Learn how to add an employee seat to your Payroller subscription straight from the Employee Onboarding page

Learn how to add additional employee seats to your Payroller subscription straight from the Employee Onboarding page with our simple guide below.

Please note that if your agent is currently paying for your subscription then you will not be able to add an employee seat unless you enter your own credit card details to the billings page to update the plan. If you are paying for the subscription and would like to provide your agent, access to customise your subscription you will need to provide them with the access to do so.

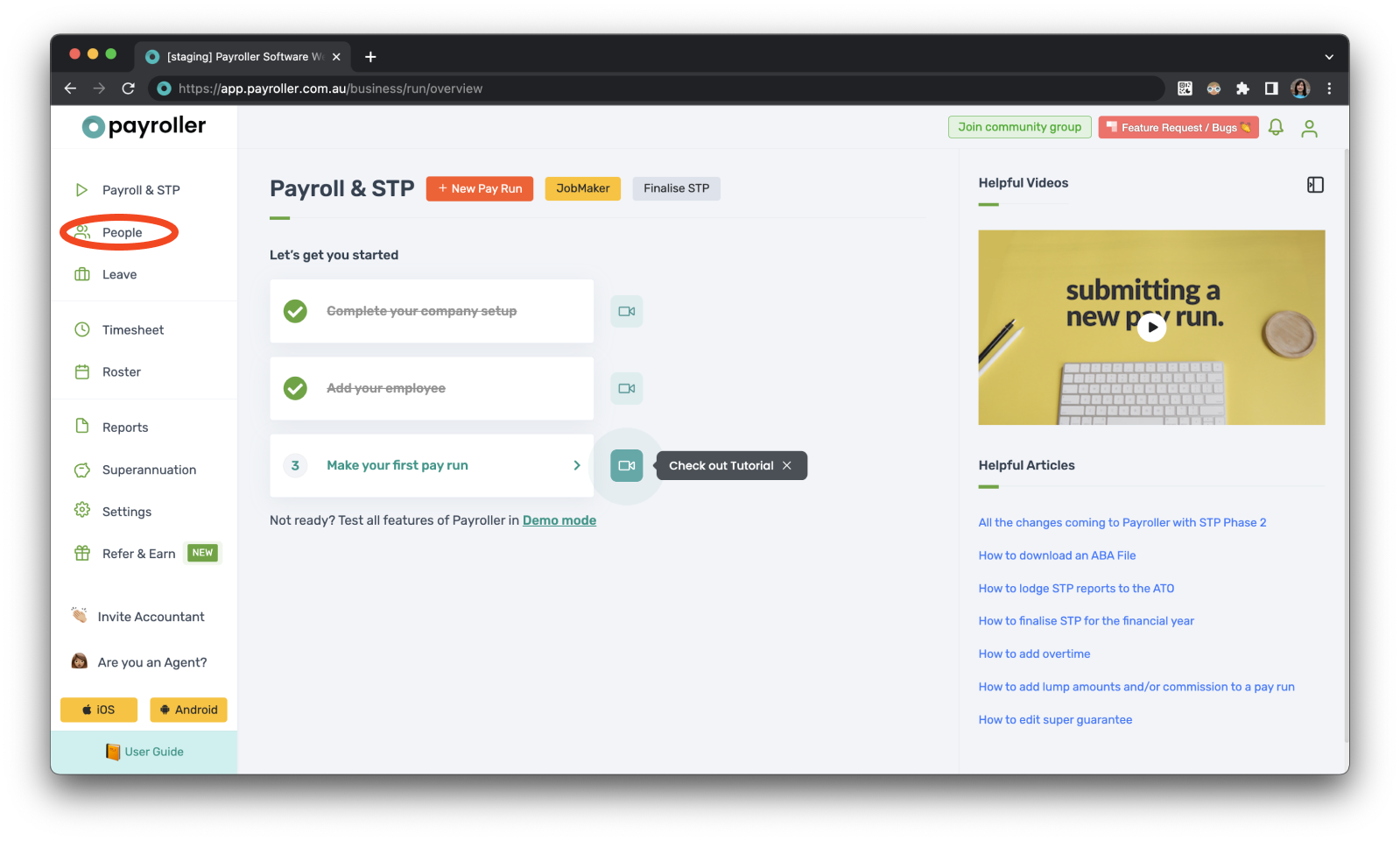

Step 1: Select ‘People’.

