Learn how to resubmit a Super contribution that has been refunded in Payroller

Learn how to resubmit a Super contribution that has been refunded in Payroller with our simple guide below.

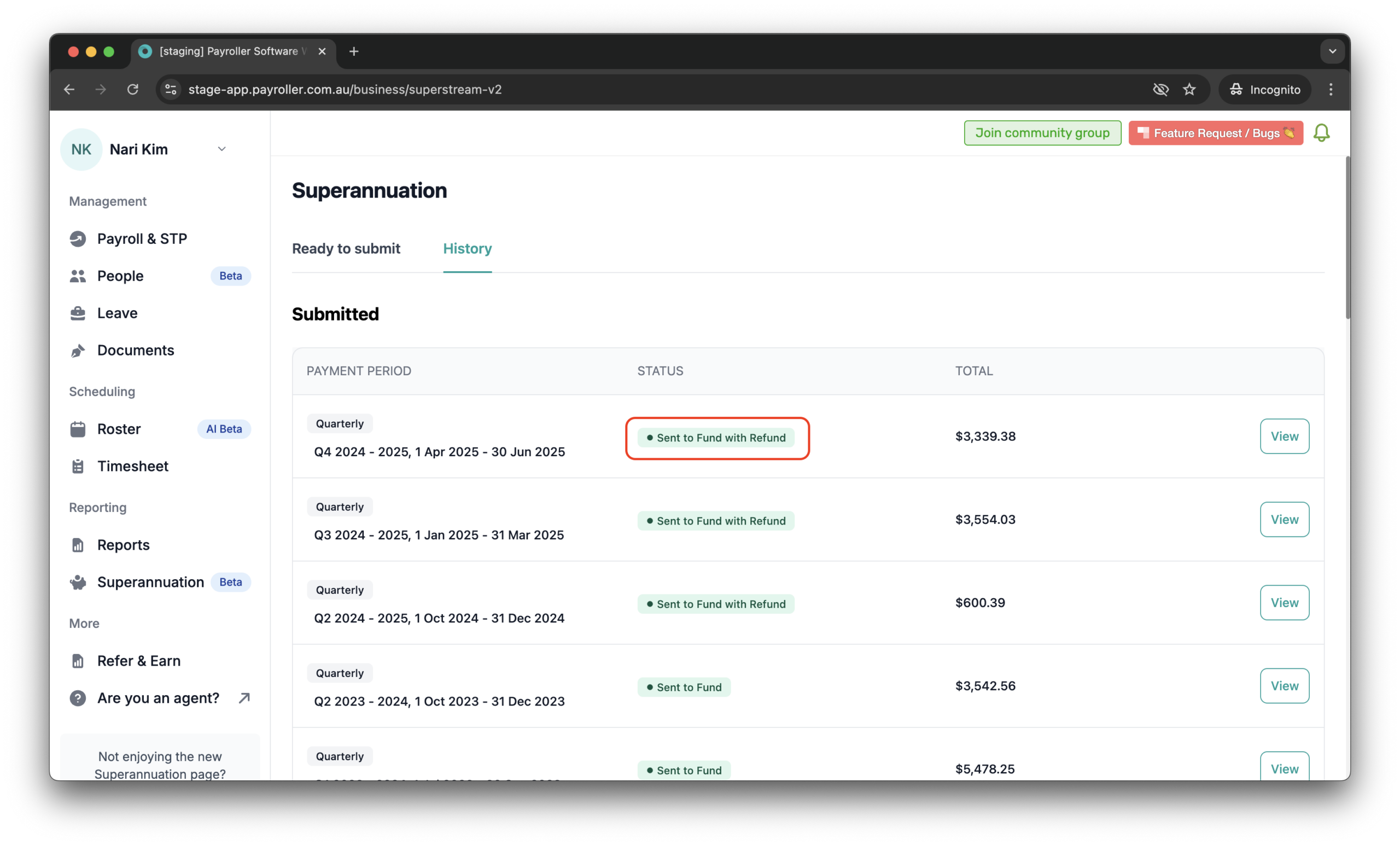

In the case below, the funds were sent to the superfund but were then refunded back into the employer’s bank account.

You’ll need to resolve the issue that caused it to be refunded in the first place.

This could be an incorrect member number or a cancelled super account.

Once the issue is resolved:

