Learn how to edit taxes in the Review section of a pay run in Payroller

Learn how to edit taxes in the Review section of a pay run in Payroller with our simple guide below.

Please note that tax is calculated based on the information entered on the employee’s card in the People section. If no TFN is provided, the system will calculate tax as if the employee doesn’t have one. To review this, go to the tax settings on the employee’s card.

To permanently set the tax for future pay runs, go to the Templates section on the employee’s card, tick Apply fixed tax, and enter the fixed tax amount.

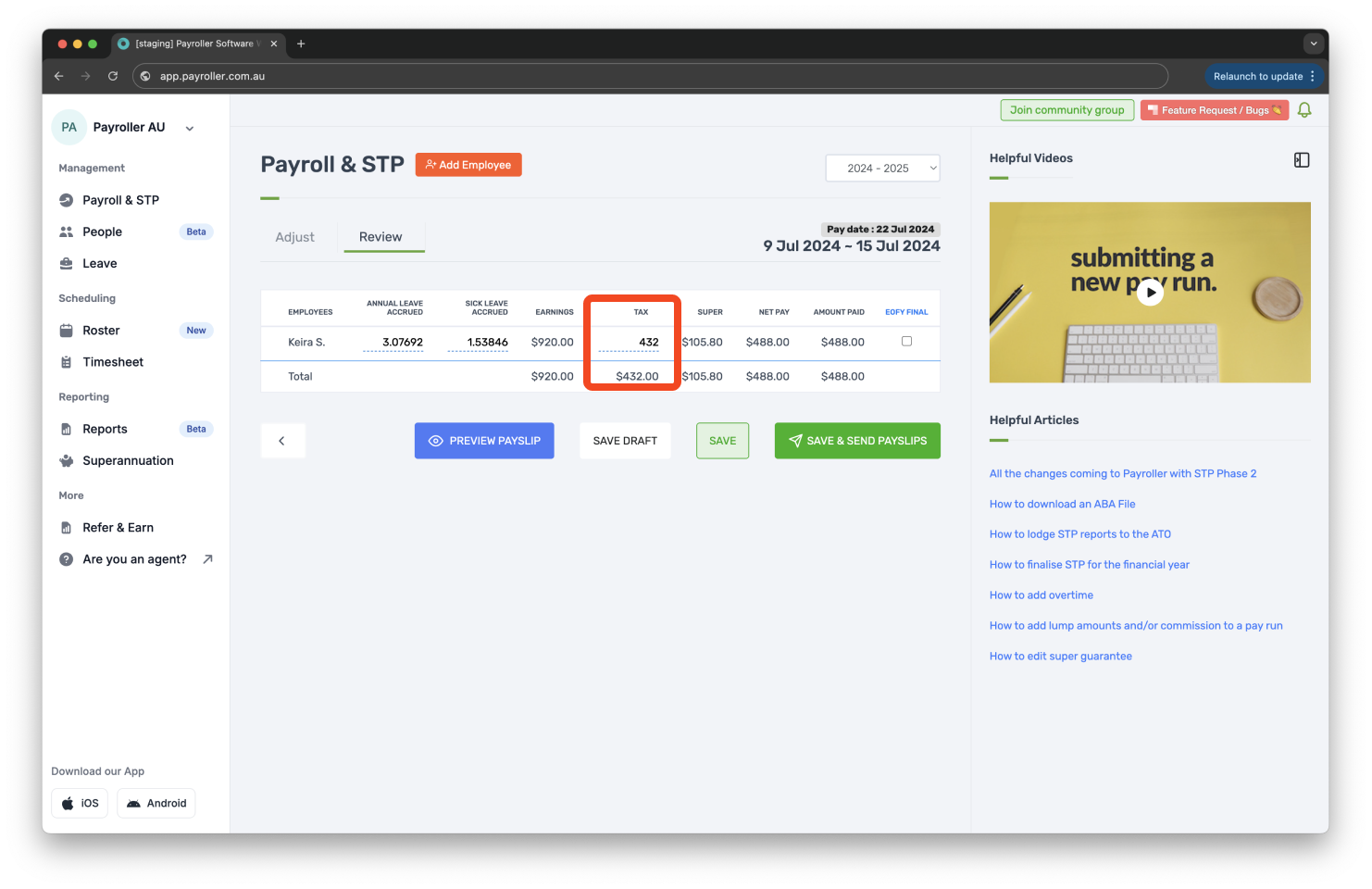

After creating a pay run, entering the dates, finalising the Adjust section, and clicking ‘Next‘, you will be directed to the Review page.