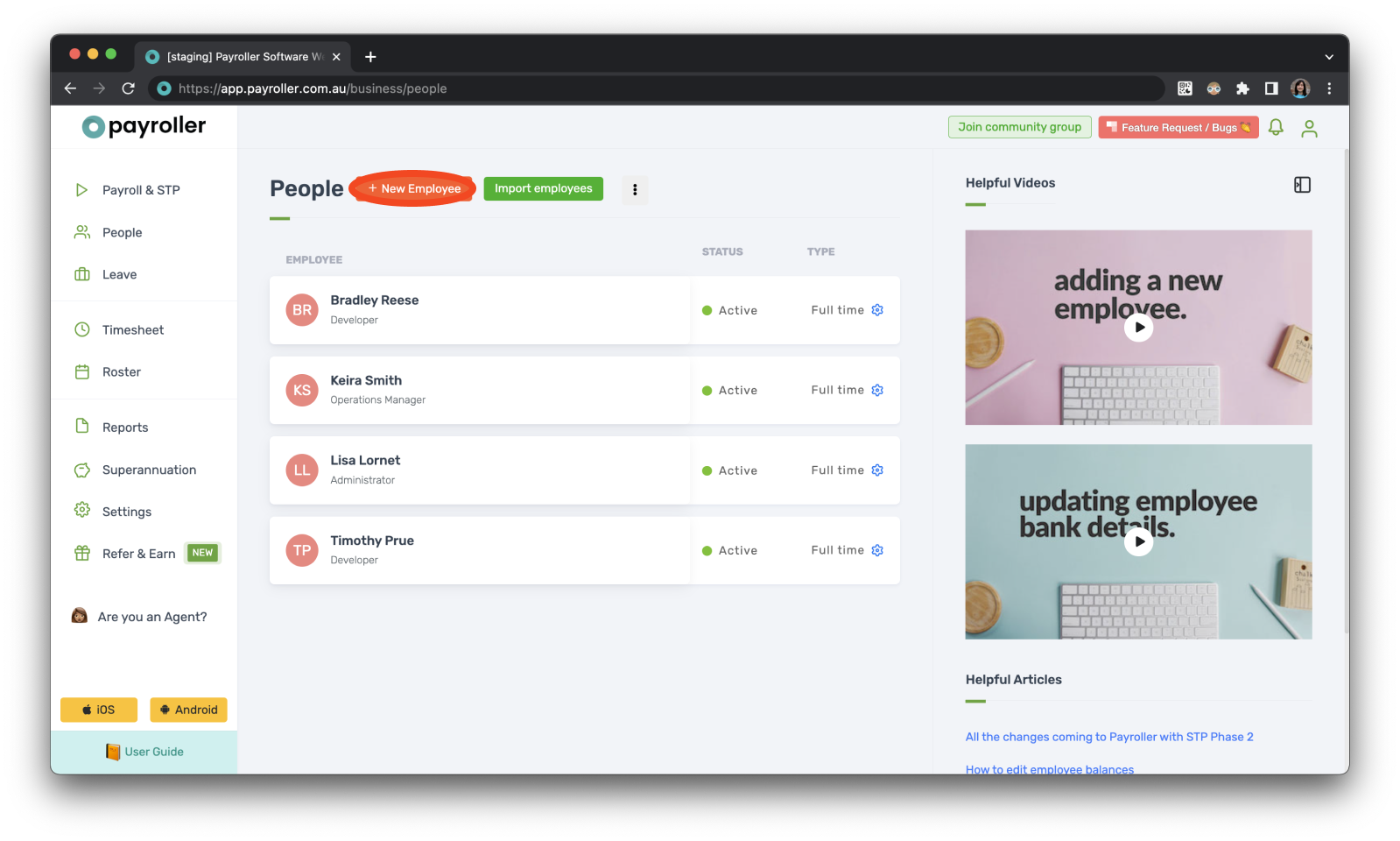

Step 2: Select ‘New Employee’.

