Learn how to submit Single Touch Payroll (STP) to the ATO in Payroller

Learn how to submit Single Touch Payroll (STP) to the ATO in Payroller with our simple video tutorial below.

Alternatively, you can follow these simple steps.

Once you have registered with the ATO, and enabled STP, you will then be able to submit any pay runs through to the ATO.

After creating a pay run and pressing submit, the STP declaration will appear.

If you’re reporting a completed pay run:

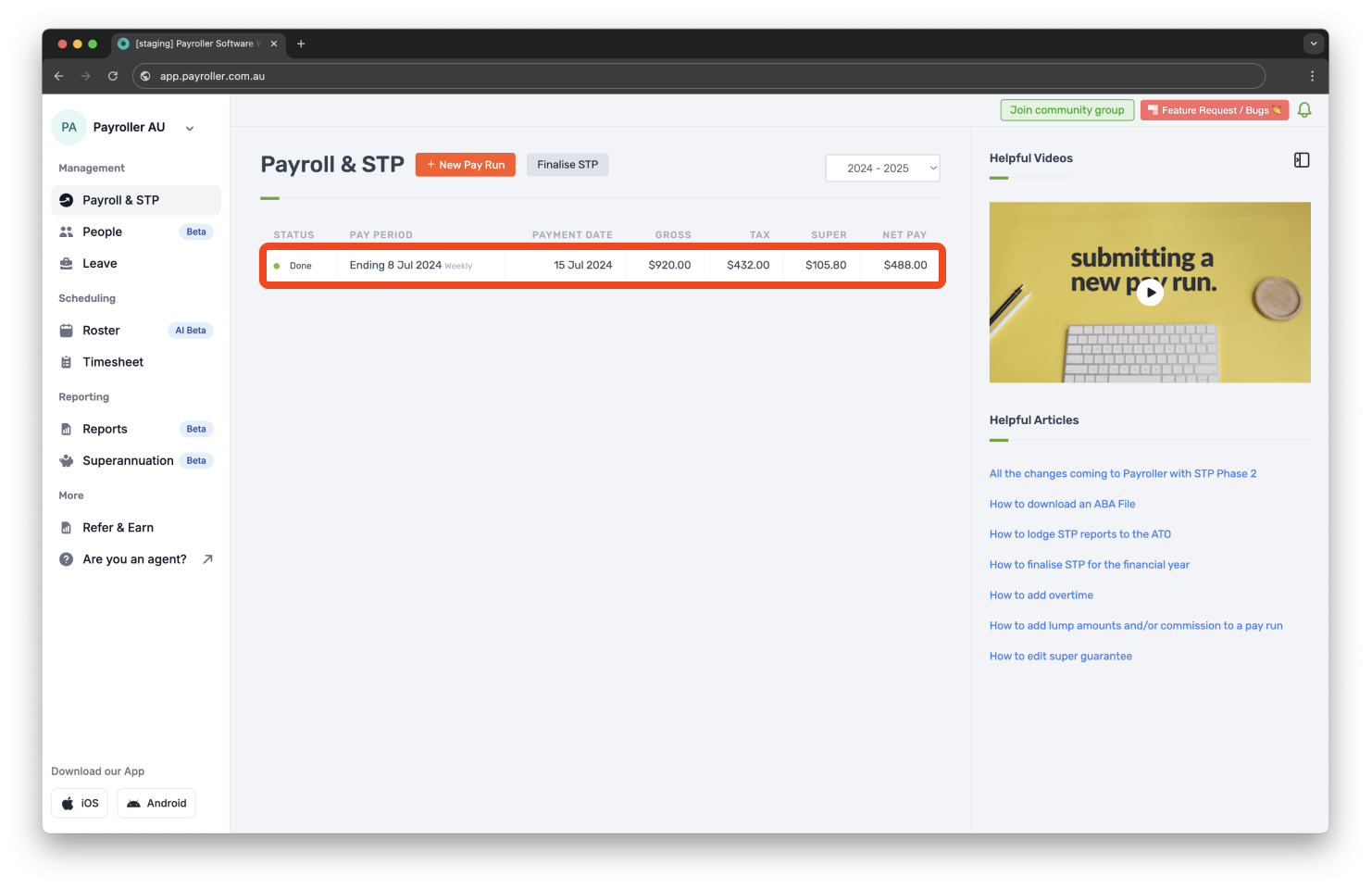

Step 1: Go to the ‘Payroll & STP’ page and select the completed pay run.

