Learn how to add opening balances in the Payroller mobile app

Learn how to add opening balances in the Payroller mobile app with our simple guide below.

The employees that you are entering may have worked for you for a while.

Because of that, you may want to add these figures as a total in the opening balances rather than entering individual pay runs from the past.

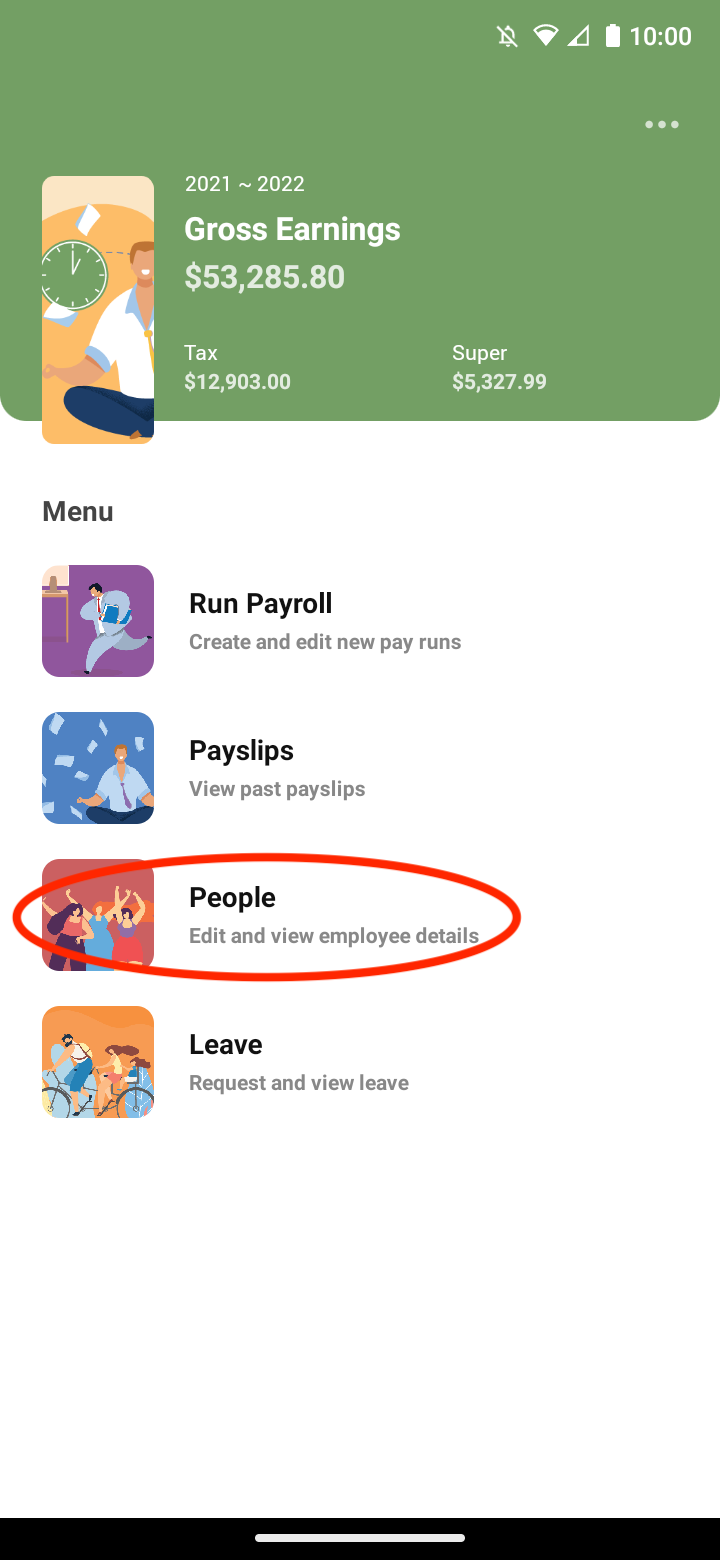

If you need to enter these balances, click on people.

