroller

Learn how to add a deduction to a pay run in Payroller with our simple guide below.

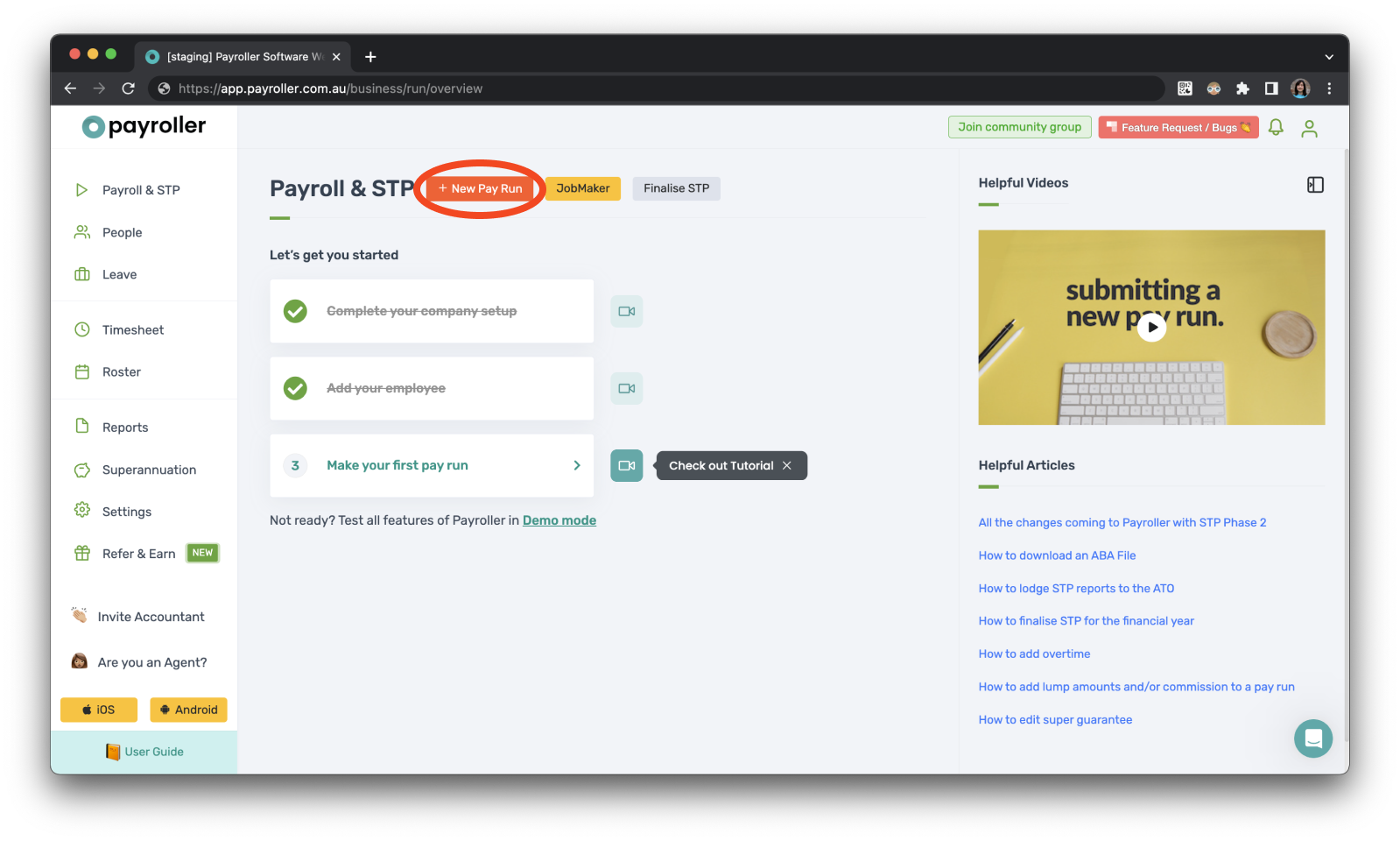

Step 1: Click on ‘+ New Pay Run’.