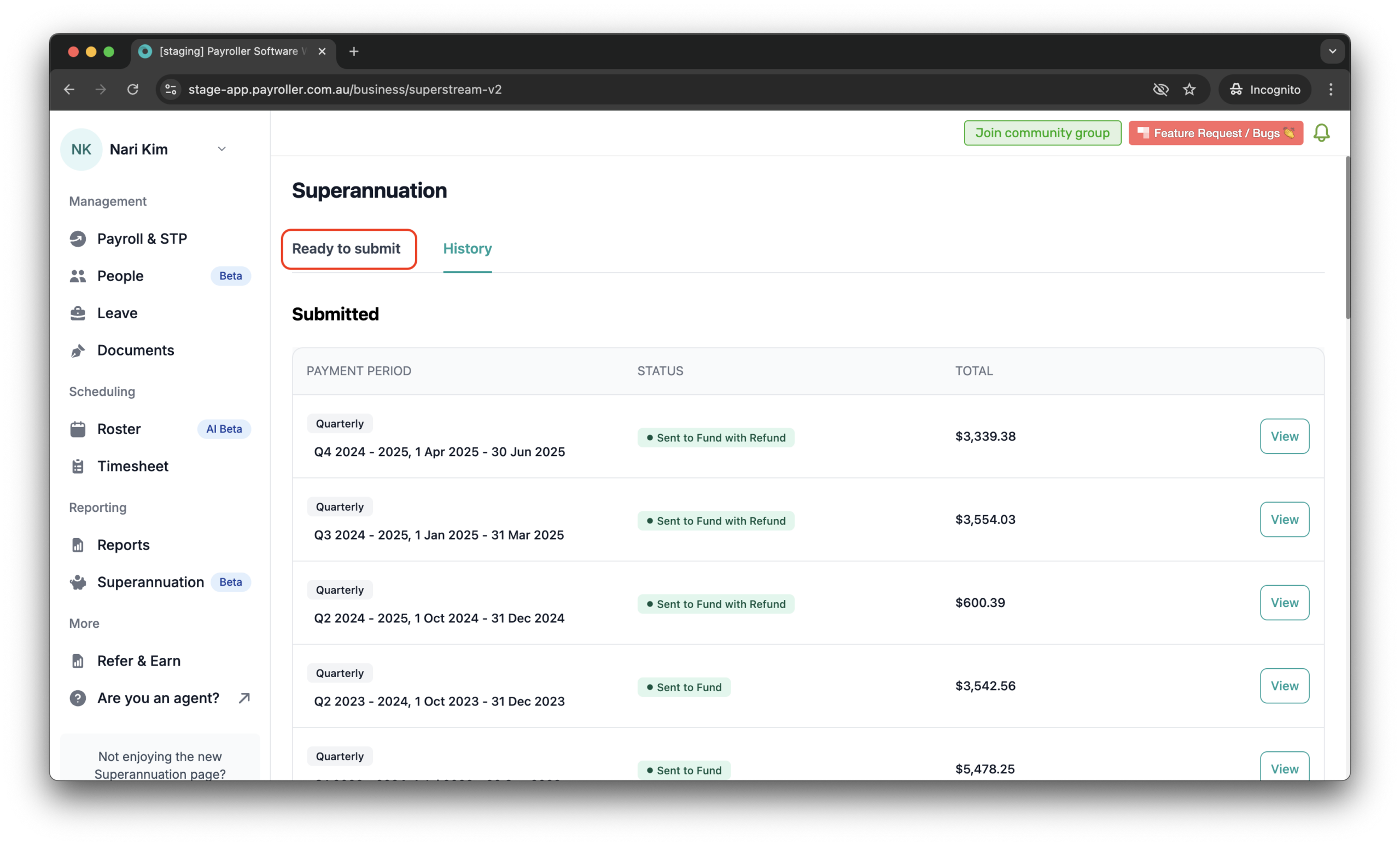

Step 1: Return to the ‘Ready to submit‘ section.

