JobKeeper FAQs

FAQs

Q: What is the minimum amount I am required to pay for JobKeeper? What if my employee earns less than the JobKeeper amount?

Q: Do I need to pay superannuation on the JobKeeper payments?

Q: Do I need to pay PAYGW on JobKeeper payments?

Q: Can my employee receive a JobKeeper payment from another employer?

Q: I hired someone after 1 March 2020, can I get the JobKeeper payment?

Q: Can I claim the JobKeeper payment for employees that I stood down.

Q: What if my employees earn over $1,500?

How to enter JobKeeper payments in Payroller

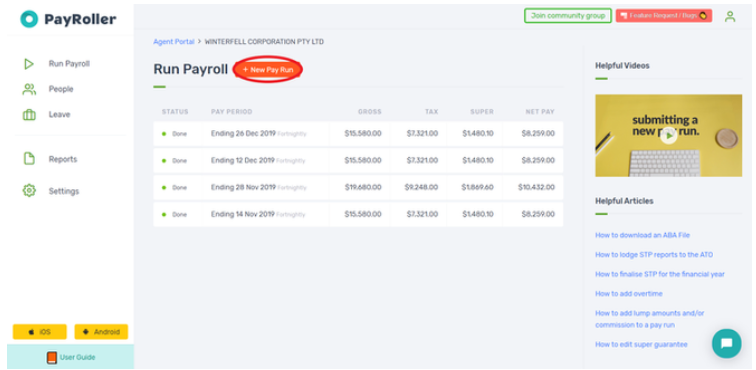

Step 1: Create a new pay run.

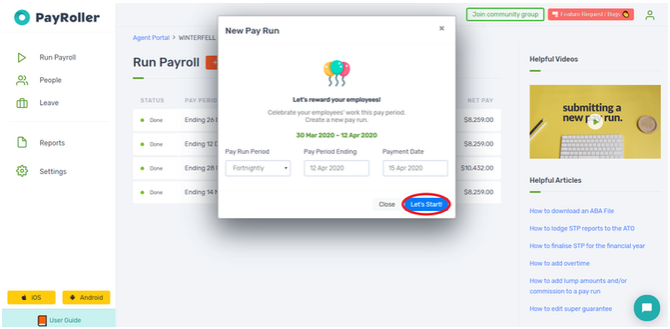

Step 2: Enter the dates that the payment will cover and click Let’s Start.

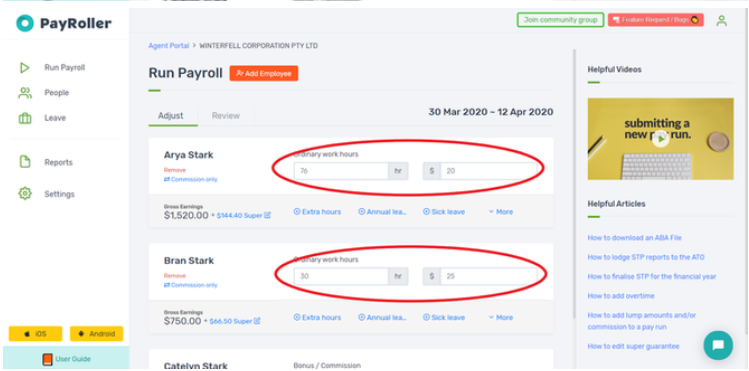

Step 3:. Now that you’re in the pay run, enter the employee’s wage. Once you’ve completed this step, either skip to step 5 for employees who earned $1,500 or more, or continue as normal for employees that earned less.