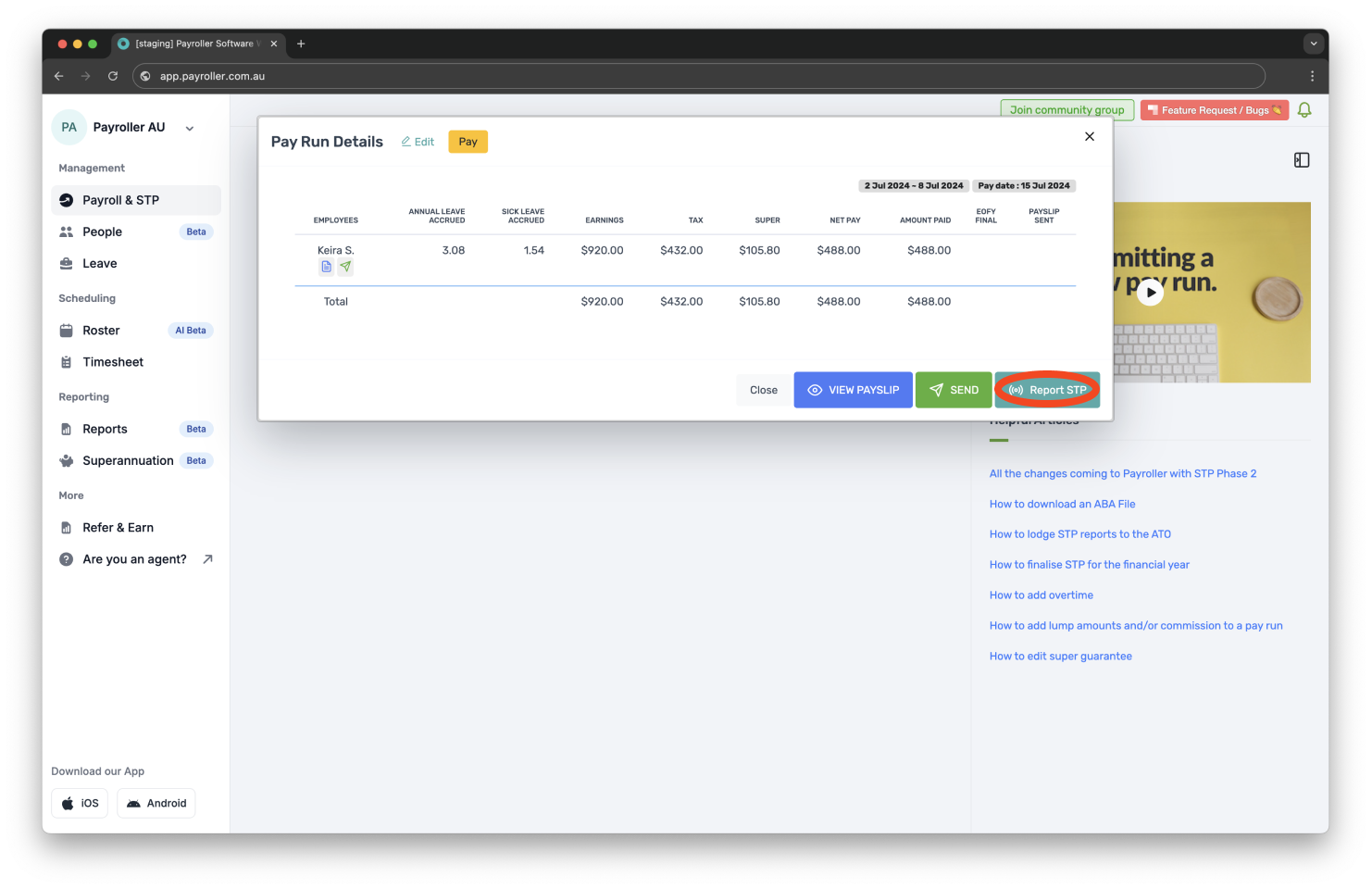

Step 2: Click ‘Report STP’.