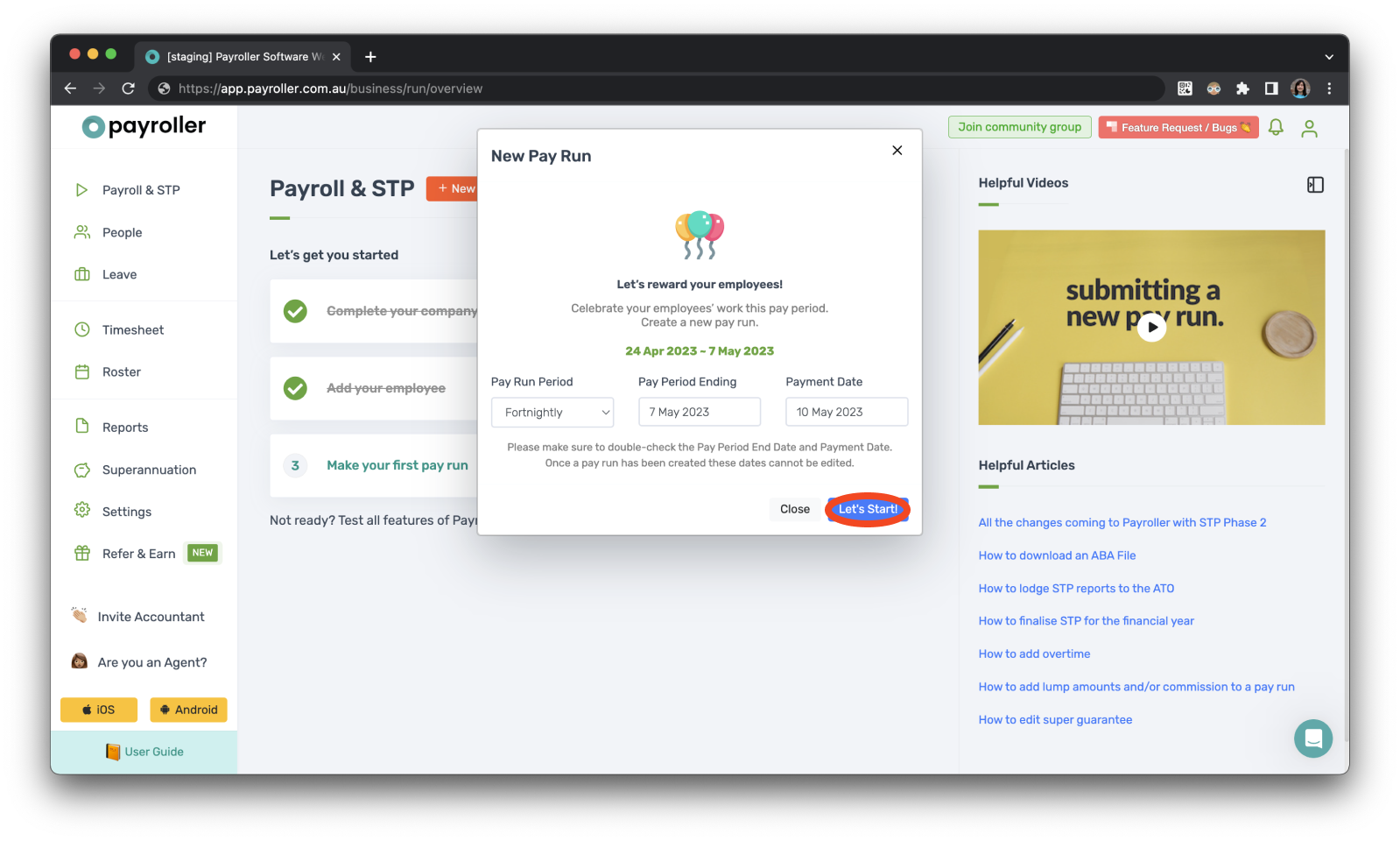

Step 2: Customise the Pay Run Period, the Pay Period Ending date, and the Payment Date, and select ‘Let’s Start!’

