Learn how to add Child Support deductions and garnishees for employees in Payroller

Learn how to add child support deductions and garnishees in Payroller with our simple guide below.

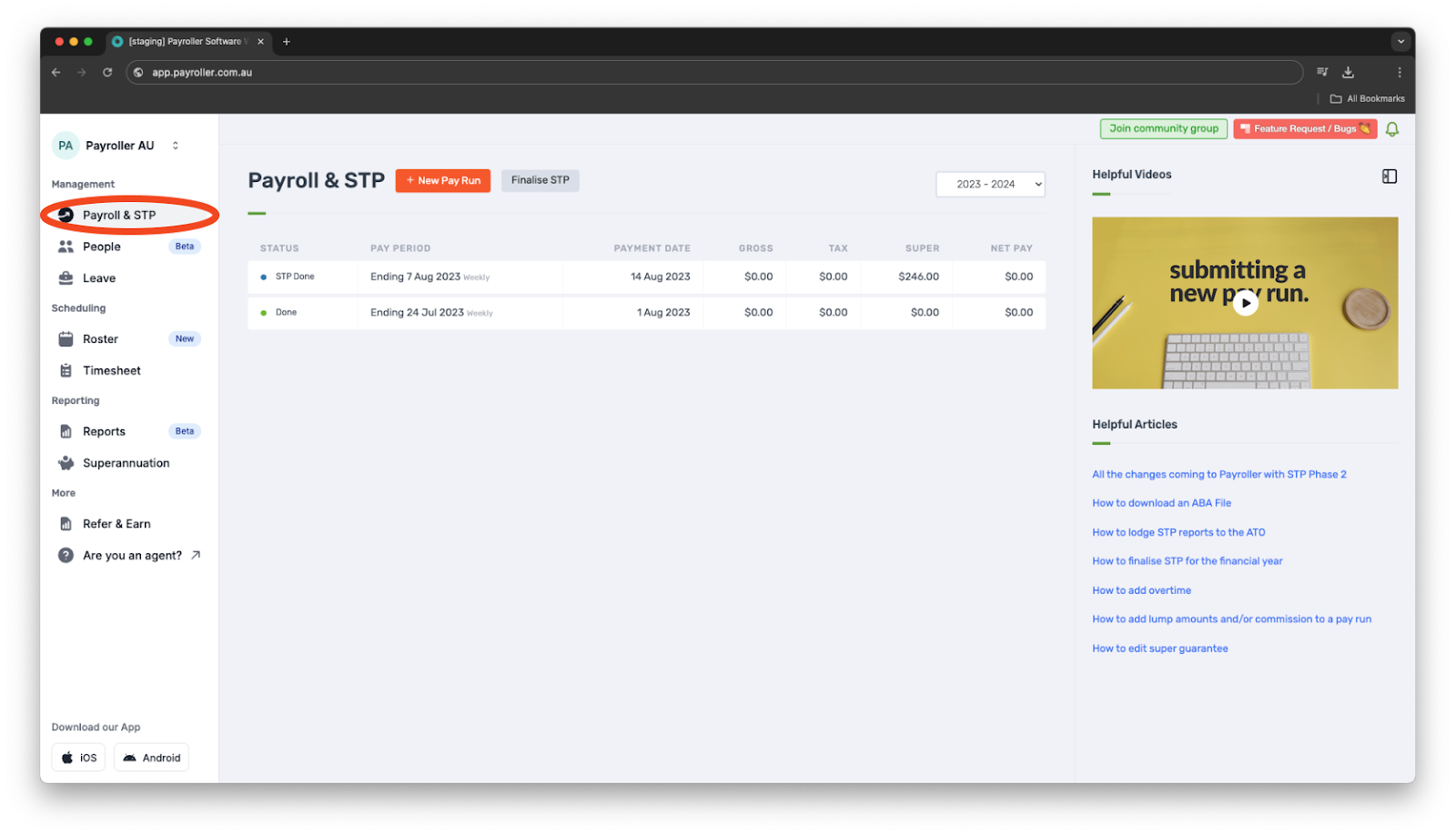

Step 1: Select ‘Payroll & STP’.