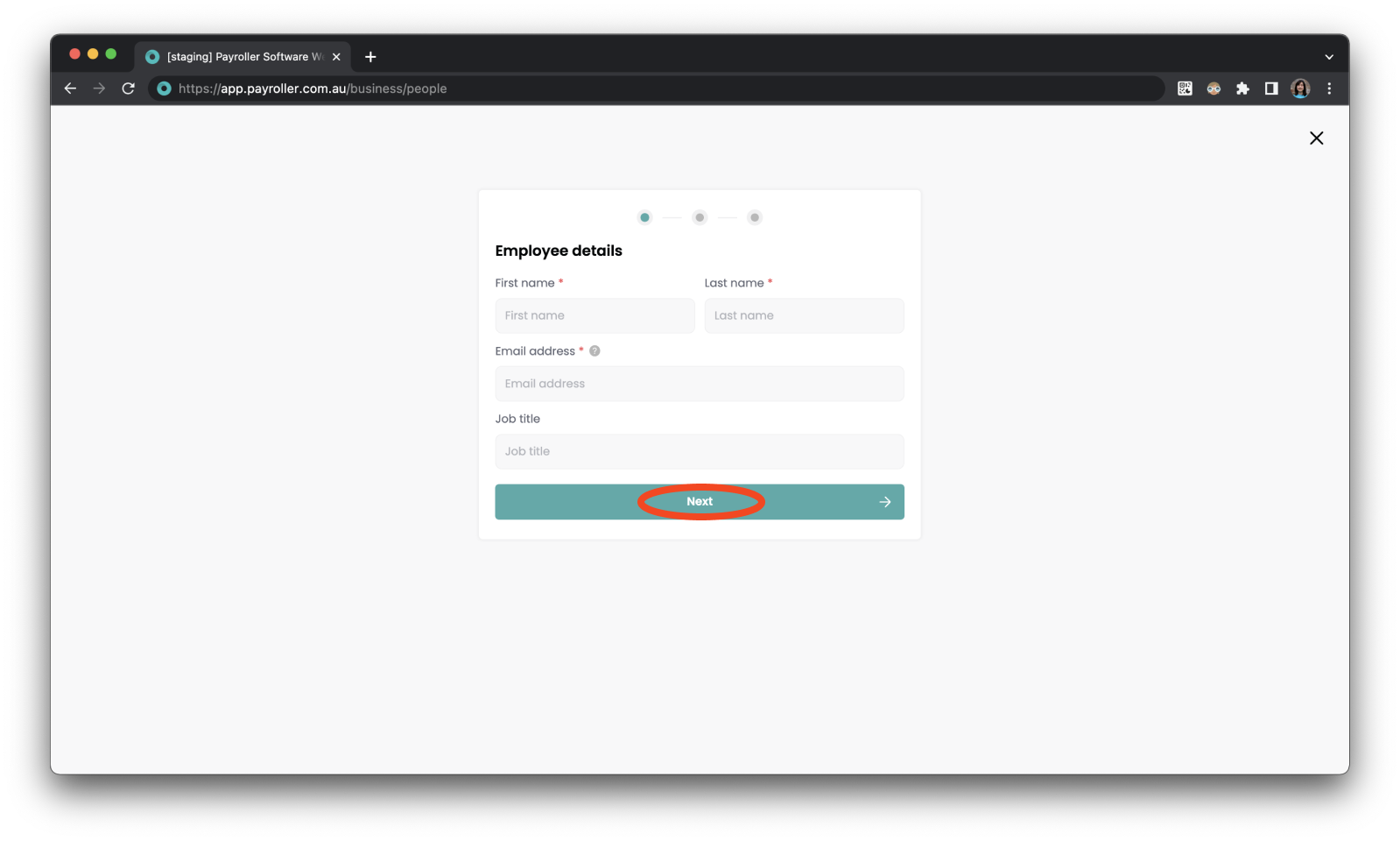

Step 3: Enter the Employee details and select ‘Next’.

