Learn how to set up a quarterly pay run in Payroller

Learn how to set up quarterly pay runs in Payroller with the simple guide below.

If you’re a micro-business and you’re looking to report every quarter, you can do so with Payroller.

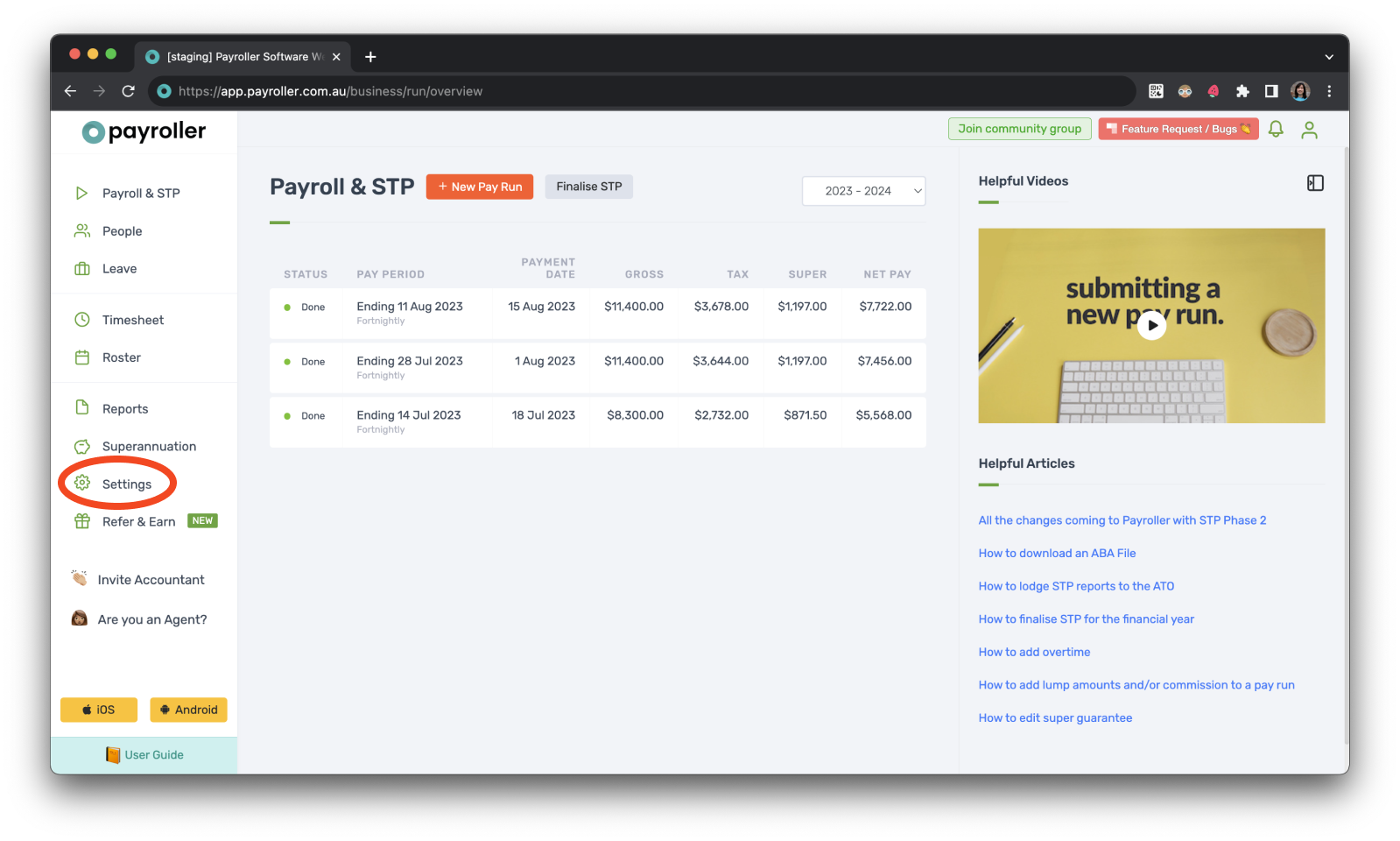

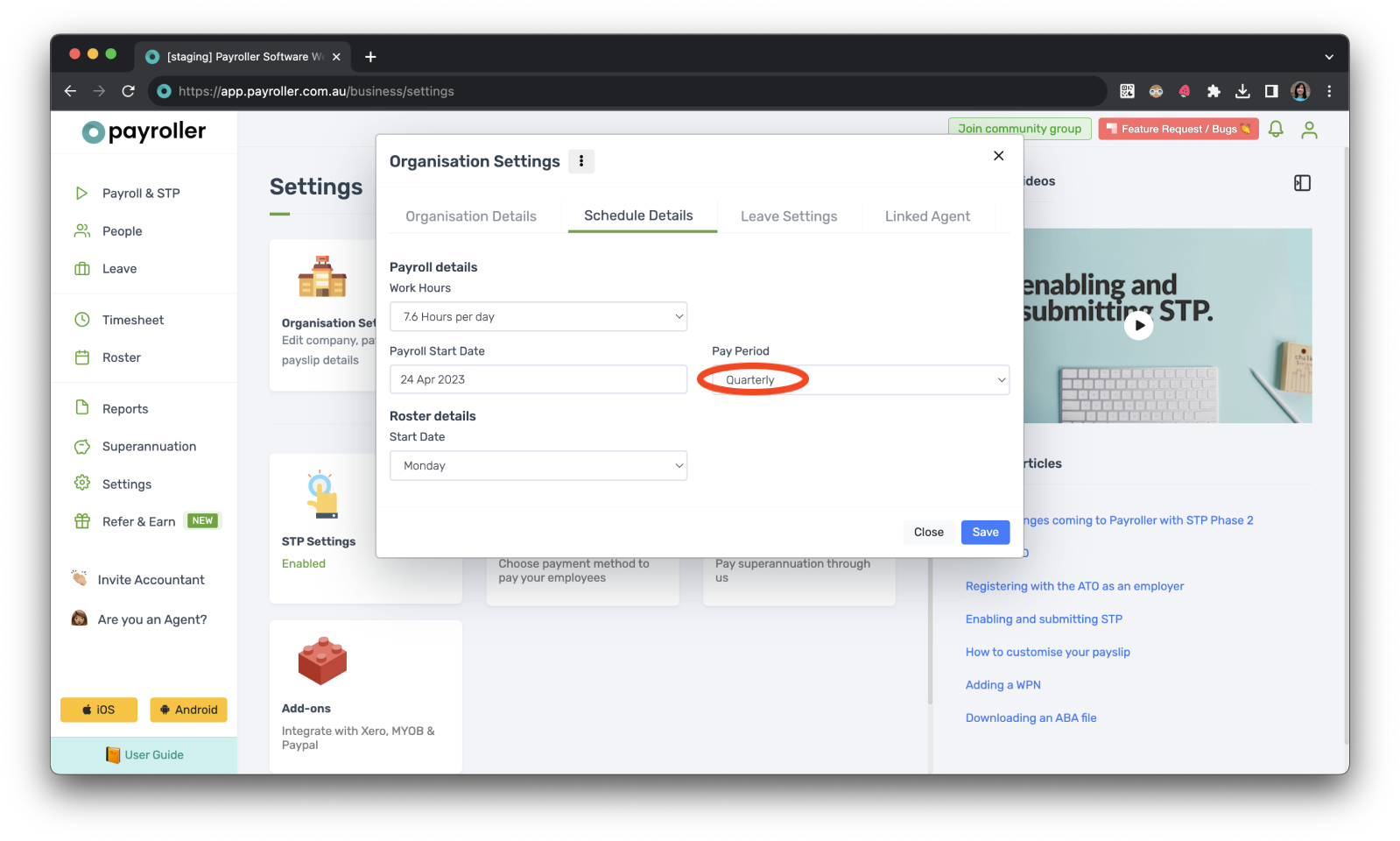

Step 1: To set this up, go to the ‘Settings’ section in the left-hand column.