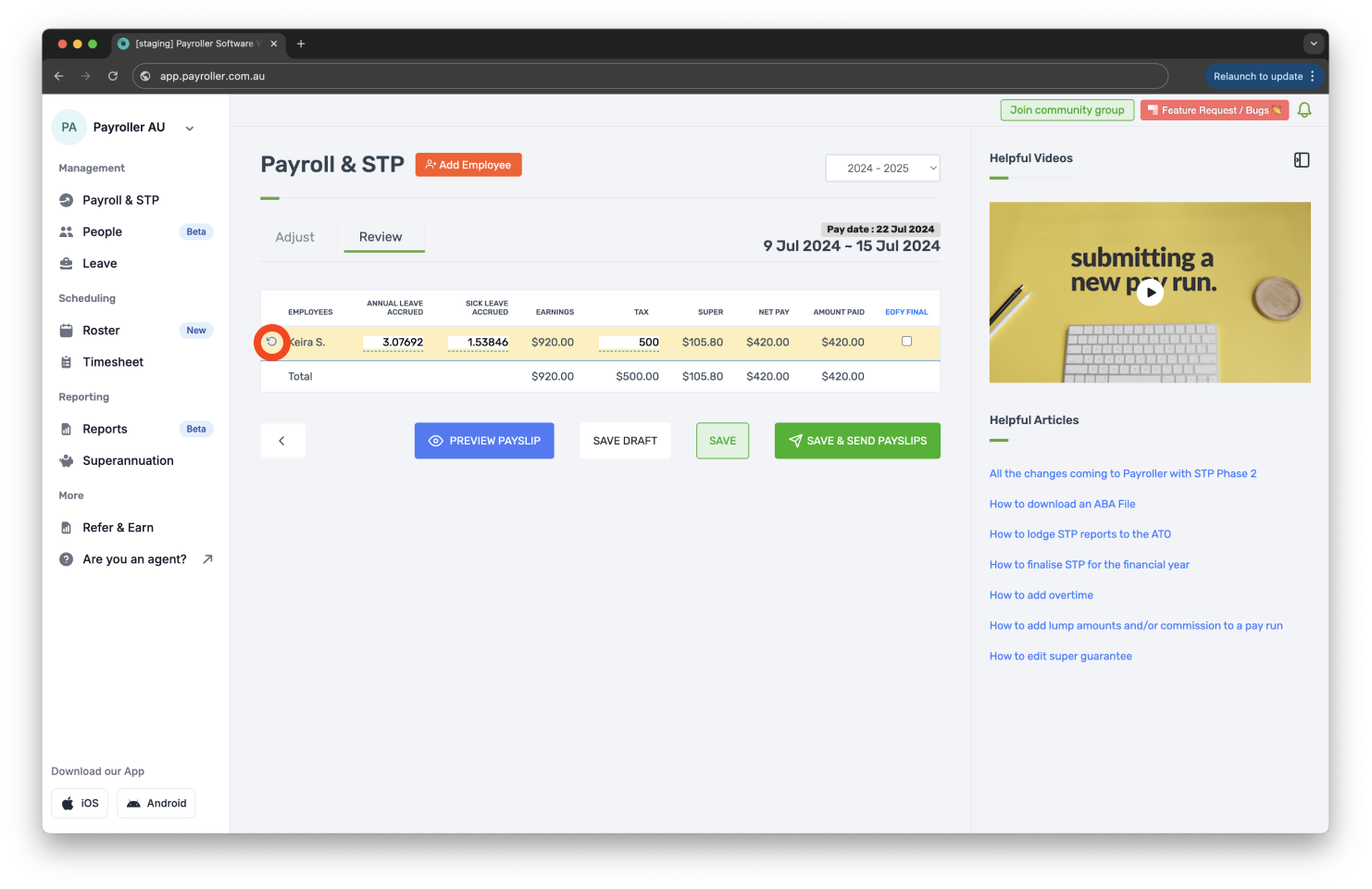

In the Tax column of the Review section, you can edit the tax amount as needed.