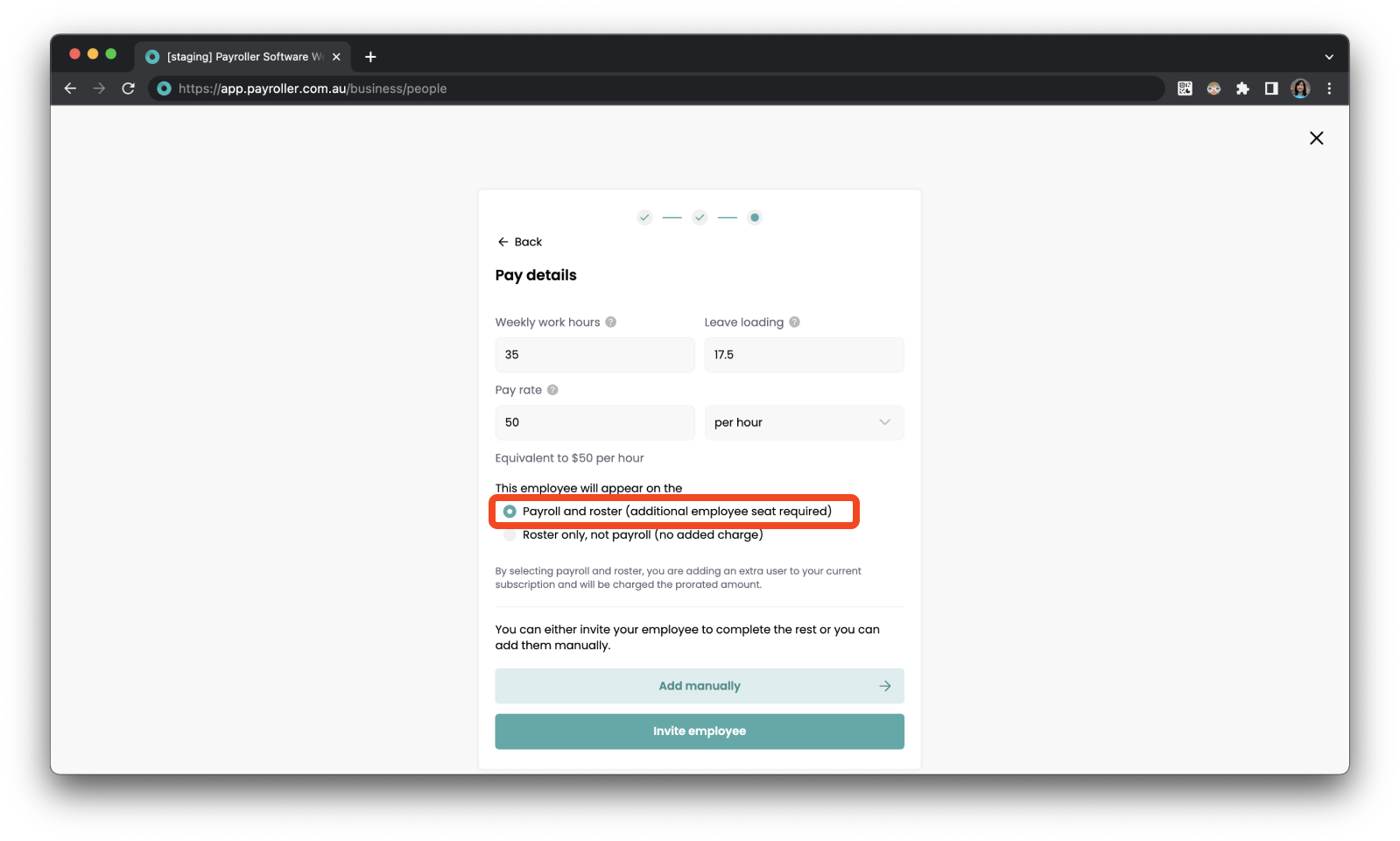

Step 4: When you get to the Pay details screen if the employee is on the payroll and roster select ‘Payroll and roster’ to add them to the subscription.

If you have a paid subscription and you select ‘Payroll and roster’ and complete the employee onboarding, your subscription will be updated if no empty paid seats are available and your card charged automatically. If you do not wish to be charged for this employee please select ‘Roster only, not payroll’. You can change this employee status to active at a later stage when you are ready.

Step 5: Enter the rest of the employee details as required. For assistance please follow this guide.

