Aimee Cando

Payroller, SEO Specialist

Aimee Cando is a Search Engine Optimisation Executive at Payroller, passionate about creating impactful content that helps businesses succeed. As a member of the Payroller team, they leverage their expertise in content strategy, digital marketing, and data analysis to optimise the user experience.

Aimee’s background includes leading content-based projects and developing SEO strategies for businesses in a range of industries, such as B2B SaaS, hospitality, and education.

Recent posts by Aimee Cando

Agent Resources

Your clients aren’t ready for Payday Super. But you can be.

The countdown to Payday Super has started, and a new reality is setting in for Australian tax agents and financial ...

Read More →

Payroll Management

Facing the upcoming compliance nightmare: Is your business prepared for Payday Super?

The emergence of Payday Super brings concerns of the small business owner juggling wages, sick leave, and taxes. Suddenly, you’re ...

Read More →

Business Management

Ready for the end-of-year shutdown? Leaves, obligations, holiday pay & more

It’s that time of year again. The calendar is filling up, the inbox is overflowing, and you’re probably dreaming about ...

Read More →

Payroll Management

Small Business Super Clearing House (SBSCH) Closure: What businesses need to know with Payday Super

You might have heard the rumblings already. The ATO is shutting down the Small Business Superannuation Clearing House (SBSCH). If ...

Read More →

Payroll Management

How to automate your payroll in 3 simple steps

On Payroller, automated payroll is not some complex, scary feature—it’s a simple switch you can flip. I’m going to show ...

Read More →

Payroll Management

What is payroll automation? Benefits, features & case studies

Payroll is a necessary part of running a business, but it doesn’t have to be a time-consuming one. If you’re ...

Read More →

Payroll Management

What is the Super Guarantee Charge (SGC)? Everything you need to know

Paying your team’s super late might seem like a small oversight, but it can trigger a costly penalty from the ...

Read More →

Payroll Management

What is Qualifying Earnings (QE)? A guide for Payday Super

The Australian Taxation Office (ATO) reported that workers lose more than $4.7 billion in unpaid super every year, and changes ...

Read More →

Payroll Management

What is Ordinary Time Earnings (OTE)?

You’ve probably heard of Ordinary Time Earnings, but you might not be 100% clear on what it covers. You’re not ...

Read More →

Payroll information & tips

What is cloud payroll? Everything you need to know

If you’re a small business owner, you know the feeling. You’re pouring your heart into your business, but the never-ending ...

Read More →

Payroll Management

Superannuation compliance: How to ensure accuracy for small businesses

Running a small business is a constant balancing act. The last thing you need is a headache from payroll and ...

Read More →

Employee Management

What is a timesheet? A complete guide to employee timesheets

Employee timesheets are a record of the hours an employee works, typically used to calculate their pay and ensure they’re ...

Read More →

Payroll information & tips

8 best payroll software for Australian businesses

Australia’s payroll requirements aren’t a walk in the park. Between Single Touch Payroll (STP), PAYG withholding, superannuation guarantee, and Fair ...

Read More →

Continuing Professional Development (CPD)

A complete CPD guide for engineers by state [Updated 2025]

Continuing Professional Development (CPD) is a cornerstone of professional growth and recognition for engineers in Australia. As engineering disciplines diversified ...

Read More →

Continuing Professional Development (CPD)

A complete CPD guide for healthcare per specialisation [Updated 2025]

Continuing Professional Development (CPD) is critical to maintaining professional registration and ensuring high-quality patient care in Australia. The Medical Board ...

Read More →

Payroll information & tips

What is payroll management? How to set up your own system

Payroll management is more than just cutting paychecks. It’s an important function in any business, ensuring employees are compensated and ...

Read More →

Payroll information & tips

How to start payroll processing for your business

Payroll is a fundamental aspect of any business. In Australia, navigating payroll can be complex due to various regulations, including ...

Read More →

Continuing Professional Development (CPD)

A complete CPD guide for lawyers per state [Updated 2025]

Continuing Professional Development (CPD) is a commitment to ongoing, lifelong learning for legal professionals. It’s mandated by The Legal Practice ...

Read More →

Continuing Professional Development (CPD)

A complete CPD guide for accountants [Updated 2025]

The accounting field is always changing because of new laws, developing technology, and shifts in industry practices. To keep up, ...