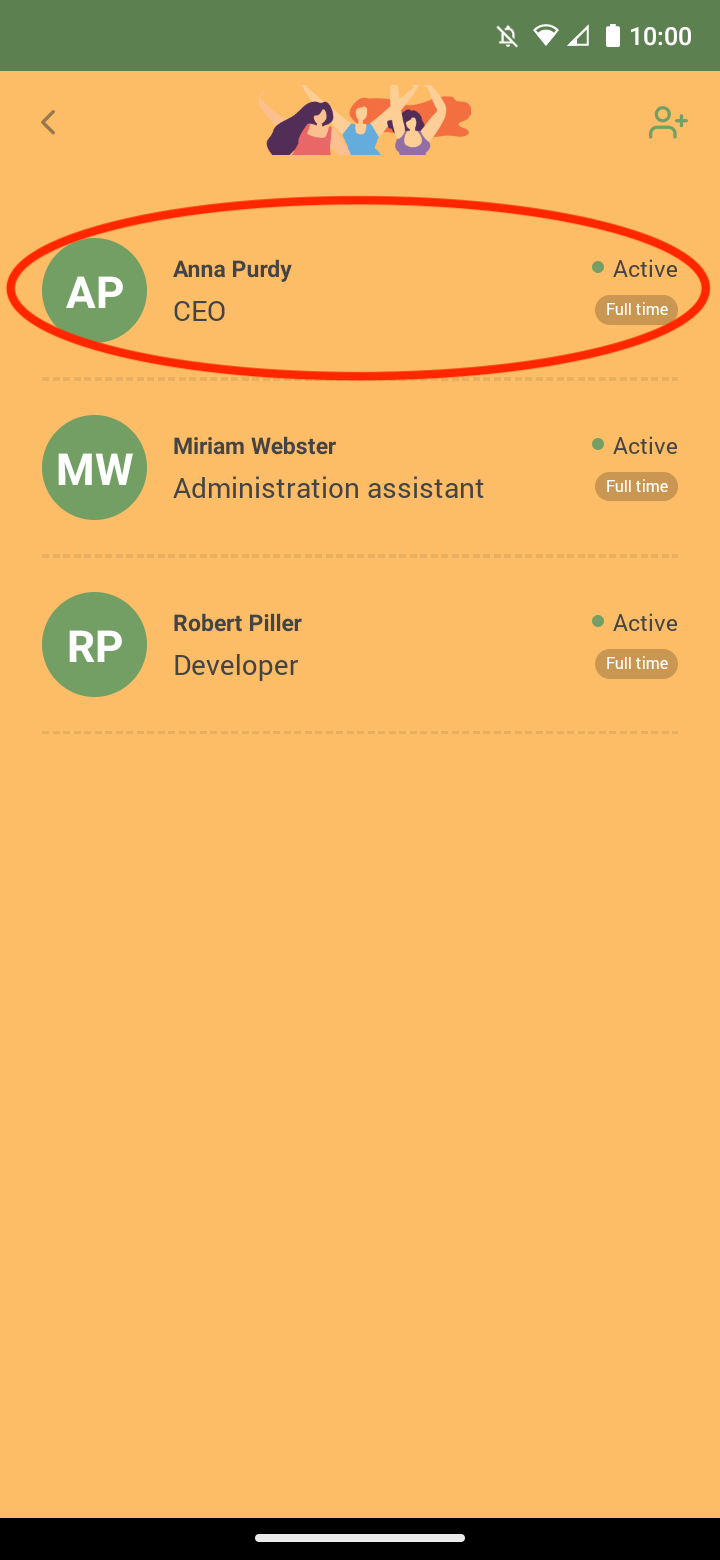

Click on the relevant employee.

