Payroll for new business

Introducing Payroller, the ultimate payroll solution for new businesses.

Managing your business payroll is easy and hassle-free with Payroller.

By clicking Try for Free, you agree to our terms of service and privacy policy.

Set up payroll for your new business in minutes

Streamline your payroll process for your new business with Payroller software. Meet legal requirements to the Australian Tax Office (ATO) and Fair Work with Payroller.

Setting up your new business with single-touch payroll software like Payroller is easy. Our easy payroll system has everything you need to manage staffing and pay. Customise pay rates, allowances and deductions for employees.

You can also pay superannuation online and generate payslips from pay runs with one click.

Payslips at your fingertips, Fair Work compliant

ATO Compliant

STP-approved by the Australian Tax Office (ATO)

Fast Setup

Simplify and automate all your payroll and STP processes

Reliable Reporting

Keep clear records of who’s been paid in real-time

Don’t just take our word for it.

EXCELLENTTrustindex verifies that the original source of the review is Google. easy to use payroll systemTrustindex verifies that the original source of the review is Google. easy to use once set upTrustindex verifies that the original source of the review is Google. Best app ever, works well very very easy to use recommend it for any one, Luv IT! Well done. Cheers Baz The Weed Terminator. Esperance WA.

Payroll made accessible

- 5 minute setup

- No credit card needed

- No contract period

Create your free account now!

*By clicking “Try For Free“, you agree to our terms of service and privacy policy.