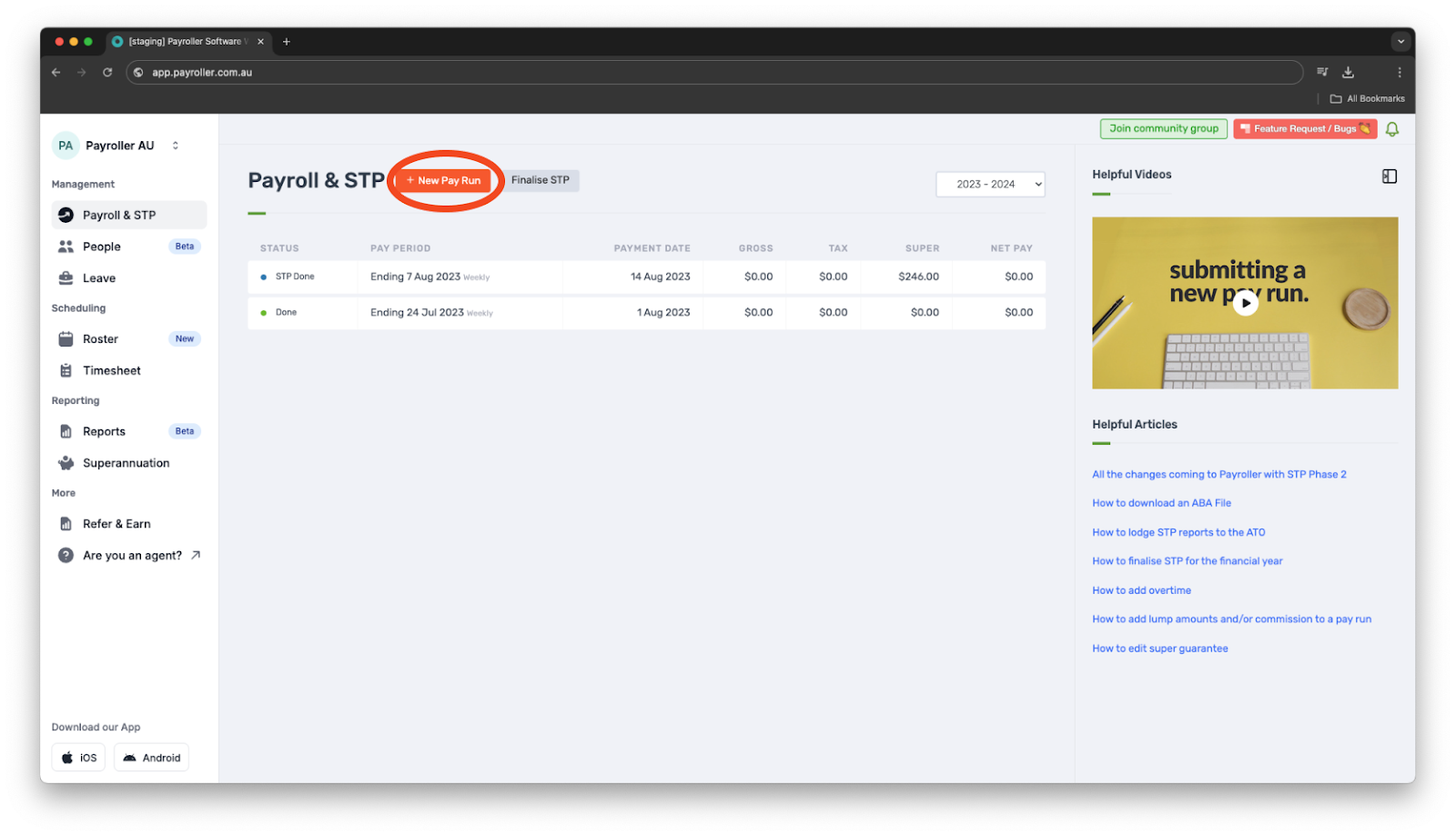

Step 2: Select ‘+New Pay Run’.