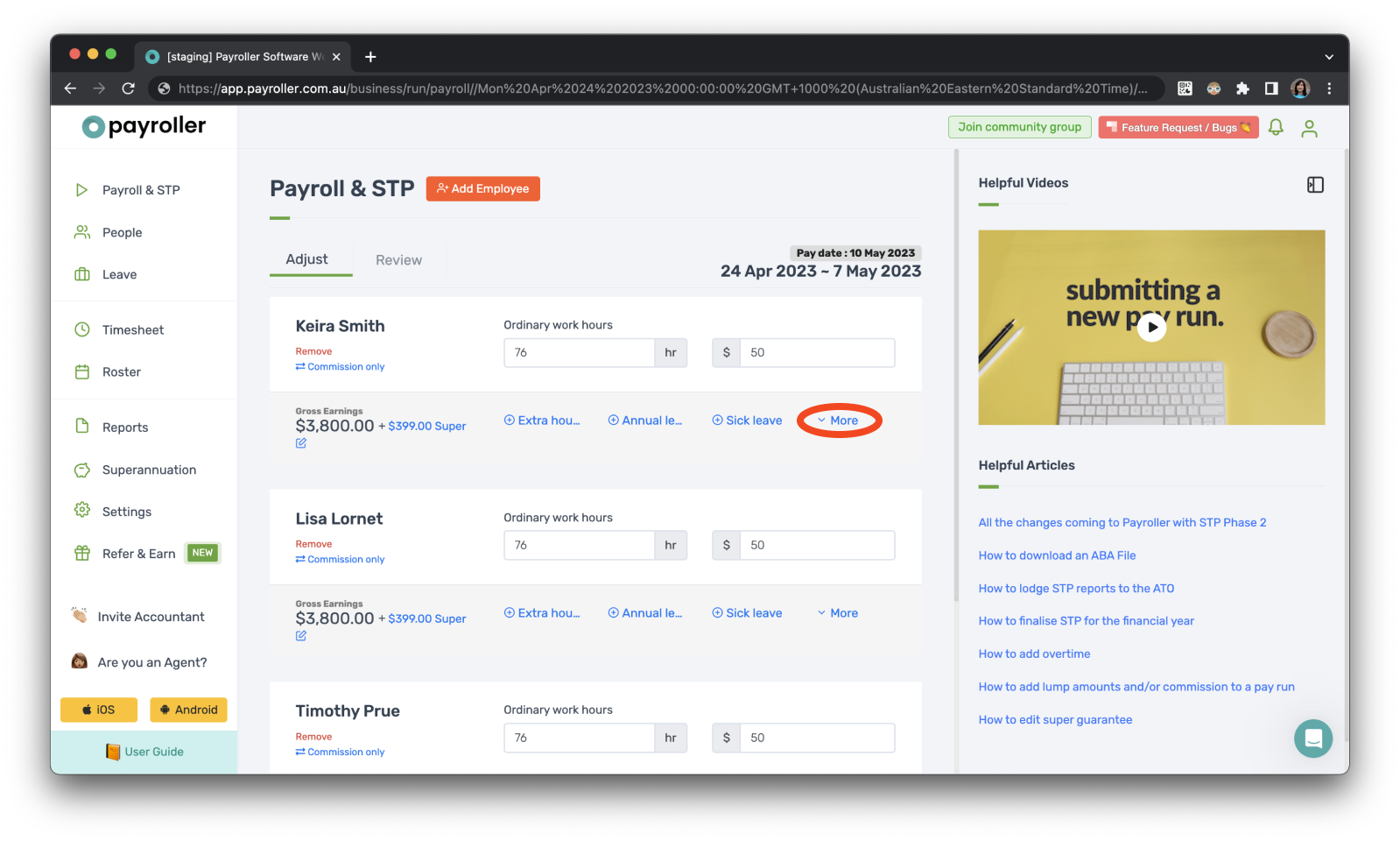

Step 3: Click on ‘More’.

