Learn how to add a Withholding Payer Number (WPN) in Payroller

Learn how to add a Withholding Payer Number (WPN) in Payroller for your payslips with our simple guide below.

There are two versions of Payroller

Version 1: Old version

Please note: You can add your WPN to Payroller for generating payslips but submitting STP on a WPN is currently not available. If you would like to see this feature on Payroller let us know on our feature request board.

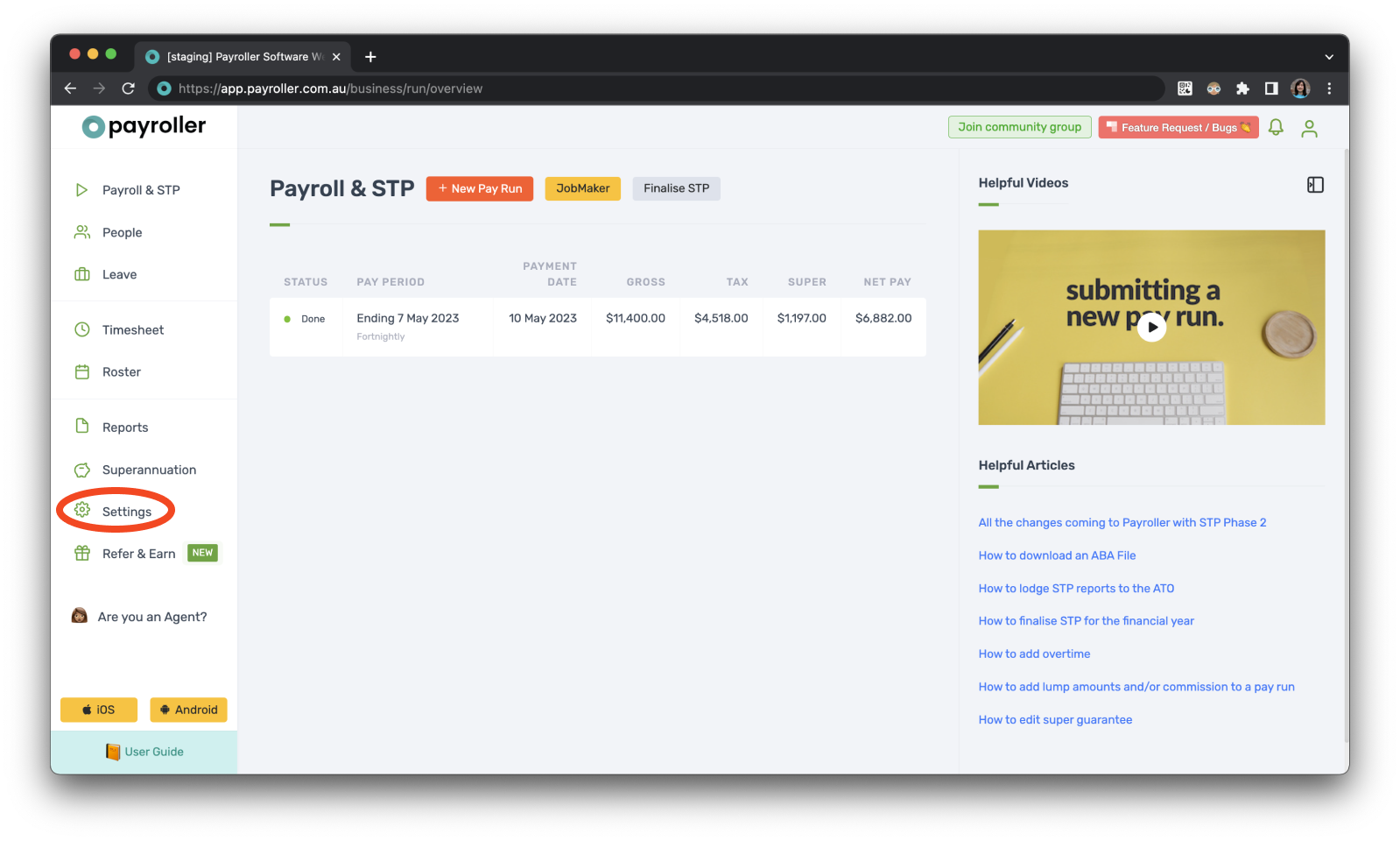

Step 1: To add a WPN to your payroller account, select ‘Settings’.