If you pay an unusual amount of tax or you like to round up your tax, this is the place to change it.

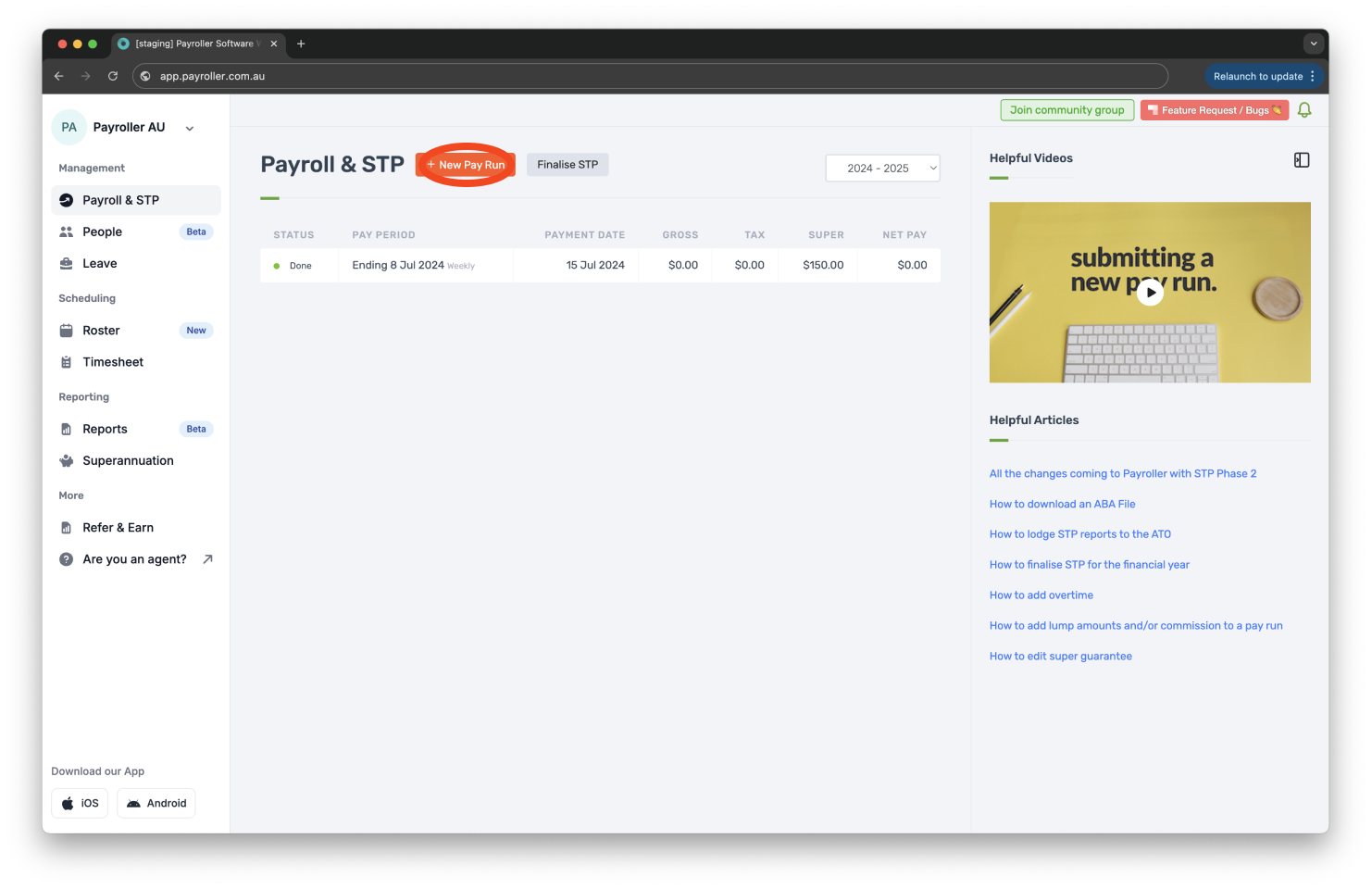

Step 1: Select ‘+New Pay Run’.

