Learn how to indicate that your employee is a closely held payee in the Payroller mobile app

Learn how to indicate that your employee is a closely held payee in the Payroller mobile app with our simple guide below.

To access the features of STP Phase 2, please use mobile app version android 0.4.2.0 or ios 3.0.14 and onwards.

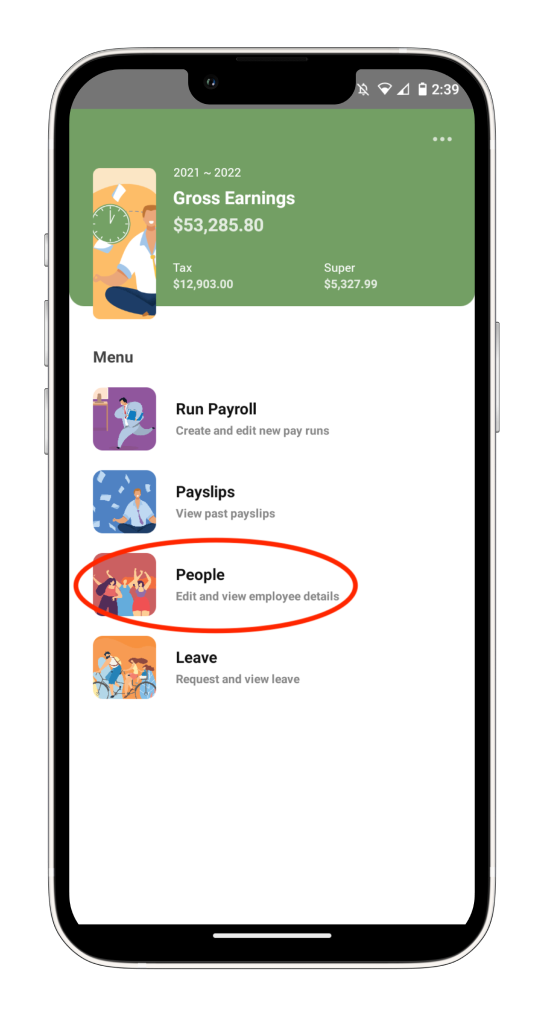

To indicate that your employee is a closely held payee, select ‘People’

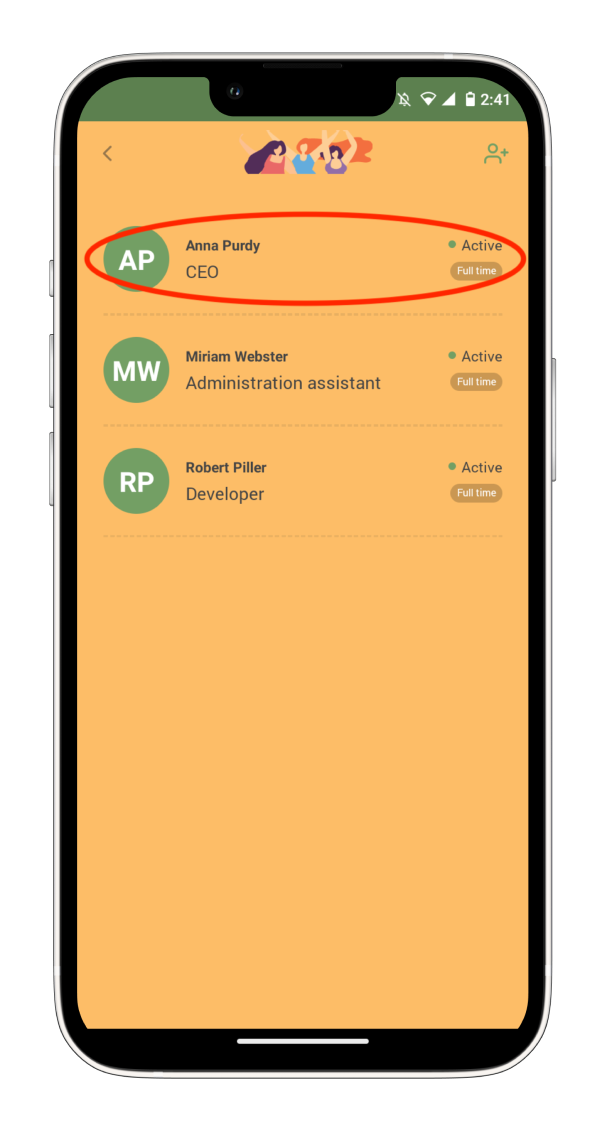

Select the employee.