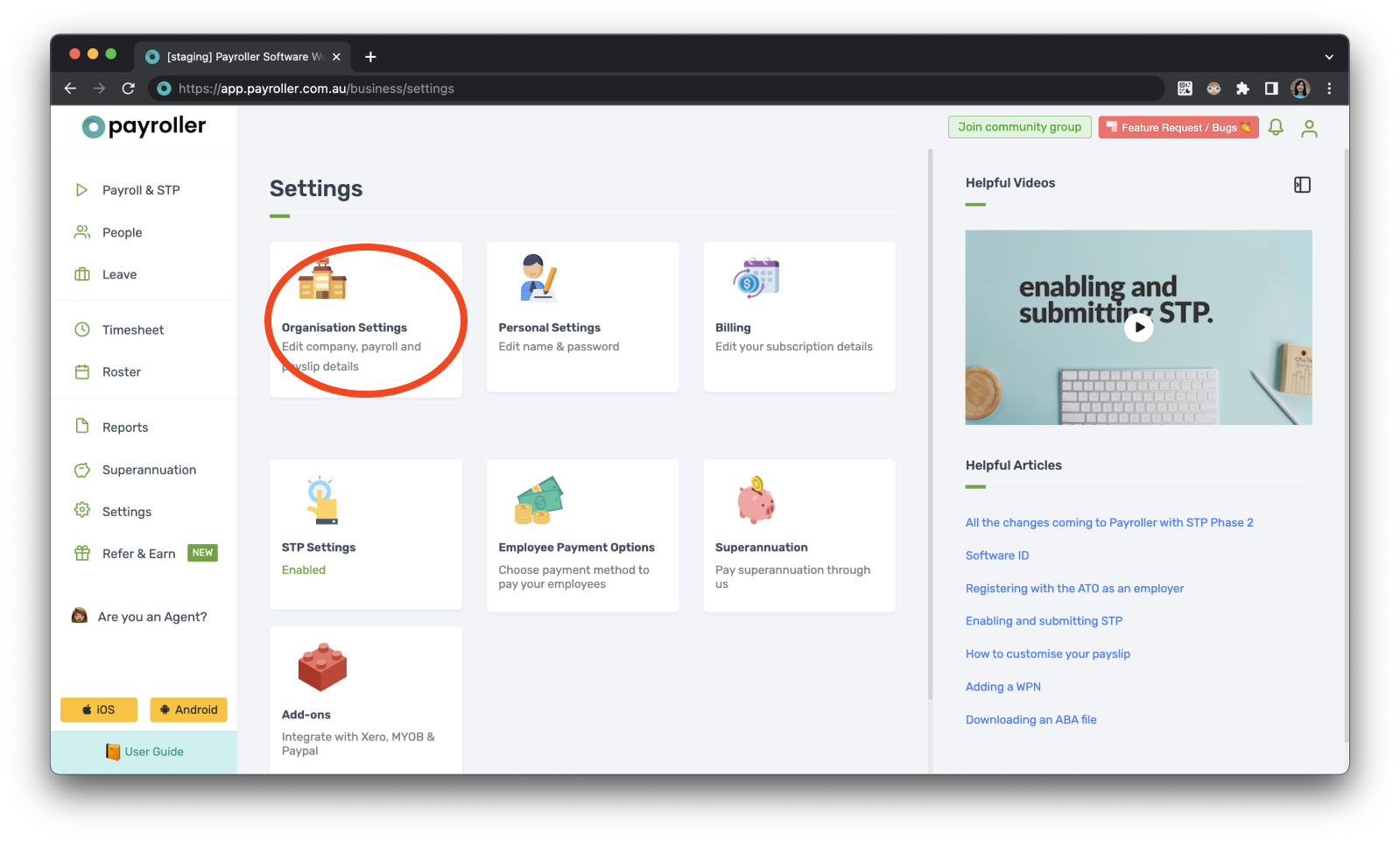

Step 2: Select ‘Organisation Settings‘.