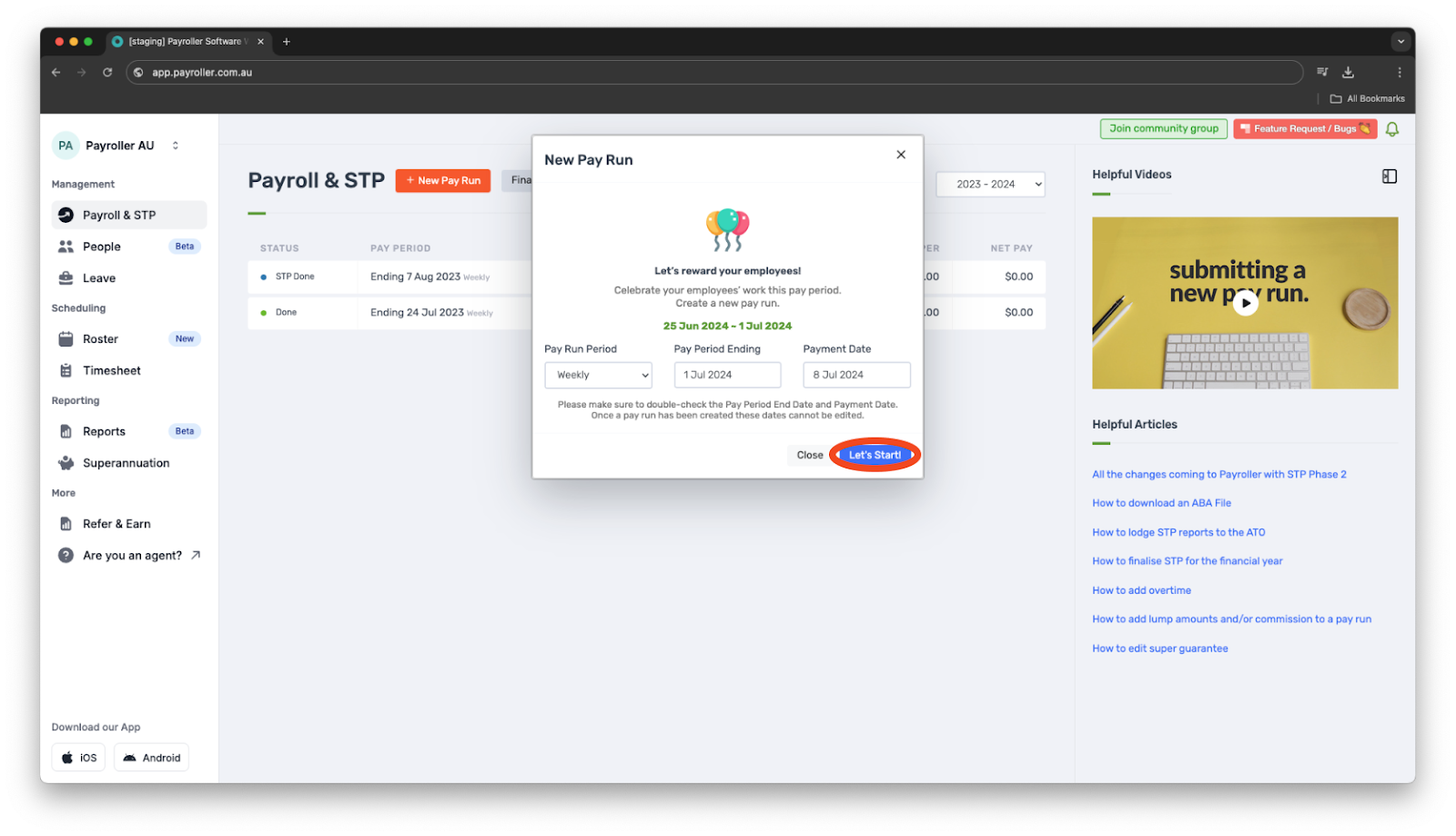

Step 3: Check and edit as required your Pay Run Period, Pay Period Ending Date, and Payment Date and select ‘Let’s Start!’.