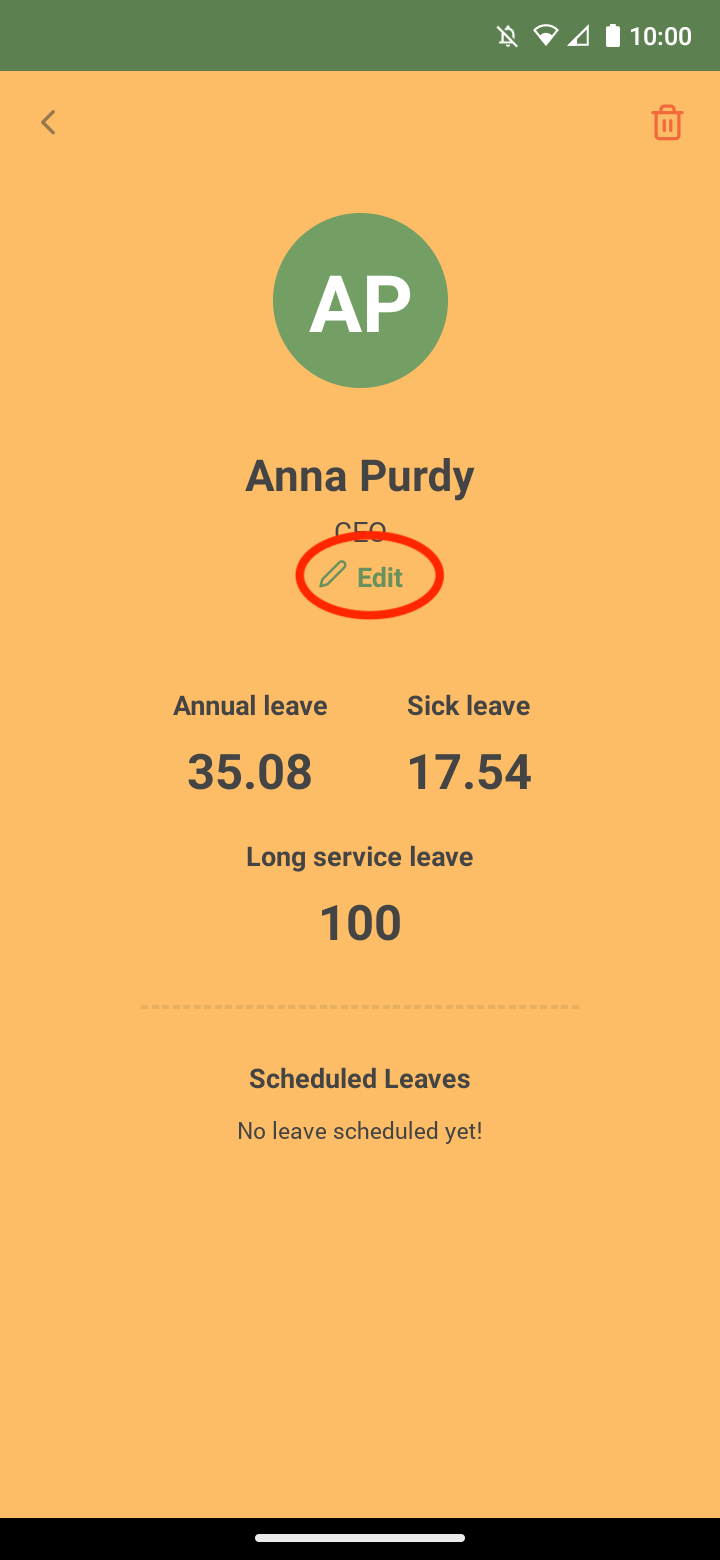

Then ‘Edit’.