Read More →

Continuing Professional Development (CPD)

A complete CPD guide for builders and construction professionals [Updated 2025]

Engaging in Continuing Professional Development (CPD) activities helps builders adapt to new technologies, such as sustainable building practices and innovative ...

Read More →

Payroll information & tips

Payroll outsourcing: Key considerations for businesses

As businesses grow and expand, payroll management can evolve into challenges like complex calculations and extensive record-keeping. This is where ...

Read More →

Payroll information & tips

How to conduct a payroll audit: A complete checklist

Businesses today face many payroll challenges, making regular payroll audits essential. These help make sure that employees are paid correctly ...

Read More →

Business Management

What is competitor analysis? Analyse your competitors in 6 steps

As you start or grow your business, you might wonder: “Who else is out there?” and “What are they doing ...

Read More →

Agent and Bookkeeper Resources

Engagement letters: How it works & tips for accountants

Accountants have many responsibilities. One of these is managing their clients. This requires strong communication and time management skills to ...

Read More →

Payroll information & tips

How much do you get paid on jury duty?

Jury duty can be a complex topic, especially when it comes to how it affects pay and leave balances. Below, ...

Read More →

Payroll Industry & ATO Updates

Xero Payroll Only: Price changes, payroll-only plan phase-out & impact on small businesses

Last updated June 2025 Latest News: Upcoming Xero price changes effective July 2025 Changes in Xero software pricing have been ...

Read More →

Employee Management

How to master scheduling for hospitality staff

In hospitality businesses, guest satisfaction relies on impeccable service. Efficient staffing is no longer a luxury afforded to chain hotels ...

Read More →

Hospitality

Understanding the hospitality industry: Key statistics & trends in 2024

Australia’s hospitality industry beckons travellers and locals, from sun-drenched beaches and vibrant cities to world-class wineries and ancient outback landscapes. ...

Read More →

Hospitality

Restaurant accounting guide for small businesses

Running a restaurant can be a dream come true, especially when we talk about Australia’s vast culinary landscape. But like ...

Read More →

Before starting your business

How to navigate and register GST for small businesses

Navigating the Goods and Services Tax (GST) world can be daunting for small business owners in Australia. But don’t worry—this ...

Read More →

Employee Management

What is staff management? Best strategies & best practices for businesses

The modern workplace presents a unique set of challenges for managing staff. From navigating a multi-generational workforce to keeping pace ...

Read More →

Employee Management

What is casual employment? A guide to work hours and entitlements

What does casual employment mean? In Australia, casual employment refers to a specific work arrangement with distinct characteristics outlined by ...

Read More →

Agent and Bookkeeper Resources

How to perform a business valuation: 5 methods to find out how much a business is worth

Whether your client is selling their business or planning for the future, business valuation is a crucial skill for professionals ...

Read More →

Agent and Bookkeeper Resources

How to evaluate and manage the financial risks of a business

In today’s dynamic business environment, navigating financial uncertainty is paramount for achieving long-term success. Financial risk, consisting of a range ...

Read More →

Agent and Bookkeeper Resources

How to measure the financial performance of a company

A company’s financial well-being is like a compass, guiding its direction and future success. As an accountant, it’s one of ...

Read More →

ATO and Fair Work Updates

Individual income tax changes in 2024: What you need to know & how it affects you

Understanding the latest tax bracket changes is crucial for effective financial planning as we approach the new fiscal year. Effective ...

Read More →

Employee Management

Contractor vs Employee: Understanding the differences, benefits & tax implications

In the small business world, understanding the difference between hiring an independent contractor versus an employee is important. This article ...

Read More →

Agent Resources

Important tax return dates for Australian agents

Key tax return dates to keep in mind As a tax agent, staying on top of key lodgement deadlines is ...

Read More →

Agent Resources

How to lodge Fringe Benefits Tax (FBT) and due dates to remember

Fringe Benefits Tax (FBT) can be a complex topic for businesses in Australia, particularly for those new to the system ...

Read More →

End of Financial Year

A complete guide to everything you need for EOFY payroll

The End of the Financial Year (EOFY) can feel like a bit of a hurdle for small businesses, but payroll ...

Read More →

End of Financial Year

EOFY checklist: Key small business tasks for the end of the financial year

The end of the financial year (EOFY) is more than just a time for compliance – it’s a crucial period ...