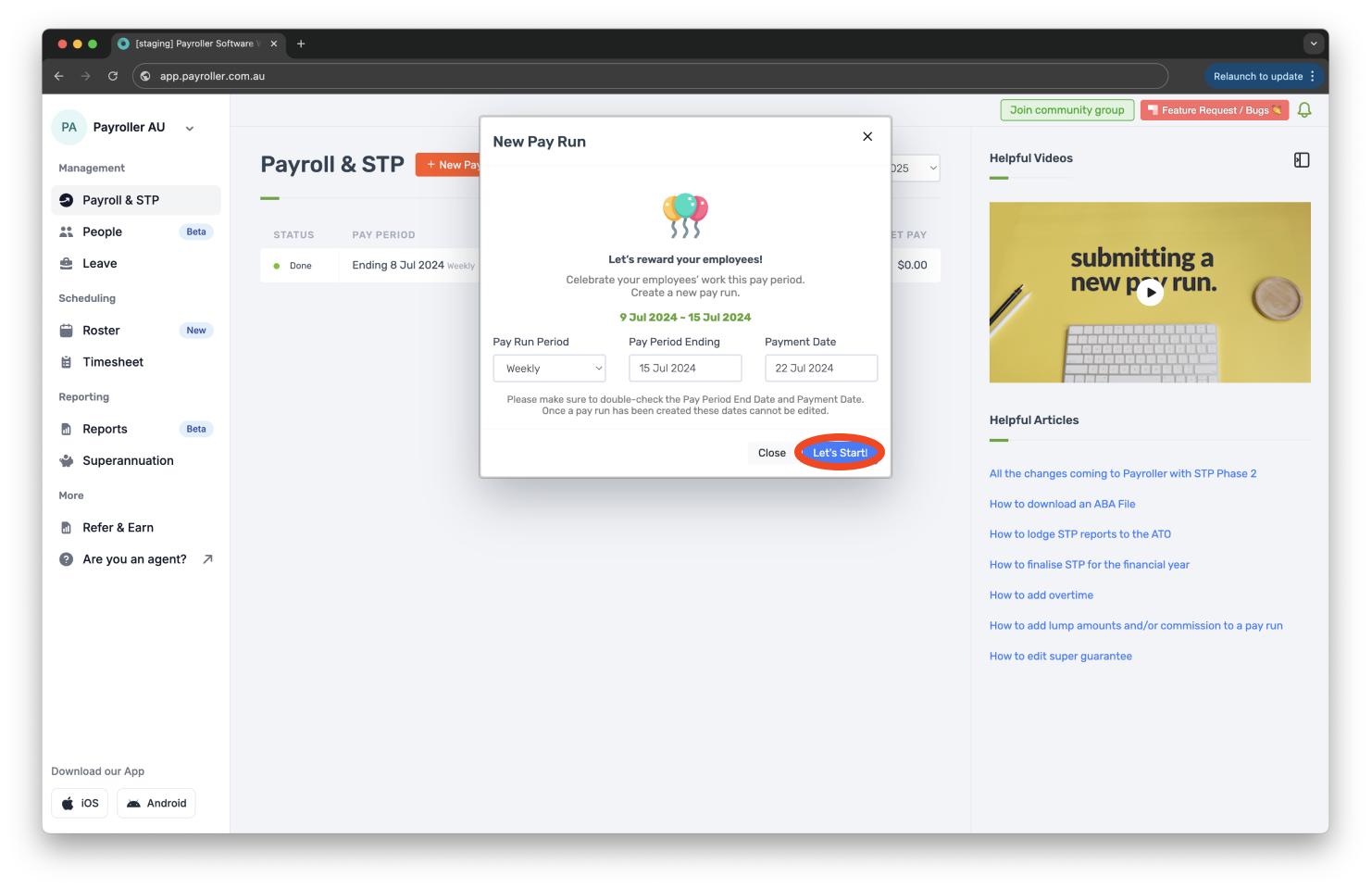

Step 2: Choose your desired payment date and select ‘Let’s Start!’.