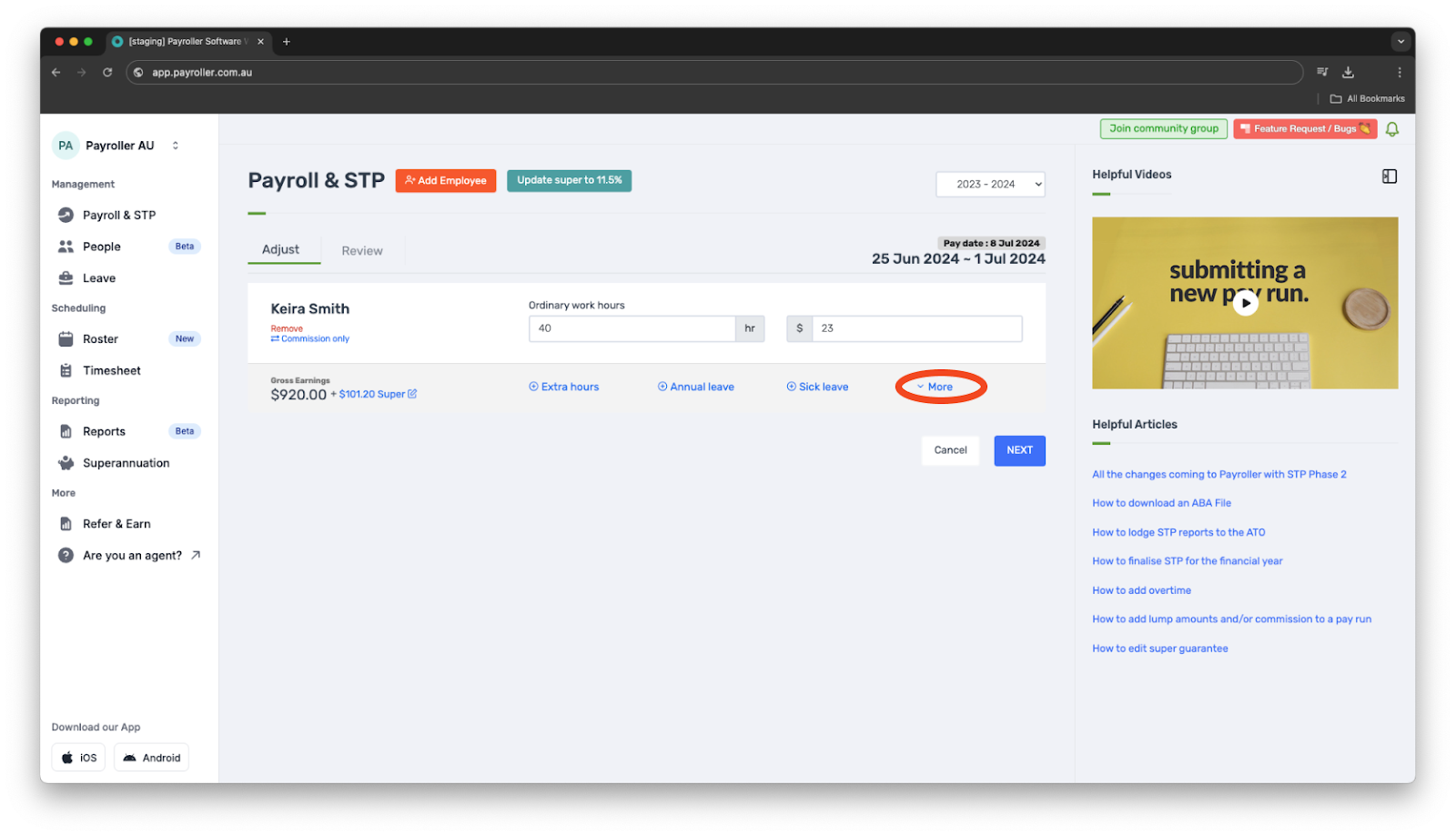

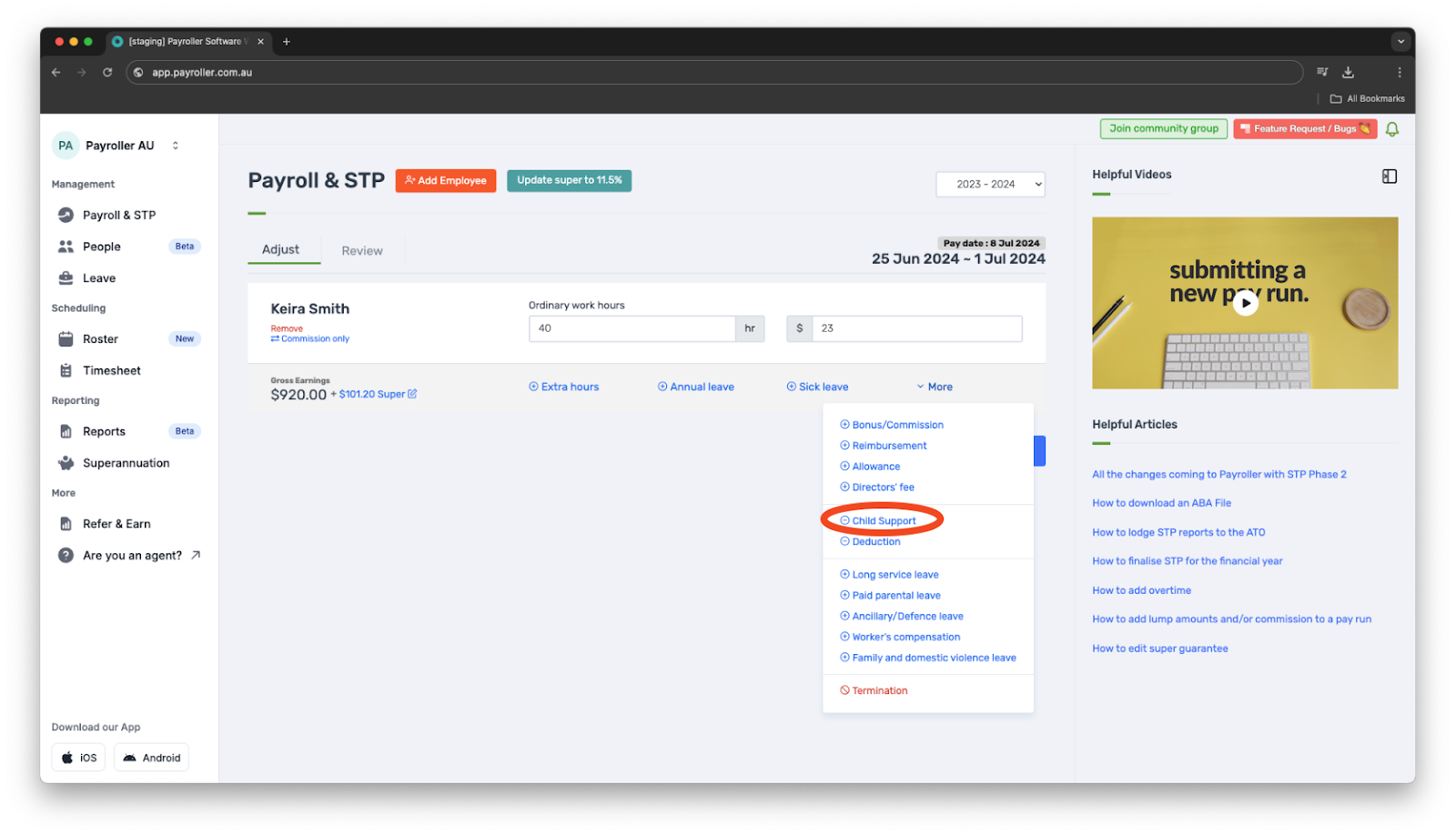

Step 4: Select ‘More’.

