Payroll for electricians

Introducing Payroller, the ultimate payroll solution for electricians.

Managing your business payroll is easy and hassle-free with Payroller.

By clicking Try for Free, you agree to our terms of service and privacy policy.

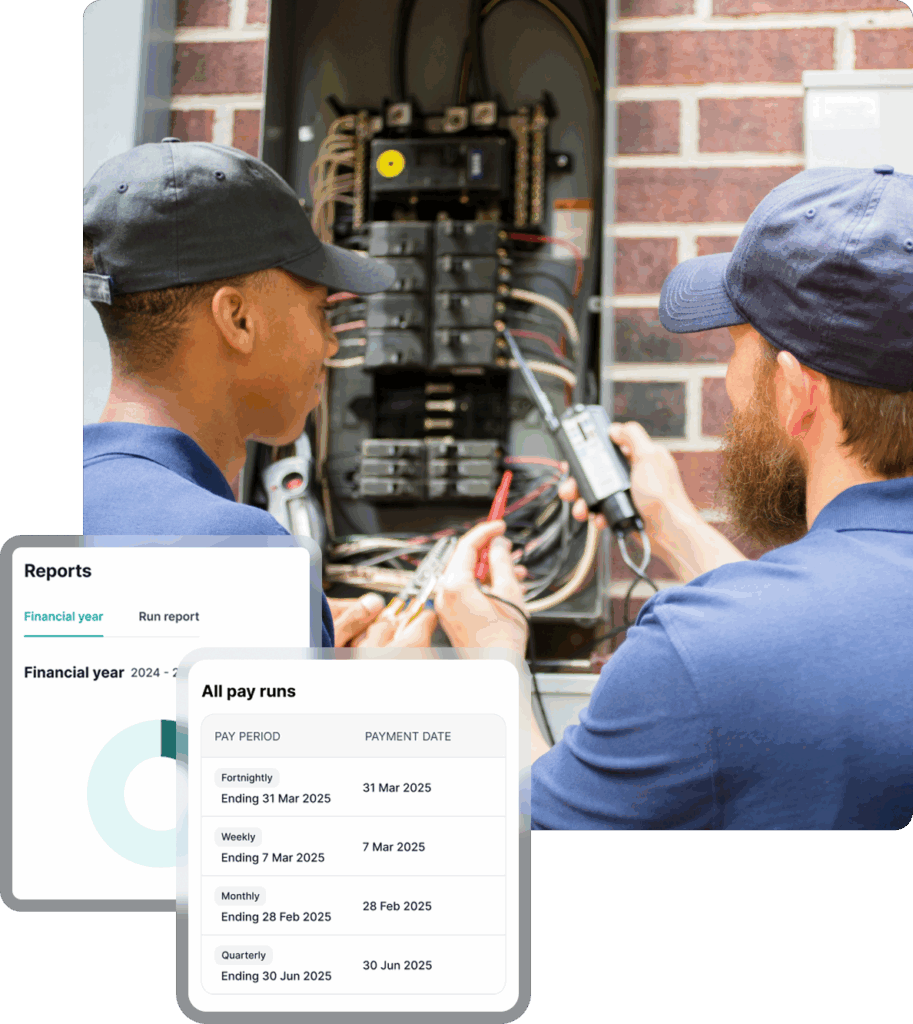

Pay electricians on time

Electricians who run their own businesses in Australia must comply with minimum pay regulations and ATO (Australian Tax Office) laws.

Pay rates vary depending on factors such as experience, qualifications, and the location of your employees. Is your electrician business paying employees weekly, biweekly, or monthly? Once you’ve set up your pay cycles, Payroller automates the calculation of net salaries, deductions, and entitlements in your pay runs.

Generate payslips for your sparkies direct from completed pay runs so you meet Fair Work laws.