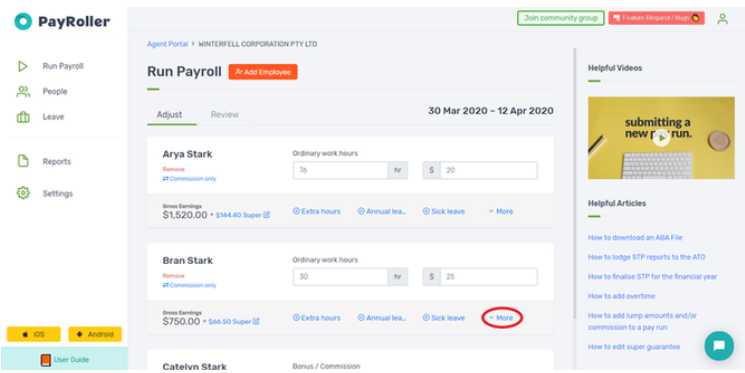

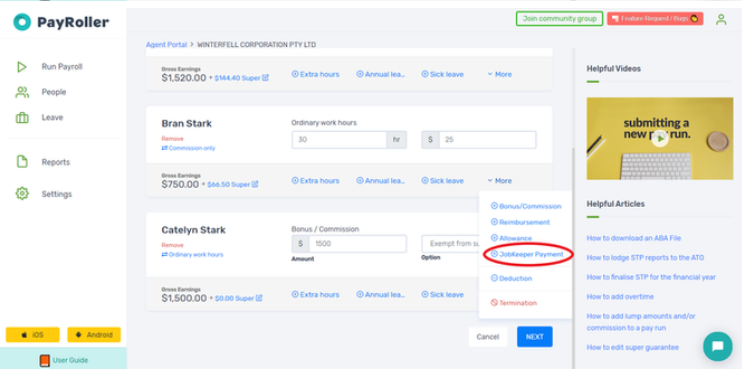

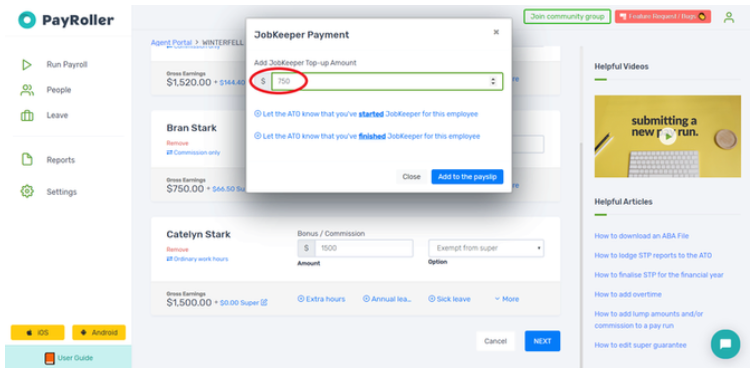

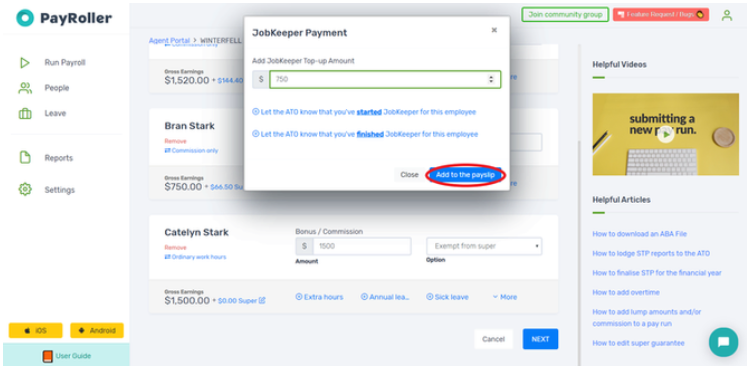

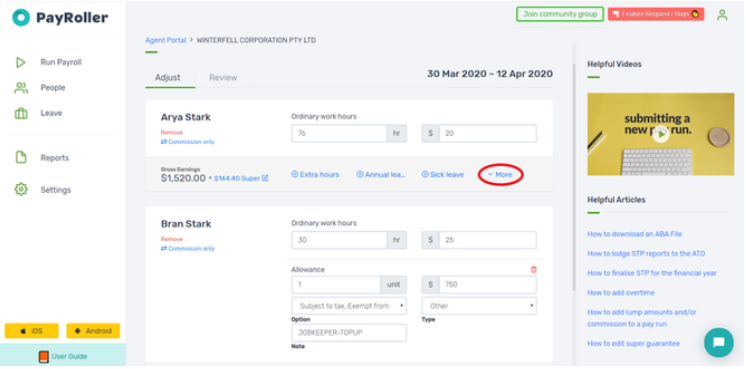

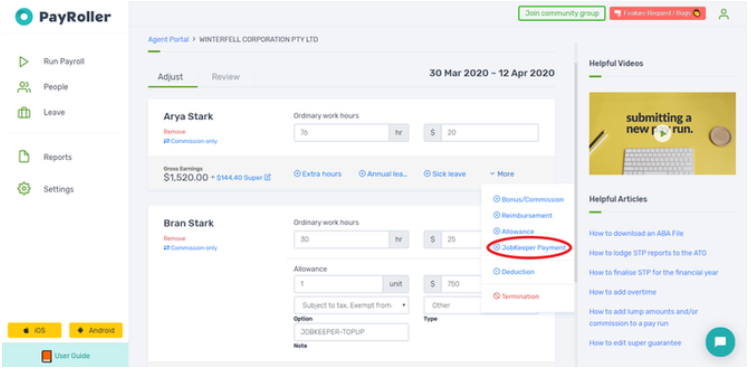

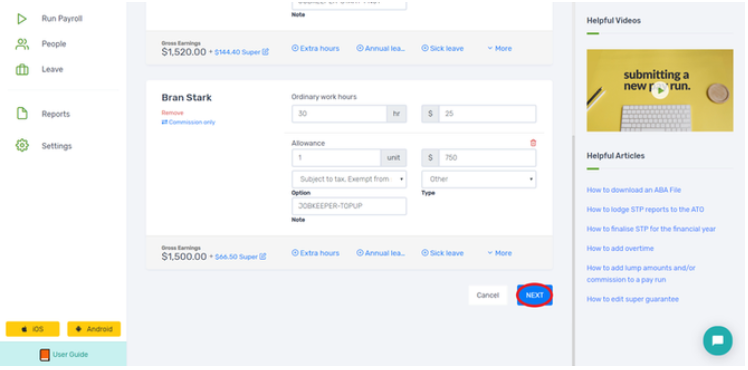

Step 4: For employees who earned less than $1,500, you will need to provide them with a top up. To do this, click on More and select JobKeeper. Enter the amount needed to make the total $1,500 and click on Add to the payslip.