Read More →

Agent and Bookkeeper Resources

Are you ready to start a bookkeeping business? The complete 8-step roadmap

A career in bookkeeping offers aspiring financial wizards a stable and rewarding career path. But where do you begin? This ...

Read More →

Agent and Bookkeeper Resources

What is cloud accounting? 9 reasons to move your accounting practice to the cloud

The Australian accounting landscape is thriving. In 2023, the industry saw a revenue of $12.3 billion. But with success comes ...

Read More →

Agent and Bookkeeper Resources

How to start an accounting practice: A guide to building your own firm

If you’re thinking of starting your own accounting practice, then you dream of building your own legacy. The freedom, flexibility, ...

Read More →

Business Management

What is PAYG withholding? How to register and stay compliant

Have you ever heard of PAYG withholding and been confused by it? You’re not alone! The Australian Tax Office (ATO) ...

Read More →

Payroll information & tips

The future of AI in payroll management and accounting

Gone are the days of staying up late, struggling with spreadsheets, and crunching numbers for payroll. Now, there’s something new ...

Read More →

Before starting your business

Why your last business grant application failed and how to fix it: How-to, funders & tips

Dreaming of launching your business into success but stuck on the launchpad due to funding woes? Traditional business loans might ...

Read More →

Agents on Payroller

Agent Portal V2

Read our overview of the Agent Portal in Payroller. Manage your clients' payroll easily as an accountant, bookkeeper, and/or BAS agent.

Read More →

Agents on Payroller

Changing your employer account to an Agent Account V2

Learn how to switch from an Employer account to an Agent account in Payroller

Read More →

Before starting your business

Small business bookkeeping: 8 simple steps to follow

Bookkeeping is your financial compass, guiding you through calm waters and choppy seas. It’s not just about numbers; it’s about ...

Read More →

Before starting your business

How to get a business loan: A complete guide for small businesses

Running and managing a business is an incredible journey, but sometimes, cash flow can be unpredictable. Business owners can take ...

Read More →

Before starting your business

How to start a business in Australia: A checklist

Dreaming of ditching the 9-to-5 and becoming your own boss? Chasing that brilliant business idea and turning it into an ...

Read More →

Before starting your business

How to turn your idea into a business: 16 steps you need to know

Have you ever imagined turning your great idea into a successful business? That spark of inspiration within you has the ...

Read More →

Employee Management

How to make a timesheet for your small business

Why should my small business use employee timesheets? You need a timesheet to accurately track employee work hours, calculate payroll, ...

Read More →

Business Management

How to comply with Australian payroll regulations

If your business idea and structure involve employing workers in Australia, you’ll need to comply with various payroll regulations. It’s ...

Read More →

Payroll Management

Key 2023 superannuation legislation changes

The world of superannuation is going through a period of notable reform. Changes to Australian superannuation laws bring substantial benefits ...

Read More →

Business Management

Common mistakes small businesses make during tax time

Tax season often comes with its share of complexities, and for many Australian businesses, navigating the labyrinth of tax deductions ...

Read More →

Payroll Management

Your 2023 superannuation checklist

You’ve worked hard to earn every dollar and you deserve a comfortable retirement. But do you know how much you’ll ...