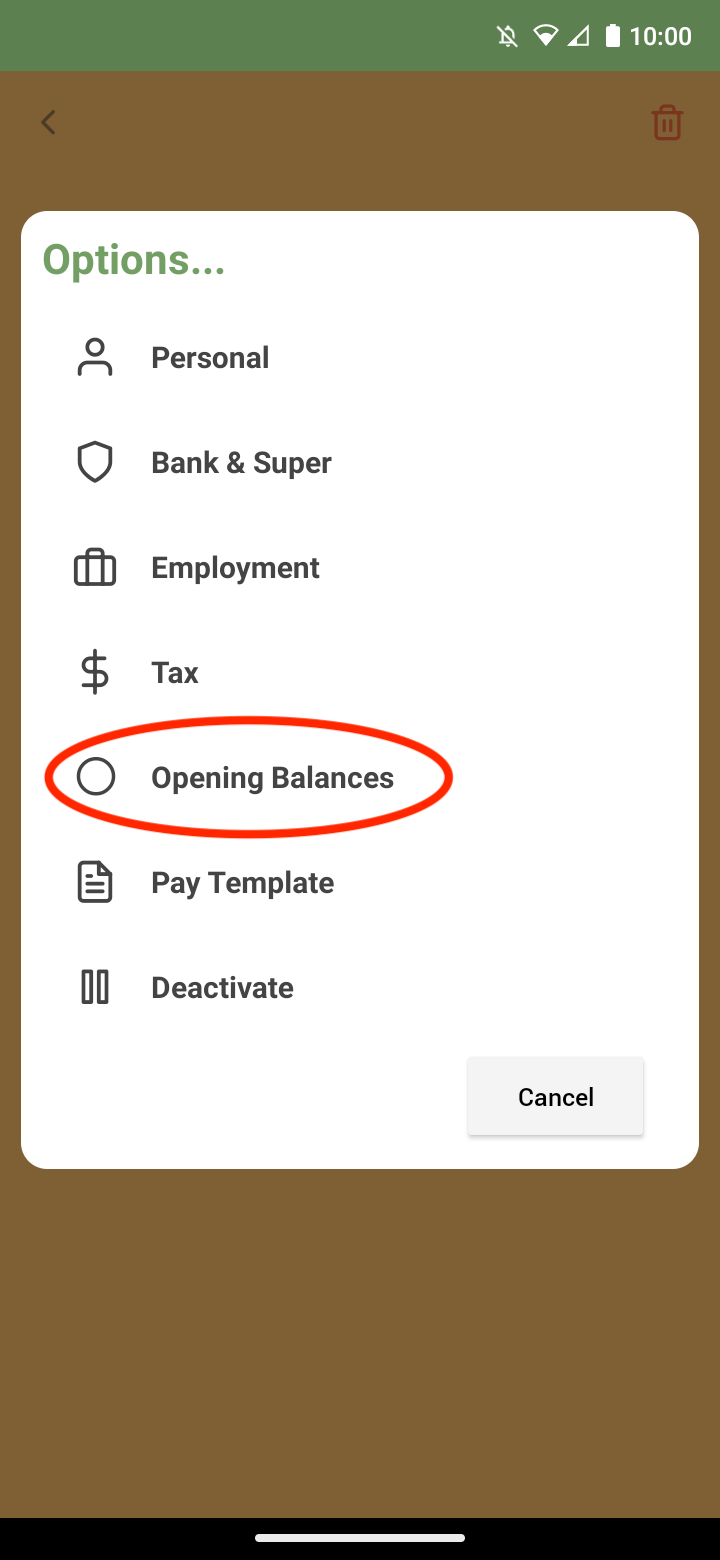

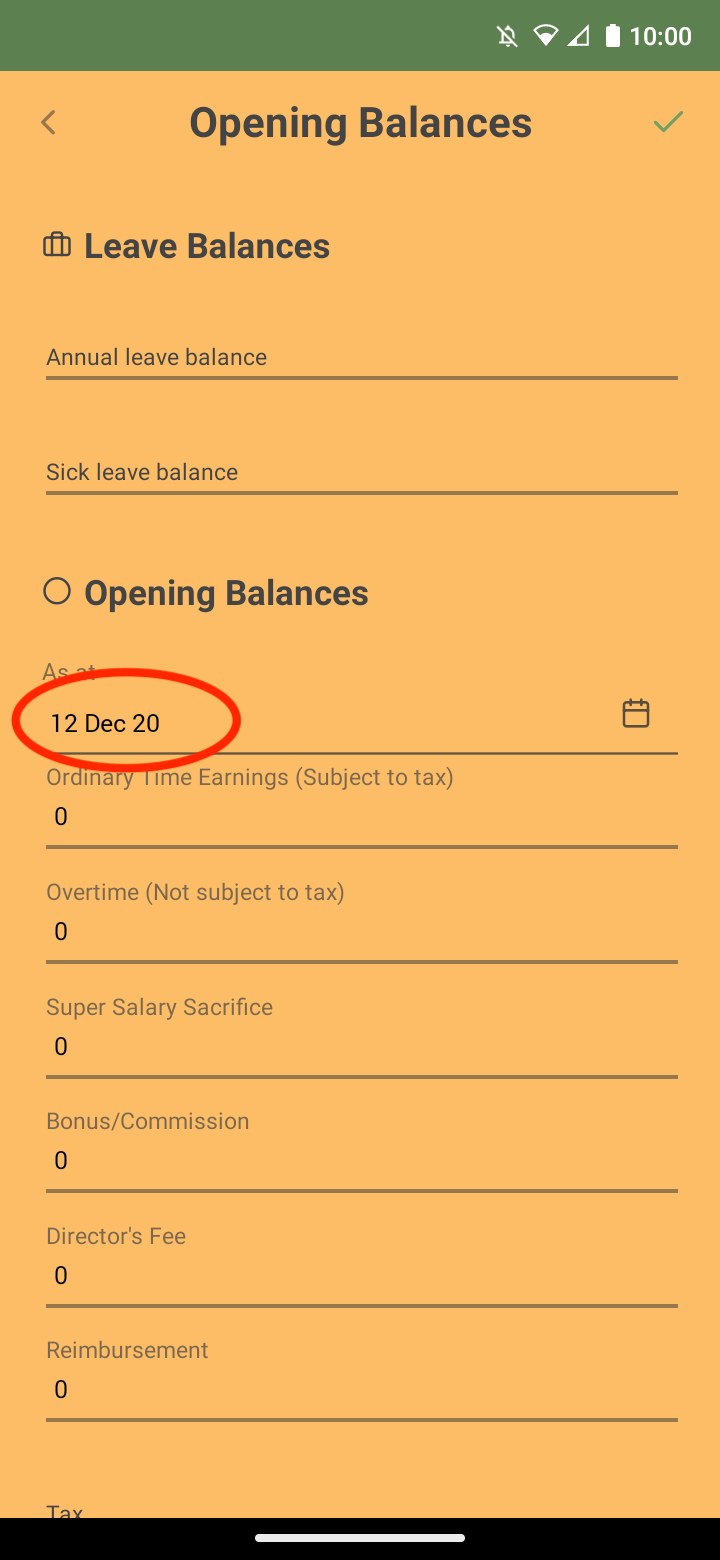

Select ‘Opening Balances’.

In the opening balances section, you can enter the following balances.

-

Leave balances (Annual, Sick Leave and long service leave if activated)

-

YTD values (Ordinary time earnings, overtime, bonuses/commission, director’s fee, super salary sacrifice, tax, super guarantee, employer contributions and reimbursement)

