Payroll made accessible.

- 5 minute setup

- No credit card needed

- No contract period

Create your free account now.

*By clicking “Try For Free“, you agree to our terms of services and privacy policy.

Introducing Payroller, the ultimate payroll solution for not-for-profits and charities in Australia.

Manage your payroll with a hassle-free software to track and apply tax exemptions like Payroller.

Create your free account now.

Payroll made accessible

STP-approved by the Australian Tax Office (ATO)

Simplify and automate all your payroll and STP processes

Keep clear records of who’s been paid in real-time

ExcellentBased on 3027 reviews

Marika Martinez25 June 2024easy to use payroll system

Marika Martinez25 June 2024easy to use payroll system Karen Coatsworth28 May 2024easy to use once set up

Karen Coatsworth28 May 2024easy to use once set up Barry Howat16 May 2024Best app ever, works well very very easy to use recommend it for any one, Luv IT! Well done. Cheers Baz The Weed Terminator. Esperance WA.

Barry Howat16 May 2024Best app ever, works well very very easy to use recommend it for any one, Luv IT! Well done. Cheers Baz The Weed Terminator. Esperance WA.

Legal compliance and cost-efficiency are priorities for non-profit organisations. Payroller makes payroll processing quick and easy for not-for-profits and charities in Australia.

Our Single Touch Payroll (STP) solution is approved by the Australian Tax Office (ATO). Use our simple cloud payroll for charities for however many or few workers.

Keep track of your employees, manage leave entitlements and make superannuation payments in one spot. Pay calculations are automated once you have customised pay rates and working hours. You can also add allowances and adjust for deductions for employees.

Comply with Fair Work regulations and generate payslips direct from your completed pay runs with one click.

Payslips at your fingertips, Fair Work compliant

Payroll made accessible.

Create your free account now.

*By clicking “Try For Free“, you agree to our terms of services and privacy policy.

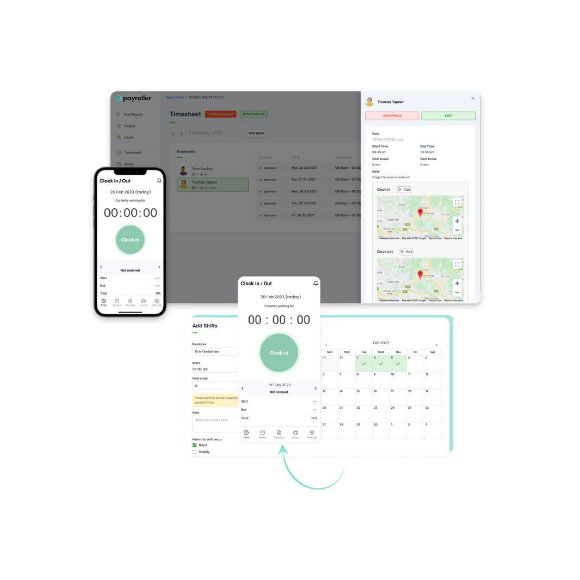

Keep on top of your charity’s payroll more conveniently than ever before. Your payroll data is synced across all devices on desktop and mobile including mobile app.

As a non-profit organisation, you may have employees on casual or flexible working arrangements. Keep track of changes in your staffing arrangements and maintain accurate employee files. Access Payroller cloud payroll anytime.

You can also set work schedules and rosters, and approve employee timesheets on the go. Managing employee hours in different locations has never been easier.

Connect your tax accountant or bookkeeper securely with Payroller. Improve communications with your accountant so that tax time is smoother. Sharing your payroll over our secure platform also helps avoid manual exports of payroll files.

Payroller makes it easier for your bookkeeper to help your not-for-profit’s tax affairs. Instead, devote your time and energy to helping people in need.

Payroller is trusted by hundreds of non-profit organisations in Australia. Our payroll system is ideal for not-for-profits who need a functional but affordable payroll solution. Meet mandatory Single Touch Payroll (STP) laws using our payroll software approved by the Australian Tax Office (ATO)

You don’t need to be an accounting or software expert to use Payroller. Our payroll system is built for small organisations such as charities as a low-cost alternative to other complex accounting providers.

85% of our users run their first payroll in under 15 minutes.

“Try for free” allows you to discover if Payroller is the right software for you and your business before you commit to our platform. “Try for free” is cost and commitment-free and we do not require any credit card details to sign up. So give Payroller a try, it only takes a few minutes to get set up.

While the Payroller mobile app is completely free – fees will apply to use the Payroller web app, Xero integration, and to make super contributions through our integrated super clearing house (Beam).

In Australia, non-profit organisations are generally required to lodge a tax return regardless of their income. There are some exceptions:

It’s important to check with the ATO or a registered tax agent to determine your specific obligations based on your organization’s structure and income level.

Payroller is an STP-enabled software that automatically submits payroll information to the Australian Taxation Office (ATO) – through a secure cloud network – whenever you perform a payrun. Payroller helps you to track, manage and record your payroll while safely sharing that information (and staying compliant) with the ATO.

As a truly one-stop payroll solution, you can manage staff roster, invite your accountant, bookkeeper or BAS agent and even make Super contribution (Beam) on Payroller.

Absolutely, you may share your account and even set different access permissions.

Only a few minutes. The majority of our customers get up and running within 15 minutes. If you do need more help in getting set up, simply reach out to our capable live agents and they will have you using Payroller like a seasoned user in no time. Check out our handy user guides.

Yes, you can manage your own payroll for a non-profit organisation. However, it requires a good understanding of Australian tax regulations, PAYG withholding, superannuation obligations, and STP reporting. Mistakes in payroll processing can lead to penalties and compliance issues.

Payroller keeps up with ATO standards to make sure your automated calculations and reporting comply with requirements and regulations.

By automating tasks like calculations, deductions, and tax withholding, Payroller saves time and reduces errors. It also helps ensure compliance with complex regulations like PAYG, superannuation, and STP reporting. This can be a major advantage for non-profits, potentially reducing administrative costs compared to hiring a dedicated payroll person. Finally, Payroller’s user-friendly design and easy reporting features make it a valuable tool for non-profits looking to streamline payroll processing, improve accuracy, and free up staff to focus on their core mission.

Yes, Payroller is integrated with Xero. By connecting your Xero account to Payroller, you can easily export and share payroll information cross-platforms.

Payroll made accessible.

Create your free account now.

*By clicking “Try For Free“, you agree to our terms of services and privacy policy.