Read More →

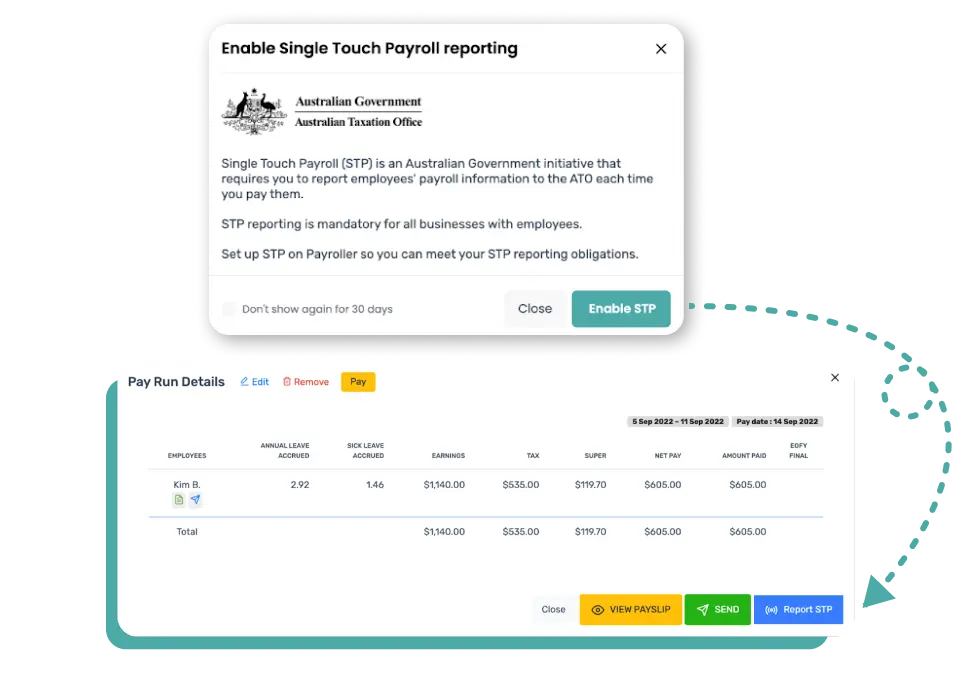

STP (Single Touch Payroll) Resources

How to choose the best Single Touch Payroll system

Small business employers in Australia must meet single touch payroll (STP) reporting requirements under Australian Tax Office (ATO) laws. It’s important ...

Read More →

STP (Single Touch Payroll) Resources

Single touch payroll benefits for small business

If you’re an Australian employer, you are required to use a cloud payroll system equipped for single touch payroll (STP). ...

Read More →

Agent Resources

How to help your clients with tax compliance and laws

Helping your clients stay compliant with tax laws and regulations is one of your key responsibilities as an Australian accountant ...

Read More →

Agent and Bookkeeper Resources

Cash flow management for small businesses: a guide for accountants

This guide helps you offer your small business clients effective cash flow management strategies. Managing cash flow for small businesses ...

Read More →

Payroll information & tips

How to pay taxes for employees

When it comes to paying taxes for your employees, it’s essential that you understand your responsibilities as an employer. Paying ...

Read More →

Payroll information & tips

How to set up payroll for new businesses

To start processing payroll, you’ll need to determine your employees’ pay rates and entitlements. You’ll have to consider factors such ...

Read More →

Payroll information & tips

How to read a payslip

The numbering and abbreviations on pay slips can be confusing at times. In this blog article, we explain what to ...

Read More →

End of Financial Year

What are tax deductions? A guide for small businesses

Tax deductions are expenses that can be claimed against your taxable income. Self-employed individuals and businesses can claim tax deductions ...

Read More →

Business Management

Cybersecurity practices for small businesses

The impact of a cyber security incident on a small business can be devastating. We see the effects of cyber ...

Read More →

Before starting your business

Small business legal structures in Australia

There are several different legal structures available in Australia for small businesses. If you are planning on starting a new ...

Read More →

Agent and Bookkeeper Resources

Should accountants run workshops for their clients?

Workshops can be an effective way for accountants to provide their clients with valuable insights, knowledge and skills related to ...

Read More →

Business Management

Benefits of paying business expenses with a credit card

Does your cash flow always go down rather than up? Are you constantly worried about how you will pay your ...

Read More →

Agent and Bookkeeper Resources

Should you provide payroll services as an accountant?

Do you provide payroll only services to your clients? This article will explain how such a practice can be beneficial ...

Read More →

Business Management

How many employees can a sole trader have?

In Australia, sole traders can have employees. There is no specific limit on the number of employees that a sole ...

Read More →

Business Management

How to pay yourself as a sole trader

Sole trader salaries, explained A sole trader is a self-employed individual who runs their own business. Unlike employees who receive ...

Read More →

Payroll Management

Payroll taxes for real estate agents

As an Australian real estate agent, you must ensure that you are meeting your payroll tax obligations. Learn how to ...

Read More →

Agriculture

The way farmers pay their employees

Payroll for farms and agribusinesses in Australia may seem challenging especially when you don’t have accounting or payroll expertise. Seasonal ...

Read More →

Hair and Beauty

A guide to payroll for beauty therapists & salons

Payroll management can be challenging if you have part-time, full-time, or casual beauty therapists. Streamline the payroll process for your beauty ...

Read More →

Agent and Bookkeeper Resources

Are your clients’ payslips easily accessible?