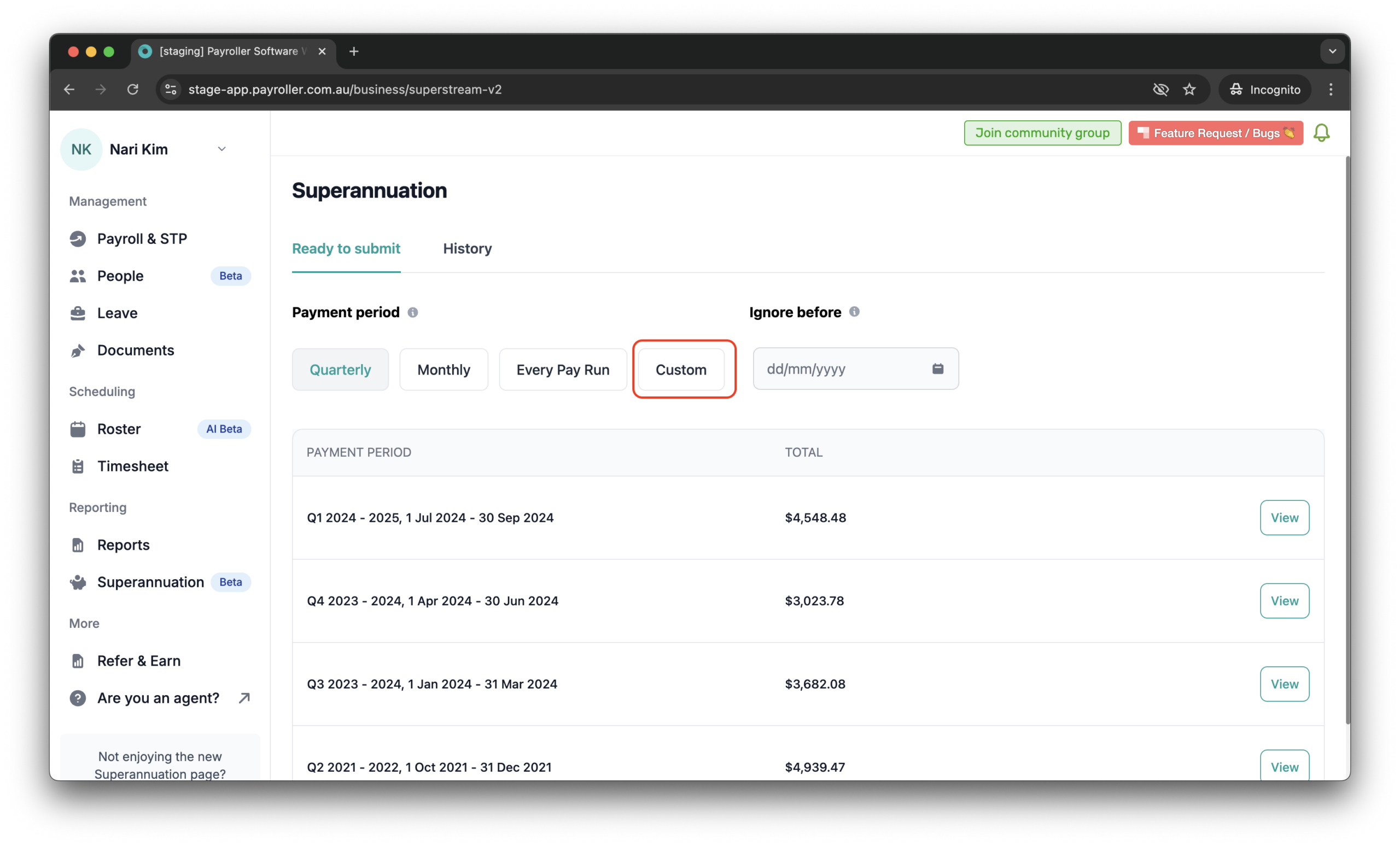

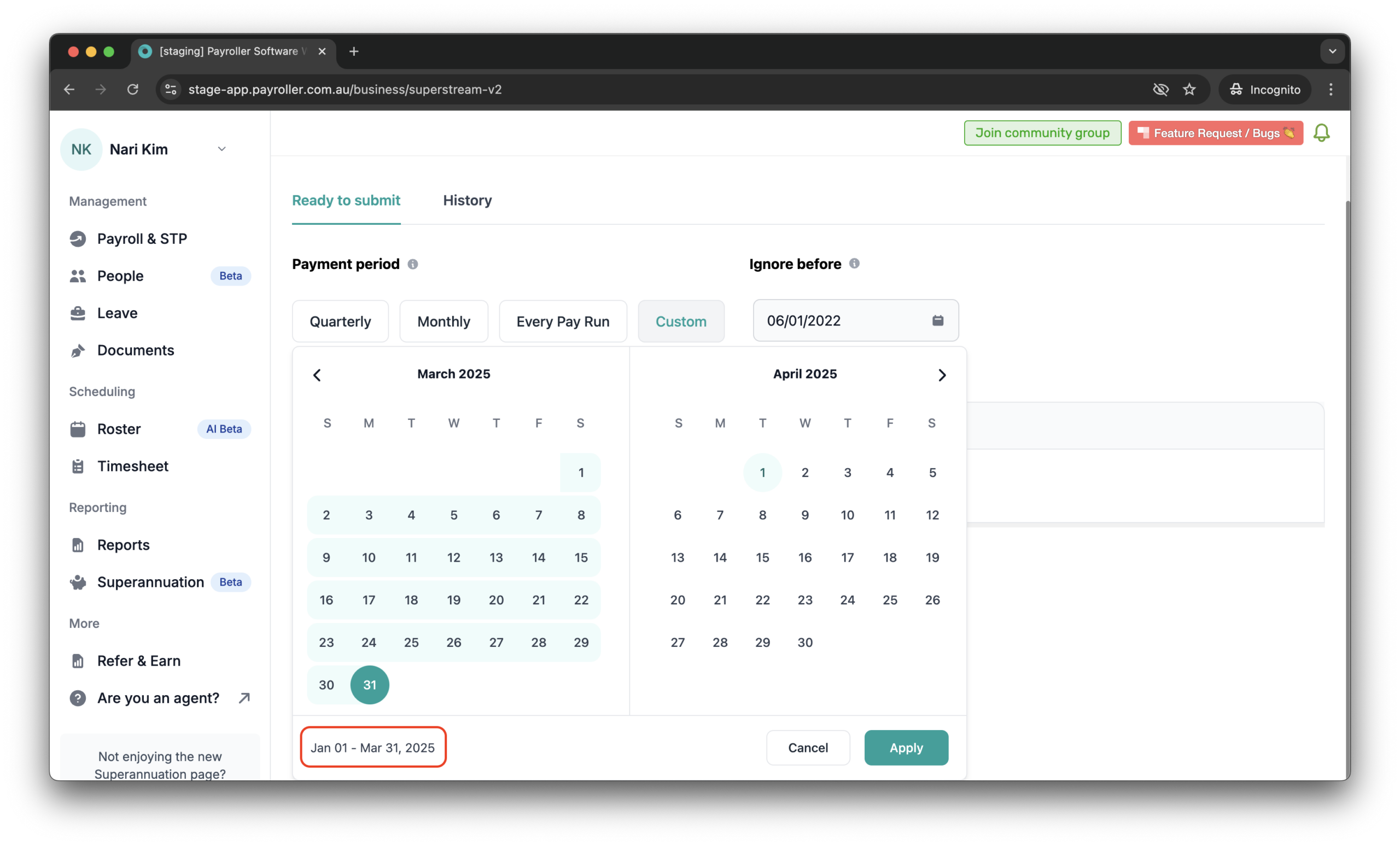

Step 2: Select the Super Payment period to ‘Custom’.

Step 3: Select the period for the custom batch. You will