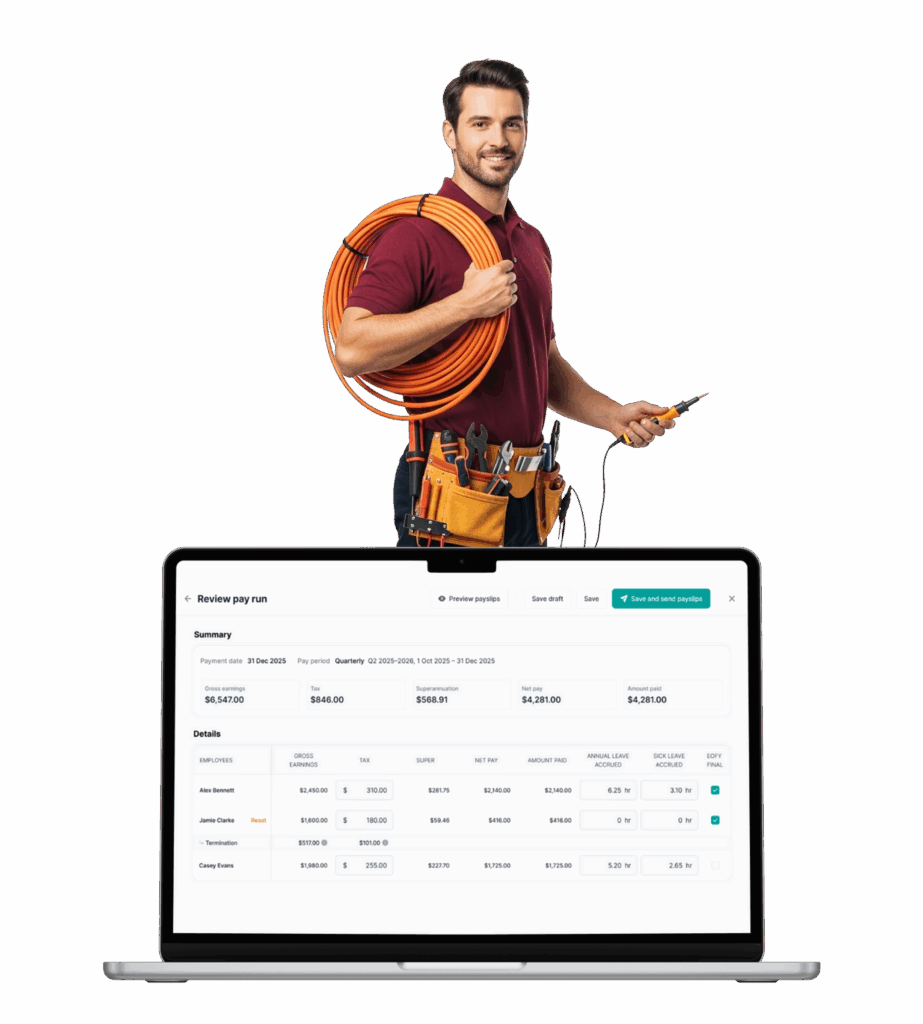

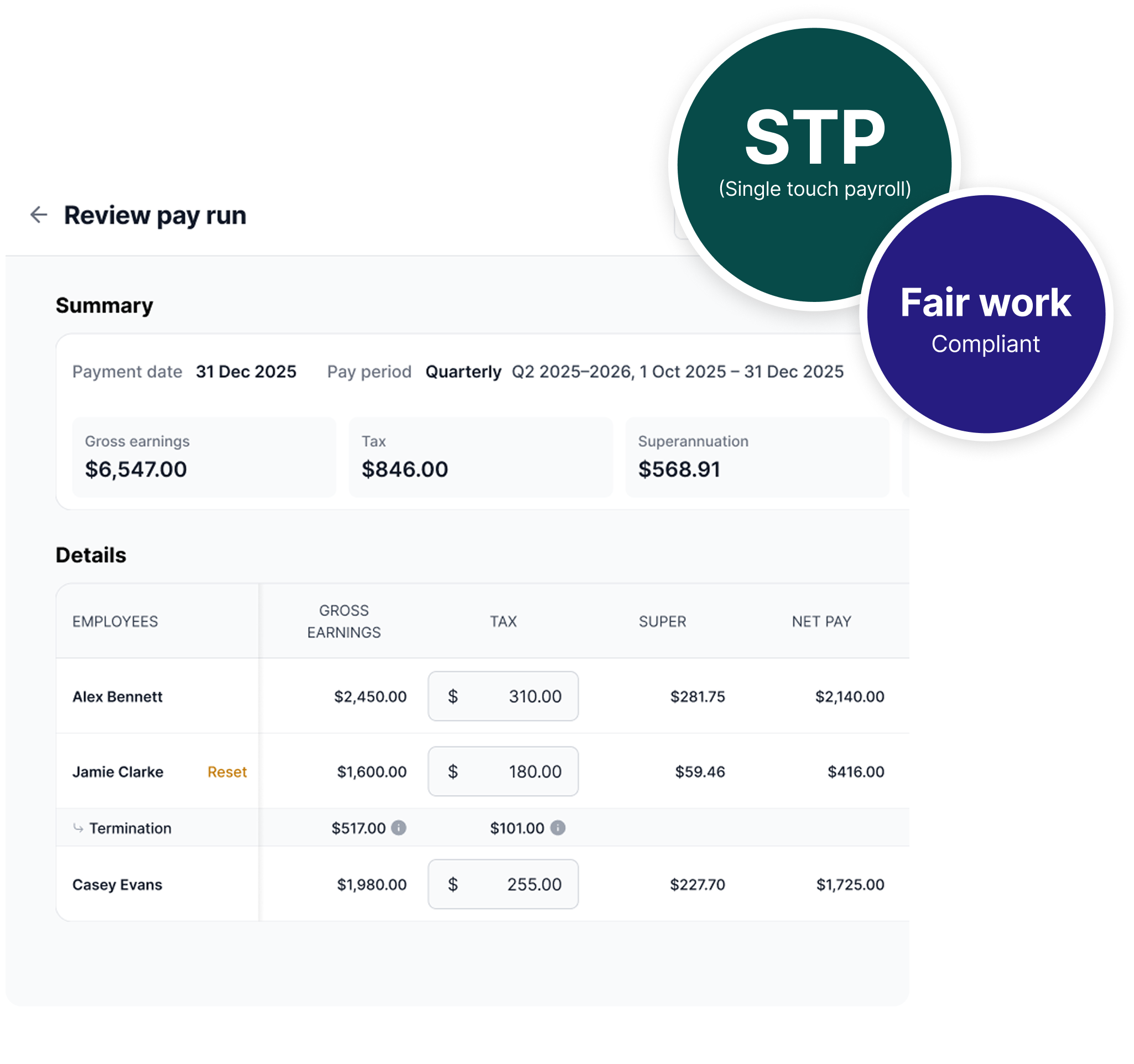

Accurate STP Lodging

Ready for STP reporting compliance based on the ATO

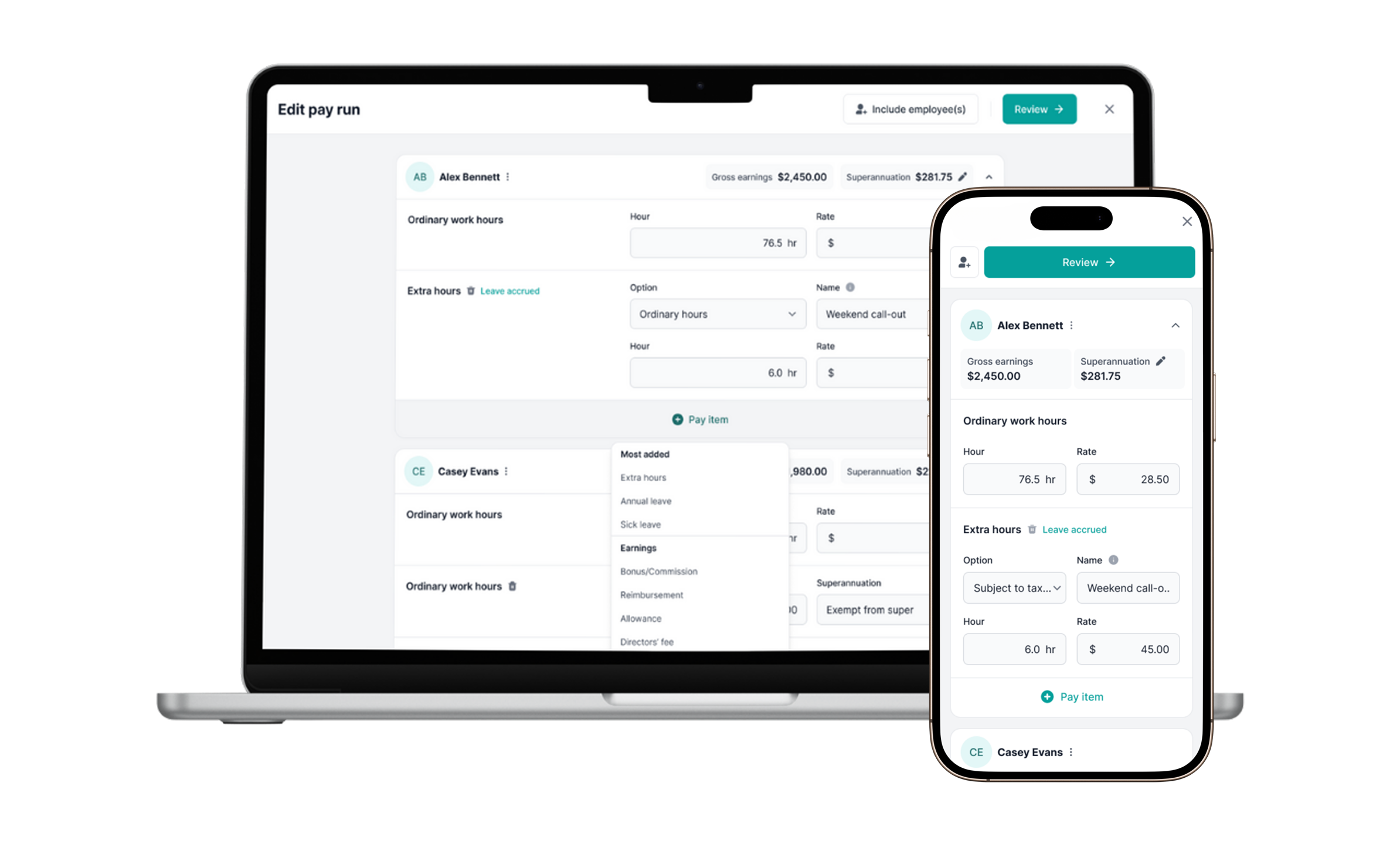

Fast Setup

Simplify and automate all your payroll and STP processes

Reliable Reporting

Keep clear records of who’s been paid in real-time

Don’t just take our word for it.

EXCELLENTTrustindex verifies that the original source of the review is Google. easy to use payroll systemPosted onTrustindex verifies that the original source of the review is Google. easy to use once set upPosted onTrustindex verifies that the original source of the review is Google. Best app ever, works well very very easy to use recommend it for any one, Luv IT! Well done. Cheers Baz The Weed Terminator. Esperance WA.

Payroll made accessible

- 5 minute setup

- 30-day money back guarantee

- No contract period

Create your free account now!

*By clicking “Try For Free“, you agree to our terms of service and privacy policy.

Payroll for electricians anytime

You’ll need to maintain accurate records of work hours to ensure you’re paying employees in your electrical services business fairly. Keep track of employee hours with our time tracking, staff scheduling and timesheets features in Payroller.

Access payroll, rosters and work schedules in one spot across all of your devices including mobile app and web.

Making payroll easy for electricians

Your employees’ pay is subject to income tax or PAYG withholding. It’s also important to maintain accurate records of your employees’ pay and taxes in the event of audits or disputes. Payroller is STP-compliant software that shares your business’s completed PAYG information for workers with the ATO in real-time and securely.

