Payroll made accessible.

- 5 minute setup

- No credit card needed

- No contract period

Create your free account now.

*By clicking “Try For Free“, you agree to our terms of services and privacy policy.

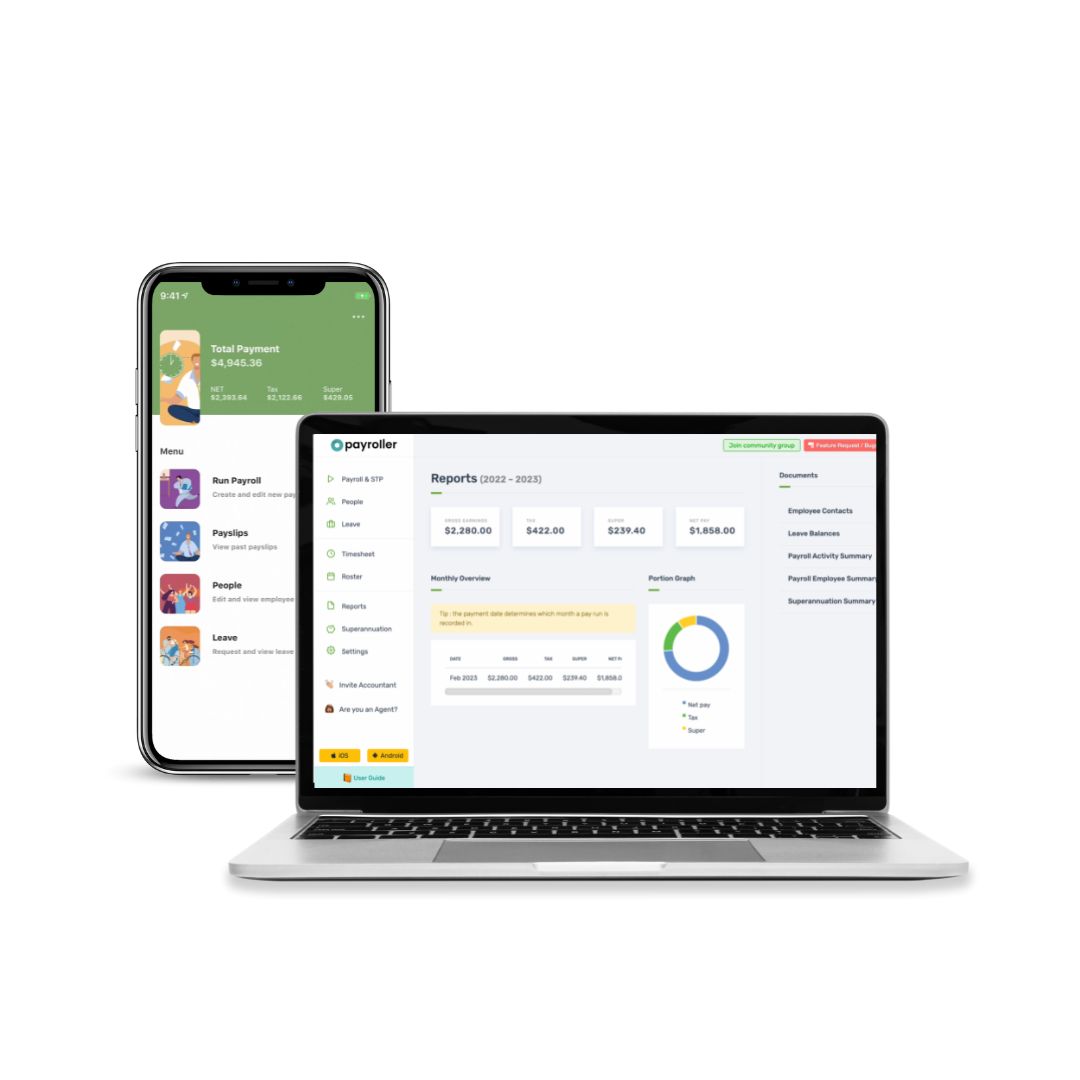

Introducing Payroller, the ultimate payroll solution for micro businesses and micro-employers in Australia

Managing your business payroll is easy and hassle-free with Payroller

Create your free account now.