need to enter the pay period of the refunded super contribution.

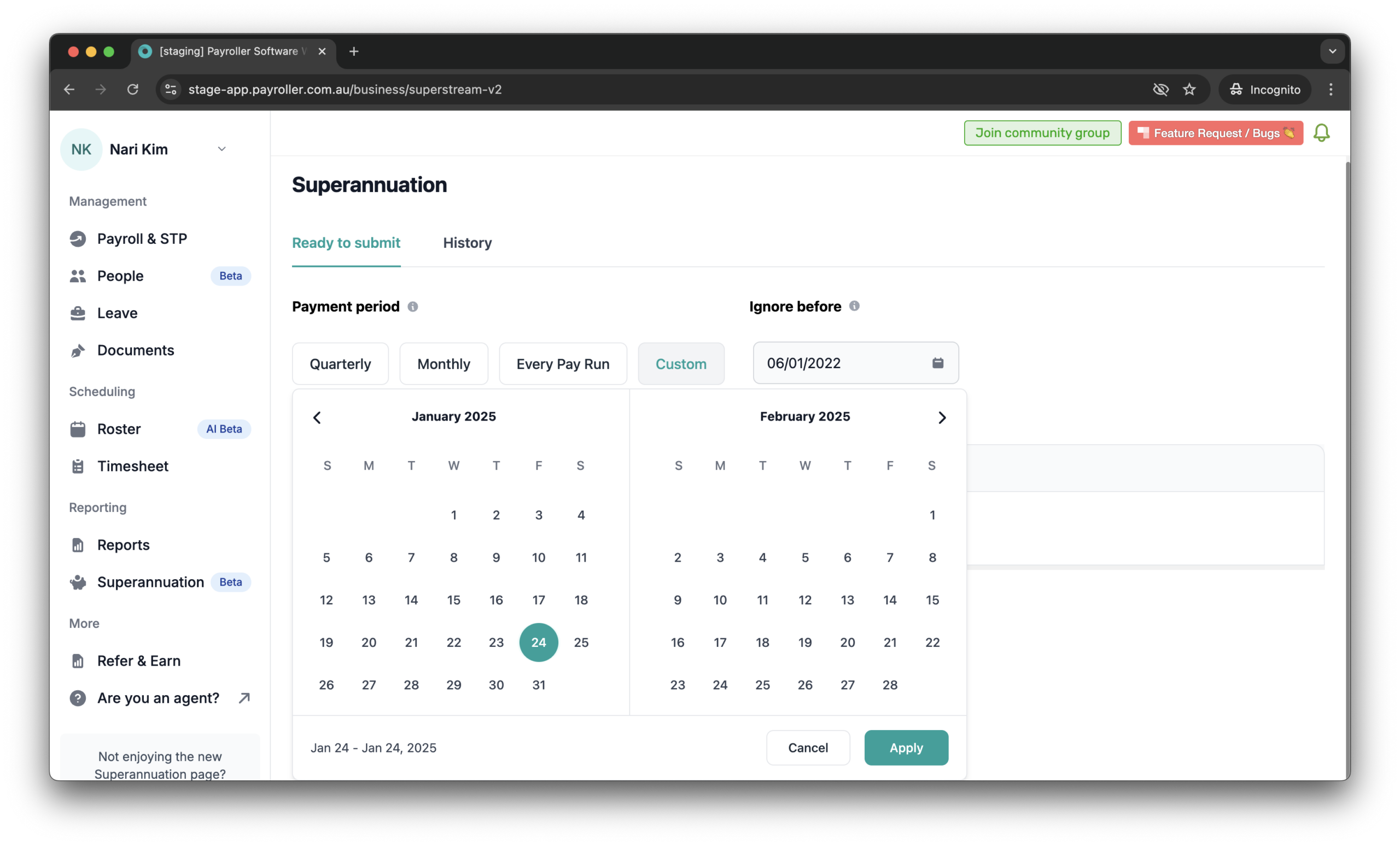

Step 4: Select the start date and the end date of the custom batch you want to pay.

