Learn how to delete a pay run that has not been submitted to the ATO yet, in Payroller

Learn how to delete a pay run that has not been submitted to the ATO yet, in Payroller.

To delete a pay run that has already been submitted to the ATO and processed through STP, please follow this guide.

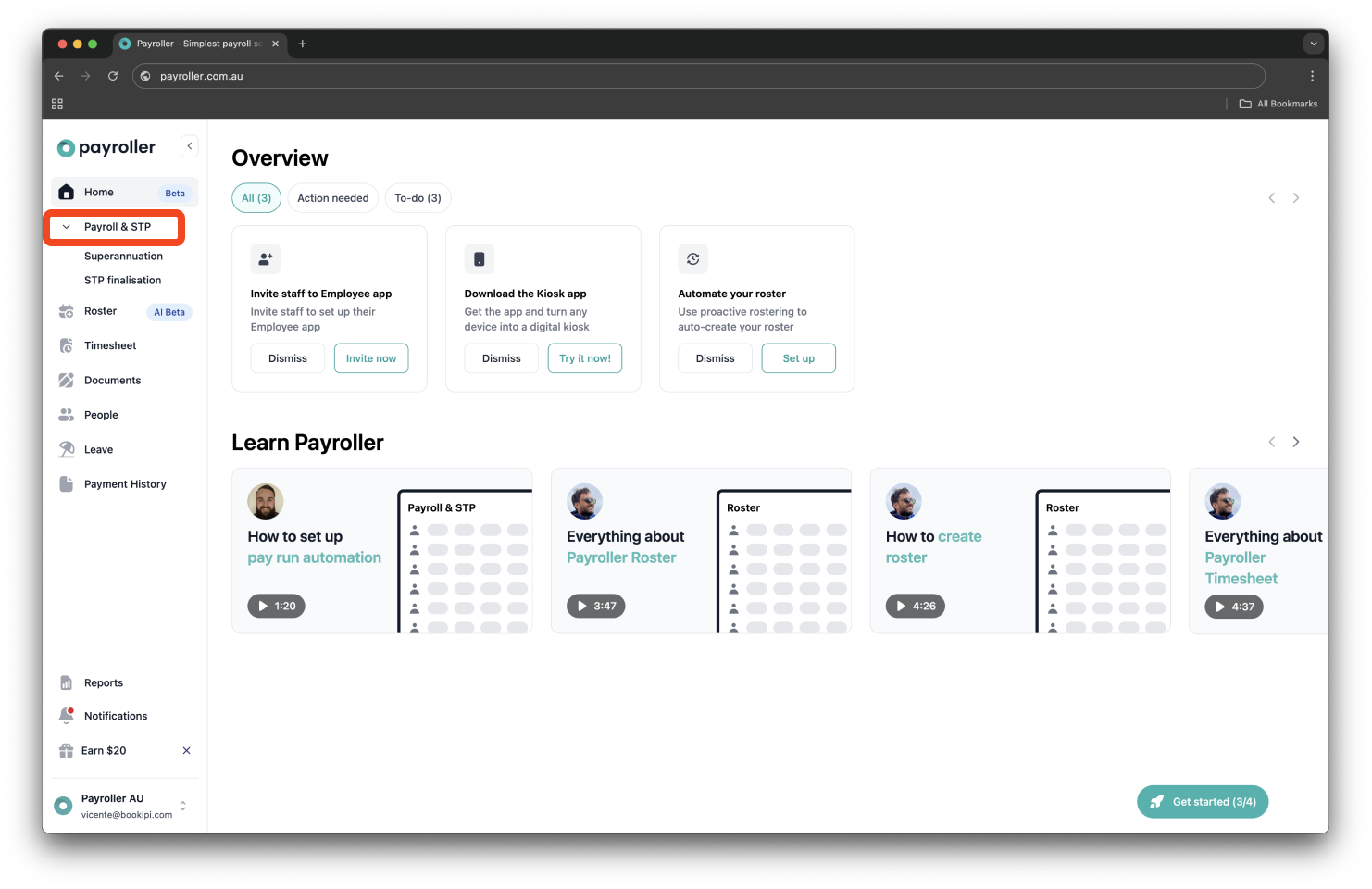

Step 1: From the ‘Home’ screen, tap ‘Payroll & STP’.