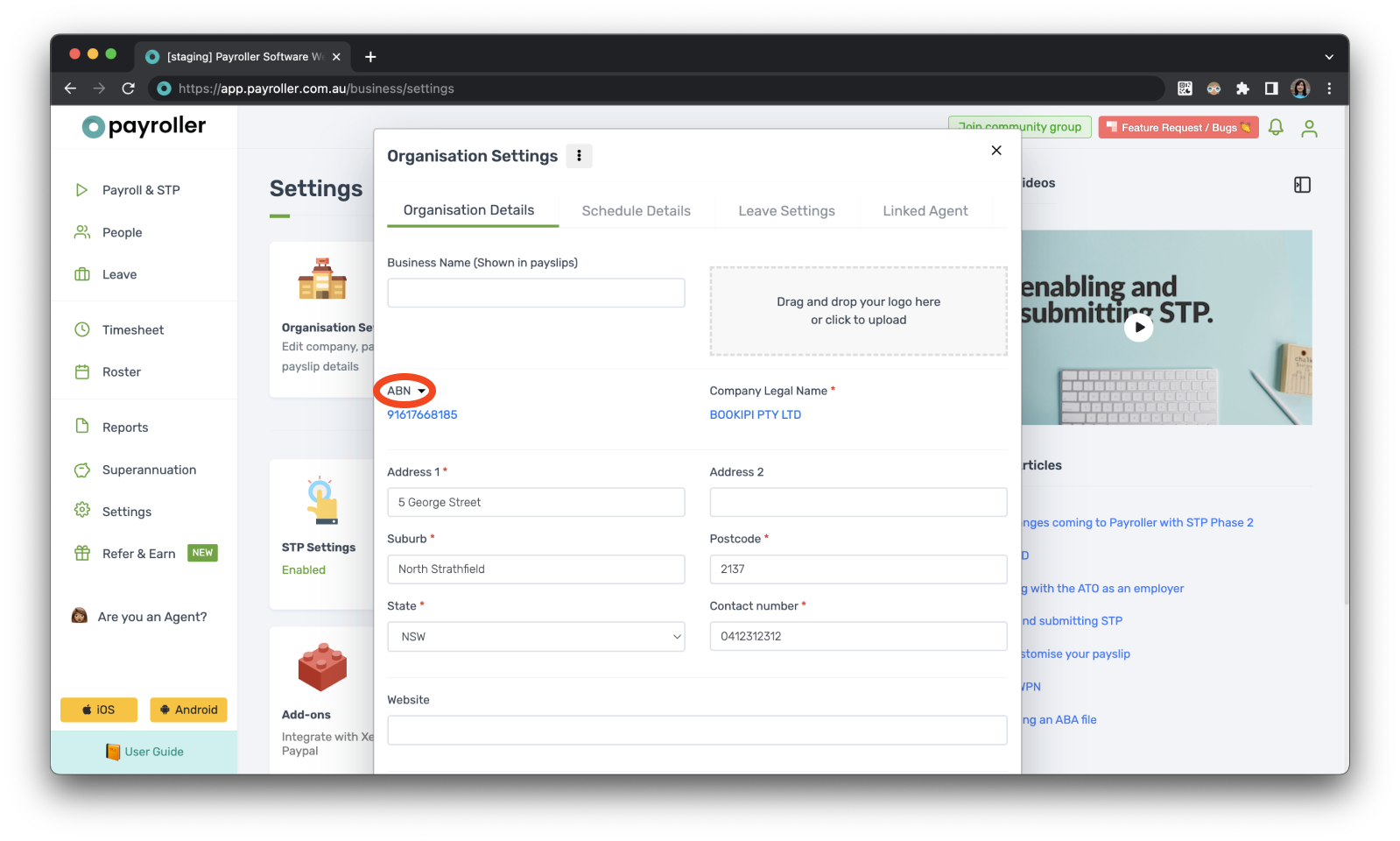

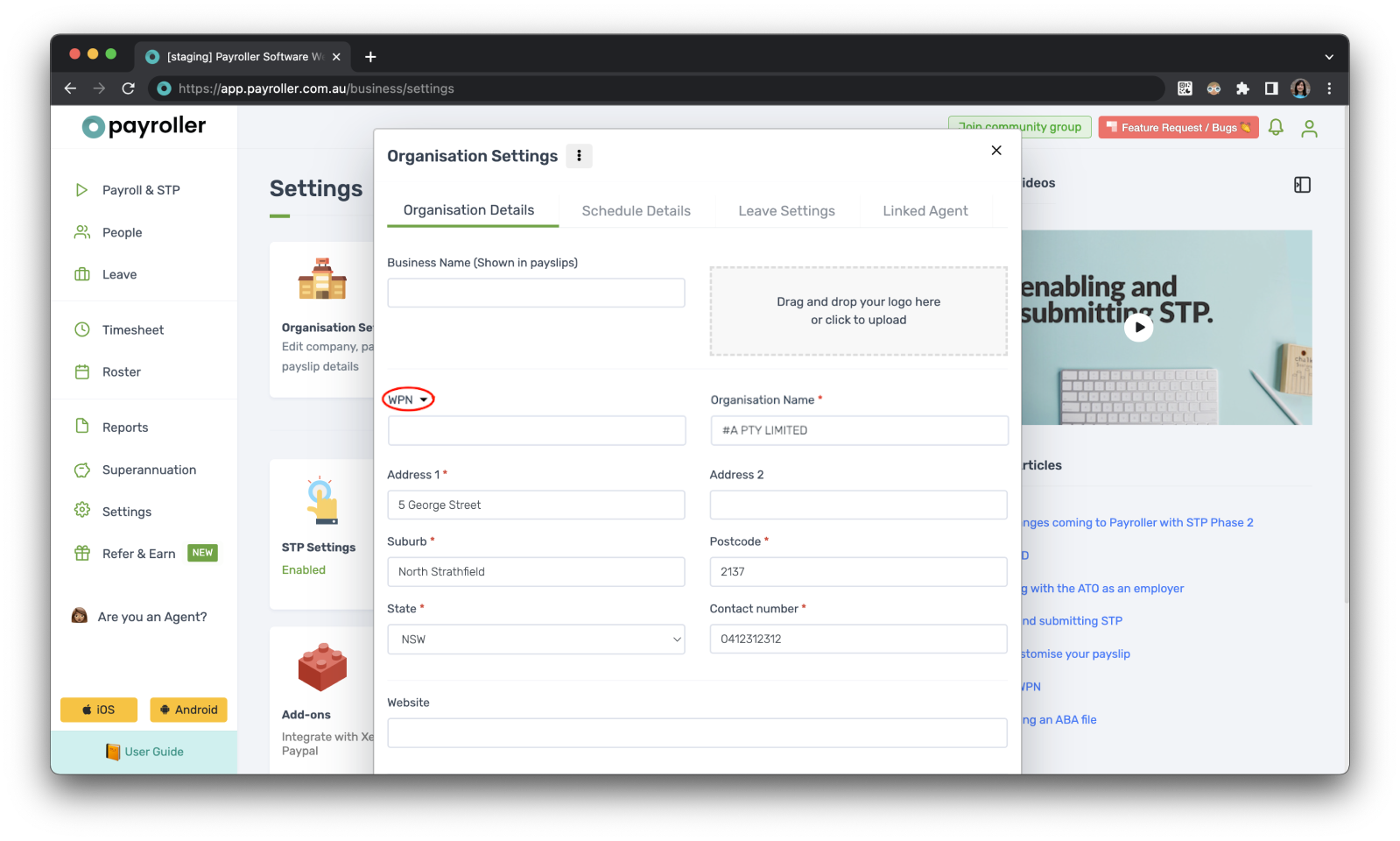

Step 3: There will be a section that says ‘ABN’ with a small triangle. If you click