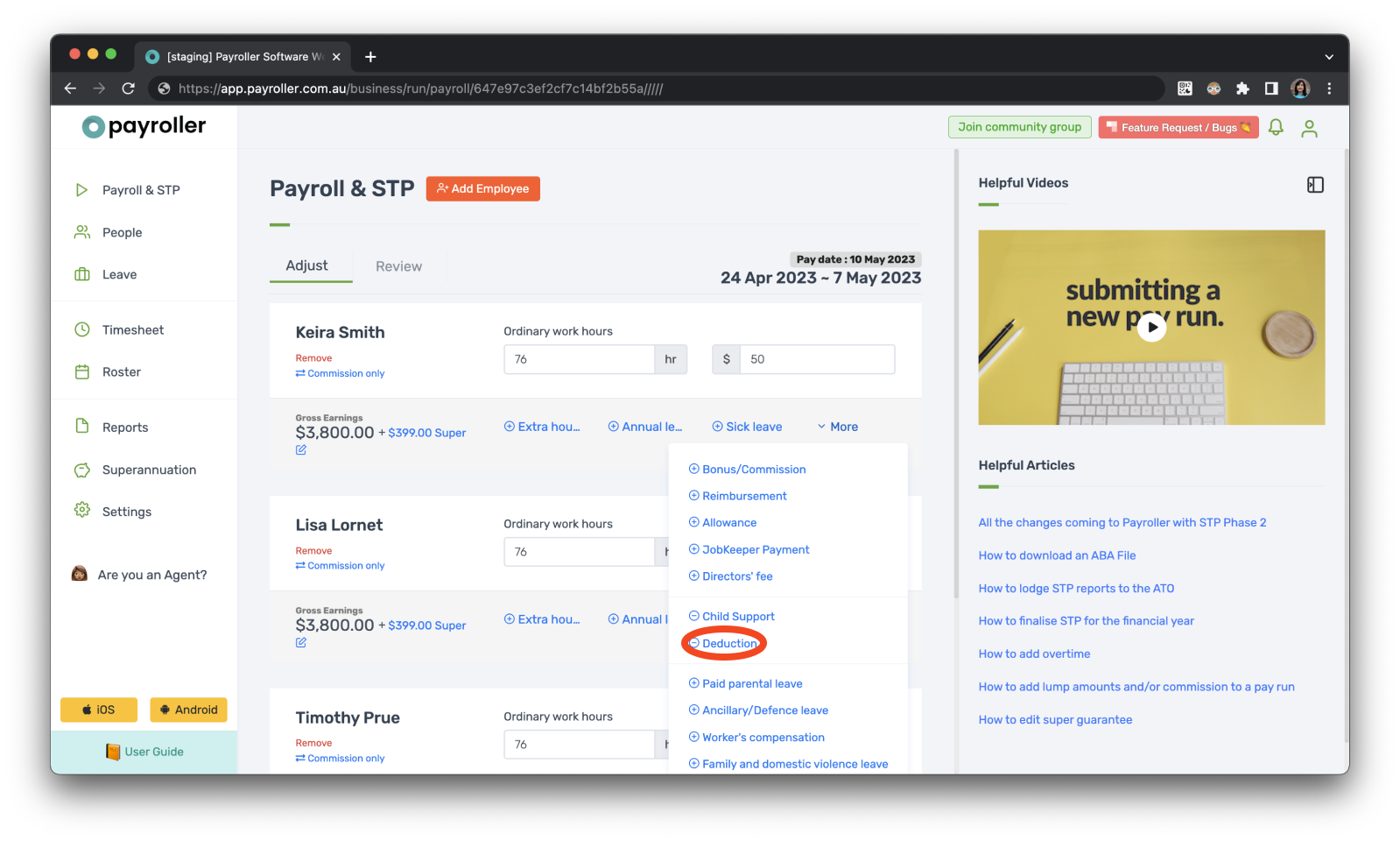

Step 4: Next, select ‘Deduction’.