Step 5: Select ‘Child Support’.

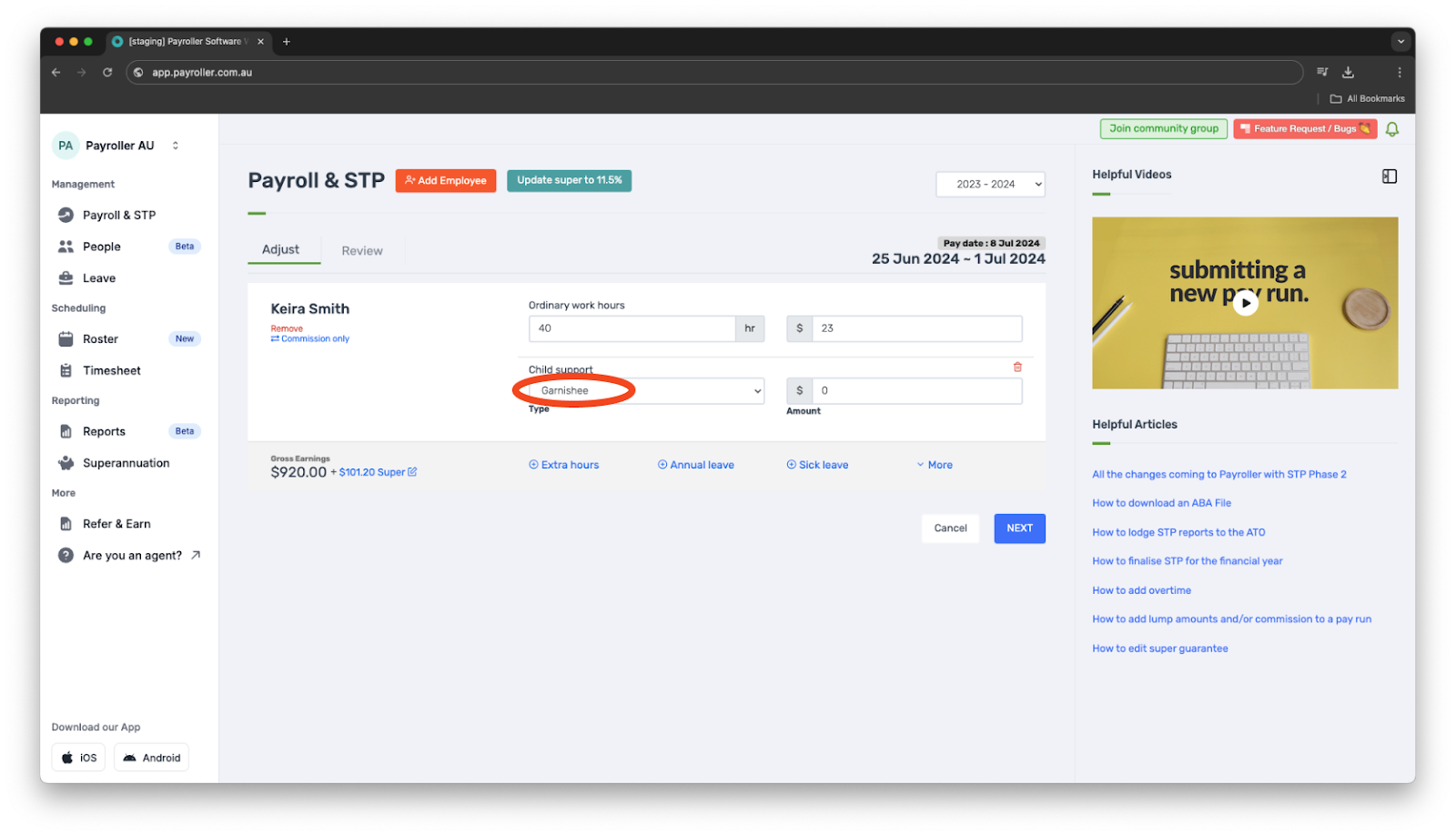

You can choose between Garnishee and Deduction using this box.

