Timesheet reports for Australian businesses

Master timesheet reports to track total hours worked, task breakdowns, and cost calculations with timesheet summary reports and timesheet detail reports.

Try Payroller today and say goodbye to timesheets, payroll and STP headaches!

By clicking Try for Free, you agree to our terms of services and privacy policy.

What is a timesheet report?

A timesheet report is a summarised record of employees’ hours worked within a set period. It takes data from individual timesheets, which employees use to track their regular work hours.

Timesheet reports contain the following information:

- Employee details

- Date range for the report

- Hours worked per employee

- Cost calculations based on pay rates and hours worked

Types of timesheet reports

Timesheet reports are a valuable tool for your business. Leverage these two timesheet report types to better monitor your employees’ work hours. Your timesheet app will likely have the data you need to build these reports.

Timesheet summary report

A timesheet summary report offers a condensed overview of employee work hours for a specific period, typically a week, month, or pay cycle. It focuses on key metrics like total hours worked per employee, department, or project.

A timesheet summary report typically includes:

- Employee details

- Total hours worked by all employees, individually and collectively for a given period

- Categorisation of regular work hours and overtime hours

- Leaves taken

- Cost calculations

Use this type of report to find work-hour trends and monitor overall staff cost.

Timesheet details report

A timesheet details report provides a deeper dive into employee work hours, offering a more granular breakdown of time spent. It enables a thorough review of time allocated across different employees and tasks.

A timesheet details report typically includes:

- Employee details

- Total hours worked by all employees, individually and collectively for a given period

- Tasks associated with hours worked by employees

- Leaves taken

- Breaks taken

- Overtime details

Use this type of report to identify inefficiencies in the business and find errors in time management.

Timesheet report benefits for businesses

Better payroll accuracy

Timesheet reports aid accurate pay calculations by presenting verified data on work hours for each employee. You can avoid errors from manual data input, especially with variables like overtime pay and leave pay.

Project management support

Timesheet reports allow businesses to track the time spent on different projects. This enables effective resource allocation and ensures tasks are completed within budget and deadlines. Timesheet data can come in handy when budgeting for future projects.

Enhanced staff productivity

A timesheet report can reveal areas where employees might be losing time. This allows businesses to address inefficiencies and improve current processes and practices. With this data, you can start a conversation with your staff on how they can improve their time management.

Legal compliance

Under the Fair Work Act, businesses are required to keep accurate records of employee work hours for a minimum period of 7 years. Timesheet reports serve as a reliable and easily accessible record for compliance purposes. Accurate timesheet records can help you avoid penalties.

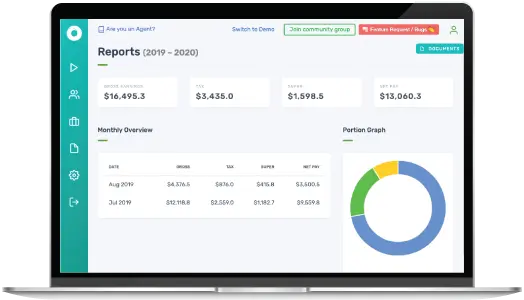

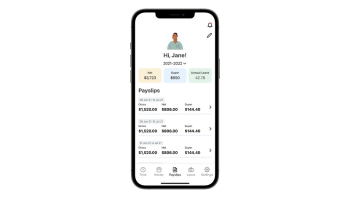

How to review timesheets on Payroller

Track employee time and make informed business decisions today

Running a business with employees can be exciting and dynamic. With several factors affecting your staff’s work hours, timesheet reports play a crucial role in pay accuracy and productivity.

With timesheet software embedded into your payroll system, you gain the knowledge to streamline your workforce. Use timesheet data to empower your employees and make informed decisions on resource allocation.

Frequently asked questions about timesheet reports

You can analyse data from a timesheet report with a few methods:

- Identify trends: Look for patterns in work hours across different tasks or departments to find areas for improvement.

- Calculate project costs: Use timesheet data along with employee pay rates to calculate the total cost of each project.

- Monitor resource allocation: Analyze which projects or tasks consume the most employee time to assess resource allocation effectiveness.

Evaluate staff performance: While not solely based on hours, timesheet data can be used as one factor to assess employee performance in terms of efficiency and adherence to schedules.

The Fair Work Act 2007 requires businesses to keep accurate records of employee work hours for a minimum of 7 years. Timesheet reports are a reliable and easily accessible record for fulfilling this requirement.

Australian businesses are not legally required to provide employees with individual timesheets. However, they are obligated to keep accurate records of employee work hours, which timesheets do.

It’s recommended to have a clear policy for timesheets, outlining the specific information required and how employees should submit their timesheet data. This helps ensure transparency and avoid potential disputes.

Annual leave loading is a percentage of their gross earnings that are paid to employees on top of standard pay. This is to compensate them for the inconvenience of taking time off work.

For example, an employee earns $1,000 per week (gross) and is entitled to annual leave loading of 17.5%. When they take one week of annual leave, they receive their normal pay of $1,000, plus an additional loading payment of $175 (17.5% of $1,000).

How does Payroller work?

Payroller is designed to make STP simple for small business employers.

Try Payroller for free as an Employer or accounting professional Agent

(accountant, bookkeeper or tax agent).