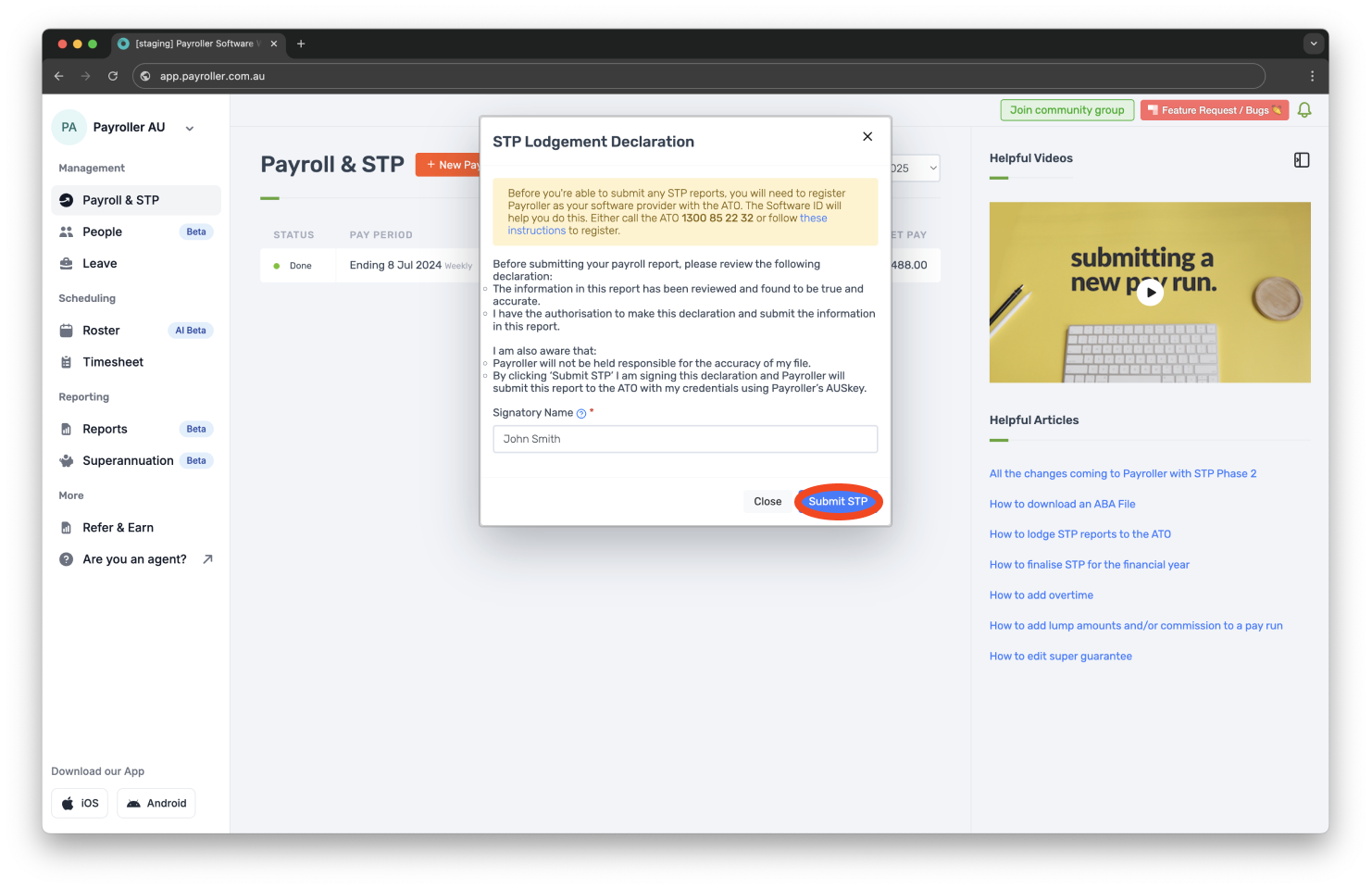

Step 3: Complete the ‘STP Lodgement Declaration’ form and click ‘Submit STP’.

Your pay run has now been submitted.

Learn how to find and edit other STP-related features on Payroller with our simple guides below:

-

How to register Payroller as your software provider with the ATO.

-

How to identify and resolve STP reporting error messages on Payroller

Discover more tutorials for using Payroller

Get started with setting up employees to create a pay run. Find out more about Single Touch Payroll (STP) and what you need to do for your small business. Sign up to try Payroller for free today.

You can access all features in Payroller on both web app and mobile app with a Payroller subscription. Find out more in our Subscription FAQs.