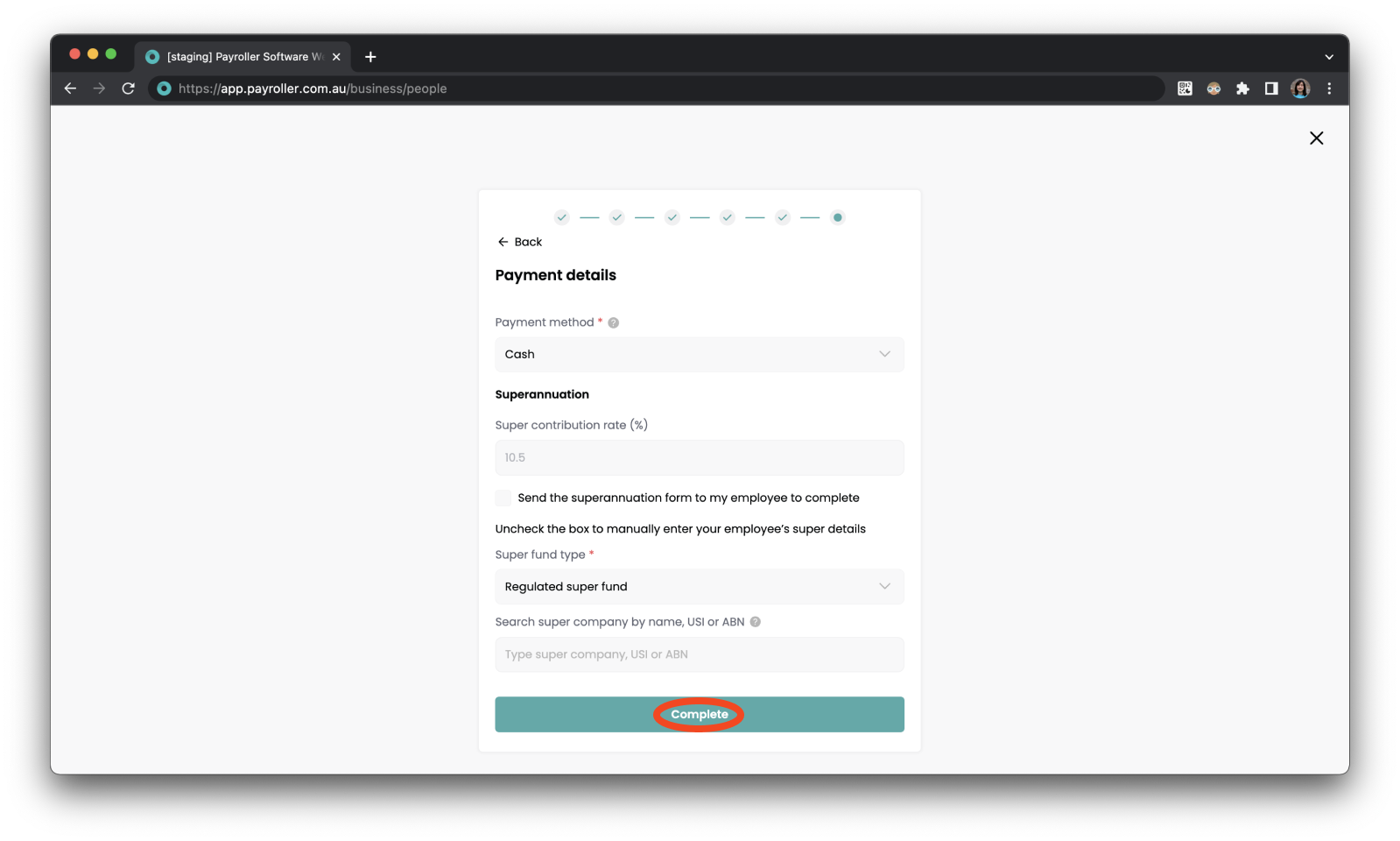

Step 6: On the final page, once you select ‘Complete’ the employee will be added to the subscription and you will be charged the