When the founder of Payroller decided to launch Payroller two and a half years ago, he wanted to solve the problems he faced as a small business owner. Managing payroll, superannuation, and STP were difficult, complex, and expensive for small Australian businesses. The Payroller team are extremely proud that we have been able to support over 25,000 businesses with their payroll system and transition to STP.

Everything you need to know about Payroller subscriptions

For the past two years, we have worked hard to keep our platform free. Government regulations and the introduction of the second stage of Single Touch Payroll (STP Phase 2) is increasing the demands on Payroller. Like your own business, we have to cover the costs of running the platform in order to provide you with our service. We have asked for feedback on pricing so we could continue to make Payroller affordable for small businesses. From Tuesday 2 November 2021, Payroller has introduced subscription fees to access Payroller on Web. As many of our users are small businesses, we have kept the Payroller mobile app free, as well as timesheets and rostering.

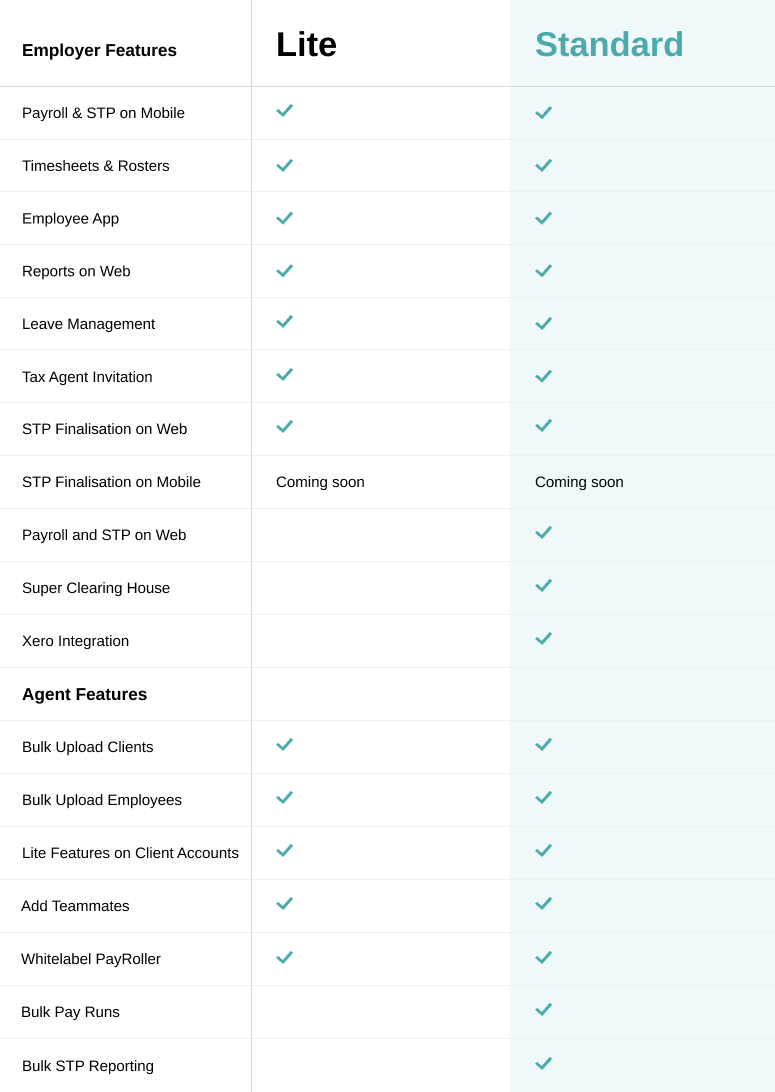

Payroller subscription plans

We believe our products provide value to our customers. You have a choice between the following plans:

All pricing is in AUD and includes GST. Your Payroller subscription gives you full access to all of the features in Payroller in Web and mobile app. Features include:

- Single touch payroll (STP) software

- ATO reporting

- Timesheets

- Staff scheduling, time tracking & online rostering

- Xero integration

- Leave management

- Payroller on Mobile App for Employers

- Payroller Employee mobile app for your staff

- Payroller Agent portal for accountants, bookkeepers and tax agents

- Superannuation

- Contact us for customer support

We’re committed to hearing your feedback. If you have any feedback about Payroller, you can submit it here.

Payroller subscription FAQs

Why are there fees to use Payroller on Web?

Like you, we have staff to pay, running costs and plans to grow. We’re proud of how our company has grown over the last two and a half years. We have supported countless small businesses and their moves to Single Touch Payroll (STP). We believe our products provide value to our customers and that we offer a cost-effective STP solution for small businesses in Australia.

How are Payroller Standard Subscription fees calculated?

A: Payroller Standard subscription fees are based on the number of active employees in a month.

You can choose to be billed annually or monthly. You will pay the equivalent of $1.99 per employee per month on an Annual subscription or $3.99 per employee per month with a Monthly subscription. Please note that minimum spend requirements may apply.

Is access to a Payroller Standard Subscription plan worth the fees?

Payroller subscriptions give you full access to all of our features across any device including web app and mobile app. To get the same range of features from a different software provider, you may have to purchase up to 3 different subscriptions. Payroller provides an affordable payroll and HR solution that goes beyond STP reporting.

How do I pass on subscription fees to my clients as an accountant or tax agent?

When you add a new client to Payroller, you can send them an invite to set up their billing details. Learn how to change who pays (Client pays, or Agent pays) for your client’s Payroller subscription with our easy user guide.

As an accountant or agent, can I pay for my clients’ Payroller Standard subscription?

Yes, you can choose to pay for your clients’ Payroller subscription on behalf of your clients. Follow our handy user guide to sign up for a Payroller subscription on behalf of a client as an Agent.

Read a more extensive overview of Subscription FAQs around the full feature version of Payroller.

Try out payroll software for small business

Why use Payroller? Our cloud payroll is ideal for small businesses to run single touch payroll (STP) easily. It’s simple and cost-effective. Try out Payroller for free today.