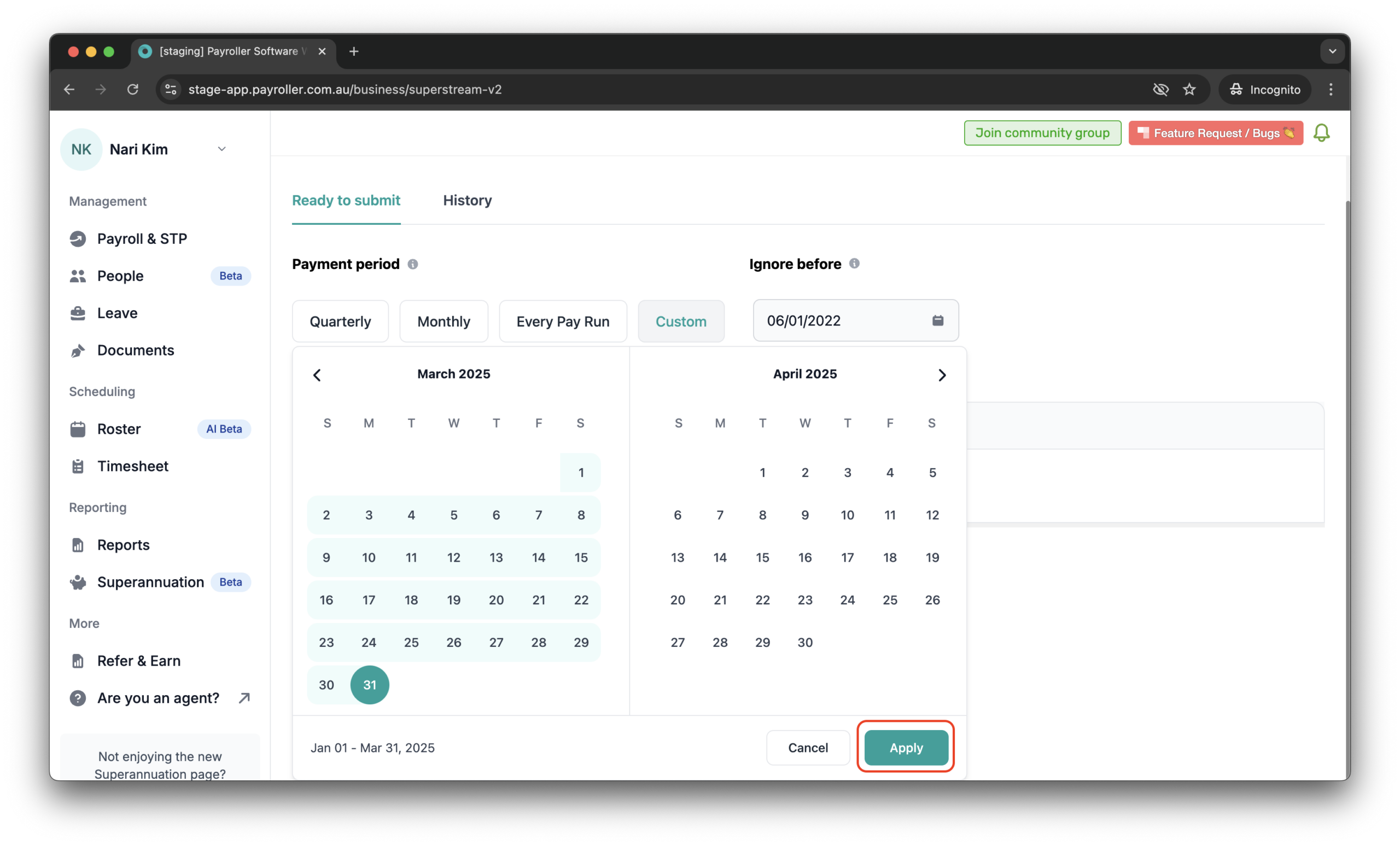

Step 5: Save the dates by clicking the ‘Apply‘ button.