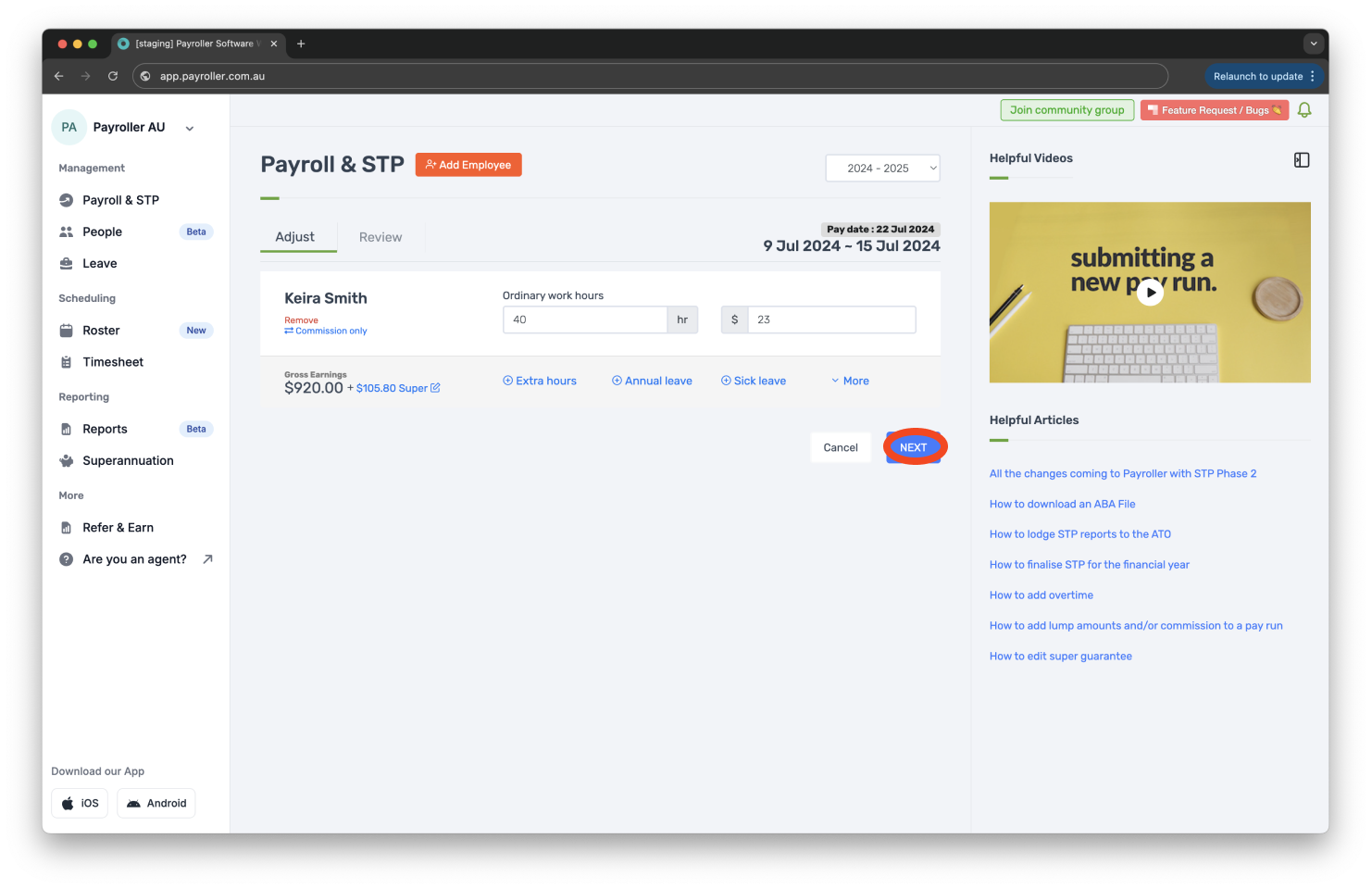

Step 3: Under the Adjust screen, apply the necessary figures then select ‘Next’.