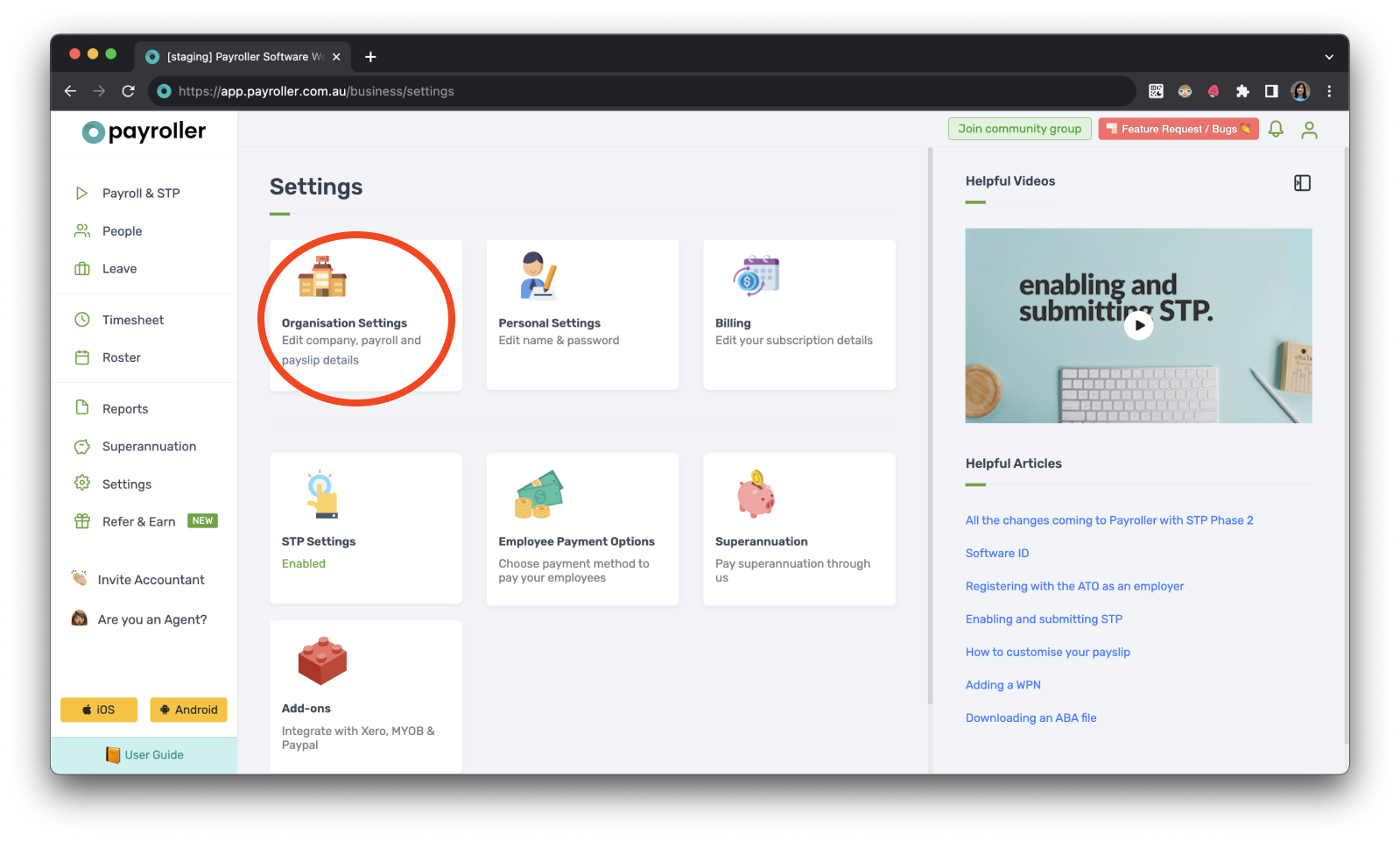

Step 2: Click on ‘Organisation Settings’.