-

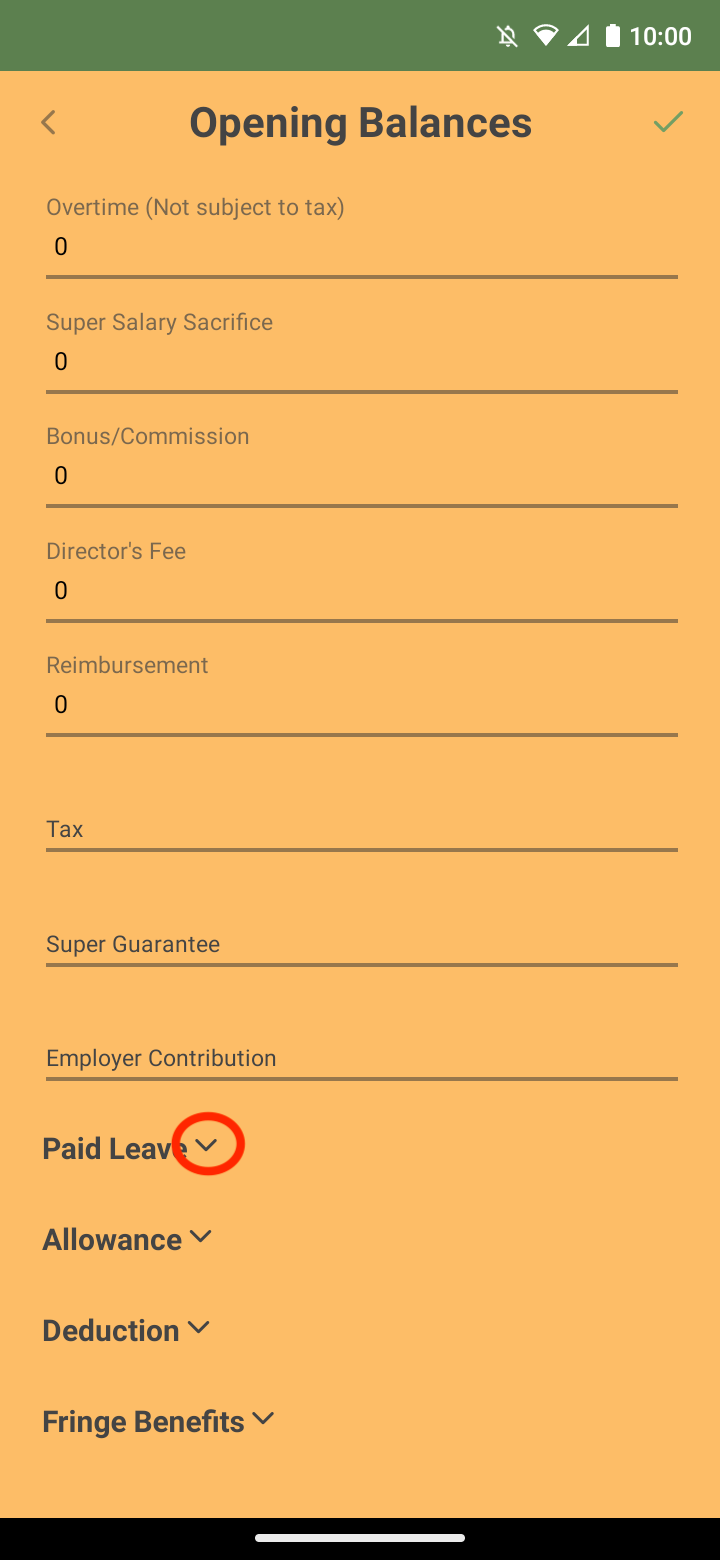

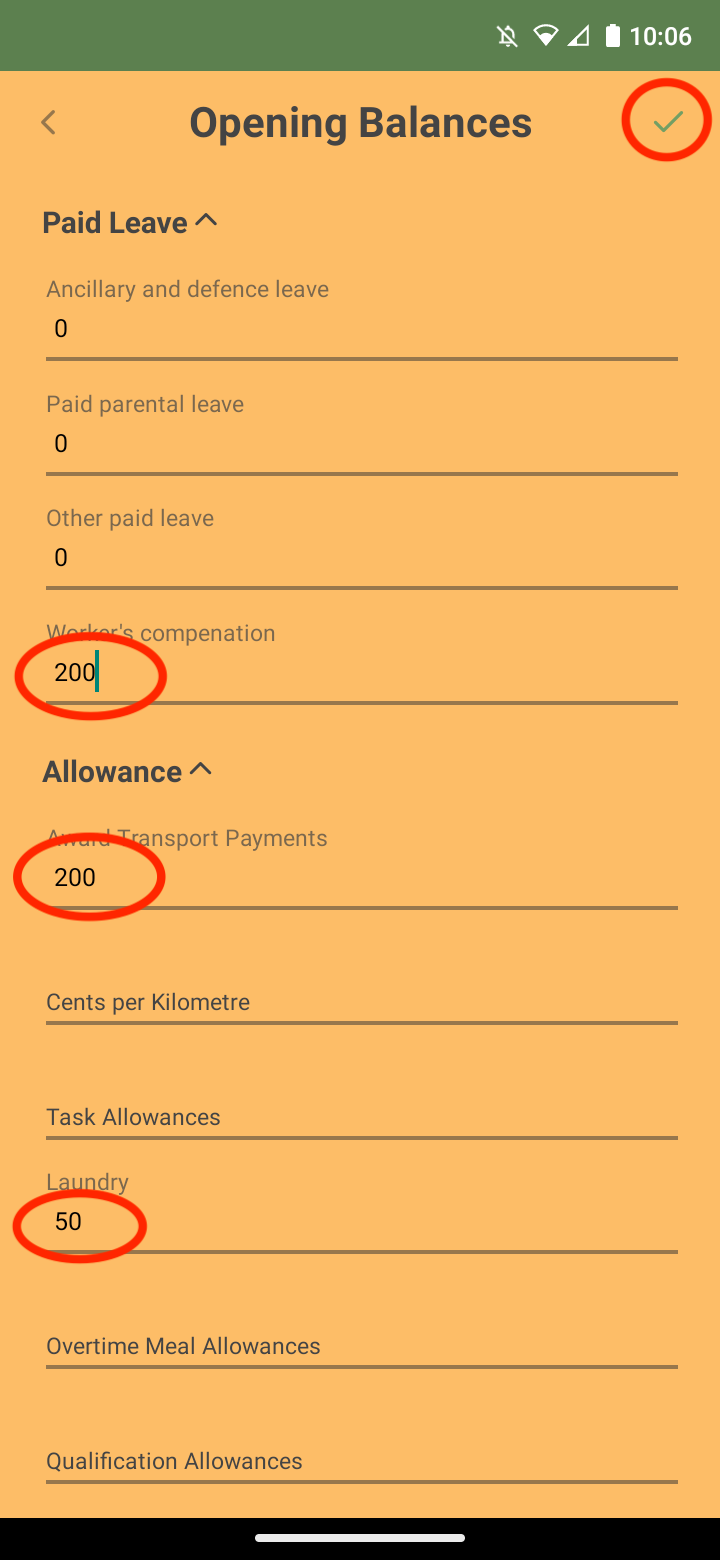

Paid Leave (Ancillary and defence leave, Other paid leave – annual, sick leave, paid parental leave and worker’s compensation)

-

Allowances (Jobkeeper, award transport payments, Cents per kilometre, task, laundry, overtime meal, qualification, travel and accommodation, tool and other allowances

-

Deductions (Fees, Workplace Giving, Child support garnishees, child support deductions)

-

Fringe Benefits (Taxable)

Please make sure to enter the correct ‘As at’ date for the opening balances to fall under the correct financial year.

You can also open or minimise ‘Paid Leave’, ‘Allowances’, ‘Deductions’ and ‘Fringe Benefits’ by selecting the arrow next to each title

Enter all the opening balances that apply to your employee and select the tick on the top right-hand corner.