It has become increasingly common for payroll software for businesses to include employee payslip generation features. As an accountant, bookkeeper ...

Read More →

Agent and Bookkeeper Resources

The agents checklist for tradies in NSW

How to help your trades clients in NSW as an accountant If you have clients that are tradies in NSW, ...

Read More →

Hospitality

What you need to know about managing hotel staff costs

Your staff are important to run your hotel, motel or resort efficiently. Tips for managing hotel staff costs Optimise staffing ...

Read More →

Payroll Management

What’s the difference between employees and contractors in design?

Employees work for an employer on an ongoing basis. However, contractors are self-employed individuals who work on a project-by-project basis ...

Read More →

Hospitality

A guide to overcoming payroll challenges in the hospitality industry

Managing your payroll can be challenging, especially in the hospitality industry where labour costs are high. Restaurant, cafe, and takeaway ...

Read More →

Business Management

A list of payroll questions to ask your accountant

A good understanding of payroll regulations is essential for Australian business owners to stay compliant with ATO & Fair Work ...

Read More →

Payroll information & tips

How to pay employees: A step-by-step guide

All Australian employers should understand their legal obligations when it comes to employee pay. To avoid legal issues, you must ...

Read More →

Payroll information & tips

5 most common payroll challenges faced by construction organisations

Construction payroll management can be challenging for even the most experienced accounting and payroll professionals. Construction projects are complex and ...

Read More →

Payroll information & tips

What is a payroll number?

Payroll is one of the most important aspects of a company. Payroll systems ensure employers can compensate employees accordingly for ...

Read More →

Payroll information & tips

What Is A Payslip?

Home Payslips are an important part of the Australian employment landscape. They are the primary way that employees see their ...

Read More →

Payroll Management

How to do payroll for retail

Managing your retail store’s payroll is vital to accurately processing, calculating and paying employee wages on time. It’s also important ...

Read More →

Hospitality

How to handle payroll for your hospitality business

In hospitality, managing payroll can be one of the most significant administrative challenges. Hospitality businesses rely on casual, part-time, and ...

Read More →

Customer stories

How Lee built his successful cleaning business: A local cleaning business’ success story

Lee Li founded his office cleaning company, Eco Commercial Cleaning in 2012. He noticed that other office cleaning businesses were charging ...

Read More →

New on Payroller

How to use Payroller to make JobMaker claims

Adding JobMaker payments in Payroller – new feature If you’re claiming JobMaker, you’re required to report the payments both ...

Read More →

New on Payroller

Superannuation summaries – New Payroller feature

Managing superannuation information is a hard task for busy small business owners. As an employer, you need to keep track ...

Read More →

New on Payroller

Timesheets and Rostering on Payroller – July 2021 Update

Managing who’s working when and how much they get paid has never been this easy. We’ve added timesheets and online ...

Read More →

New on Payroller

Reduced Payroller support over the holiday period

2021 was a big year at Payroller and Bookipi. Our team is taking some well-deserved time off over the holiday ...

Read More →

STP (Single Touch Payroll) Resources

What is STP Phase 2? A guide for Australian employers

What is STP Phase 2? In the 2019-20 Budget, the Federal Government announced an expansion to Single Touch Payroll (STP) reporting obligations. ...

Read More →

Payroll Management

What is Super stapling and what does it mean for your business?

What is super stapling? As part of the federal Budget in October 2020, the government introduced the Your Future, Your ...

Read More →

New on Payroller

Payroller Subscription fees will be introduced from 2 November 2021

When the founder of Payroller decided to launch Payroller two and a half years ago, he wanted to solve the ...

Read More →

Payroll Management

2021-22 BEAM Superannuation Contributions cut-off dates

With the end of the first quarter of this 2021-22 financial year approaching, the superannuation lodgment dates are also coming ...

Read More →

New on Payroller

Timesheets and Rosters in Payroller – New features for all users!

Managing who’s working when and how much they get paid has never been this easy. Payroller has timesheets and online ...

Read More →

Customer stories

Celebrating local art as a small business with Payroller

Jacqueline Mitchell founded her first business Art Logic in 2002. The business gathered local South Australian artists and rented their ...

Read More →

New on Payroller

Payroller Timesheets Update: Timesheets & rostering features are available in Payroller

Managing who’s working when and how much they get paid has never been this easy. We’ve added timesheets and online ...

Read More →