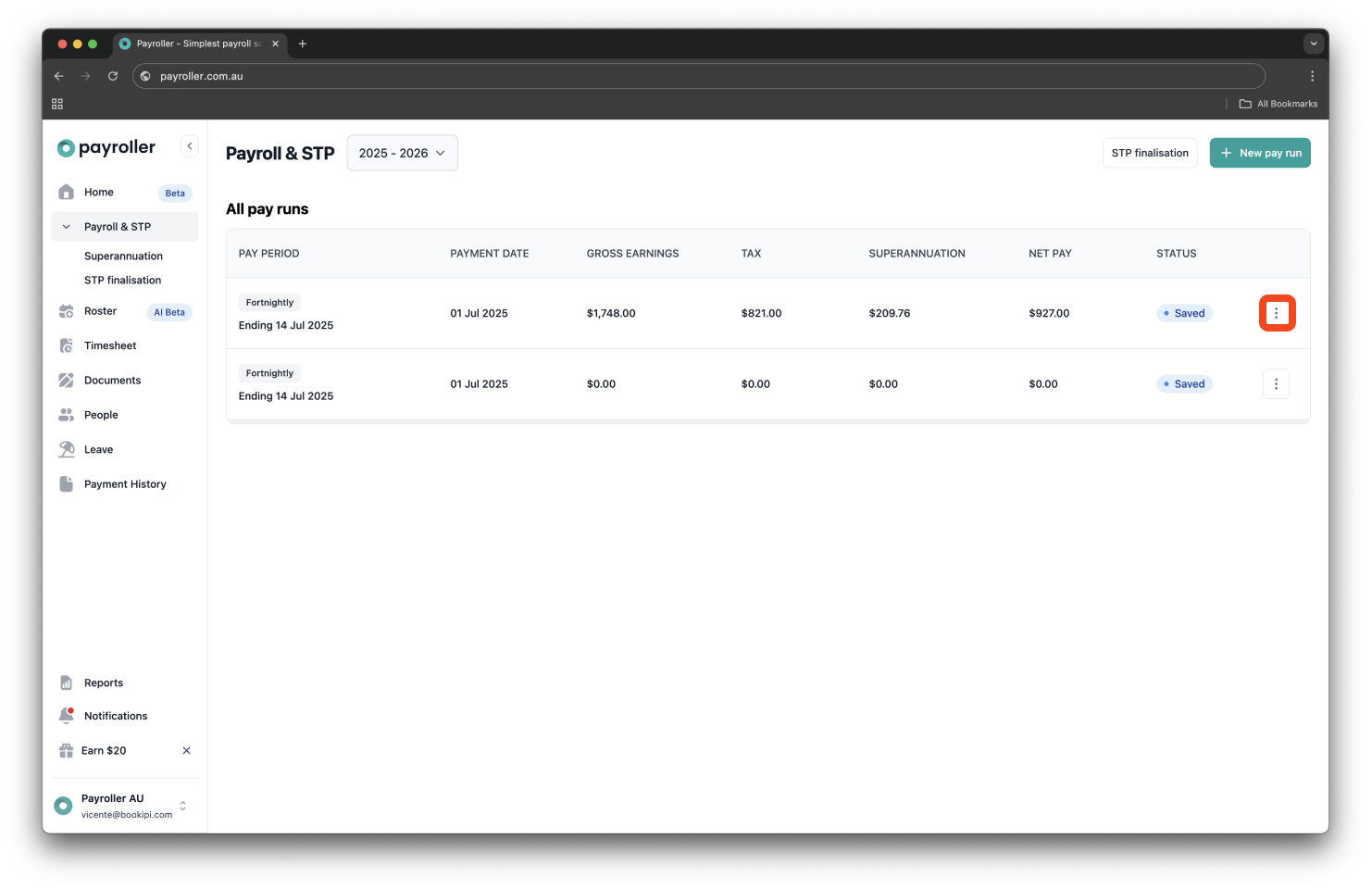

Step 2: Click the three dots beside the pay run you want to remove.

