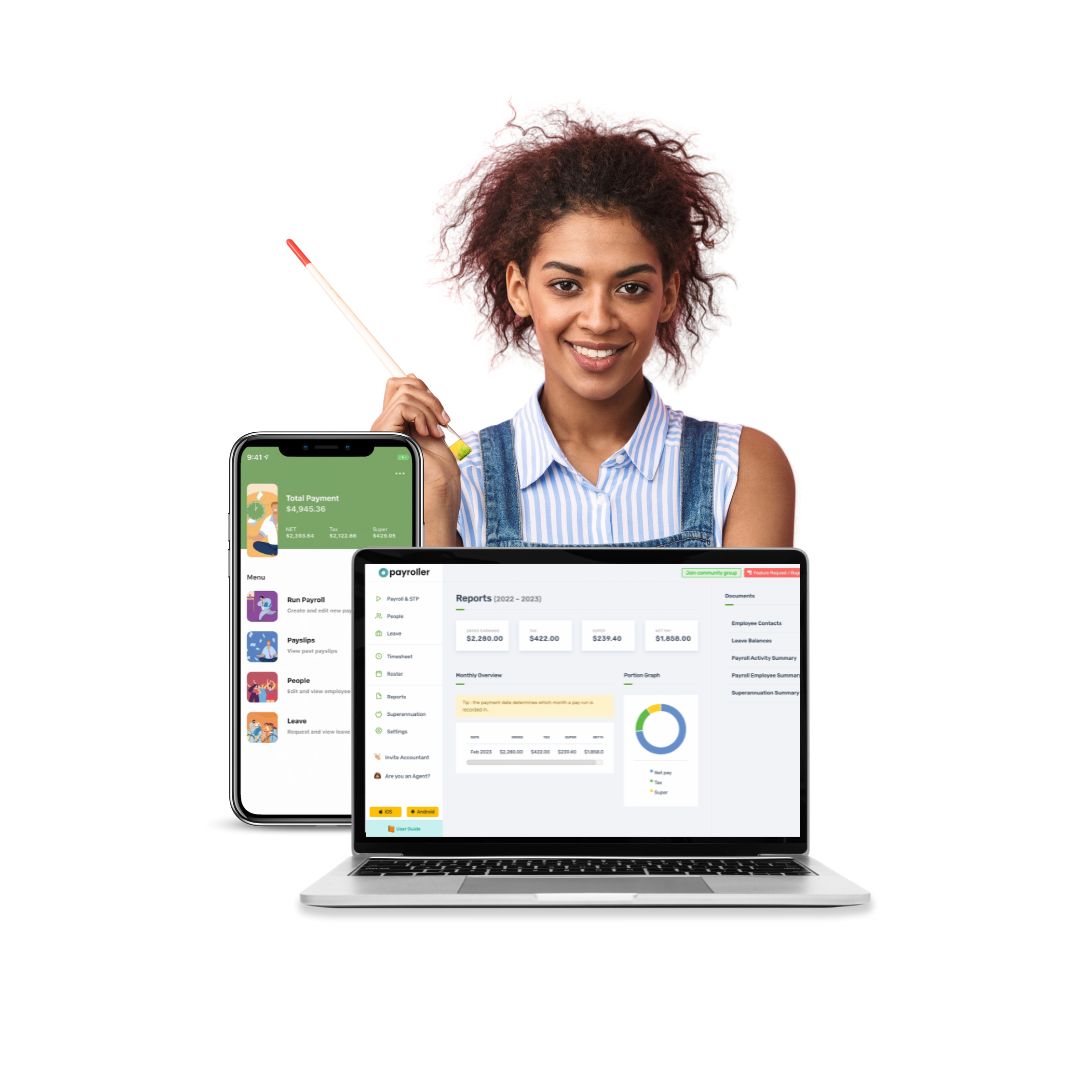

Payroll for any business

From contractors to small businesses, manage your business payroll with Payroller.

ATO Compliant

STP-approved by the Australian

Tax Office (ATO)

Reliable Reporting

Keep clear records of who’s

been paid in real-time

Payroll software for any business.

Payroll solution for micro businesses and micro employers

Payroll solution for consultants and firms offering consulting services

Payroll solution for managing independent contractors

As a sole trader in Australia, you are responsible for managing your own payroll.