Step 4: Select the amount.

If you make a mistake with the tax and want to restore it to the original amount, click the reset icon on the left side of the employee.

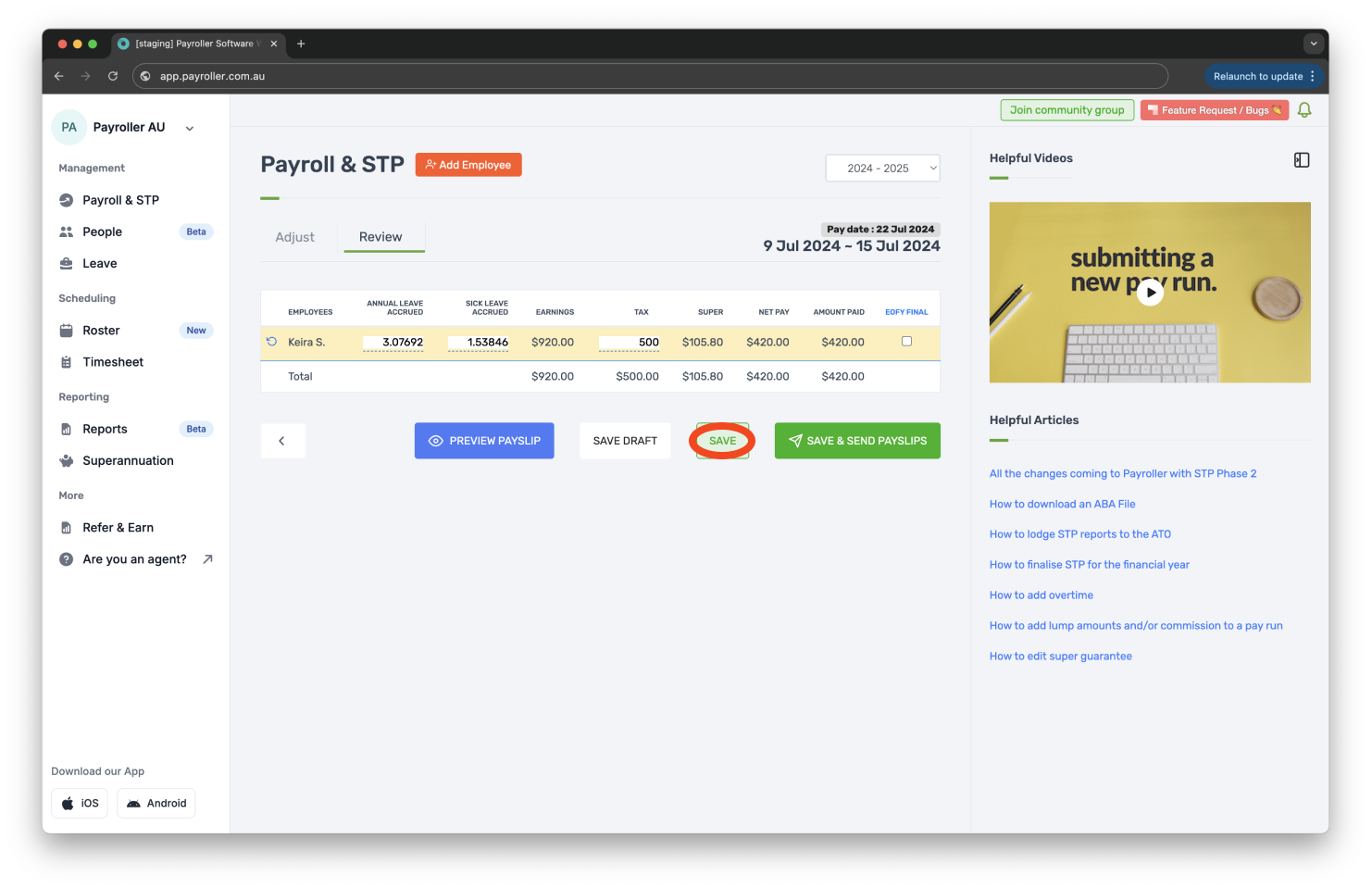

Step 5: Save the pay run.