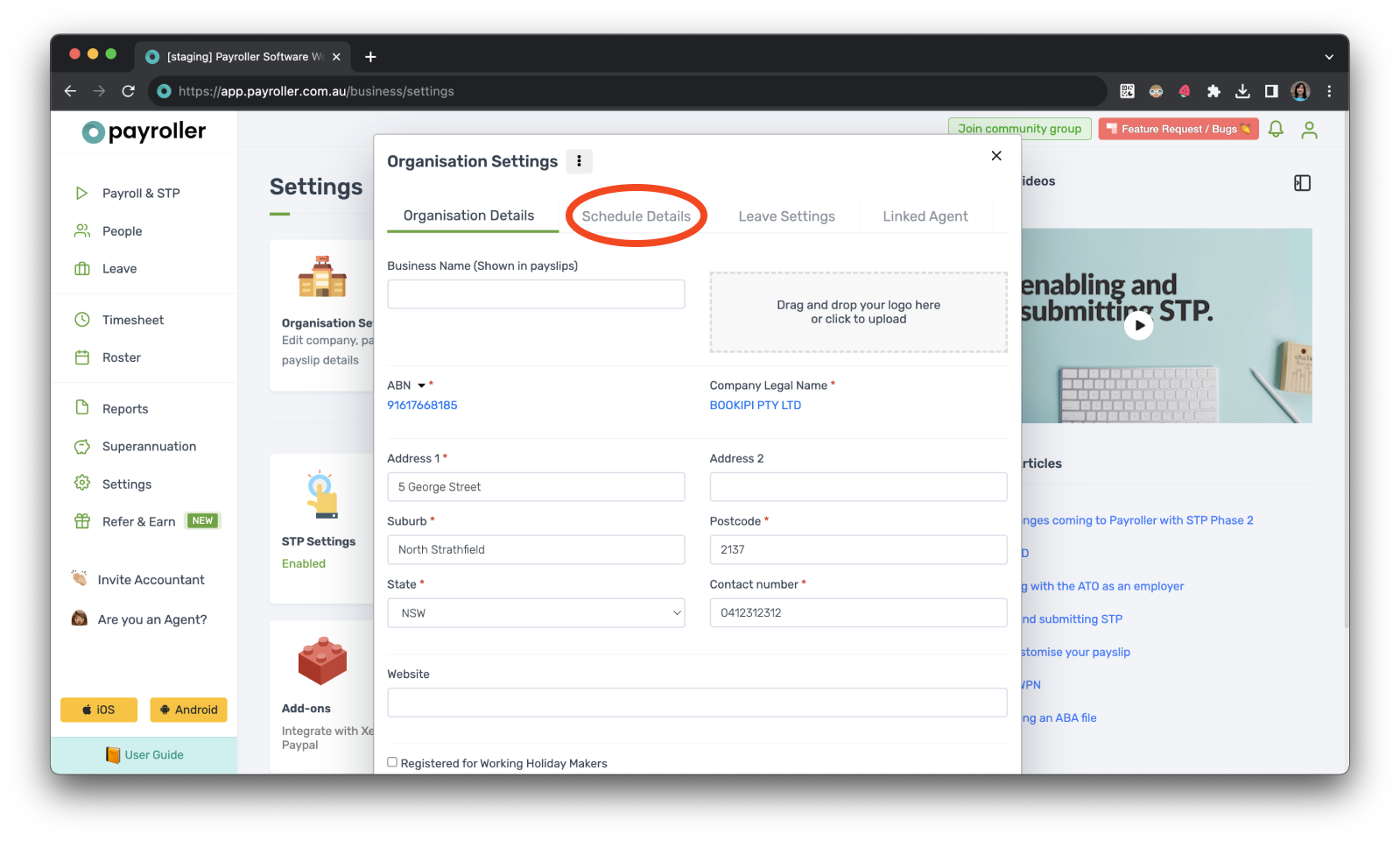

Step 3: Select ‘Schedule Details’.