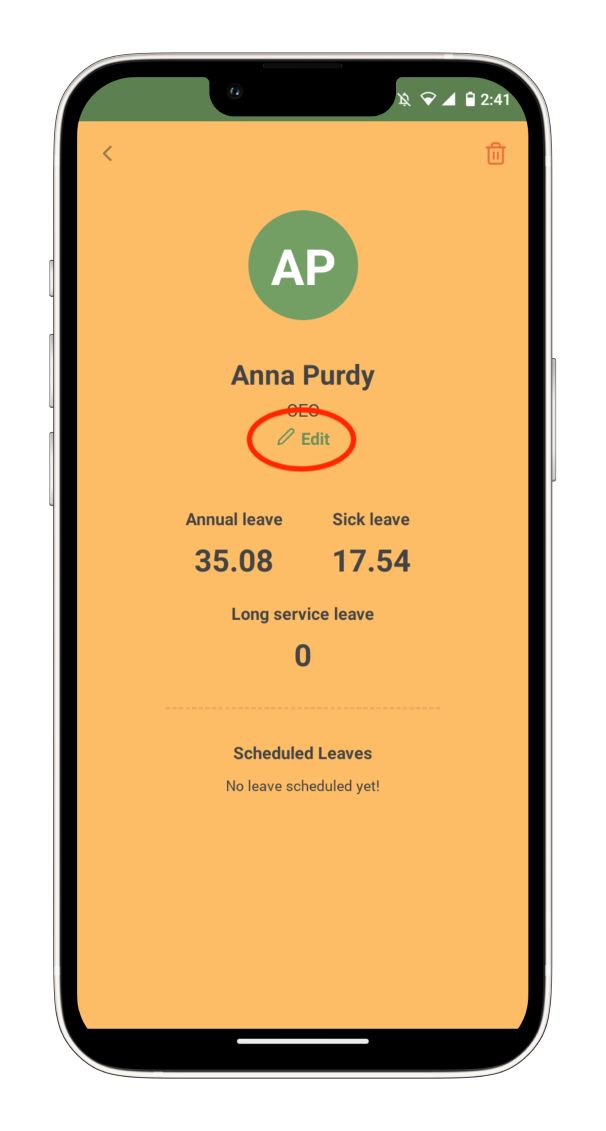

Select edit.