on this, an option for ‘WPN’ will appear.

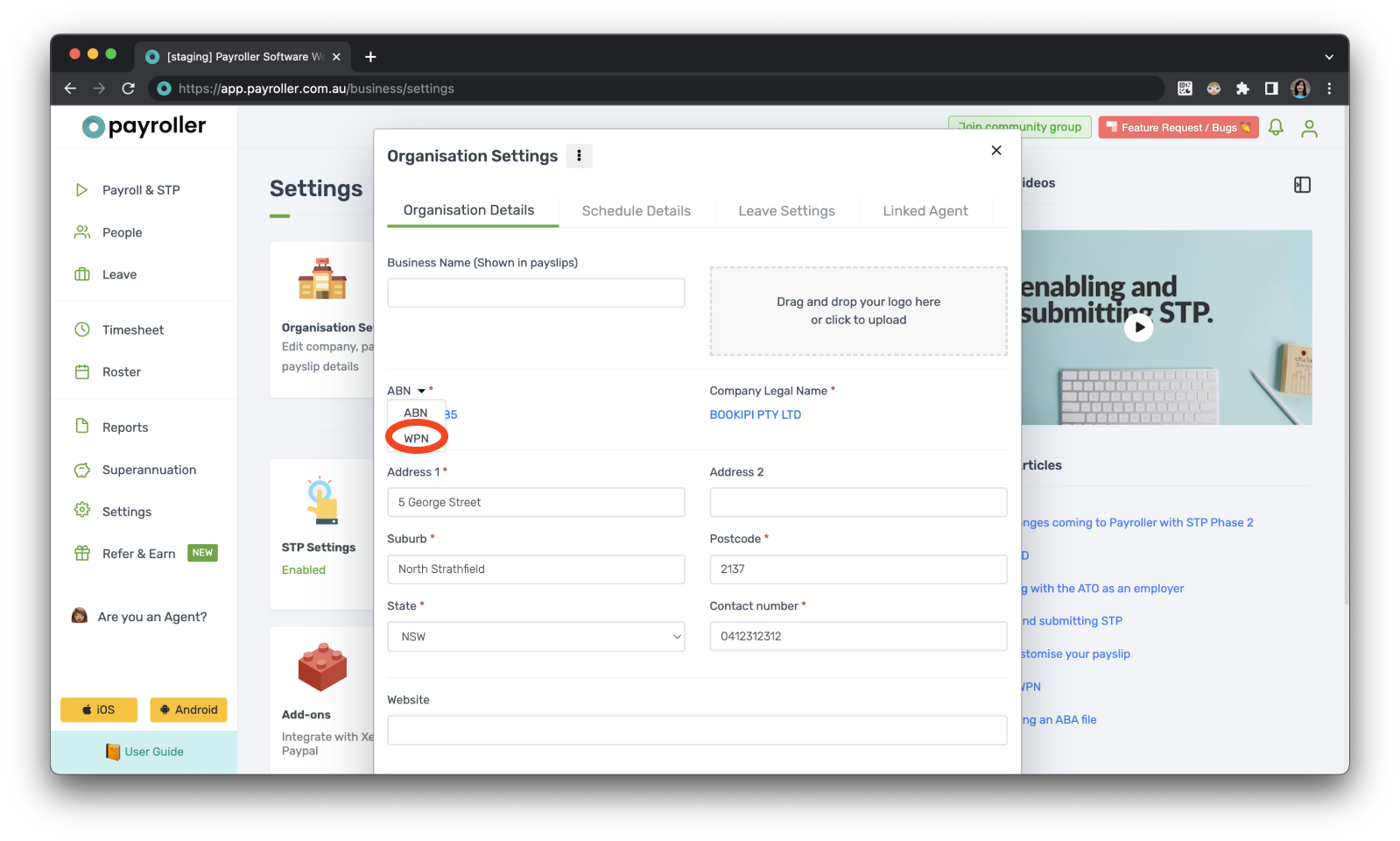

Step 4: Select ‘WPN’.

Step 5: Enter your ‘WPN’ and ‘Organisation Name’ and ‘Save’.