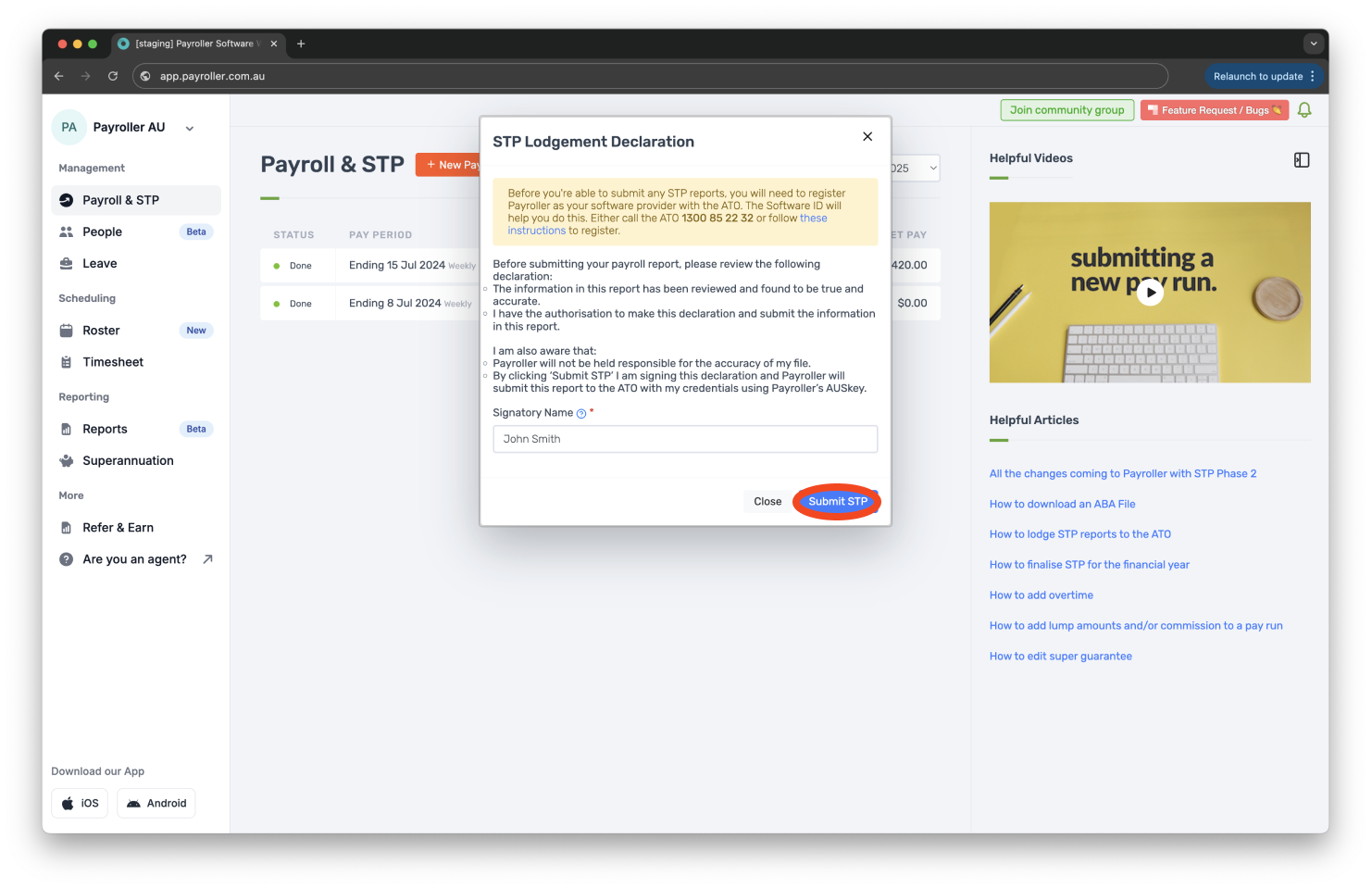

Step 6: Submit the STP.