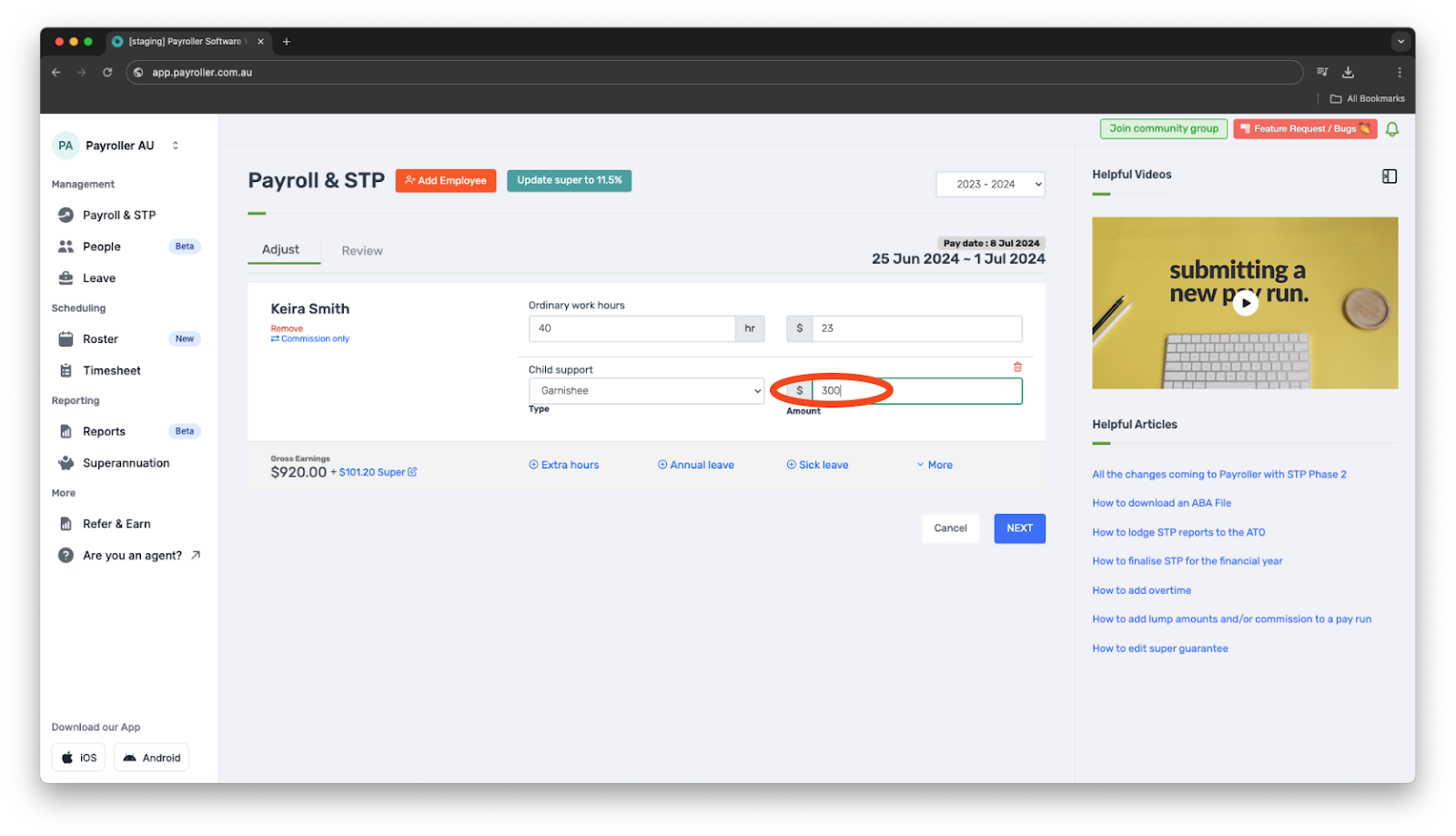

Step 6:Enter the total amount for Child support.

Please note that this figure indicates how much of the gross will be deducted for child support.