WPN numbers must be added onto Payroller starting with 00 followed by 9 digits

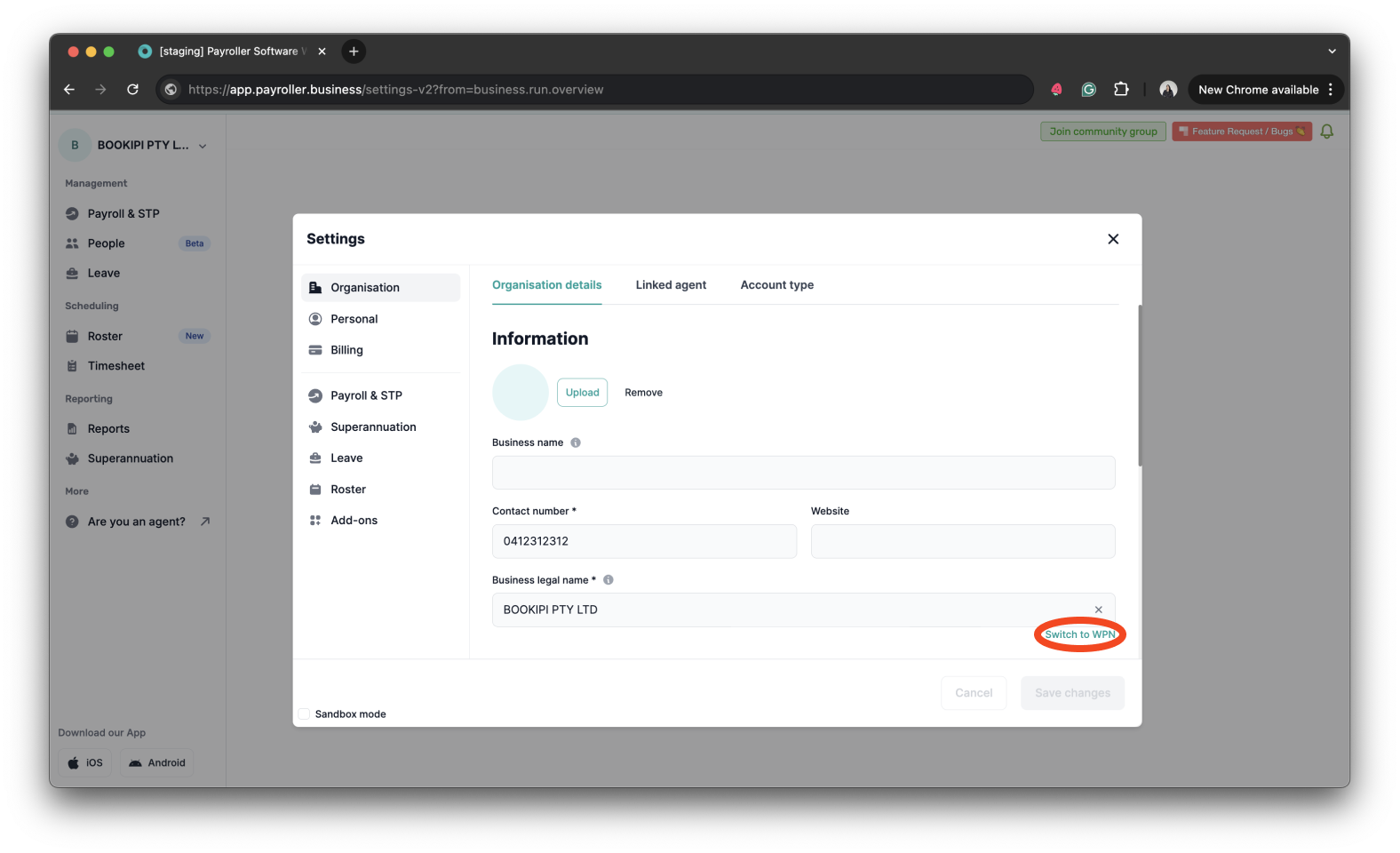

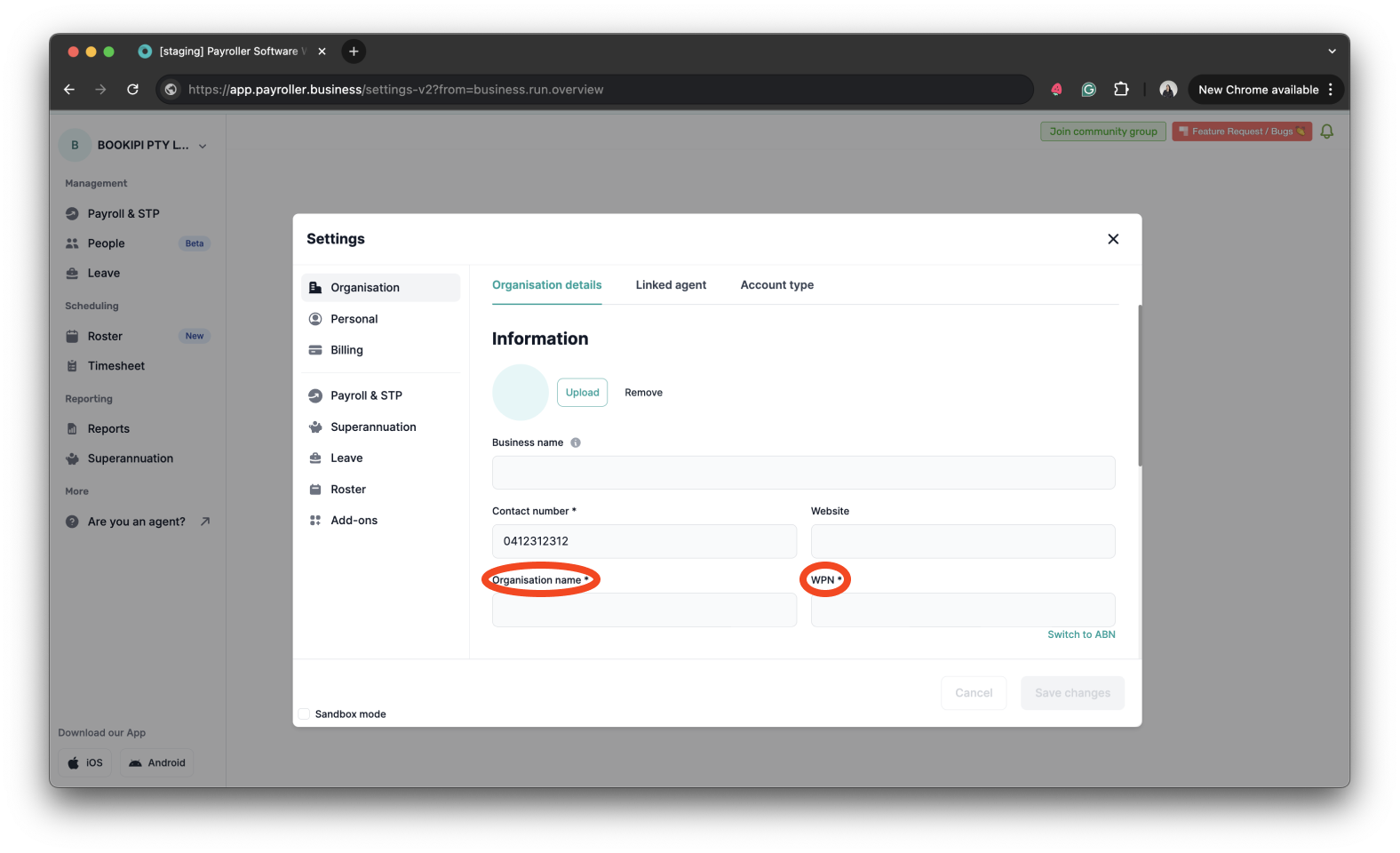

Version 2: New Version

Please note: You can add your WPN to Payroller for generating payslips but submitting STP on a WPN is currently not available. If you would like to see this feature on Payroller let us know on our feature request board.