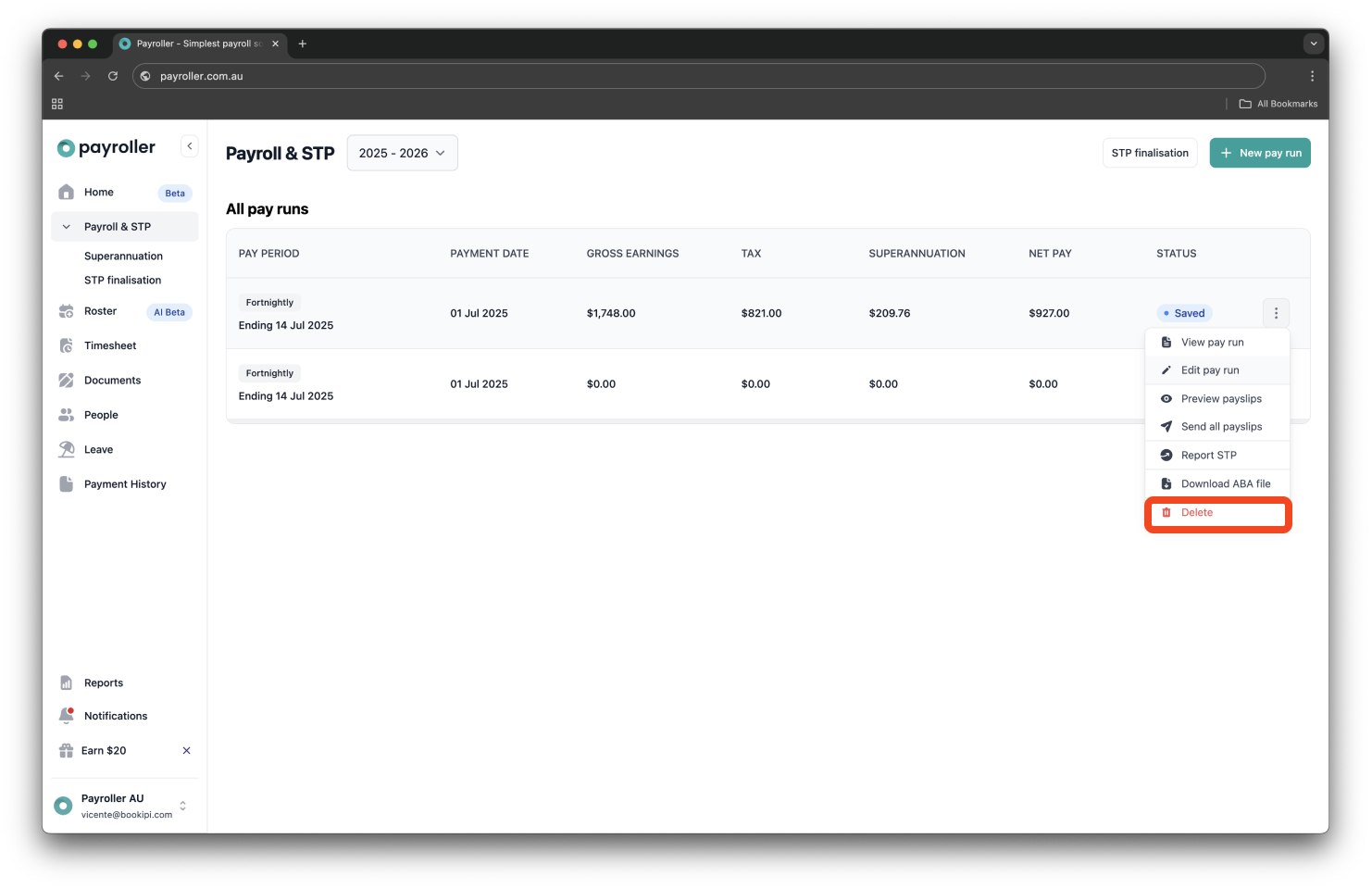

Step 3: Select ‘Delete’.