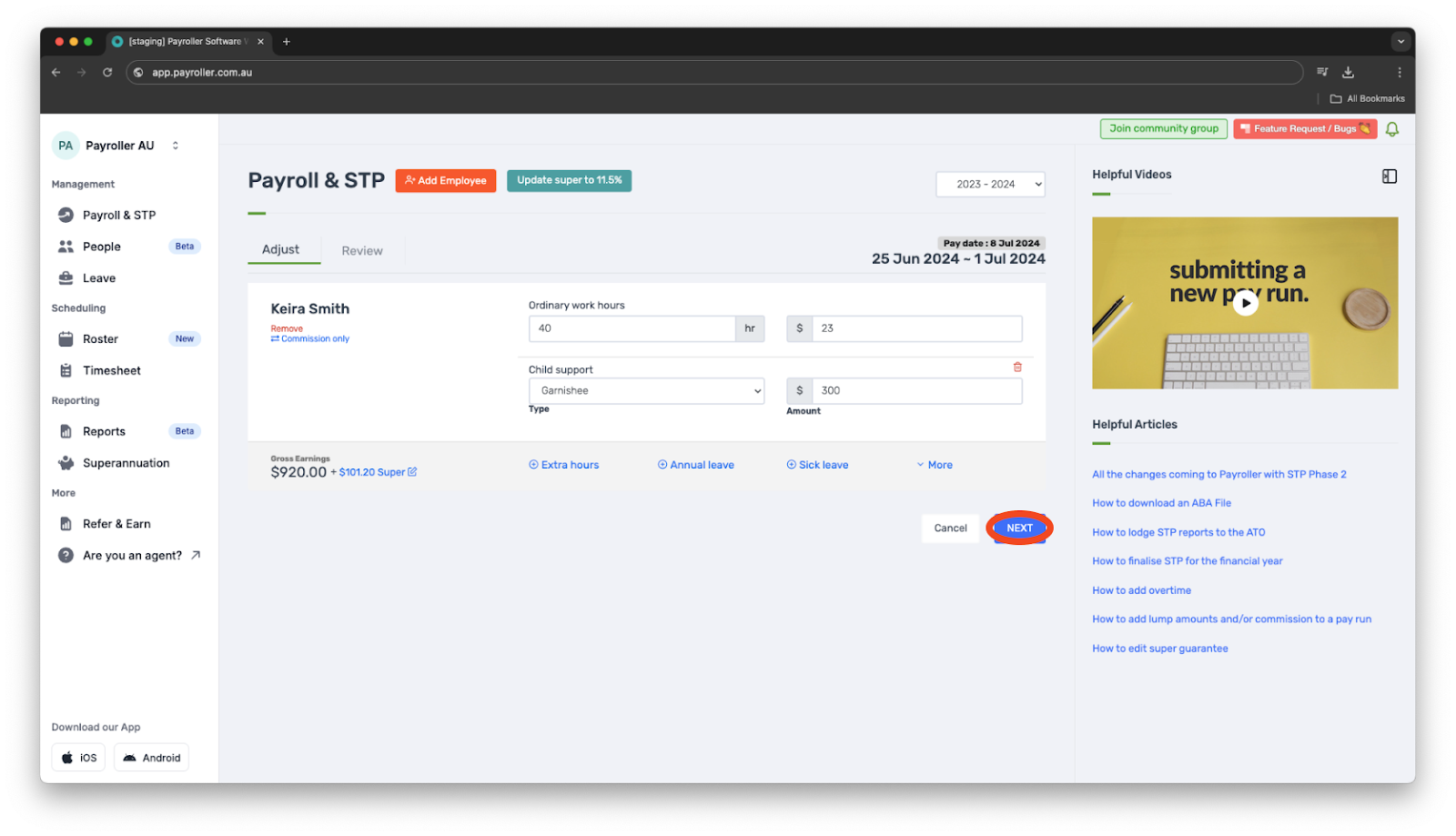

Step 7: Once you have finished entering those details select ‘Next’.