prorated amount automatically.

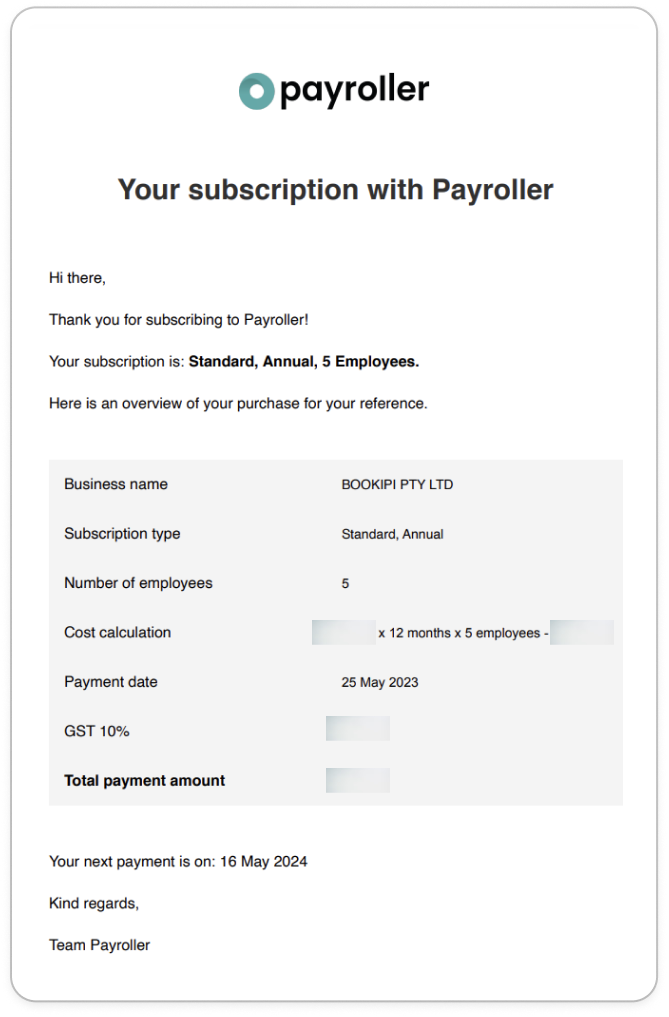

Your subscription has now been updated and you should have received a receipt in your email.