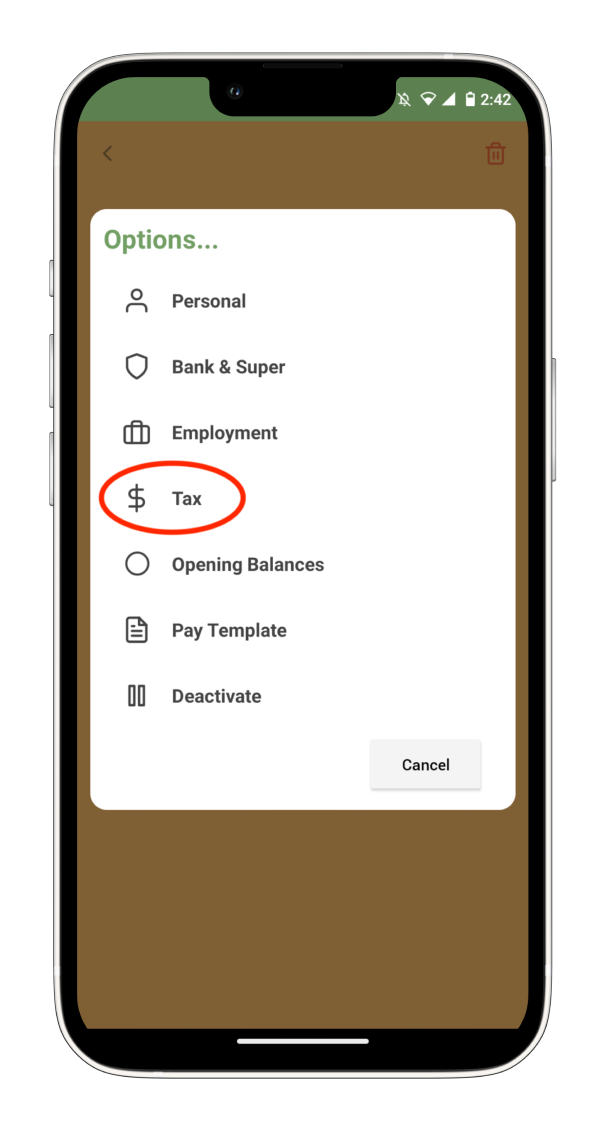

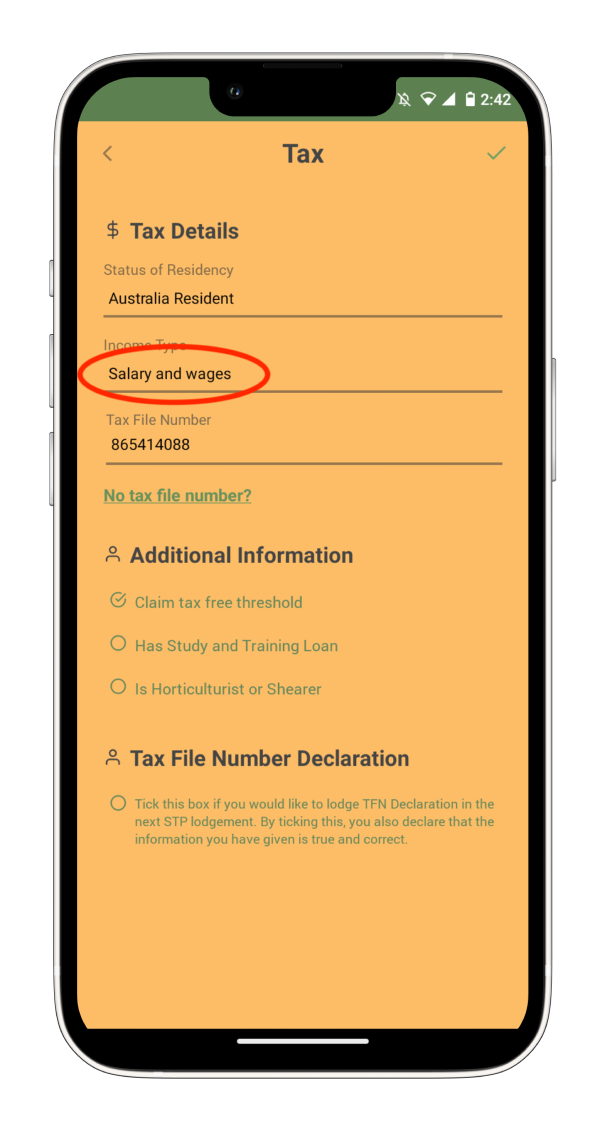

Select ‘Tax’

