Payroll made accessible.

- 5 minute setup

- No credit card needed

- No contract period

Create your free account now.

*By clicking “Try For Free“, you agree to our terms of services and privacy policy.

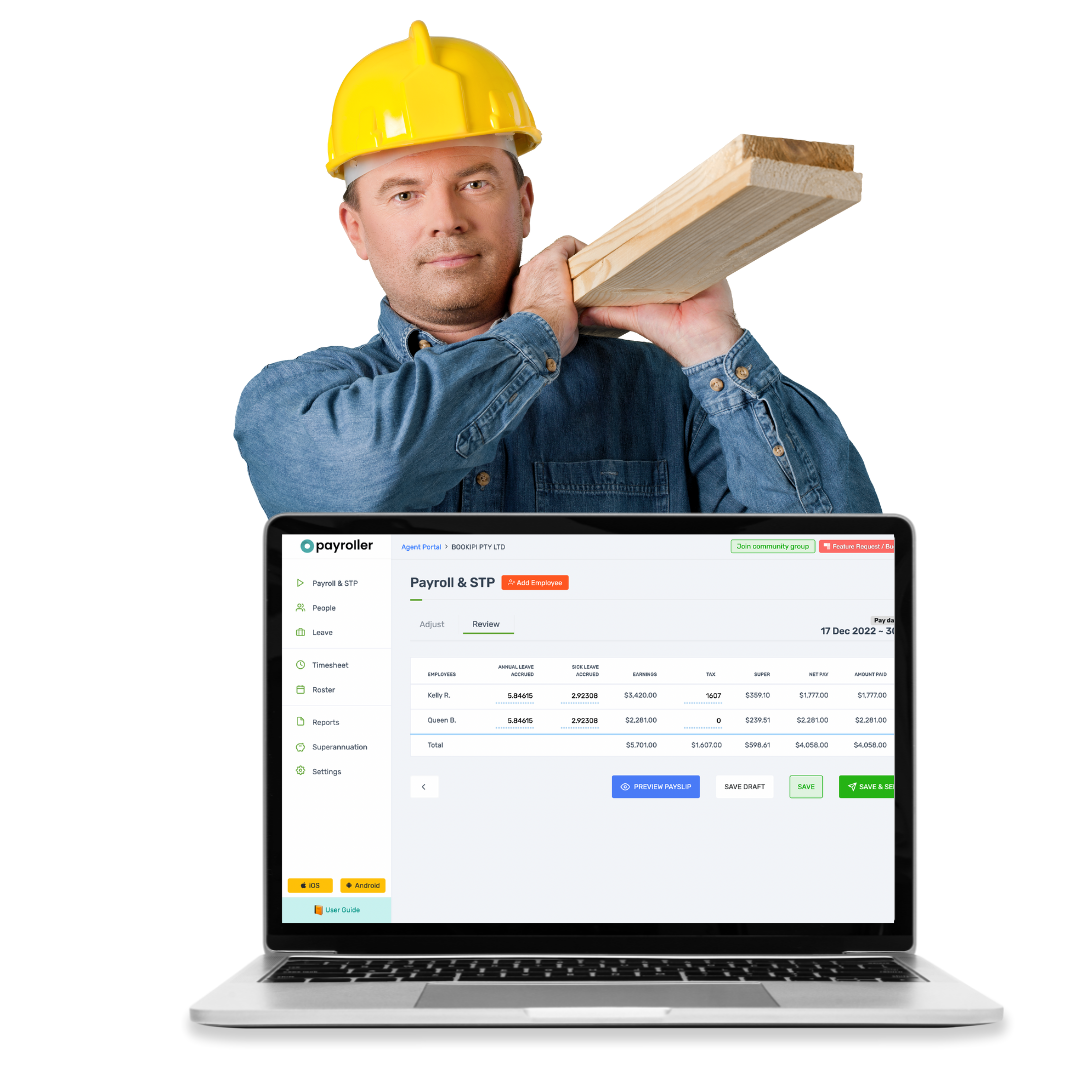

Introducing Payroller, the ultimate payroll solution for tradespeople & trades.

Managing your business payroll is easy and hassle-free with Payroller.