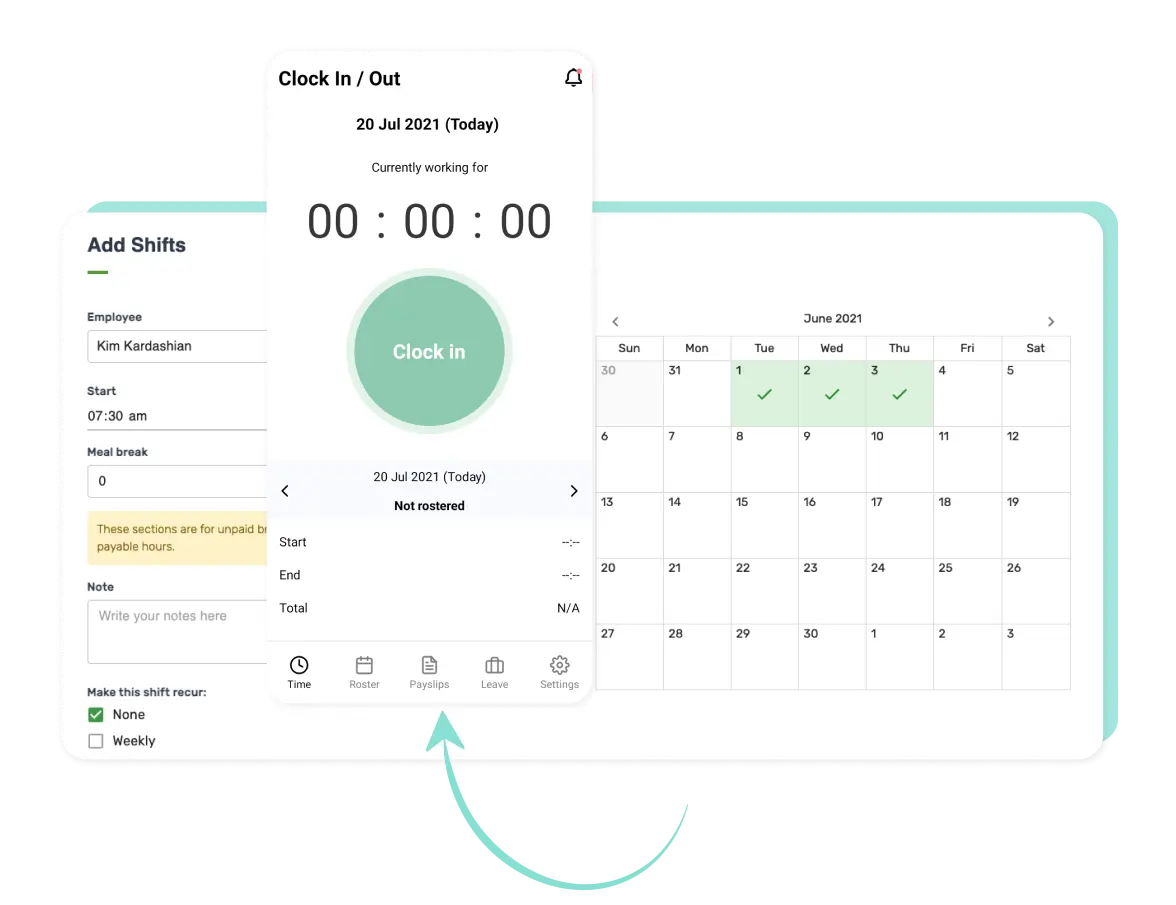

Start running STP from anywhere

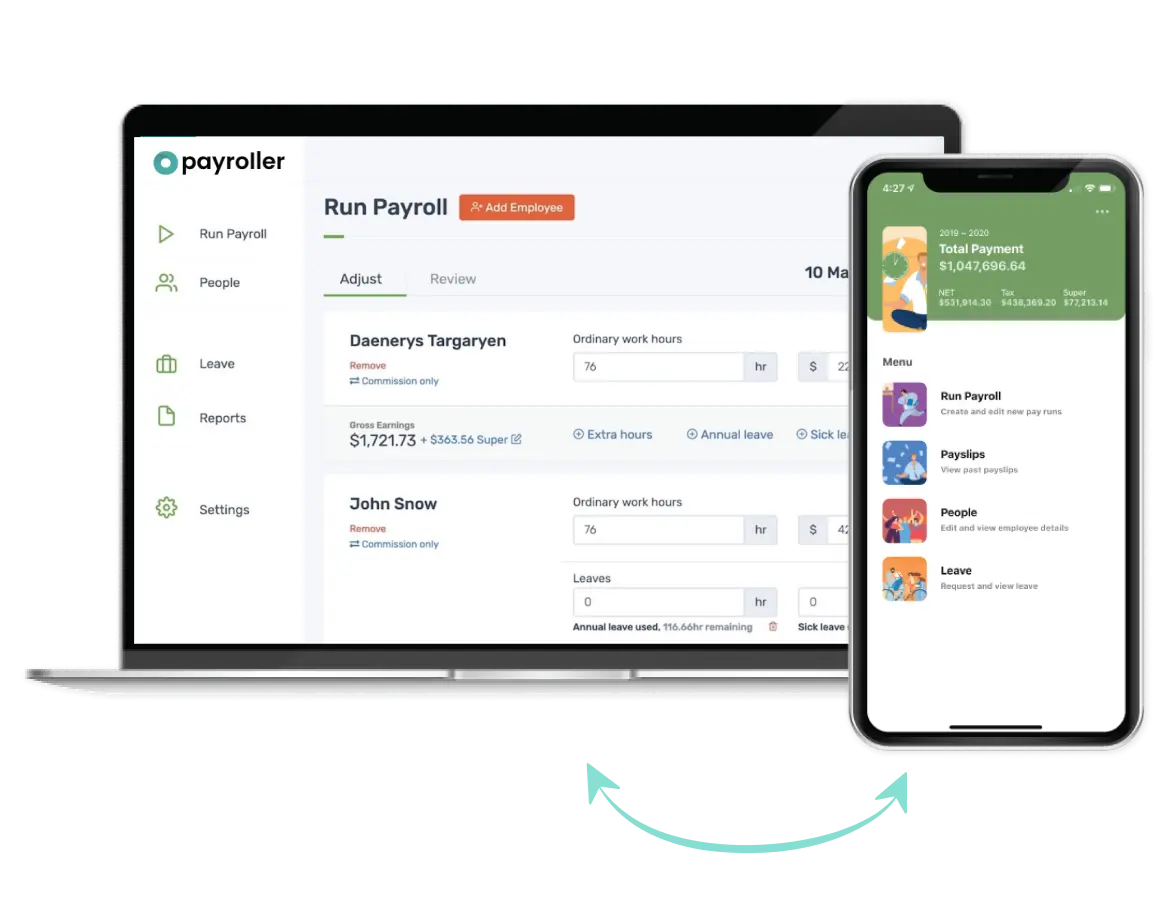

There’s so much to do when you start a new business. With Payroller, it’s simple to onboard new employees and make your first pay run. Adjust pay cycles and edit employee information when needed.

