Employee remuneration reports

Employee remuneration goes beyond salary. Understand the different types and review remuneration reports to find out how they impact your business and staff.

Try Payroller today and say goodbye to payroll and STP headaches!

By clicking Try for Free, you agree to our terms of services and privacy policy.

What is remuneration?

Remuneration is the total package of compensation that employees get in exchange for their work. It goes beyond salary and considers other factors in their compensation, including non-monetary benefits.

Employee remuneration directly impacts employee value proposition (EVP). EVP is the overall set of benefits that attract employees. Having a clear sense of your business’ remuneration strategy can be key to retaining your awesome staff and preparing to expand the team.

Common types of employee remuneration

Base salary or wages

These are the fundamental components of employee remuneration. This indicates an employee’s fixed regular payment for work done per hour, week, or month. It is the predictable and guaranteed portion of an employee’s compensation package.

While it is the core element of remuneration, it’s just one piece of the puzzle. Many employers offer other forms of remuneration.

Commissions

Commissions are performance-based remuneration directly tied to an employee’s sales performance. Typically, these employees are in sales-oriented roles, such as real estate agents and insurance brokers.

The amount employees earn from commissions varies depending on the percentage of total sales, which can depend on the industry, company policy, or product sold. Some organisations have a tiered commission structure to encourage employees to hit high sales targets.

Tips

Tips are voluntary remuneration given by customers to service industry employees because of good service. Examples of employees who typically receive tips as compensation are servers and bartenders, hairstylists, drivers, and delivery personnel. The amount earned from tips varies depending on the customer. In Australia, individuals are expected to report tips as part of their assessable income.

Cash incentives and bonuses

Similar to commissions, cash incentives and bonuses are performance-based remuneration that are given to employees as a way to motivate and reward specific achievements. They are typically one-time payments, and the amount can vary depending on an employer’s discretion.

Effectively designed incentive programs can do wonders to improve productivity, performance, and engagement.

Non-monetary compensation

Non-monetary forms of remuneration aren’t usually found on a payslip. They offer intangible value to employees to enhance their overall work experience. They can come in many forms that are not exclusive to the following:

- Flexible work arrangements

- Training and development opportunities

- Recognition and awards

- Employee perks and discounts

- Health and wellness programs

The type and value of non-monetary remuneration depends on the industry, employee preferences, and the business itself. Diverse options help create a work environment that attracts, motivates, and retains employees.

What is an employee remuneration report?

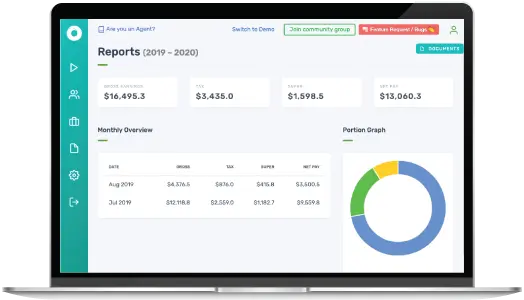

An employee remuneration report is a document that summarises and analyses the compensation packages given to employees. It helps businesses make informed decisions on remuneration strategies and salary budgeting.

Employee remuneration reports enable comparisons between employees, competitors, and the industry benchmark. This leads to data-driven decision-making in labour law and payroll regulation compliance.

A report typically includes the following:

- Overview of total compensation, monetary and non-monetary

- Salary trends

- Industry benchmarks

- Cost-benefit analysis

Who uses employee remuneration reports and why

Human resource professionals

HR professionals use employee remuneration reports to analyse the current compensation practices of a business. This can involve identifying pay gaps, ensuring equity in pay, and staying competitive with the talent market.

These reports provide data on the cost-effectiveness of remuneration programs, which lets HR optimise strategies to get the best ROI. Pay data can also highlight potential issues with labour laws and payroll regulations.

Management and executives

Insights from employee remuneration reports allow senior leadership to make decisions on talent acquisition and retention. For instance, they can assess the cost-effectiveness of hiring new employees compared to retaining existing ones by analysing salary trends and benefits costs.

These reports also provide key metrics on human capital costs as a portion of the overall business expenses. This enables evaluations of workforce ROI and identifies potential areas for cost control.

Investors and financial analysts

These professionals may use remuneration reports for financial due diligence processes to analyse a company’s human capital cost over financial health. The data can be used to assess compensation costs, turnover rates, and the effectiveness of talent management.

These reports also help highlight risks for a business, such as employee skill gaps or morale

Happy employees can make a successful business

Employee remuneration reports play an important role in promoting a culture of transparency, strategic decision-making, and overall business success. The data they offer can empower the professionals within a business to foster a positive and effective work environment.

Optimise your human capital investment with data-driven reports to achieve your long-term goals! Use an ATO-approved online payroll software to centralise your employee data and streamline your reports.

Frequently asked questions about employee remuneration

While remuneration and salary are related concepts, they are not the same. Salary is the fixed and regular monetary payment an employee receives before tax deductions. It forms a core part of an employee’s remuneration package.

The total monetary amount an employee receives makes up the total taxable income of an employee. This typically includes salary and wages, bonuses and commissions, allowances, and fringe benefits.

Bonuses and commissions are liable for payroll tax under the Payroll Tax Act 2007. These need to be added to the taxable value of wages. Examples of benefits that may be deductible from taxable income can include travel, meals, or clothing allowances.

Executive remuneration is also known as executive pay. This term refers to the compensation package offered to high-level executives within a business. Aside from the common remuneration types, executive remuneration often includes stock options or other equity compensation.

Several factors can influence an employee’s remuneration package, including job role and responsibilities, industry benchmarks, education and experience, performance, and budget. Government regulations can also come into play through minimum wage laws.

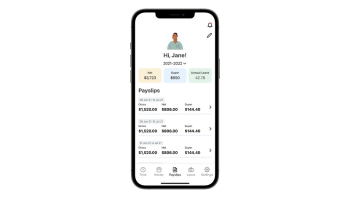

How does Payroller work?

Payroller is designed to make STP simple for small business employers.

Try Payroller for free as an Employer or accounting professional Agent

(accountant, bookkeeper or tax agent).