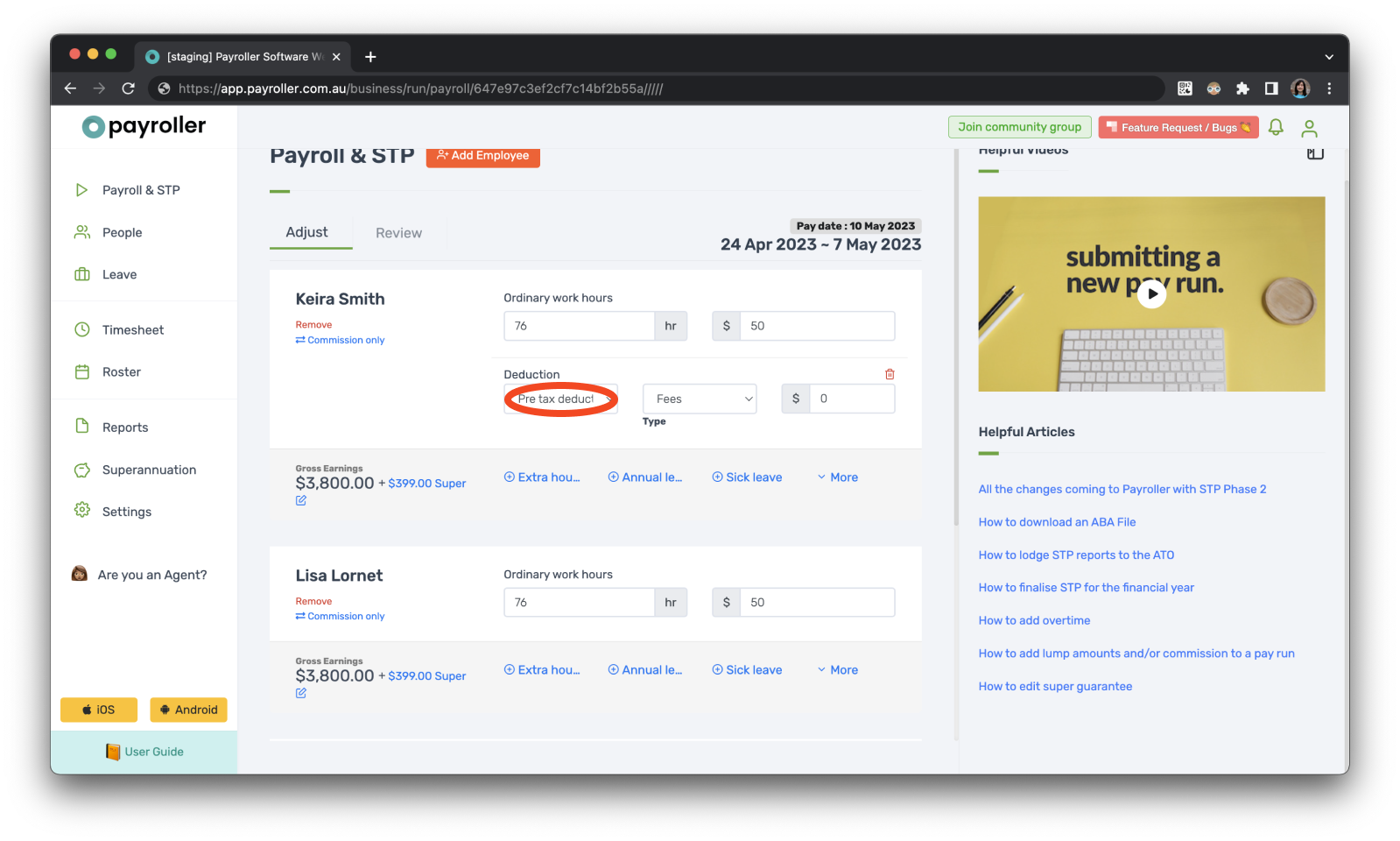

Step 5: Select whether it is a Pre-tax deduction, Post-tax deduction, or Non-reportable deduction.