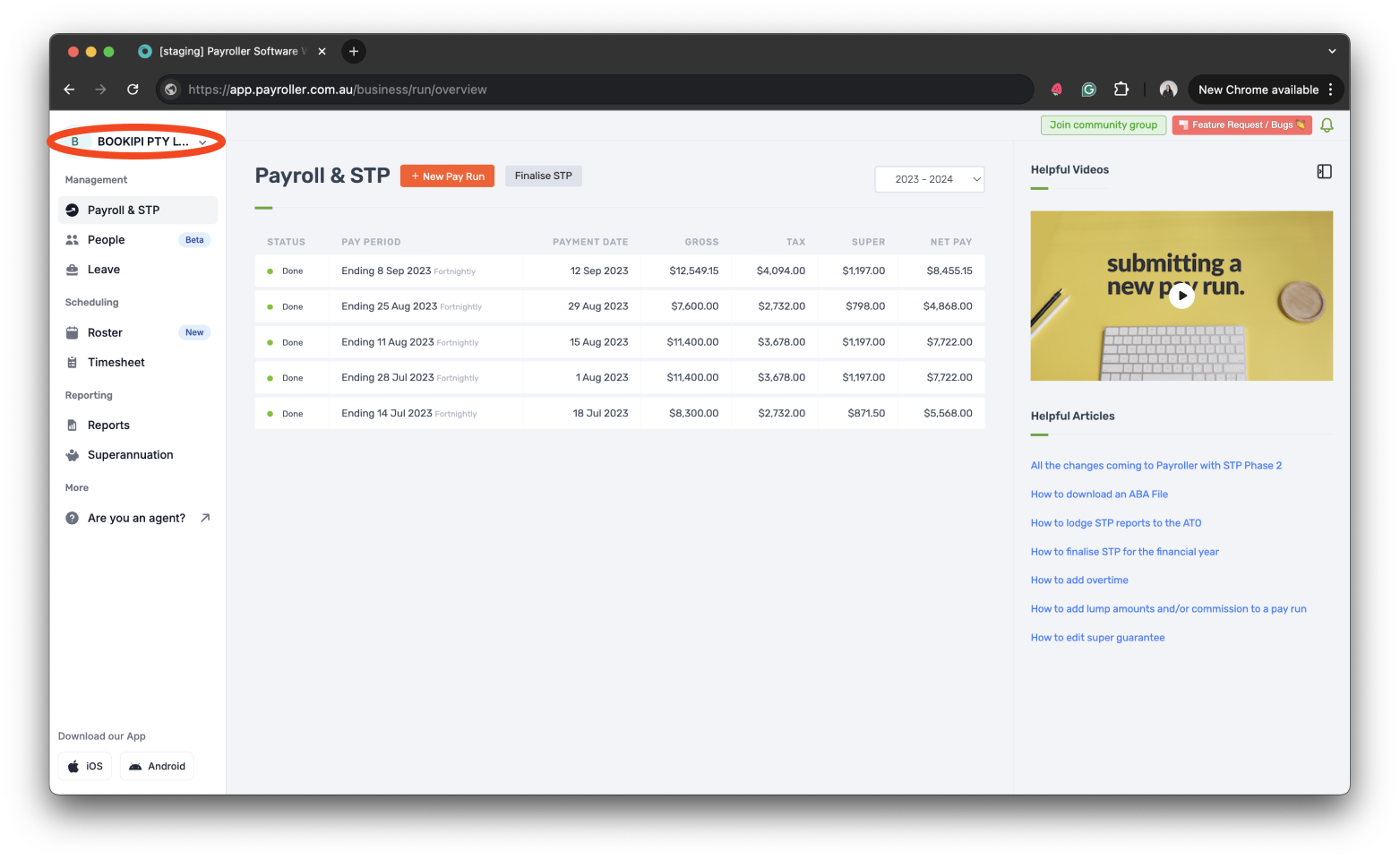

Step 1: Go to your account’s profile in the upper left corner of your main screen.

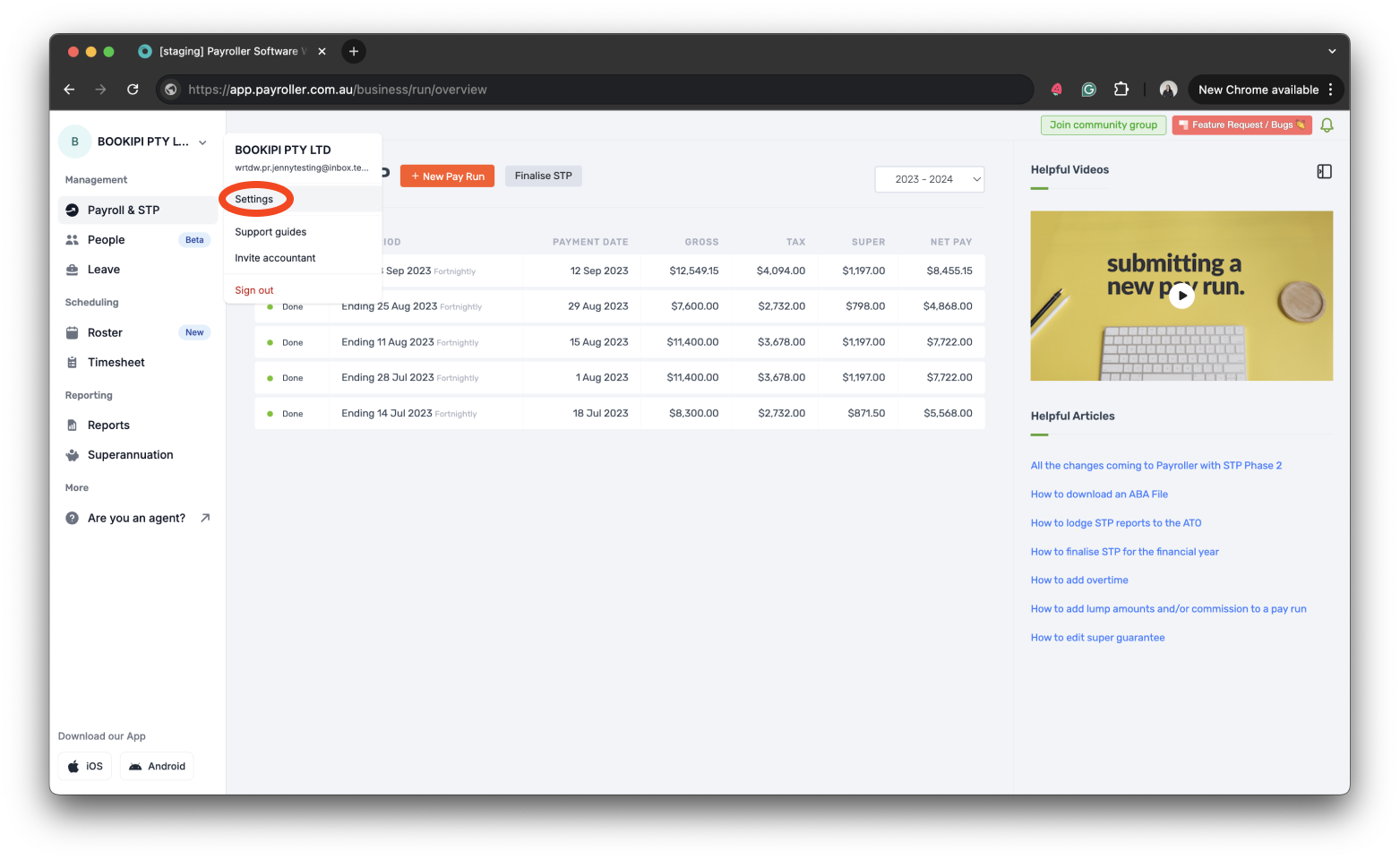

Step 2: Select ‘Settings‘.