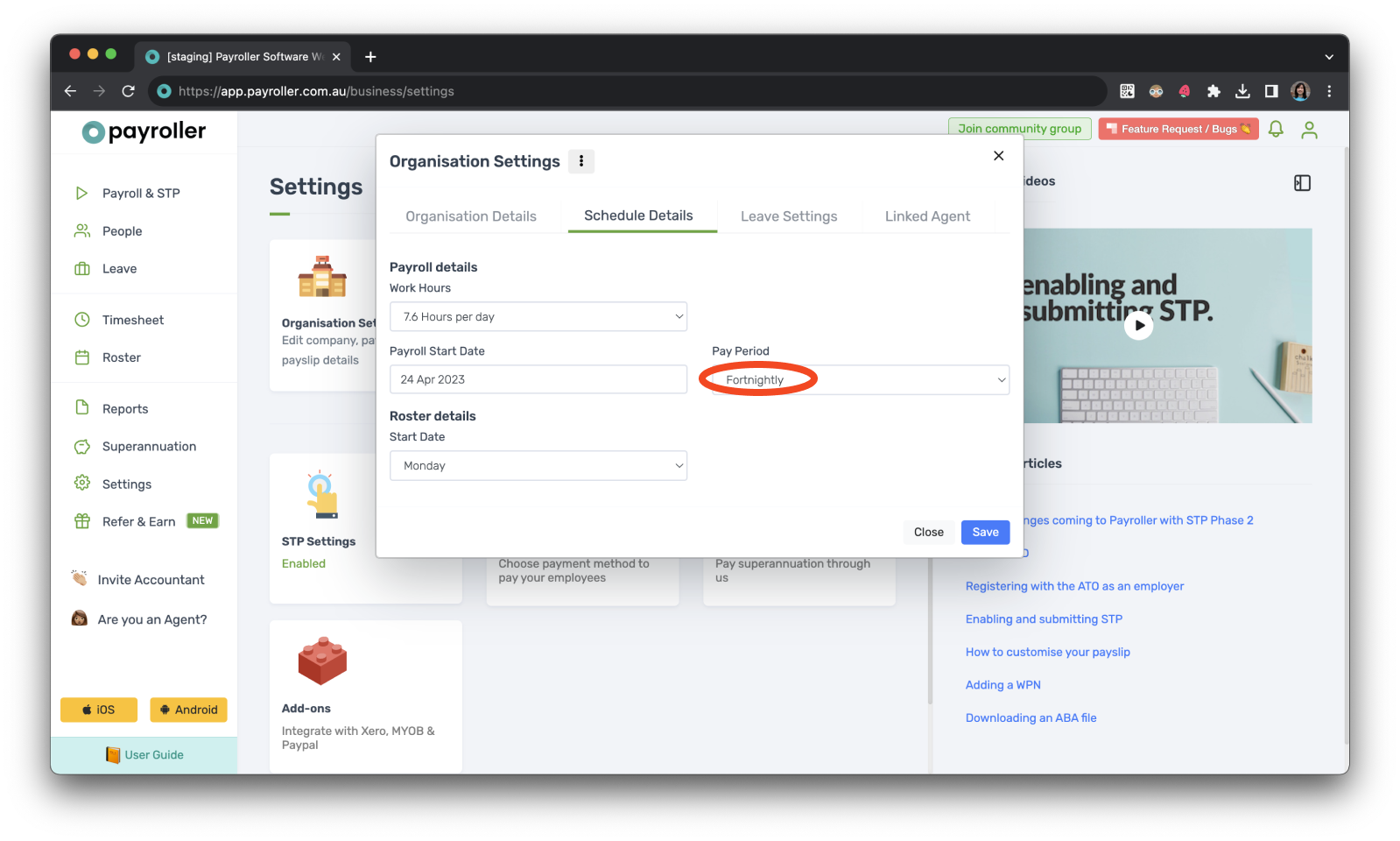

Step 4: Select the Pay Period drop-down menu.

Step 5: Change this to ‘Quarterly’.