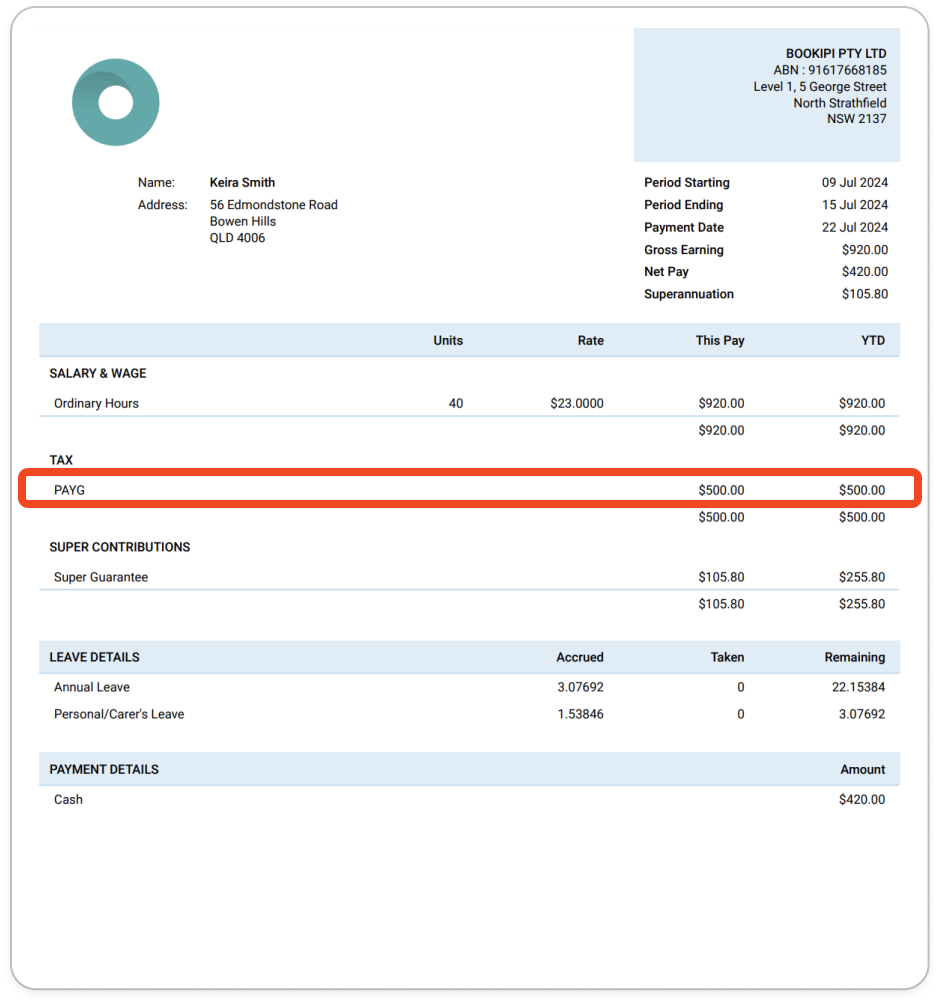

Once the pay run is finalised, you will be able to see the changes to the Tax on the employee’s payslip.

Learn how to make changes to pay runs relating to pay rates and extra hours with our other simple guides below:

-

How to add extra hours for employees in a pay run (ordinary hours or overtime hours)

-

How to add overtime for employees in a pay run (extra hours worked)

Discover more tutorials & get the most out of using Payroller

Learn more about easily creating and editing pay runs with our simple guides.

Want access to full Payroller features on web and mobile app? Sign up for a Payroller subscription for synced payroll across all devices. Read up on our Subscription FAQs.

Discover more tutorials & get the most out of using Payroller

Learn more about easily creating and editing pay runs with our simple guides.

Want access to full Payroller features on web and mobile app? Sign up for a Payroller subscription for synced payroll across all devices. Read up on our Subscription FAQs.