Definition:

-

A pre-tax deduction deducts the amount from the taxable income before tax has been calculated. Tax is then calculated off this reduced amount.

-

A post-tax deduction deducts the amount from the gross income after the tax has been calculated. This doesn’t affect tax.

-

A non-reportable deduction acts in the same way as a pre-tax deduction but the deduction is not reported to the ATO.

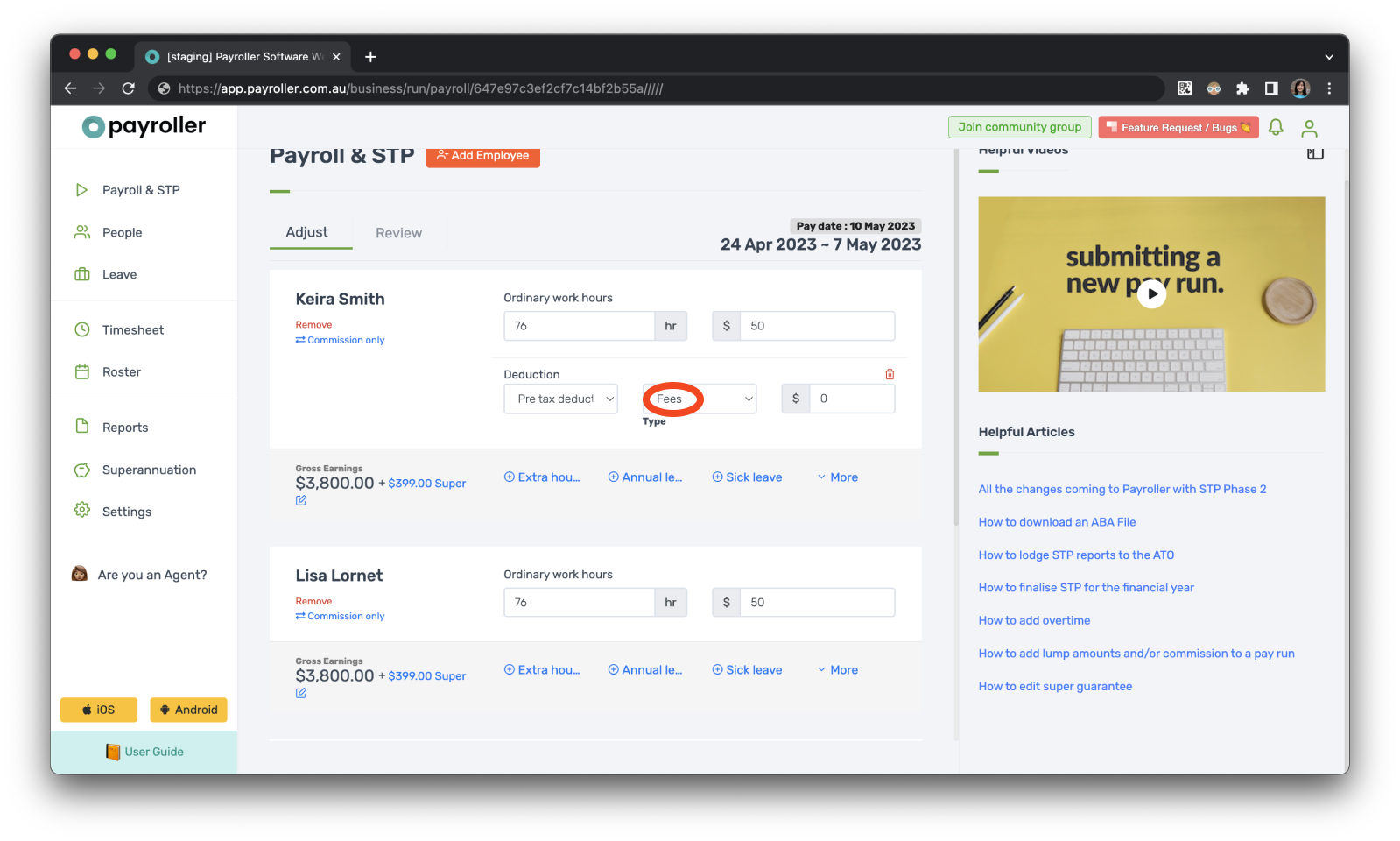

Step 6: The next thing you’ll need to decide is the type of deduction it is; fees or workplace giving.