Payroll made accessible

STP-approved by the Australian Tax Office (ATO)

Simplify and automate all your payroll and STP processes

Keep clear records of who’s been paid in real-time

ExcellentBased on 3027 reviews

Marika Martinez25 June 2024easy to use payroll system

Marika Martinez25 June 2024easy to use payroll system Karen Coatsworth28 May 2024easy to use once set up

Karen Coatsworth28 May 2024easy to use once set up Barry Howat16 May 2024Best app ever, works well very very easy to use recommend it for any one, Luv IT! Well done. Cheers Baz The Weed Terminator. Esperance WA.

Barry Howat16 May 2024Best app ever, works well very very easy to use recommend it for any one, Luv IT! Well done. Cheers Baz The Weed Terminator. Esperance WA.

As a micro-employer, you want a simple and affordable payroll system like Payroller. When you manage just one or two employees, your microbusiness simply needs reliable single touch payroll (STP) software that meets ATO laws.

Payroller is a cost-effective solution when you don’t have complex payroll needs. Make pay runs, manage leave and make super payments in seconds.

You can process payroll for your microbusiness quickly and then generate payslips for employees direct from pay runs.

Payslips at your fingertips – Fair Work compliant

Payroll made accessible.

Create your free account now.

*By clicking “Try For Free“, you agree to our terms of services and privacy policy.

Single Touch Payroll (STP) is a legal requirement for all Australian microbusinesses. Other payroll solutions may be too complex, expensive and have unnecessary features for your needs as a micro-employer.