Payroll solution for small businesses in Australia

Payroll solution for not-for-profit organisations and charities

A payroll solution for any business employing casual staff

Pricing

Lite

Free

- Timesheets & Rosters

- Leave Management

- Employee App

- Payroll & STP on Mobile

- STP Phase 2 Enabled

Standard

$1.99

/month per employee*

- Timesheets & Rosters

- Leave Management

- Employee App

- Payroll & STP on Mobile

- STP Phase 2 Enabled

- Superannuation

- Xero Intergration

Enterprise

Contact Us

- Timesheets & Rosters

- Leave Management

- Employee App

- Payroll & STP on Mobile

- STP Phase 2 Enabled

- Superannuation

- Xero Intergration

*Based on 5 or more employees of paid yearly

Payroll to grow your business

More Time. Happy Clients. Easy To Use.

Try our Payroll Software

✔️5 minute setup ✔️No credit card needed ✔️No contract period

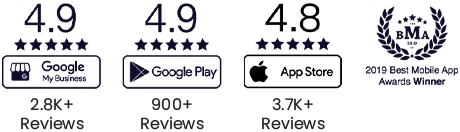

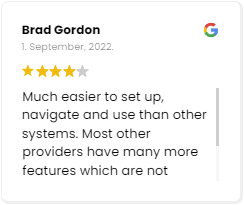

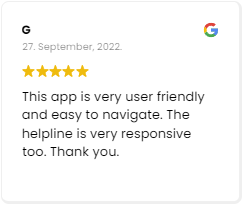

Don't just take our word for it

FAQs

Payroller is an STP-enabled software that automatically submits payroll information to the Australian Taxation Office (ATO) – through a secure cloud network – whenever you perform a payrun. Payroller helps you to track, manage and record your payroll while safely sharing that information (and staying compliant) with the ATO.

As a truly one-stop payroll solution, you can manage staff roster, invite your accountant, bookkeeper or BAS agent and even make Super contribution (Beam) on Payroller.

Absolutely, you may share your account and even set different access permissions.

Only a few minutes. The majority of our customers get up and running within 15 minutes. If you do need more help in getting set up, simply reach out to our capable live agents and they will have you using Payroller like a seasoned user in no time. Check out our handy user guides.

Single Touch Payroll (STP) is a mandatory Australian Taxation Office (ATO) initiative to reduce employers’ reporting obligations to government agencies. By using Payroller, it eliminates the need for manual reporting to the relevant government agencies, keeps your business compliant and streamlines all your payroll processes – error-free.

Find out more about our Single Touch Payroll software.

STP Phase 2 is the expansion of the ATO’s Single Touch Payroll reporting. Under these changes, you will no longer need to manually report information about your employees to multiple government agencies. If you are an existing Payroller user, you would have received instructions on how to transfer over to STP Phase 2. (If you did not, please contact our live agents to assist you.)

If you are a new user, your Payroller account will automatically be set on STP Phase 2 and all payruns will already be converted to the new reporting format.

Find out more with our guide to Single Touch Payroll (STP) Phase 2.

As the ATO continuously refines how STP will adapt to employers’ needs – you can rest assured that Payroller will remain STP-compliant with current and new requirements by the ATO.

“Try for free” allows you to discover if Payroller is the right software for you and your business before you commit to our platform. “Try for free” is cost and commitment-free and we do not require any credit card details to sign up. So give Payroller a try, it only takes a few minutes to get set up.

While the Payroller mobile app is completely free – fees will apply to use the Payroller web app, Xero integration, and to make super contributions through our integrated super clearing house (Beam).

Absolutely, use Payroller freely between devices as it syncs across desktop (Windows, MacOS) and mobile (iOS, Android) to ensure that all your data is consistent.

Yes we are. A cloud payroll software allows you to manage all the elements of payroll online – on mobile and desktop. That means you’ll be able to operate payroll processes, onboard new employees and manage staff rosters remotely as long as you have an internet connection.

STP-enabled Payroller automatically sends your employees’ tax and superannuation information to the ATO. You will not need to manually complete payment summaries and group certificates at the end of the financial year. Less paperwork, more time saved.

Yes, Payroller is integrated with Xero. By connecting your Xero account to Payroller, you can easily export and share payroll information cross-platforms.

Speaking to the community, we understand what agents and employers need from a cloud payroll solution. Payroller streamlines and uncomplicates your payroll processes. Our user-friendly software is why we’re rated exceptionally across devices and operating systems.

Explore what else you might need

Bookipi is the easiest invoice maker for freelancers

and small businesses. Send invoices and receive

payments quicker — on mobile or web.