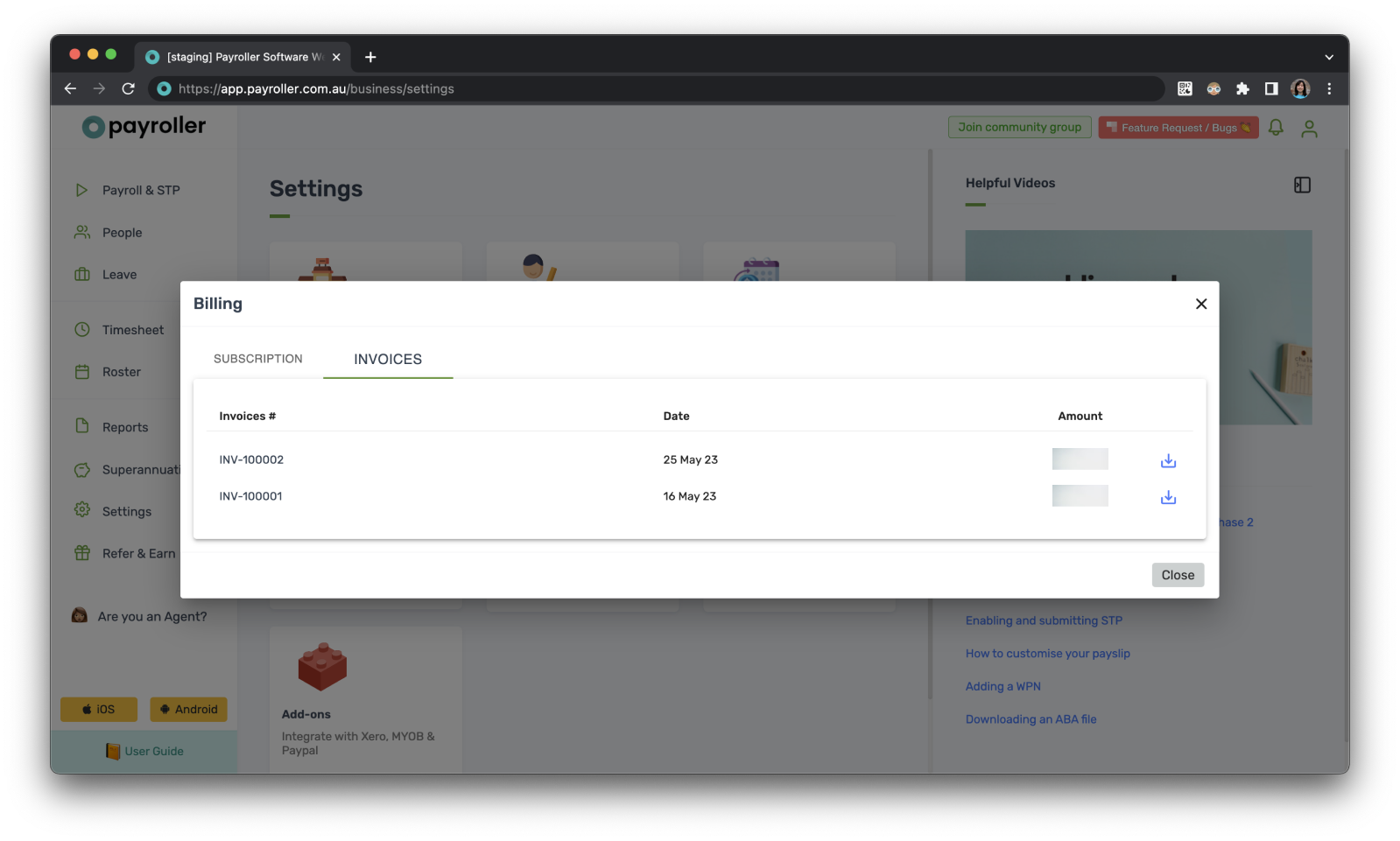

This receipt will also be available in the invoice section of your Billing page.

Discover more tutorials & get the most out of using Payroller

Get started with setting up Single Touch Payroll (STP) with our simple user guides. Signing up for a Payroller subscription gives you access to all features via the web and mobile app.

You can also invite your accountant or tax agent to help you manage your business payroll with our step-by-step guide.