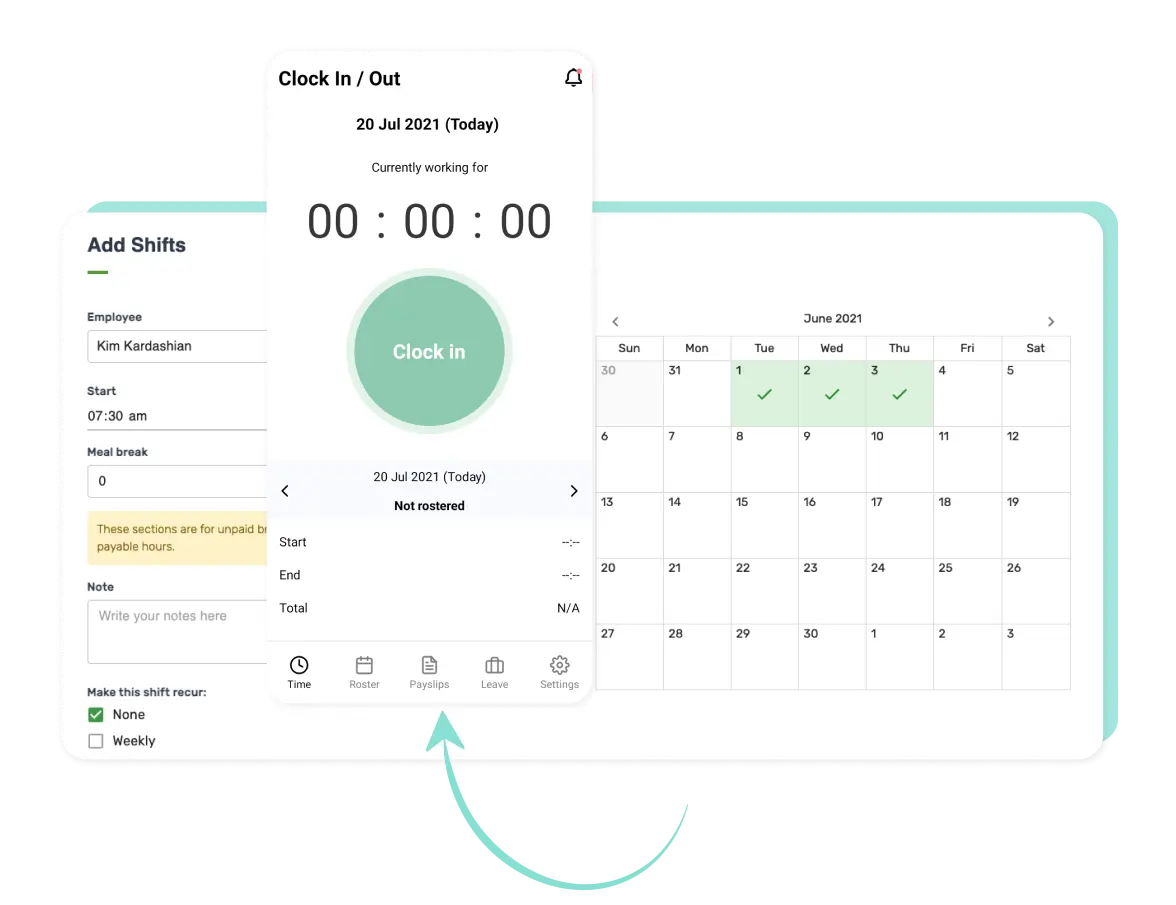

Payroller offers simple payroll that is synced across all internet-connected devices including desktop, mobile web and mobile app. You can also access our work rostering, time tracking and timesheet tools in our simple solution.

Doing payroll has never been easier or faster with Payroller. Whether you’re working from home or on the go, make ATO compliant pay runs with a few clicks.

You don’t need much accounting knowledge to use Payroller. However, you can still connect your accountant or bookkeeper to access your payroll data securely using Payroller.

Your tax agent can help you manage your payroll and tax faster. Concentrate on growing your micro-business instead of tax and finances.

You don’t need to be a software or accounting expert to use Payroller. Our payroll software is STP-approved by the Australian Tax Office (ATO). Payroller is loved by thousands of Australian microbusinesses for being simple and reliable.

Add or remove employees as you require. Our easy payroll solution for micro-employers can grow with your needs.

85% of our users run their first payroll in under 15 minutes.

“Try for free” allows you to discover if Payroller is the right software for you and your business before you commit to our platform. “Try for free” is cost and commitment-free and we do not require any credit card details to sign up. So give Payroller a try, it only takes a few minutes to get set up.

While the Payroller mobile app is completely free – fees will apply to use the Payroller web app, Xero integration, and to make super contributions through our integrated super clearing house (Beam).

Microbusiness in Australia are responsible for withholding income tax (PAYG) from employee salaries and remitting it to the ATO, contributing a percentage of earnings towards employee superannuation, and potentially paying payroll tax (depending on their state/territory and exceeding a wage threshold). Additionally, STP may require electronic reporting of employee salary and super information to the ATO.

Running payroll yourself for your microbusiness is possible, but it depends on your skills and the complexity of your setup.

DIY payroll might work if you have a few staff, a simple pay structure with fixed salaries, and a firm grasp on Australian tax rules, superannuation, and reporting. However, it’s time-consuming and error-prone. Keeping up with changing regulations can also be tricky.

Payroll software can be a better option, especially with STP rules. It automates calculations, minimises errors, and ensures compliance. It also saves you time and streamlines processes like generating payslips and managing deductions. The software can even scale to handle more employees and complex pay structures.

Payroll software for microbusinesses

automates calculations, reducing errors and saving time. The software also ensures compliance with tax regulations and superannuation contributions, giving you peace of mind. Additionally, it streamlines processes like generating payslips and managing deductions, freeing you up to focus on growing your business. Even if you use software, consulting a payroll professional can provide valuable setup guidance and answer any questions you encounter.

Payroller is an STP-enabled software that automatically submits payroll information to the Australian Taxation Office (ATO) – through a secure cloud network – whenever you perform a payrun. Payroller helps you to track, manage and record your payroll while safely sharing that information (and staying compliant) with the ATO.

As a truly one-stop payroll solution, you can manage staff roster, invite your accountant, bookkeeper or BAS agent and even make Super contribution (Beam) on Payroller.

Absolutely, you may share your account and even set different access permissions.

Only a few minutes. The majority of our customers get up and running within 15 minutes. If you do need more help in getting set up, simply reach out to our capable live agents and they will have you using Payroller like a seasoned user in no time. Check out our handy user guides.

Yes, Payroller is integrated with Xero. By connecting your Xero account to Payroller, you can easily export and share payroll information cross-platforms.

*By clicking “Try For Free“, you agree to our terms of services and privacy policy.