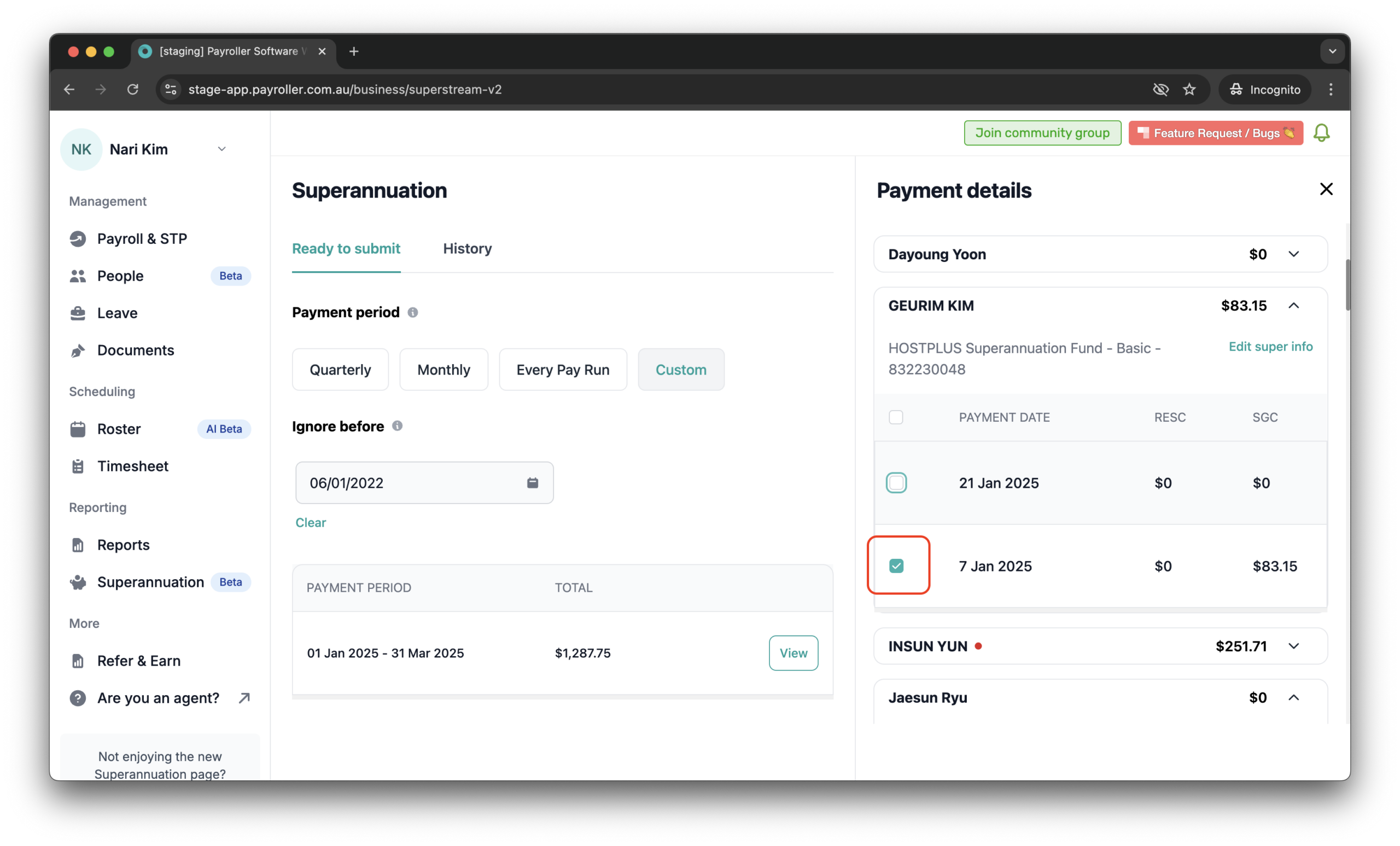

Step 6: Make sure only the relevant employee is selected.