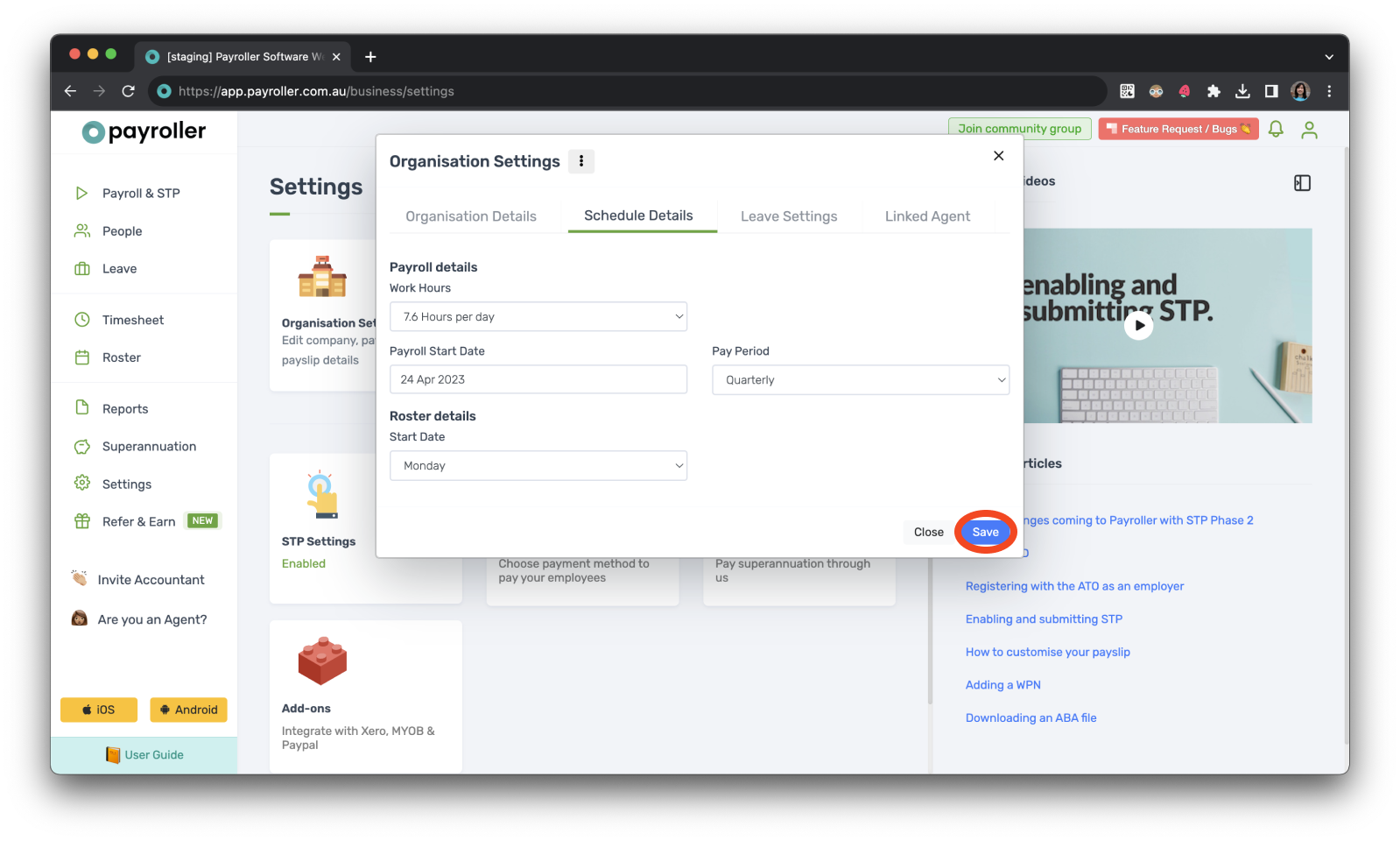

Step 6: Click ‘Save’ and ‘Close’.