As an employer, you also need to make contributions to your employees’ nominated superannuation accounts. Use our integration with BEAM super clearing house to make super payments straight from finalised pay runs.

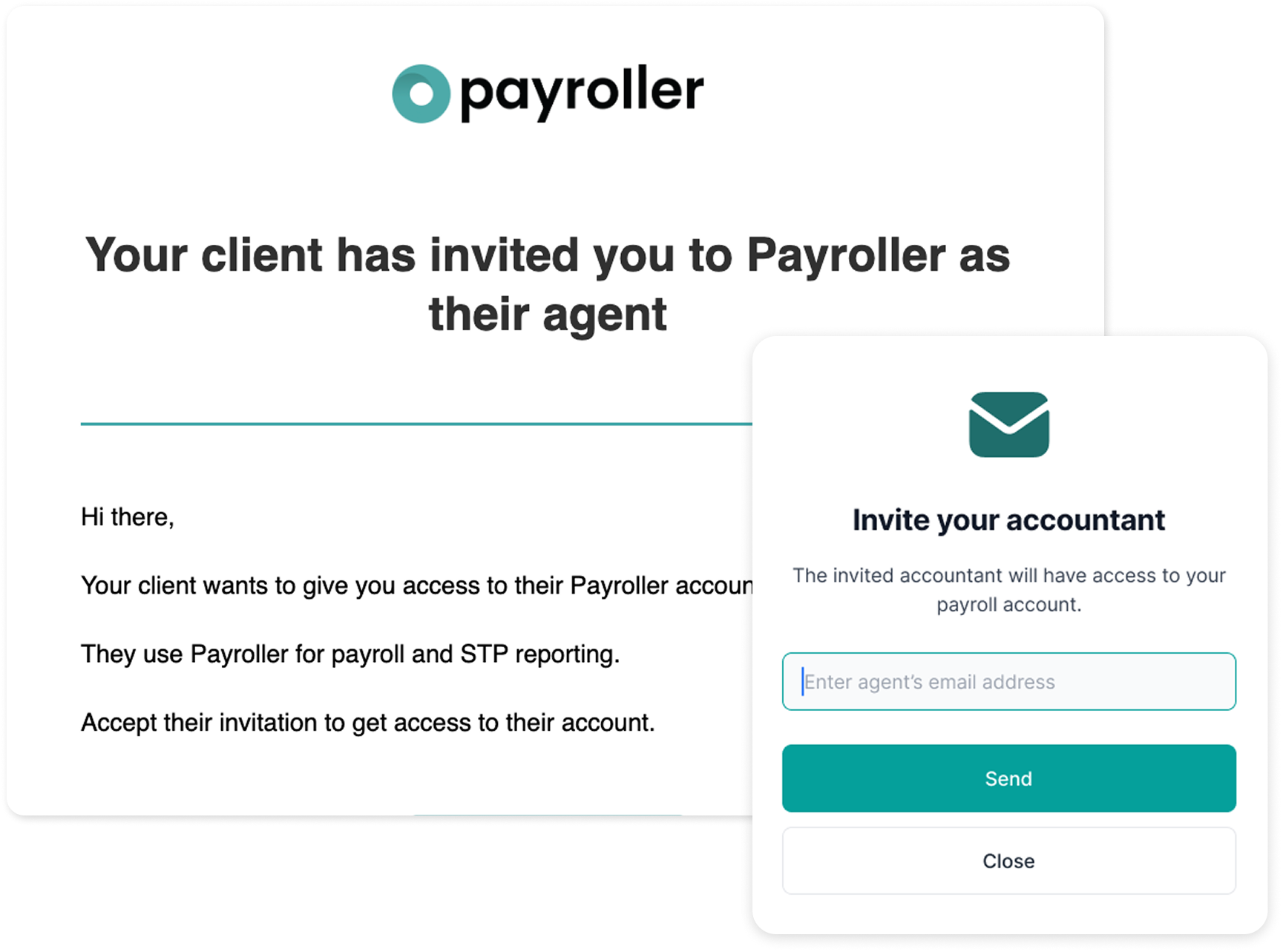

Secure payroll direct to your accountant

Invite your accountant, bookkeeper or tax agent to get access to your payroll via the dedicated Payroller Agent portal. Accounting professionals can have real-time access to your payroll so you don’t have to manually export files and send emails.

