Superannuation reports for Australian businesses

Superannuation reports are like a window into your business’s financial health, especially regarding employee pay and government contributions.

Navigating these reports can be tricky for those outside the payroll team. This guide aims to simplify your process.

Try Payroller today and say goodbye to payroll and STP headaches!

By clicking Try for Free, you agree to our terms of services and privacy policy.

What is superannuation reporting?

Superannuation reporting is the process of sending employee super contributions to the Australian Tax Office (ATO).

Every quarter, employers are responsible for making Superannuation Guarantee (SG) contributions to their employees’ super funds. SG is 11% of the employee’s income, which will increase to 12% by 2025.

SG contributions are paid alongside employee salaries and are reported through Single Touch Payroll (STP) reports. Adjustments to super payments and additional reportable employee superannuation contributions must be reported annually to the ATO.

Managing your STP is easier with Payroller

Simplify employee management: Juggling payroll, benefits, and employee data? Let Payroller be your extra hand.

Sign up with Payroller today and share your payroll files on a regular basis with your accountant or bookkeeper. Visit our website to get started.

What are reportable employee superannuation contributions (RESC)?

RESC are super payments made beyond the mandatory SG contributions. These affect an employee’s taxable income and the amount of tax owed, as well as decide eligibility for certain benefits.

The following qualifies as RESC:

- Salary sacrifice arrangements

- Additional super contributions, such as bonuses and overtime pay

- Bonuses and one-off payments that are part of super calculations

How to calculate reportable superannuation contributions

To know the amount of RESC you need to pay and report, you must identify and sum up the contributions on top of SG.

- Calculate the SG contribution for an employee based on the current 11% rate.

- Gather information and amounts on additional contributions.

- Employer-initiated: Salary sacrifice amounts, bonuses directed to super, or other additional contributions included in the super calculation.

- Employee-initiated: Salary sacrifice contributions exceeding the concessional contribution limit (currently $27,500 per year).

- Add up both employer and employee-initiated contributions to make up the total RESC.

Types of superannuation reports

The following superannuation report types deal with your employees’ superannuation contributions, but they showcase the information differently. Both reports are crucial for managing your superannuation obligations effectively.

Superannuation payment reports

Superannuation payment reports showcase the actual super contributions made to your employees’ super funds. They’re used to verify that the correct payments were made to the correct super fund.

These reports should have the following information:

- Employee name

- Employee Tax File Number (TFN), if applicable

- Contribution details:

- Amount of contribution paid

- Date the contribution was paid to the super fund

- Super fund the contribution was made to

Superannuation accrual reports

Superannuation accrual reports showcase the superannuation contributions earned by your employees, but not necessarily paid yet. They are used for internal monitoring and budgeting purposes.

As a business, you can use superannuation accrual reports to ensure you have enough funds to make the required payments.

These reports should have the following information:

- Employee name

- Employee Tax File Number (TFN), if applicable

- Accrual details:

- Amount of superannuation earned by the employee within a specific period

- Other details like salary sacrificed or one-off payments

How to access your superannuation reports

Superannuation reporting obligations for employers

Effective payroll reporting is essential for Australian businesses to ensure accurate record-keeping, timely employee payments, and compliance with superannuation legislation by utilising STP-enabled software, automating processes, and submitting reports on time.

The days of pouring over payroll records to ensure your money is going to the right place are over. With the proper payroll software, you can focus on activities to poise your business for success.

Superannuation reporting obligations for employers

Eligibility

You are required to make superannuation contributions for eligible employees who are:

- Aged 18 years or over and working full-time, part-time, or casually.

- Under 18 years old and working more than 30 hours per week.

Contribution rate

The current SG contribution rate is 11% of an employee’s ordinary time earnings (base salary, wages, and allowances before tax). This rate is gradually increasing and is planned to reach 12% by July 1st, 2025.

Payment frequency

You are required to make superannuation contributions for your employees at least quarterly. However, you can choose to pay more frequently if it suits your business needs.

Choosing a super fund

You must offer eligible employees a choice of super fund when they start working for you. You can provide them with a Standard choice form or another compliant option.

Superannuation reporting and payment due dates

| Quarter | Period | Super payment deadline |

|---|---|---|

| 1 | 1 July to 30 September | 28 October |

| 2 | 1 October to 31 December | 28 January |

| 3 | 1 January to 31 March | 28 April |

| 4 | 1 April to 30 June | 28 July |

Master superannuation reporting with the right payroll software

Superannuation reports might feel like a bit of a maze at first, but understanding the basics can help. Reporting it accurately ensures that everyone’s on the same page, the ATO gets what they need, and your employees can feel confident about their future. It’s a win-win for everyone involved, so make it part of your superannuation checklist!

Remember, clear communication is key. Talk to your employees if you have any questions, and don’t hesitate to seek guidance from a tax professional if needed. With a little understanding and teamwork, superannuation reporting can be a breeze.

Managing your STP is easier with Payroller

Simplify employee management: Juggling payroll, benefits, and employee data? Let Payroller be your extra hand.

Sign up with Payroller today and share your payroll files on a regular basis with your accountant or bookkeeper. Visit our website to get started.

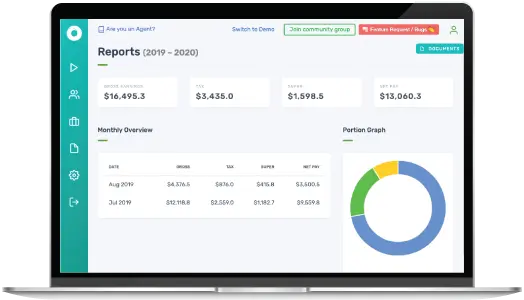

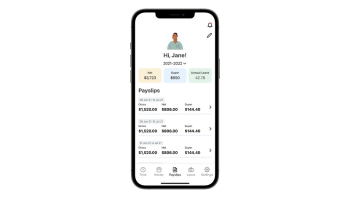

How does Payroller work?

Payroller is designed to make STP simple for small business employers.

Try Payroller for free as an Employer or accounting professional Agent

(accountant, bookkeeper or tax agent).