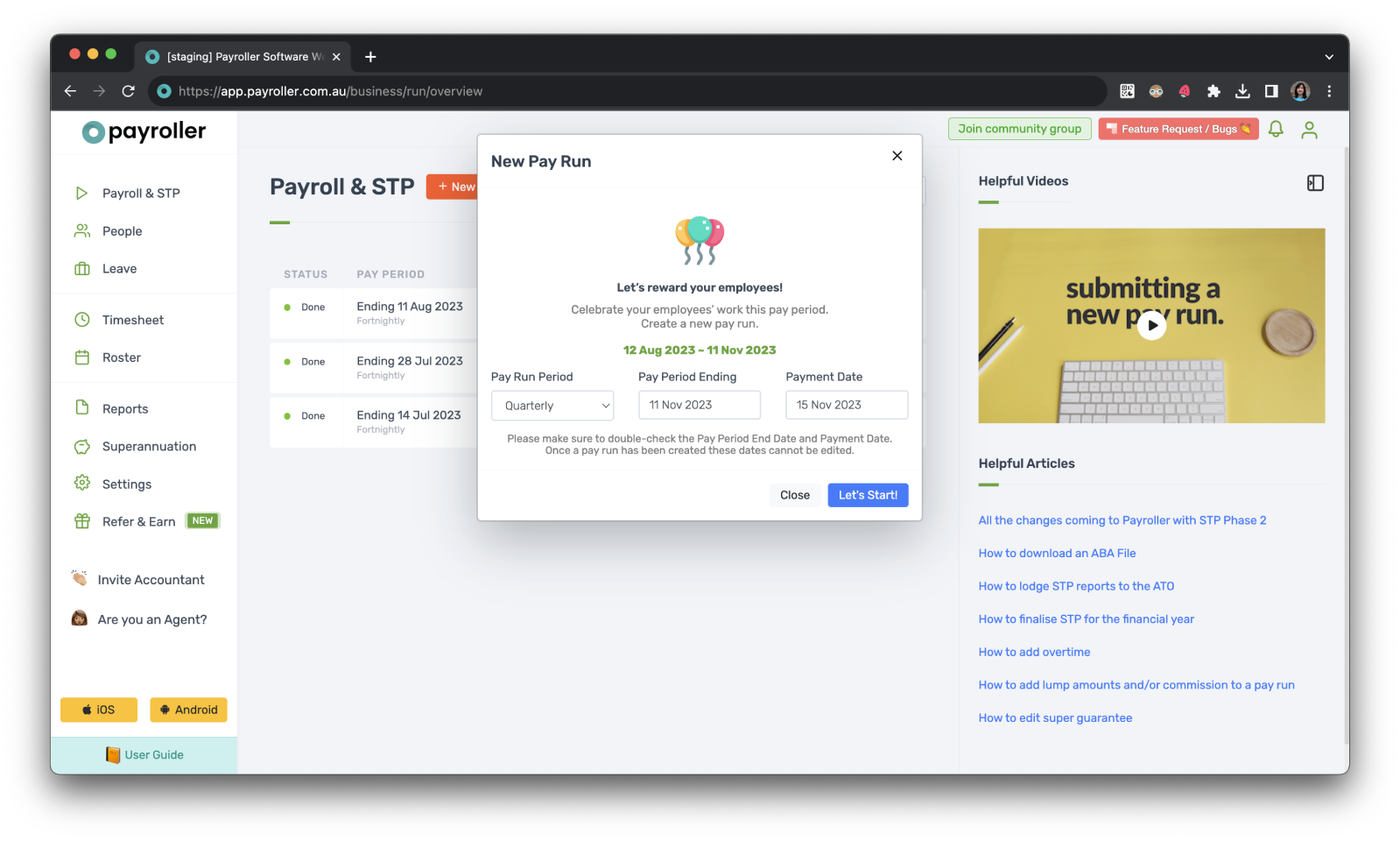

Step 7: Next when you go to add a pay run the quarterly pay period will have automatically been selected.

This process doesn’t differ in any way. Just make sure you add the correct amounts for that quarter.

Learn more about our useful features and functions in Payroller with our other handy guides:

Setting up 2FA on a new mobile phone device

Make an online tax file number (TFN) declaration

Finalise reporting for the financial year

Set employees up on different pay periods

Approve leave requests made by employees in the Payroller Employee mobile app

Discover more tutorials for using Payroller

Learn more about useful features and functions in Payroller with our simple user guides.

Try Payroller for free and get started setting up employees for STP and payroll.

With a subscription to Payroller, you can access full features across both web app and mobile app. Learn more with our Subscription FAQs.