Payroll made accessible.

- 5 minute setup

- No credit card needed

- No contract period

Create your free account now.

*By clicking “Try For Free“, you agree to our terms of services and privacy policy.

Introducing Payroller, the ultimate payroll software for agriculture businesses.

Managing your business payroll is easy and hassle-free with Payroller.

Create your free account now.

Payroll made accessible

STP-approved by the Australian Tax Office (ATO)

Simplify and automate all your payroll and STP processes

Keep clear records of who’s been paid in real-time

ExcellentBased on 3027 reviews

Marika Martinez25 June 2024easy to use payroll system

Marika Martinez25 June 2024easy to use payroll system Karen Coatsworth28 May 2024easy to use once set up

Karen Coatsworth28 May 2024easy to use once set up Barry Howat16 May 2024Best app ever, works well very very easy to use recommend it for any one, Luv IT! Well done. Cheers Baz The Weed Terminator. Esperance WA.

Barry Howat16 May 2024Best app ever, works well very very easy to use recommend it for any one, Luv IT! Well done. Cheers Baz The Weed Terminator. Esperance WA.

Manage payroll and staff for your agribusiness in just a few clicks. Whether you have casual farm-hands or full-time workers, it’s easy to customise pay rates depending on the job.

Our easy-to-use single touch payroll (STP) solution is ideal for farms that employ seasonal and casual workers with different pay frequencies. Payroller‘s automated gross pay and net pay calculations saves you time to focus on your operations.

With Payroller you can log hours worked, leave taken, entitlements, deductions and reimbursements for staff. You can also meet Fair Work legal requirements and generate payslips to employees straight from your payroll.

Payroll made accessible.

Create your free account now.

*By clicking “Try For Free“, you agree to our terms of services and privacy policy.

Onboard new workers including fruit pickers and farm helpers quickly and from anywhere. You can make pay runs remotely including on mobile web or mobile app when you’re outside, or on desktop.