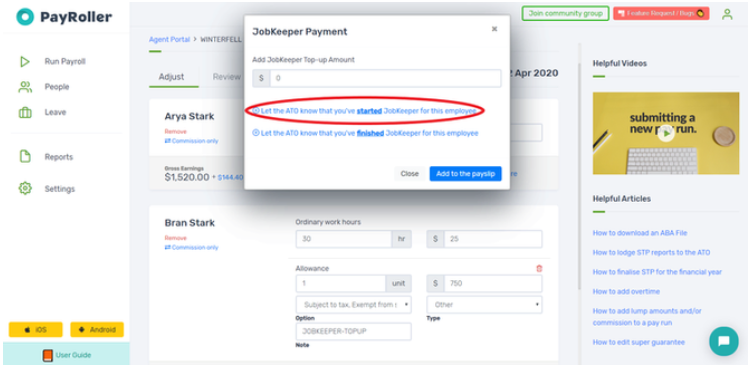

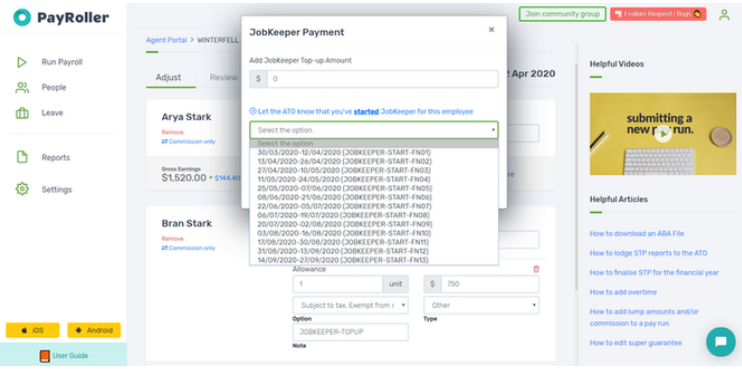

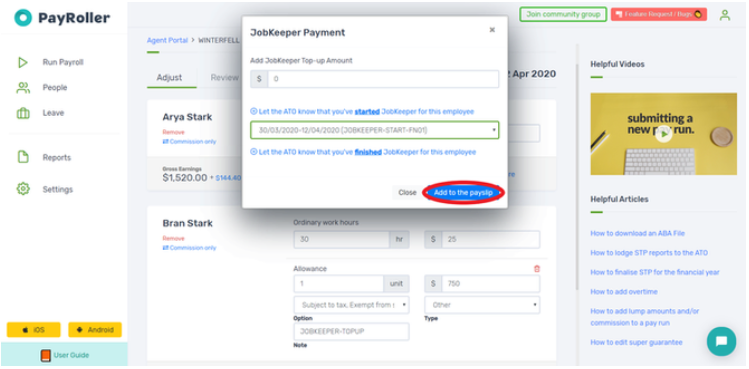

Step 5: For your first JobKeeper payment for an employee, you will need to notify the ATO. To do this, click on More and select JobKeeper. Select whether it is the first Jobkeeper payment and then select the relevant fortnight. If all is correct, click on Add to the payslip. This will appear on the pay run as zero – leave it as so. You will also need to do the same process for your first pay run WITHOUT JobKeeper but instead, select that you have finished JobKeeper. This will indicate that you will no longer be receiving the payments.

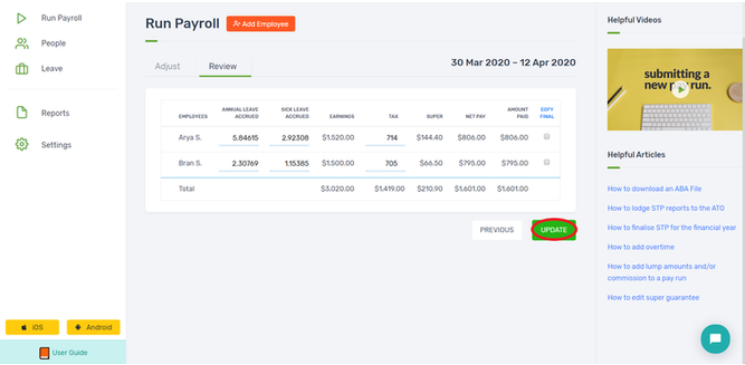

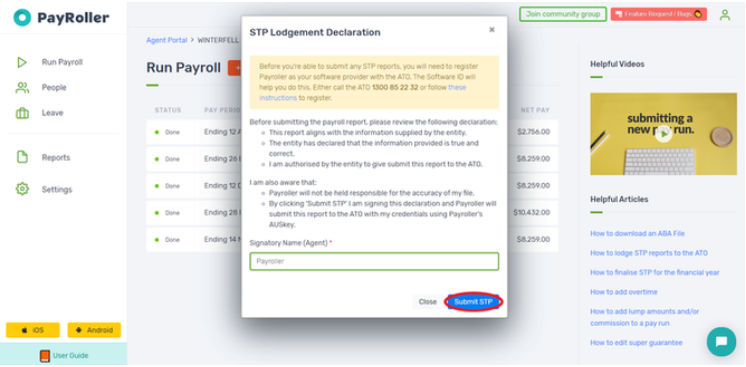

Step 7:. Complete the rest of the pay run as normal and report STP.

Learn how to use Payroller for JobKeeper

You can add JobKeeper in Payroller with our easy user guides. Try out Payroller for free today.