Select the ‘Income Type’ dropdown menu

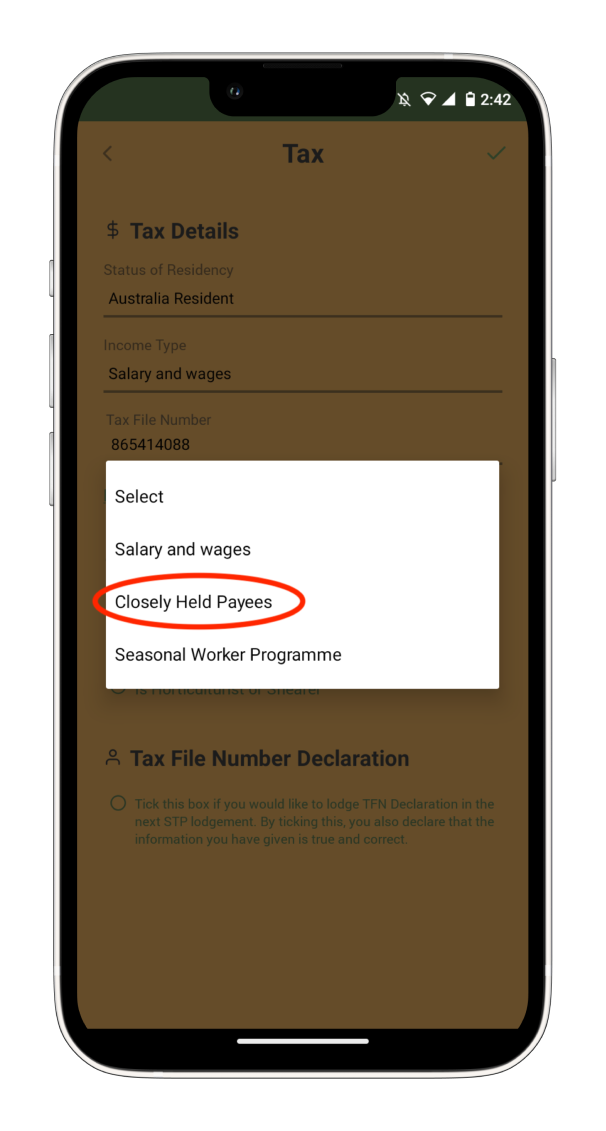

Select ‘Closely Held Payee’

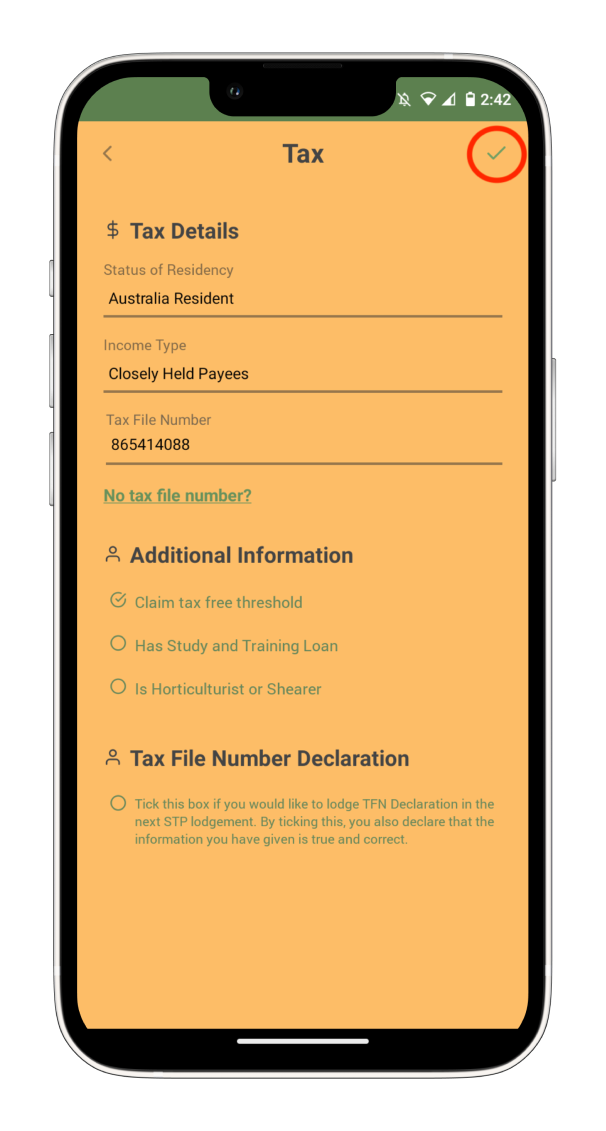

Select the tick icon on the top right.

You have now marked your employee as closely held.

Discover more tutorials & get the most out of using Payroller

Try out Payroller for free. Learn how to create and submit a pay run in the Payroller mobile app.

You can also get a Payroller subscription that gives you access to all features via the web and mobile app. Read up on our Subscription FAQs.

Invite your accountant, bookkeeper or tax agent to help you run your business payroll with our guide.