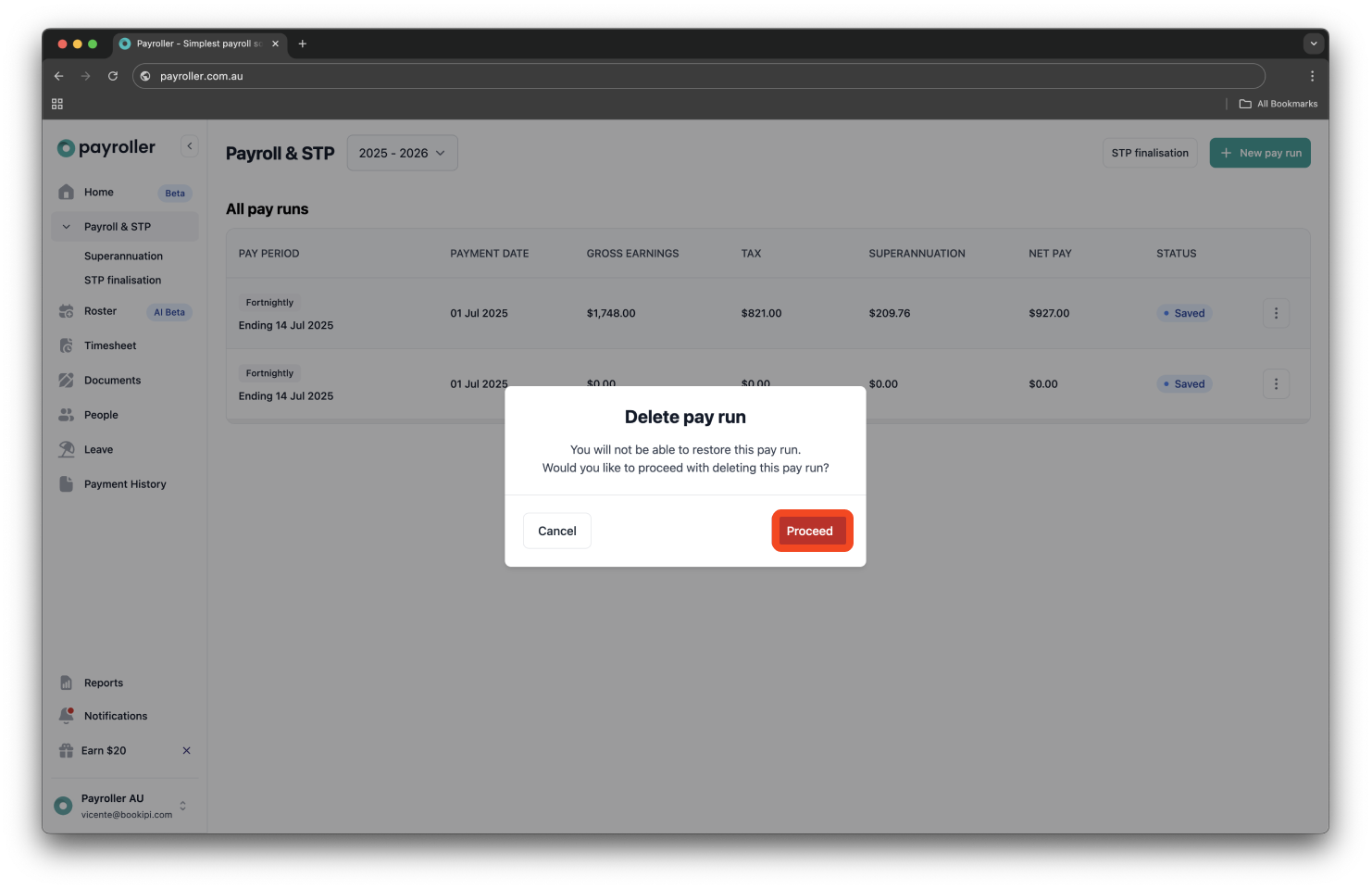

Step 4: Confirm by selecting ‘Proceed’.

