Payroll Management

Home » Payroll Management » Page 2

Welcome to Payroll Management!

Here, you can find helpful tips and resources on payslips, running payroll, tax deductions, and more. Additionally, we offer information related to the ATO, Fair Work regulations, and superannuation to enhance your payroll management experience.

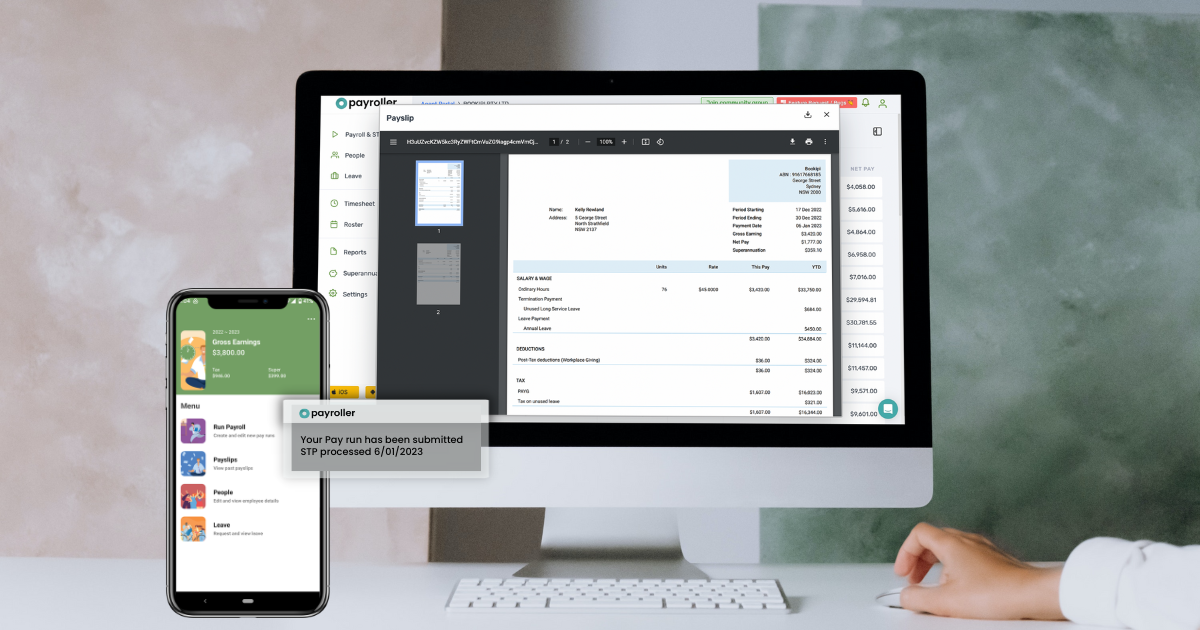

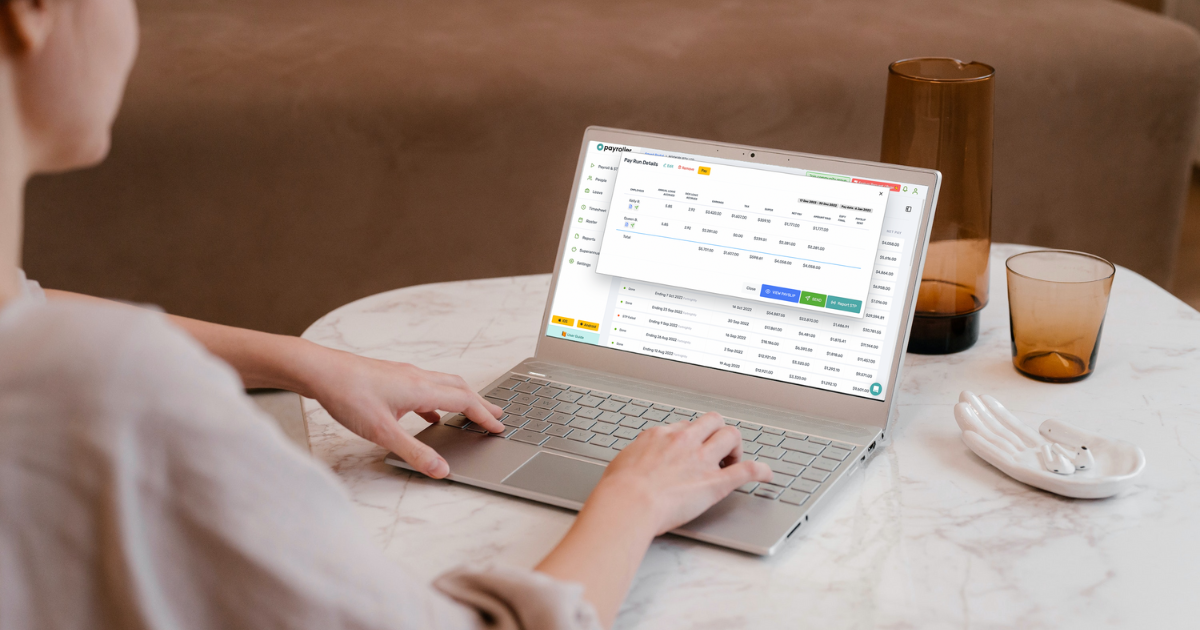

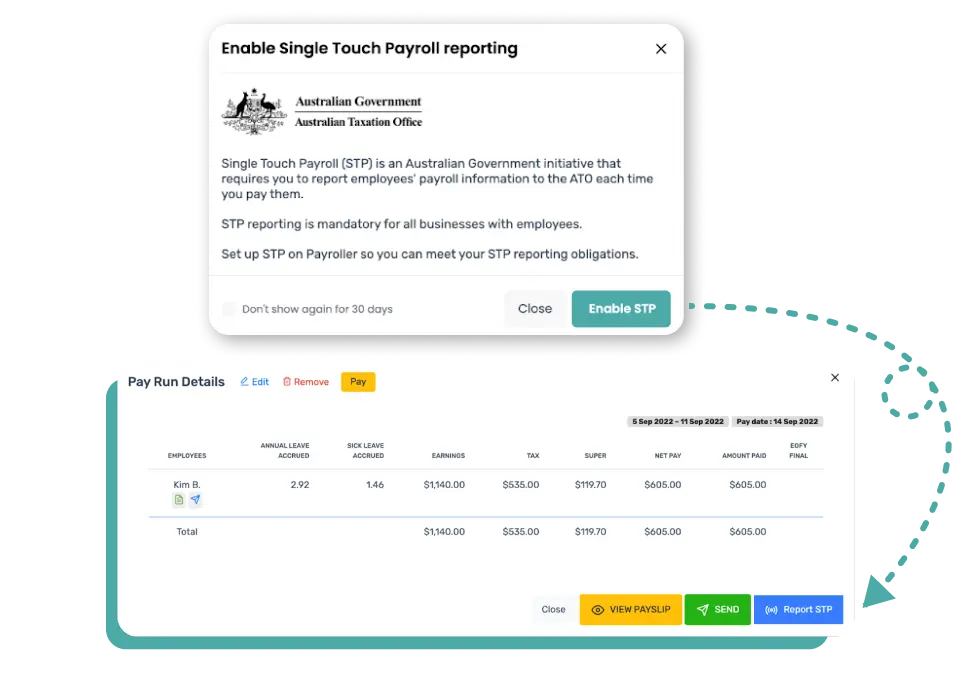

Whether you’re an experienced entrepreneur or just starting out, our aim is to provide you with the necessary tools to streamline payroll and ensure your business stays on track. Sign up to Payroller to make a payslip with one click direct from your pay run with single touch payroll (STP) software.

Payroll management

Payroll information & tips

Before you set up a payroll, it’s important to gather the right payroll information from your business and employees. Here you’ll find out exactly what’s required, as well as other tips that will help you successfully prepare payroll for your small business.

Payroll by industry

Tailored payroll solutions are essential for different industries with unique needs. This section explores industry-specific insights, best practices, and solutions to streamline your payroll processes. Whether you operate in healthcare, retail, or any other sector, our curated content provides industry-specific information to ensure your payroll aligns seamlessly with the demands of your business.

Hospitality

Sorry, we couldn't find any posts. Please try a different search.

Agriculture

Professional Services

Superannuation

Learn about what superannuation in payroll is, how to include super in your small business payroll and more.Payroller automates employee superannuation calculations in your payroll process. Our simple user guides help you with everything you need as a small business to get on top of reporting and paying employee superannuation.

Sorry, we couldn't find any posts. Please try a different search.

See All Articles