Save time with Payroller and focus on getting more jobs for your electrical services business.

85 % of our users run their first payroll in under 15 minutes.

Frequently asked questions about electrician payroll

How does “Try for free” work?

“Try for free” allows you to discover if Payroller is the right software for you and your business before you commit to our platform. “Try for free” is cost and commitment-free and we do not require any credit card details to sign up. So give Payroller a try, it only takes a few minutes to get set up.

While the Payroller mobile app is completely free – fees will apply to use the Payroller web app, Xero integration, and to make super contributions through our integrated super clearing house (Beam).

What tools can help with payroll processing for electricians?

Electricians in Australia can benefit from several tools to streamline payroll processing. Timesheet apps or software can help accurately capture regular pay, overtime, and public holiday/weekend work. Payroll software can take timesheet data and map them to payslips for your employees or reports for internal or compliance use. The same software should be able to calculate PAYG withholding, SG contributions, and payroll tax of the correct state.

What are the payment options for electricians?

When it comes to paying your electricians, several options are available. The most common and secure method is direct deposit (EFT), electronically transferring wages directly into their bank accounts. This ensures timely and accurate payments. Prepaid payroll cards can also be an option, particularly for managing cash flow or for employees who may not have traditional bank accounts. While less common due to security concerns, cash payments might still be used in some situations.

How do I ensure compliance with prevailing wage for electricians?

Ensuring your electrical business pays the correct prevailing wage for electricians requires staying informed and using several resources. The Fair Work Ombudsman website provides a wealth of information and tools to understand the Building and Construction Award (BCA), which outlines minimum pay rates and conditions specific to electricians. Additionally, registered enterprise agreements may exist for your workplace, and these agreements can sometimes override certain BCA provisions.

To navigate these complexities, the Fair Work Commission offers valuable resources and assistance, including help with interpreting award details. By utilising these tools and staying current on relevant regulations, you can guarantee your business complies with prevailing wage requirements for your electricians.

How are payroll taxes calculated for bricklayers?

Payroll tax calculations depend on your state or territory and their payroll tax thresholds. If your business surpasses the threshold (e.g., $700,000 annually in Victoria), you’ll need to register for payroll tax and calculate the amount owed based on your total wages paid. Specific payroll tax rates and calculation methods vary by state/territory, so consulting a registered tax agent or the relevant state revenue office is recommended.

How does Payroller work?

Payroller is an STP-enabled payroll-only software that automatically submits payroll information to the Australian Taxation Office (ATO) – through a secure cloud network – whenever you perform a payrun. Payroller helps you to track, manage and record your payroll while safely sharing that information (and staying compliant) with the ATO.

As a truly one-stop payroll solution, you can manage staff roster, invite your accountant, bookkeeper or BAS agent and even make Super contribution (Beam) on Payroller.

Can I share my Payroller account?

Absolutely, you may share your account and even set different access permissions.

How long does it take to set up electrician payroll with Payroller?

Only a few minutes. The majority of our customers get up and running within 15 minutes. If you do need more help in getting set up, simply reach out to our capable live agents and they will have you using Payroller like a seasoned user in no time. Check out our handy user guides.

Does Payroller integrate with other platforms?

Yes, Payroller is integrated with Xero. By connecting your Xero account to Payroller, you can easily export and share payroll information cross-platforms.

Get started today and experience the many benefits of Payroller.

Try it now for free!

Payroll made accessible

- 5 minute setup

- 30-day money-back guarantee

- No contract period

Create your free account now!

*By clicking “Try For Free“, you agree to our terms of service and privacy policy.