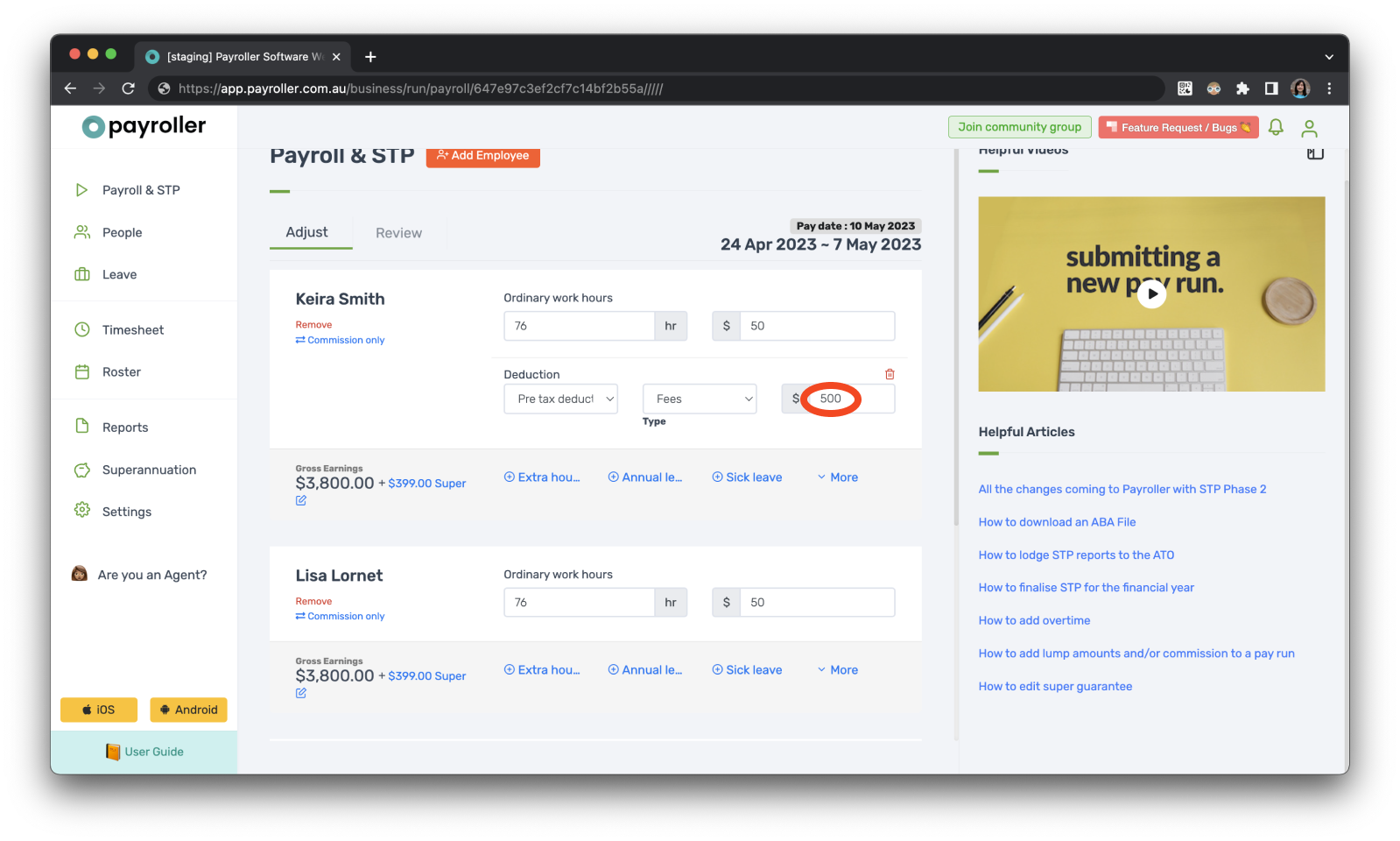

Step 7: Finally, add the amount.