Take control of your new team and business no matter where you are. Payroller gives you flexibility to run payroll across any internet-connected devices, including desktop, mobile web and mobile app. Your employees can also access payslips, rostered shifts, and submit timesheets on the Payroller employee mobile app.

You can also access Payroller’s staff scheduling and time tracking tools. Our integrated payroll, rosters and timesheets system is the most affordable option for new businesses in Australia who want basic HR features.

Your accountant can view payroll & tax instantly

Securely connect your tax accountant to your payroll with Payroller. Avoid manually exporting your payroll files, as your bookkeeper has real-time access to your payroll data. This improves communication with your accountant.

You don’t need to be an accounting expert to use Payroller. However, it is always helpful to have a professional review your payroll processes. Focus on starting your new business and growing your income.

New business payroll that is STP approved by the ATO

The Payroller STP program is designed to be easy for new businesses and start-ups. Our user-friendly payroll software is tried and tested by thousands of Australian businesses. When you’re busy setting up your new business, you want fast payroll set-up and legally compliant pay runs.

Try our STP-approved software for free. Meet your legal obligations to the Australian Tax Office (ATO) in a low-cost way.

85 % of our users run their first payroll in under 15 minutes.

Frequently asked questions about payroll for new businesses

How does “Try for free” work?

“Try for free” allows you to discover if Payroller is the right software for you and your business before you commit to our platform. “Try for free” is cost and commitment-free and we do not require any credit card details to sign up. So give Payroller a try, it only takes a few minutes to get set up.

While the Payroller mobile app is completely free – fees will apply to use the Payroller web app, Xero integration, and to make super contributions through our integrated super clearing house (Beam).

What are the main payroll taxes that new businesses should consider?

There are three main payroll taxes in Australia:

- PAYG withholding: Income tax withheld from employee salaries and remitted to the Australian Taxation Office (ATO) quarterly.

- Superannuation guarantee (Super): You contribute a percentage of an employee’s Ordinary Time Earnings (OTE) towards their superannuation fund (currently 10.5% as of April 2024).

- Payroll tax: Depending on your location and exceeding a wage threshold, you may need to pay payroll tax on wages paid to employees.

What features should I look for in payroll software for a new business?

Here are some key payroll features to consider that would serve new businesses well:

- STP compliance: Ensures automatic and compliant reporting of payroll information to the ATO.

- Easy onboarding & set-up: Simplifies the process of adding new employees and setting up their payroll details.

- Cloud-based access: Allows you to access and manage payroll information from anywhere with an internet connection.

Can I do payroll for my new business on my own?

Managing payroll yourself might be an option for a tiny team with a simple pay structure. However, as your business grows, so does the complexity of payroll. Payroll software can be a game-changer, freeing up your valuable time and minimising errors. It also ensures you’re adhering to all the relevant award rates and tax regulations, which can become increasingly intricate. In short, payroll software is a wise investment that becomes even more critical as your business expands

How does Payroller work?

Payroller is an STP-enabled software that automatically submits payroll information to the Australian Taxation Office (ATO) – through a secure cloud network – whenever you perform a payrun. Payroller helps you to track, manage and record your payroll while safely sharing that information (and staying compliant) with the ATO.

As a truly one-stop payroll solution, you can manage staff roster, invite your accountant, bookkeeper or BAS agent and even make Super contribution (Beam) on Payroller.

Can I share my Payroller account?

Absolutely, you may share your account and even set different access permissions.

How long does it take to set up a new business's payroll with Payroller?

Only a few minutes. The majority of our customers get up and running within 15 minutes. If you do need more help in getting set up, simply reach out to our capable live agents and they will have you using Payroller like a seasoned user in no time. Check out our handy user guides.

Does Payroller integrate with other platforms?

Yes, Payroller is integrated with Xero. By connecting your Xero account to Payroller, you can easily export and share payroll information cross-platforms.

Resources for new businesses

Get started today and experience the many benefits of Payroller.

Try it now for free!

Payroll made accessible

- 5 minute setup

- No credit card needed

- No contract period

Create your free account now!

*By clicking “Try For Free“, you agree to our terms of service and privacy policy.