Payroll made accessible.

- 5 minute setup

- No credit card needed

- No contract period

Create your free account now.

*By clicking “Try For Free“, you agree to our terms of services and privacy policy.

Introducing Payroller, the ultimate payroll solution for builders in Australia.

Managing your business payroll is easy and hassle-free with Payroller.

Create your free account now.

Payroll made accessible

STP-approved by the Australian Tax Office (ATO)

Simplify and automate all your payroll and STP processes

Keep clear records of who’s been paid in real-time

EXCELLENTTrustindex verifies that the original source of the review is Google. easy to use payroll systemTrustindex verifies that the original source of the review is Google. easy to use once set upTrustindex verifies that the original source of the review is Google. Best app ever, works well very very easy to use recommend it for any one, Luv IT! Well done. Cheers Baz The Weed Terminator. Esperance WA.

Manage sub-contractors, employees, and apprentices’ information with just a few clicks using Payroller.

Under Fair Work laws, there are minimum standards for pay and conditions for employees in the building industry. With Payroller, you can enter different pay rates for your building workforce and automate net salary calculations.

Automate superannuation entitlement calculations and make super payments to builders using Payroller’s connection to BEAM super clearing house.

Generate payslips for your contractors and builders instantly when you finalise pay runs with Payroller. Save time with Payroller and focus on managing your building projects.

Payroll made accessible.

Create your free account now.

*By clicking “Try For Free“, you agree to our terms of services and privacy policy.