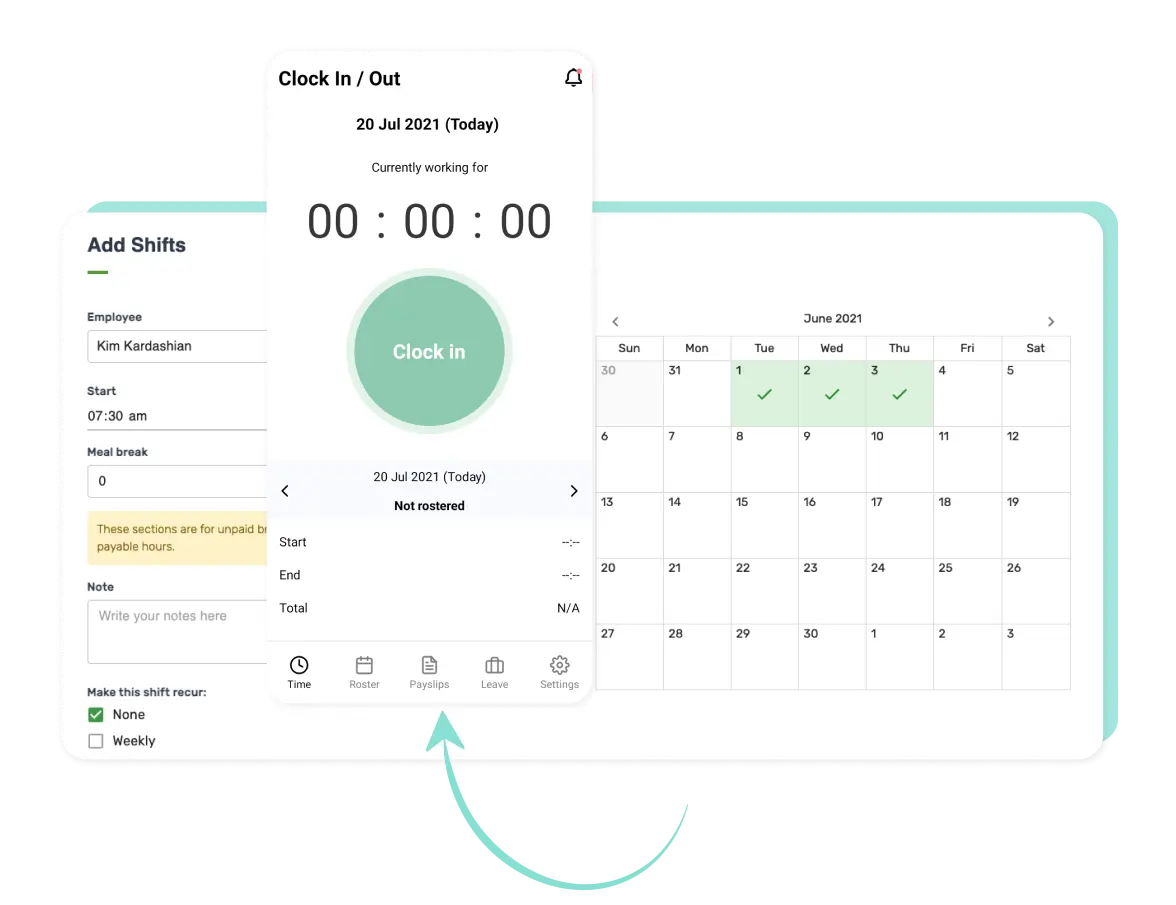

Keep track of your staff and make easy edits to their individual pay details and work hours.

Payroller software also supports multiple pay periods, including weekly, bi-weekly, and monthly pay frequencies. Our payroll system makes it easy for you to customise pay runs to adjust to busy and quiet times in agriculture.

Payroller offers online access for agriculture businesses to make and edit pay runs anytime.

You can also confidently make work schedules, track employee work hours and approve timesheets in one spot.

Your farm’s employees can view payslips, clock in and out of rostered shifts, submit timesheets, and more on a dedicated employee mobile app.