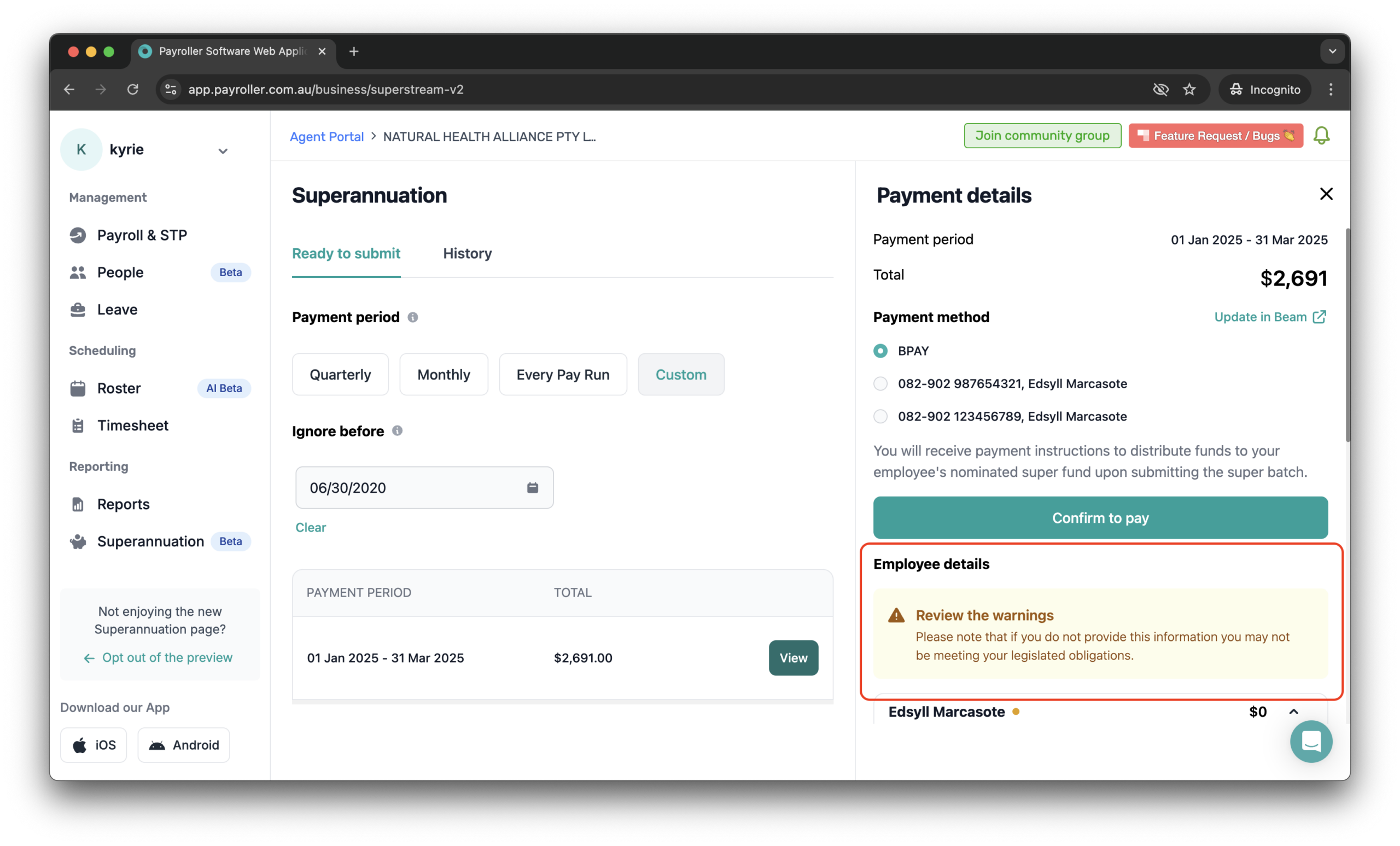

Step 7: Read any warnings and click ‘Confirm to pay’.