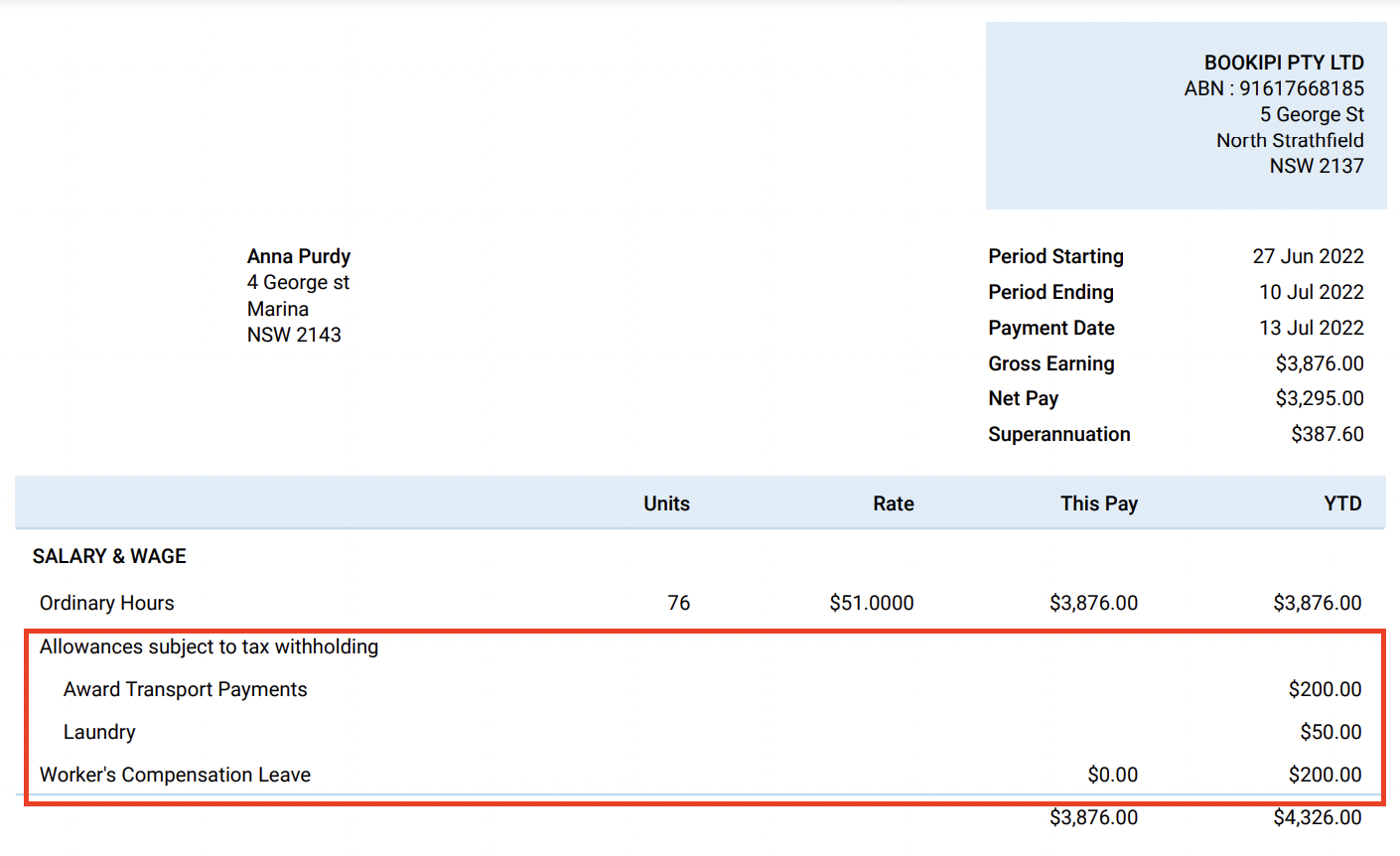

When you generate a pay run, it will now automatically add the opening balance figures into the YTD

Please note: if your opening balances are not adding into the YTD please check that your opening balance dates and figures have been entered correctly. The opening balance date determines which financial year the opening balances will be calculated in.

Discover more tutorials & get the most out of using Payroller

Try out Payroller for free. Learn how to create and submit a pay run in the Payroller mobile app.

You can also get a Payroller subscription that gives you access to all features via the web and mobile app. Read up on our Subscription FAQs.

Invite your accountant, bookkeeper or tax agent to help you run your business payroll with our guide.