Create your free account now.

Payroll made accessible

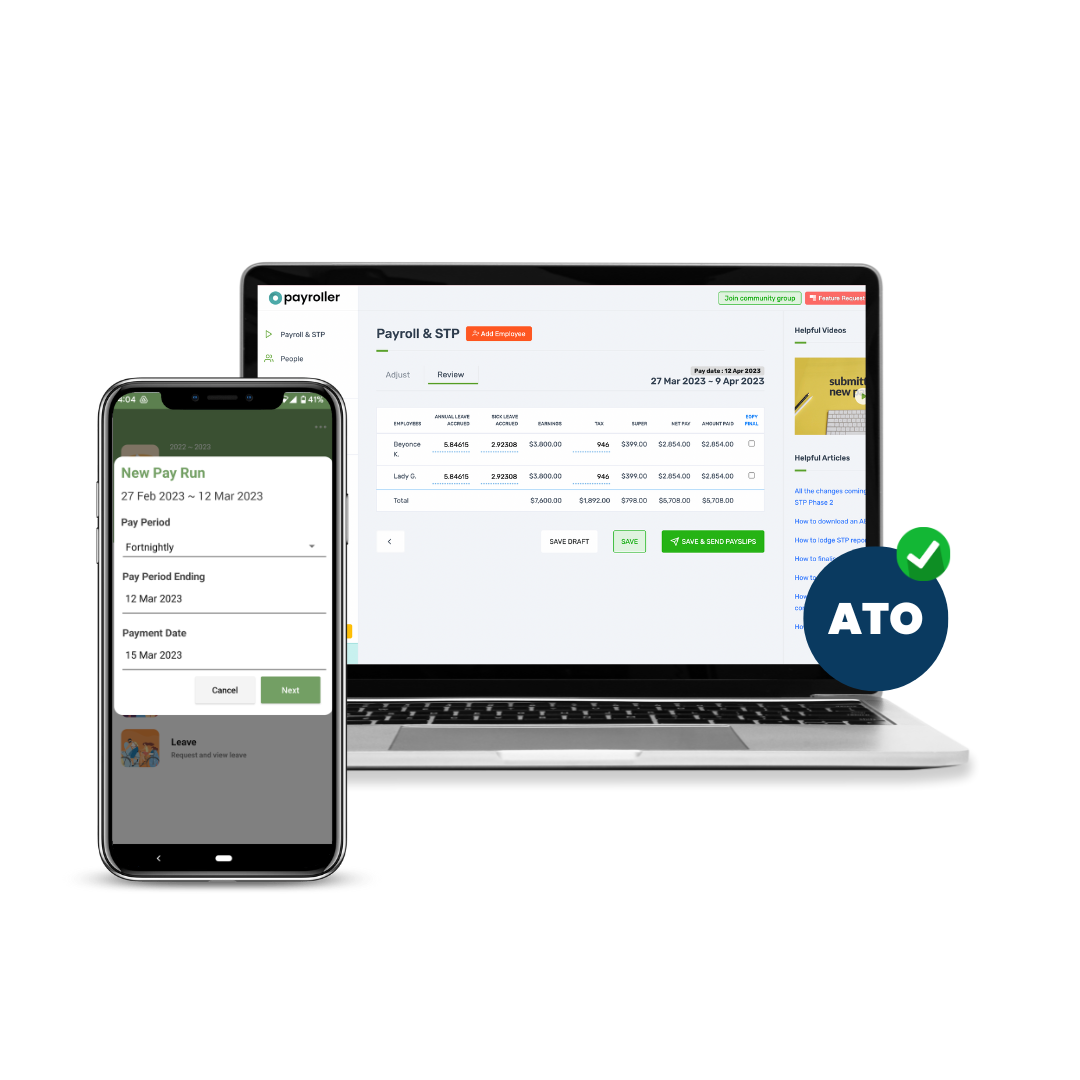

STP-approved by the Australian Tax Office (ATO)

Simplify and automate all your payroll and STP processes

Keep clear records of who’s been paid in real-time

EXCELLENTTrustindex verifies that the original source of the review is Google. easy to use payroll systemTrustindex verifies that the original source of the review is Google. easy to use once set upTrustindex verifies that the original source of the review is Google. Best app ever, works well very very easy to use recommend it for any one, Luv IT! Well done. Cheers Baz The Weed Terminator. Esperance WA.