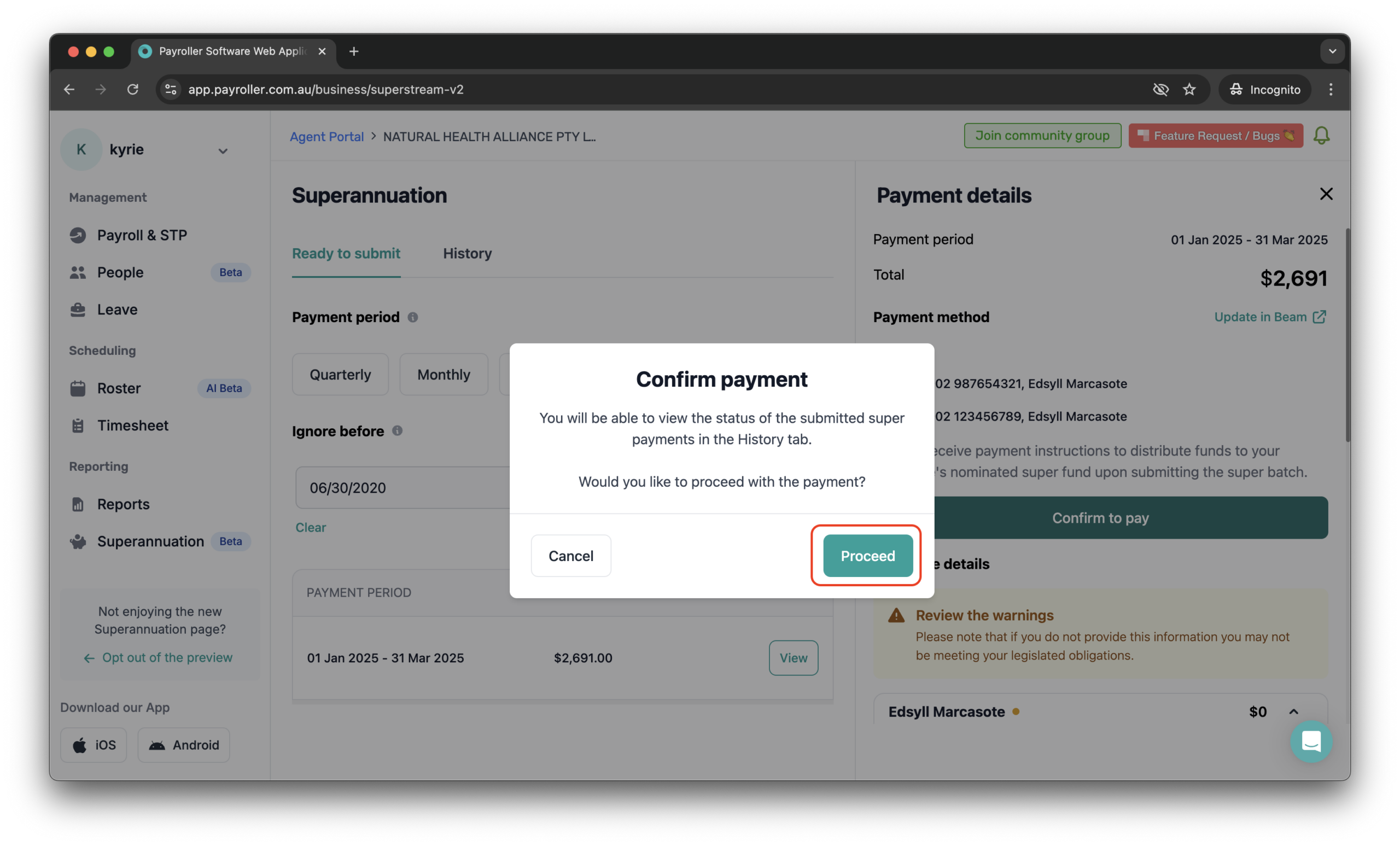

Step 8: Click ‘Proceed’ to confirm payment.

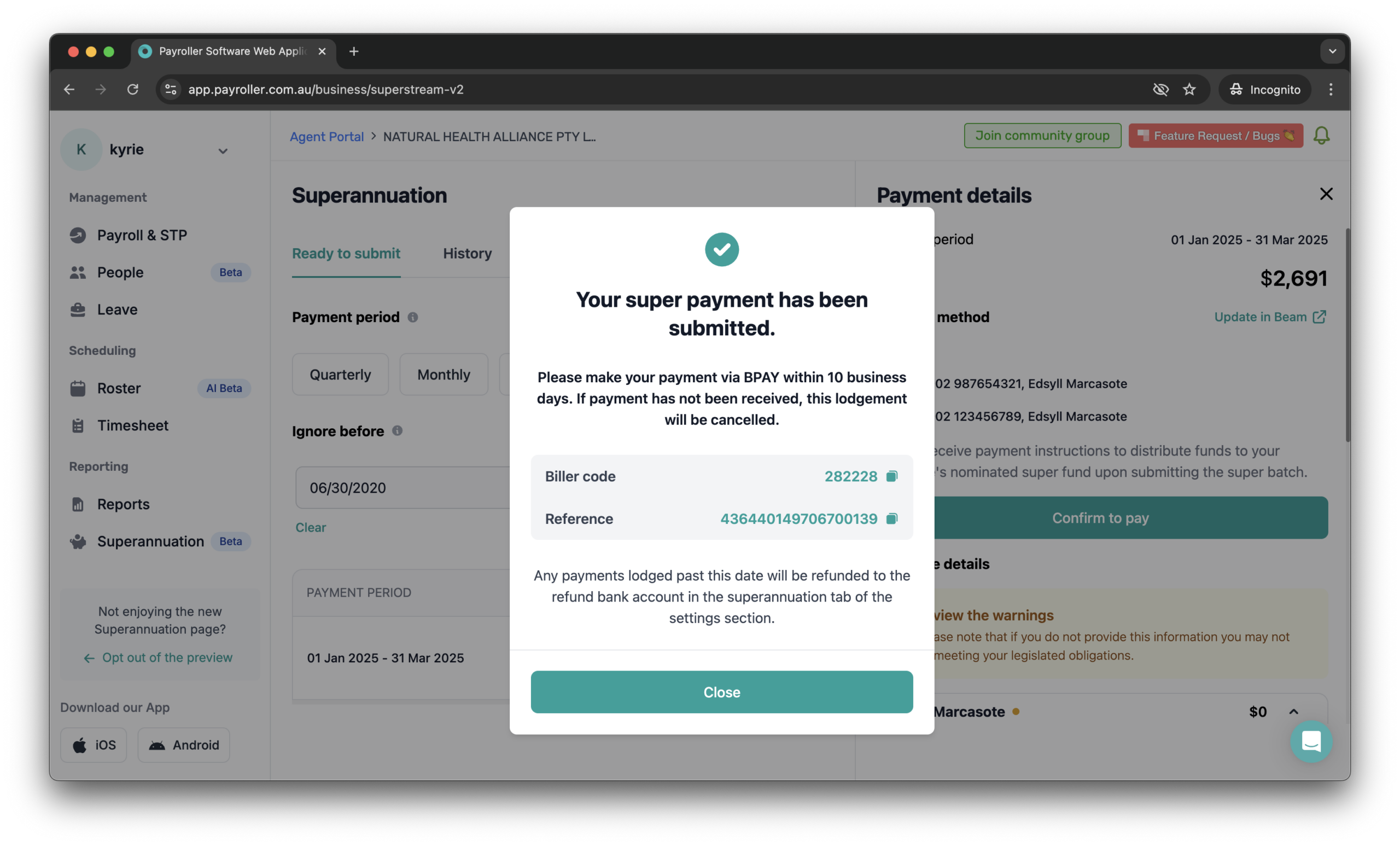

Step 9: If the submission is sent successfully, you will receive the following screen.

Discover more tutorials & get the most out of using Payroller

Try out Payroller for free. Learn how to create and submit a pay run.

You can also get a Payroller subscription that gives you access to all features via the web and mobile app. Read up on our Subscription FAQs.

Invite your accountant, bookkeeper or tax agent to help you run your business payroll with our guide.