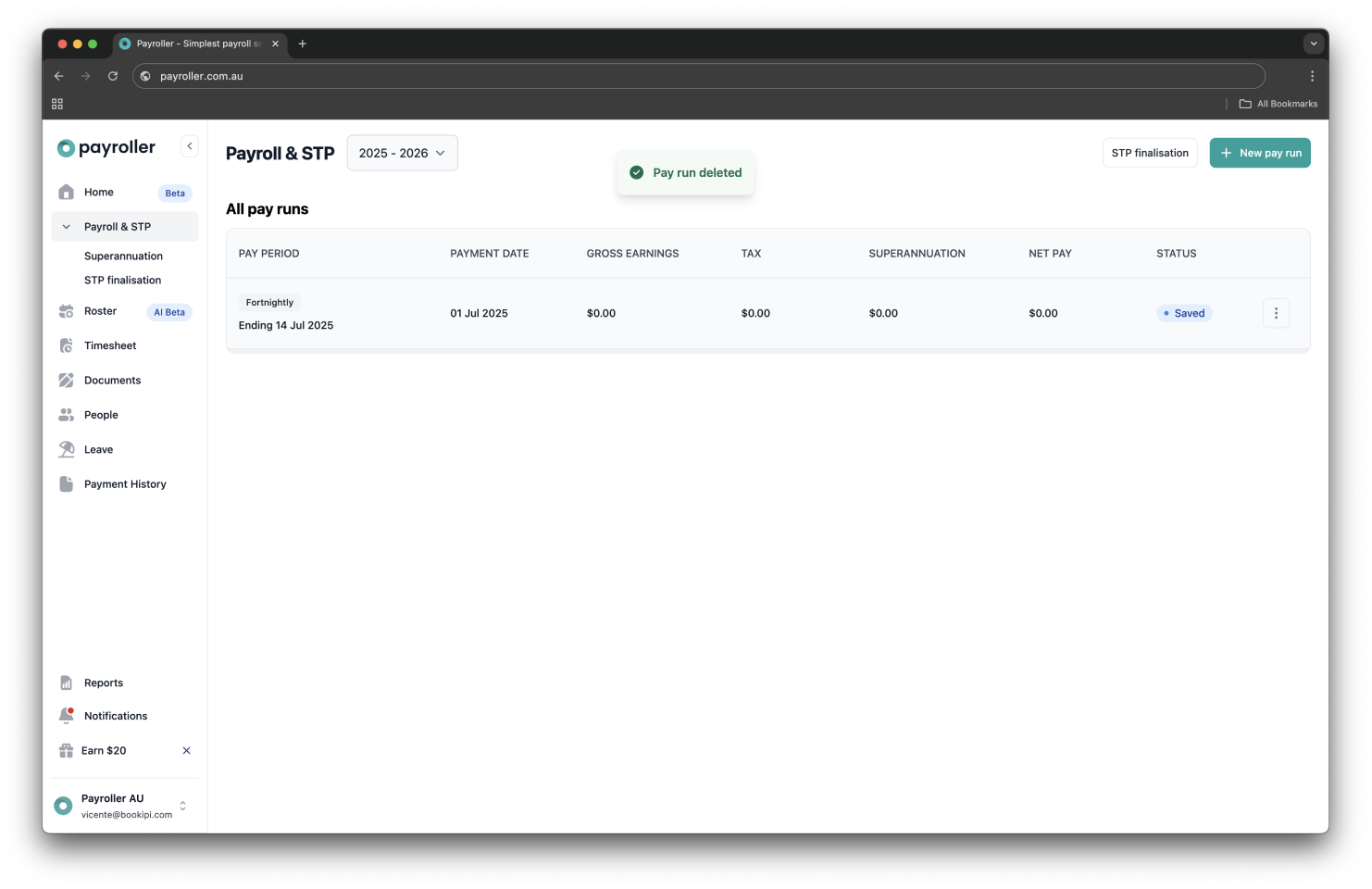

Your pay run has been successfully deleted.

Learn how to make changes to pay runs relating to pay rates and extra hours with our other simple guides below:

-

How to add extra hours for employees in a pay run (ordinary hours or overtime hours)

-

How to add overtime for employees in a pay run (extra hours worked)

Discover more tutorials & get the most out of using Payroller

Learn more about easily creating and editing pay runs with our simple guides.

Want access to full Payroller features on web and mobile app? Sign up for a Payroller subscription for synced payroll across all devices. Read up on our Subscription FAQs.