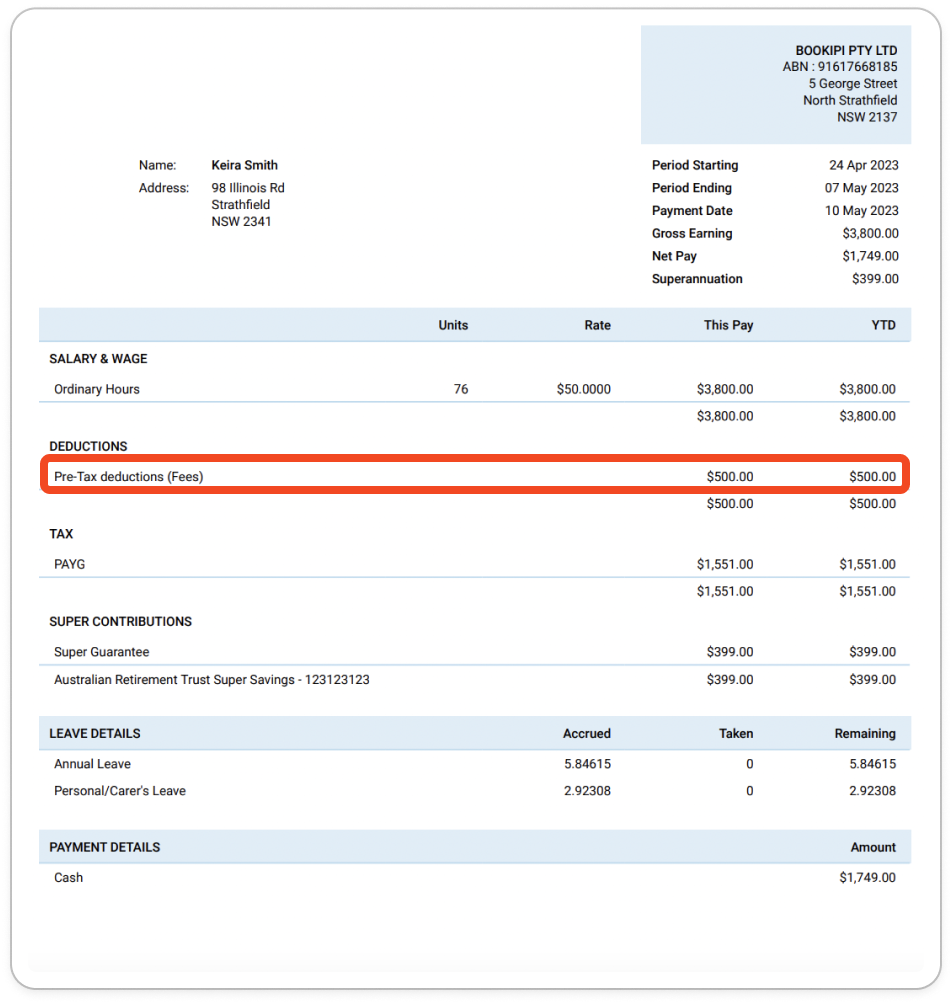

Once you have finalised the pay run you will be able to see the Deduction on the employee’s payslip

If you have recurring Deduction you can add this in the templates section of the employee card.

Learn how to add other items to your pay run in Payroller with our other simple guides:

Discover more tutorials & get the most out of using Payroller

Learn more about easily creating and editing pay runs with our simple guides.

Want access to full Payroller features on web and mobile app? Sign up for a Payroller subscription for synced payroll across all devices. Read up on our Subscription FAQs.