Paying tradespeople is typically covered by the Fair Work Act 2009, which sets out Australia’s minimum standards for pay and working conditions.

The pay rates for subbies and tradies vary depending on a number of factors, including experience, qualifications, and sub-industry whether it be plumbing or HVAC work.

Automate calculations of net salaries including superannuation, deductions and entitlements for individual employees using Payroller software.

Payroll made accessible.

Create your free account now.

*By clicking “Try For Free“, you agree to our terms of services and privacy policy.

Track work sites, work hours, and set work schedules for your tradespeople with Payroller. It’s easy to set up rosters for workers and make or approve employee timesheets on the go with Payroller mobile app and web.

Make pay runs, generate payslips, manage employees, and set work schedules from any device with our STP-compliant software.

Employers must withhold tax from their employees’ pay and remit it to the Australian Taxation Office (ATO) on their behalf. You also need to make superannuation contributions to your tradies and workers. You can make super payments using Payroller and its BEAM integration.

There’s no need to worry about calculations with Payroller. Simply add your employees’ pay details and your pay run preferences. You can make pay runs and generate payslips in minutes.

“Try for free” allows you to discover if Payroller is the right software for you and your business before you commit to our platform. “Try for free” is cost and commitment-free and we do not require any credit card details to sign up. So give Payroller a try, it only takes a few minutes to get set up.

While the Payroller mobile app is completely free – fees will apply to use the Payroller web app, Xero integration, and to make super contributions through our integrated super clearing house (Beam).

Beyond basic payroll features, tradespeople can benefit from functionalities catering to their needs. Timesheet integration allows seamless recording of regular pay, overtime, and public holiday/weekend work through timesheet apps. Some software even offers optional location tracking (with employee consent) for managing mobile workforces and ensuring proper travel or remote work allowances. Additionally, the software can automate complex calculations for PAYG withholding tax, Super Guarantee contributions, and state payroll tax.

Payroll software also simplifies compliance by generating reports for taxes, superannuation, and employee payslips, streamlining record-keeping for your trade business

Payroll software for tradespeople automates calculations, minimizes errors, and saves valuable time compared to manual processing. This translates to accuracy and efficiency in your payroll tasks. Secondly, the software ensures compliance with everything from award rates for electricians or plumbers to tax regulations and superannuation contributions. This gives you peace of mind knowing you’re following all the rules.

You can benefit from streamlines processes by simplifying tasks like generating payslips, managing deductions, and filing reports. As your business grows and your workforce expands, the software can also scale to handle more employees and complex pay structures.

Maintaining compliant payroll involves a few key practices. First, keeping accurate records is crucial. Hold onto timesheets, payslips, tax reports, and other payroll documents for at least seven years. Second, don’t hesitate to seek professional advice from a registered tax agent. They can be invaluable for navigating complex situations or staying updated on changing regulations.

Additionally, some payroll software offers employee-facing apps that allow them to access payslips, update personal details, and even submit leave requests electronically. This can further streamline payroll processes for both you and your employees.

Payroller is an STP-enabled payroll-only software that automatically submits payroll information to the Australian Taxation Office (ATO) – through a secure cloud network – whenever you perform a payrun. Payroller helps you to track, manage and record your payroll while safely sharing that information (and staying compliant) with the ATO.

As a truly one-stop payroll solution, you can manage staff roster, invite your accountant, bookkeeper or BAS agent and even make Super contribution (Beam) on Payroller.

Absolutely, you may share your account and even set different access permissions.

Only a few minutes. The majority of our customers get up and running within 15 minutes. If you do need more help in getting set up, simply reach out to our capable live agents and they will have you using Payroller like a seasoned user in no time. Check out our handy user guides.

Yes, Payroller is integrated with Xero. By connecting your Xero account to Payroller, you can easily export and share payroll information cross-platforms.

Payroll made accessible.

Create your free account now.

*By clicking “Try For Free“, you agree to our terms of services and privacy policy.