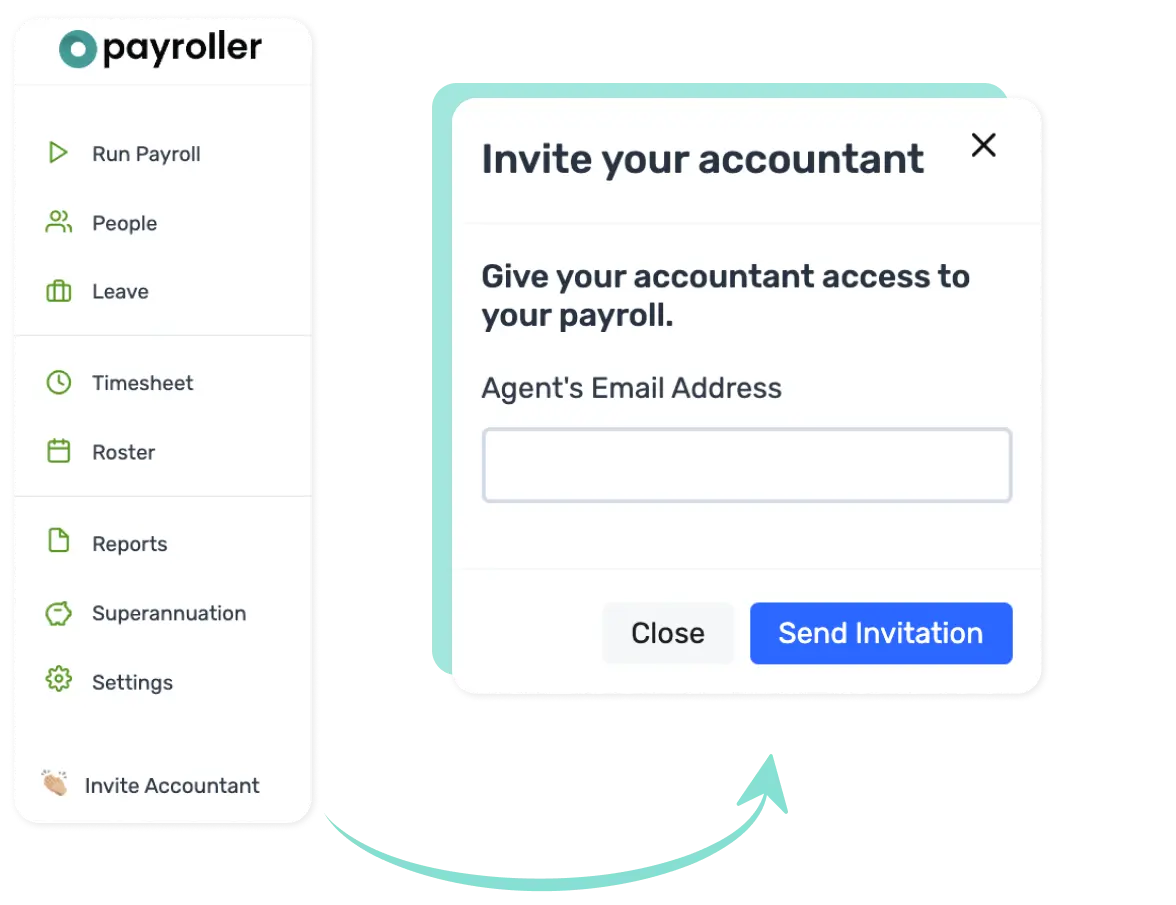

Invite your tax accountant to manage your payroll in Payroller at no extra cost. Focus on your farm’s operations while your agent works on your payroll and tax files.

Forget manual data exports that may be unsafe over long email chains. Your bookkeeper can access your payroll securely online so your tax affairs are sorted out on time.

Payroller is approved for STP reporting by the Australian Tax Office (ATO). Our simple software is trusted by over 180,000 businesses including farms and agribusinesses across Australia.

Payroller has built-in tax compliance features. Rest assured that your farm or agriculture business meets ATO & Fair Work laws. You don’t need accounting knowledge as our payroll system is easy to learn.

Try Payroller for free and experience simple, safe and fast payroll.

“Try for free” allows you to discover if Payroller is the right software for you and your business before you commit to our platform. “Try for free” is cost and commitment-free and we do not require any credit card details to sign up. So give Payroller a try, it only takes a few minutes to get set up.

While the Payroller mobile app is completely free – fees will apply to use the Payroller web app, Xero integration, and to make super contributions through our integrated super clearing house (Beam).

Many farms employ seasonal workers. Ensure proper record-keeping of their hours worked and pay them according to the relevant award or agreed-upon piece rates. Payroll software can simplify these calculations for piecework.

Absolutely, you can give farm payroll a crack yourself, especially if your farm is a smaller operation with just a handful of employees and a straightforward pay structure. However, chucking yourself into the world of farm payroll can be a fair dinkum time commitment, and there’s a fair whack of room for error. Payroll software can be a real lifesaver for Aussie farmers. It can help with STP, record-keeping, and specific pain points such as seasonal worker management.

If your business is part of the agricultural sector, keep in mind the following awards:

Farm work can involve irregular hours. Clearly communicate award rates and ensure you’re paying staff correctly for overtime, weekend, and public holiday work according to the relevant award. Payroll software can help with these calculations.

Click edit button to change this text. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Payroller is an STP-enabled software that automatically submits payroll information to the Australian Taxation Office (ATO) – through a secure cloud network – whenever you perform a payrun. Payroller helps you to track, manage and record your payroll while safely sharing that information (and staying compliant) with the ATO.

As a truly one-stop payroll solution, you can manage staff roster, invite your accountant, bookkeeper or BAS agent and even make Super contribution (Beam) on Payroller.

Absolutely, you may share your account and even set different access permissions.

Only a few minutes. The majority of our customers get up and running within 15 minutes. If you do need more help in getting set up, simply reach out to our capable live agents and they will have you using Payroller like a seasoned user in no time. Check out our handy user guides.

Yes, Payroller is integrated with Xero. By connecting your Xero account to Payroller, you can easily export and share payroll information cross-platforms.

*By clicking “Try For Free“, you agree to our terms of services and privacy policy.