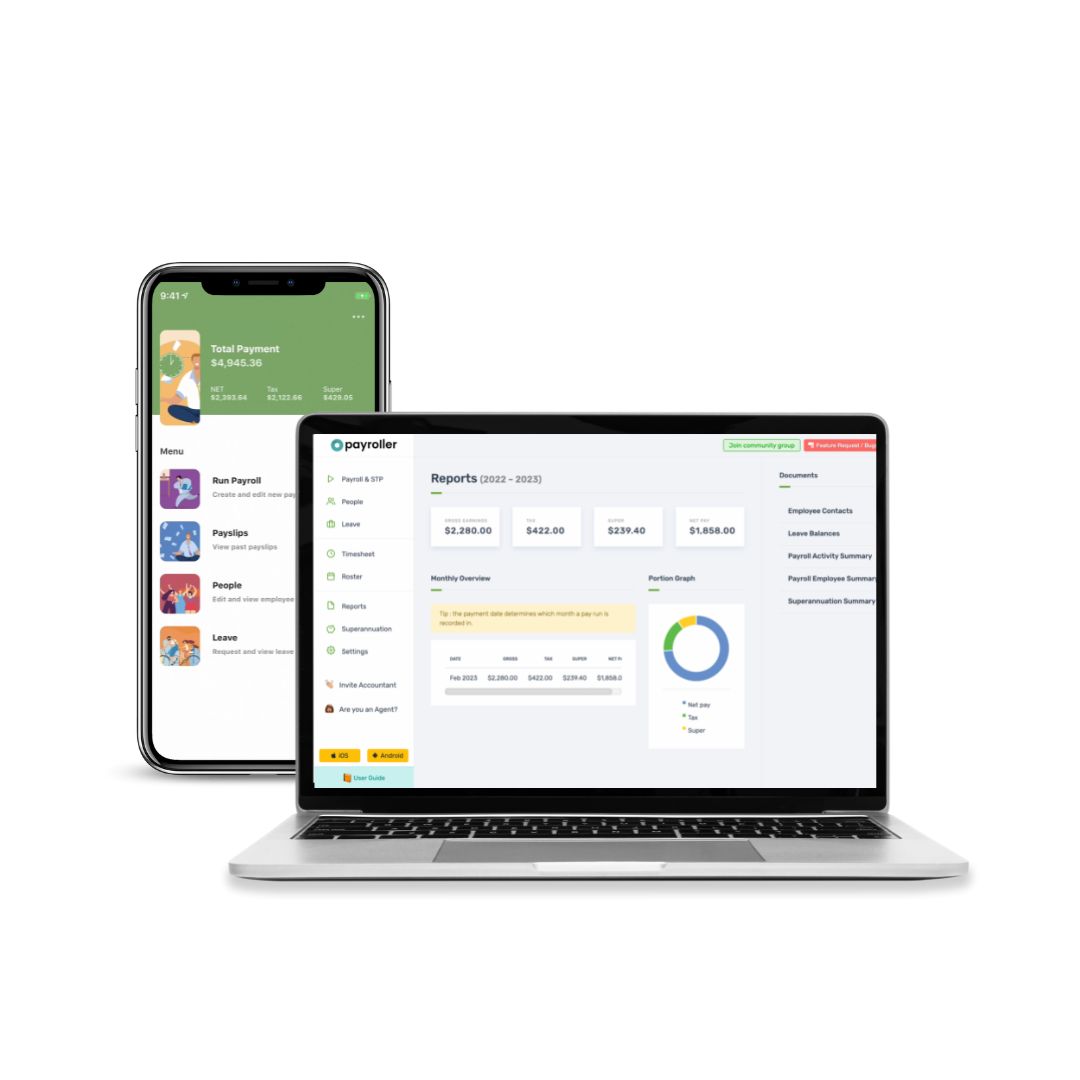

Make pay runs & send payslips whenever with Payroller. Make changes on desktop and mobile devices including mobile app. Invite your builders & workers to use their own employee mobile app to view your payslips.

You can also manage work rosters and schedule shifts from any building site. Keep track of your employees’ and subcontractors’ work sites, hours worked and days off with Payroller. Make pay runs instantly from approved timesheets.

Managing building projects can be complex. The last thing you’d want to think about is sorting out payroll issues. Invite your tax accountant to access your building business’ payroll with Payroller.

Payroller single touch payroll (STP) software ensures secure communications with your accountant or tax agent. No need to manually share pay files through messy email chains.

Share your building business’ payroll with your bookkeeper safely and save time.

Payroller is the easiest payroll solution for building businesses in Australia. Our software is approved for Single Touch Payroll (STP) reporting by the Australian Tax Office (ATO).

You don’t need to be an accounting expert to use our easy payroll systems. It’s easy to self-manage payroll because Payroller is built for small business. Save money and meet Fair Work and ATO laws with our low-cost solution.

Renovation businesses in Australia need to manage a range of workers tasked with differing jobs. Renovators can access flexible payroll systems for employees whether they’re casual, part-time, full-time or contractors.

“Try for free” allows you to discover if Payroller is the right software for you and your business before you commit to our platform. “Try for free” is cost and commitment-free and we do not require any credit card details to sign up. So give Payroller a try, it only takes a few minutes to get set up.

While the Payroller mobile app is completely free – fees will apply to use the Payroller web app, Xero integration, and to make super contributions through our integrated super clearing house (Beam).

Construction workers typically fall under the Building and Construction Award 2020. This award outlines minimum pay rates, allowances, penalty rates for overtime, weekends, and public holidays. Payroll software can ensure you’re paying your workers correctly based on their classification (e.g., carpenter, bricklayer, laborer).

Apprentices and trainees have specific pay rates and conditions outlined in the relevant award. Payroll software can help calculate their wages based on their experience level and ensure compliance with their training requirements.

Construction workers may be entitled to various allowances depending on the site location and conditions, such as dirty work allowances, confined space allowances, or working at heights allowances. Payroll software can help manage these allowances and ensure they’re reflected accurately in workers’ pay.

Construction is a high-risk industry with a higher chance of work-related accidents or injuries. Workers’ compensation insurance protects your business from financial liability if an employee gets injured on the job. It covers medical expenses, lost wages, and rehabilitation costs for injured workers.

While workers’ compensation insurance isn’t directly processed through payroll software, it can indirectly affect your payroll calculations.

The cost of your workers’ compensation insurance policy is often based on factors like the type of construction work you do, your claims history, and your payroll. This means higher-risk projects or a history of claims may lead to higher premiums, impacting your overall labor costs. Some workers’ compensation plans may also have employee deductibles, meaning the employee might be responsible for a small portion of their initial medical expenses. This could temporarily affect their take-home pay.

Payroller is an STP-enabled payroll-only software that automatically submits payroll information to the Australian Taxation Office (ATO) – through a secure cloud network – whenever you perform a payrun. Payroller helps you to track, manage and record your payroll while safely sharing that information (and staying compliant) with the ATO.

As a truly one-stop payroll solution, you can manage staff roster, invite your accountant, bookkeeper or BAS agent and even make Super contribution (Beam) on Payroller.

Absolutely, you may share your account and even set different access permissions.

Only a few minutes. The majority of our customers get up and running within 15 minutes. If you do need more help in getting set up, simply reach out to our capable live agents and they will have you using Payroller like a seasoned user in no time. Check out our handy user guides.

Yes, Payroller is integrated with Xero. By connecting your Xero account to Payroller, you can easily export and share payroll information cross-platforms.

Payroll made accessible.

Create your free account now.

*By clicking “Try For Free“, you agree to our terms of services and privacy policy.