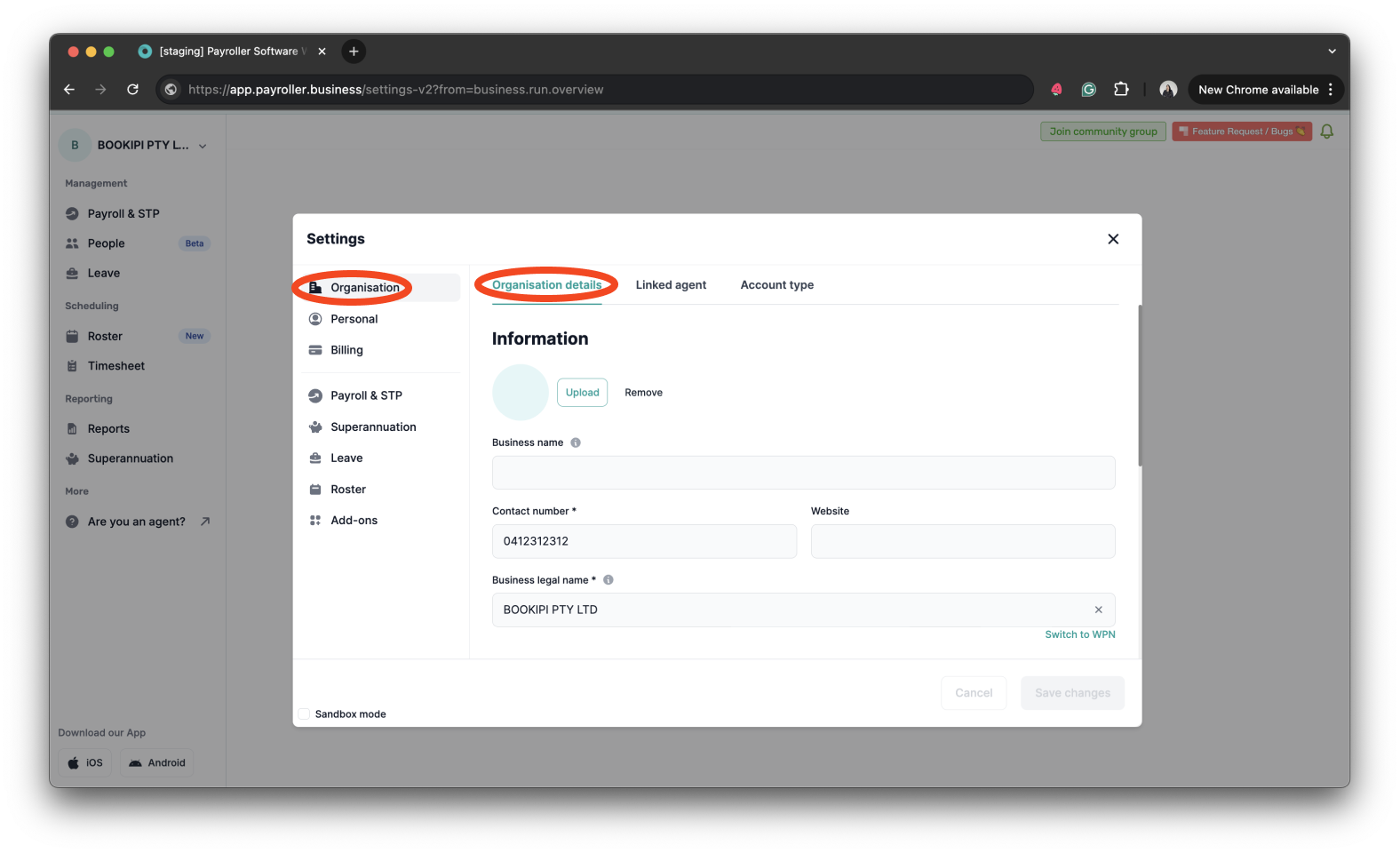

Step 3: Select ‘Organisation’ and make sure you are on the ‘Organisation details’ tab.

Step 4: Click the option ‘Switch to WPN’.

Step 5: Enter your ‘Organisation Name’ and ‘WPN’ and click the ‘Save changes’ button.

Learn how to make changes to your business details and edit default settings for pay runs with our other simple guides below:

Changes to your business details in Payroller

-

How to update your business details including name, address, and contact number

-

How to view or change your ABN (Australian Business Number) in Payroller

Changes to default pay run settings

Changes to default payslip settings

Discover more tutorials & get the most out of using Payroller

Learn how to change your user Settings in Payroller with our simple guides.

Signing up for a Payroller subscription gives you access to all features via the web and mobile app. Read our Subscription FAQs.