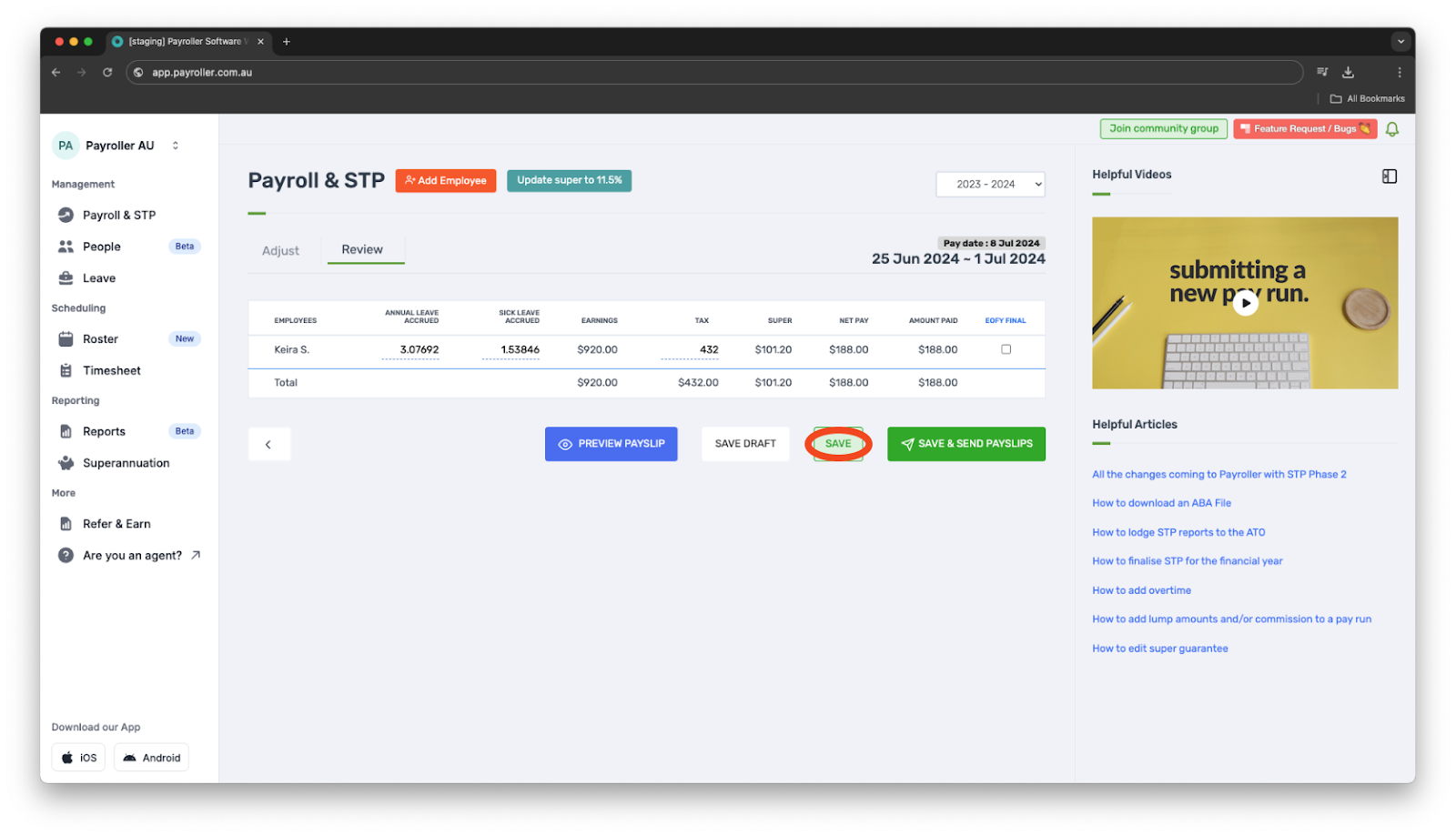

Step 8: Review the figures. Once you’re happy, select ‘Save’.

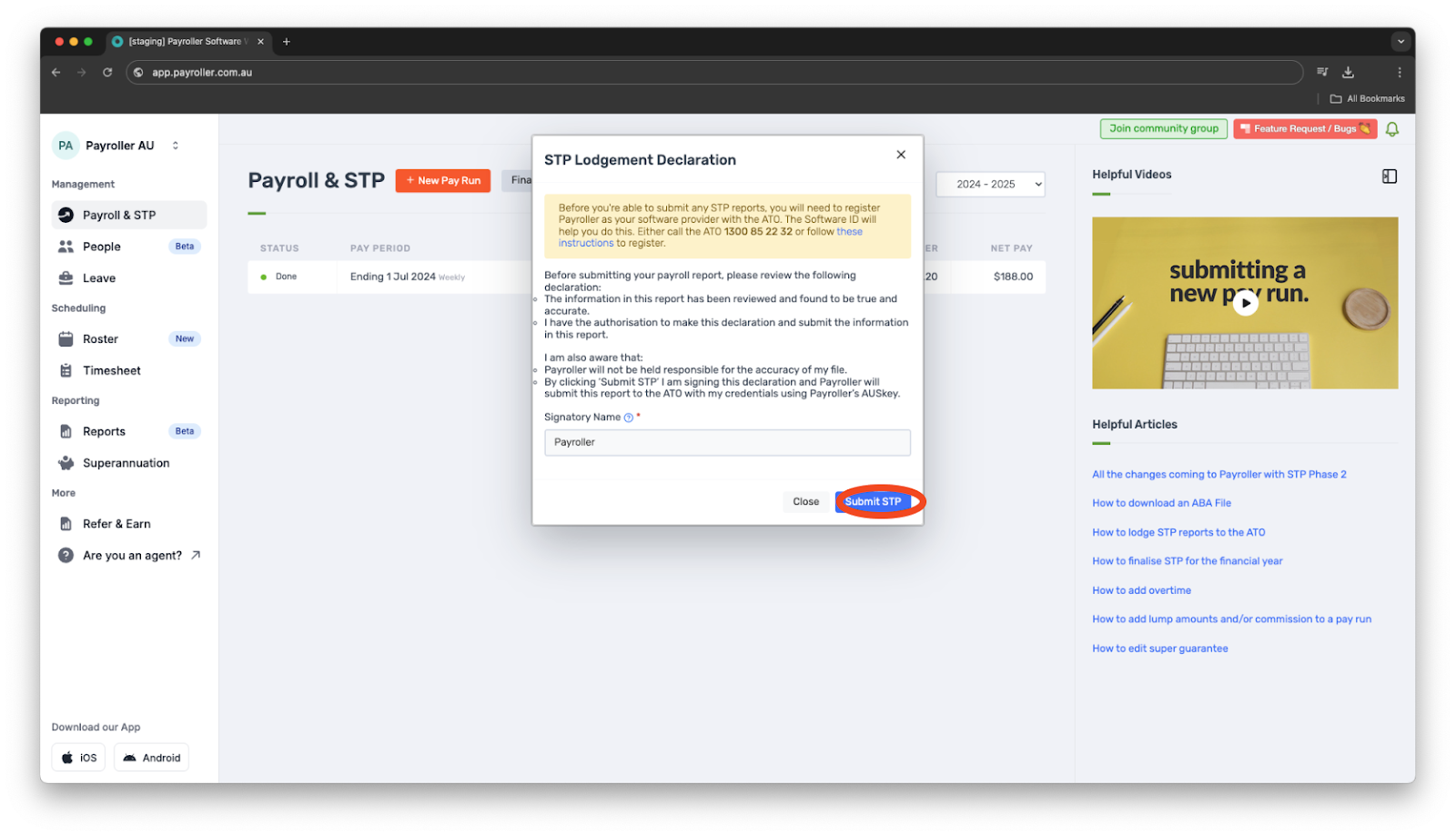

Step 9: Submit the pay run.

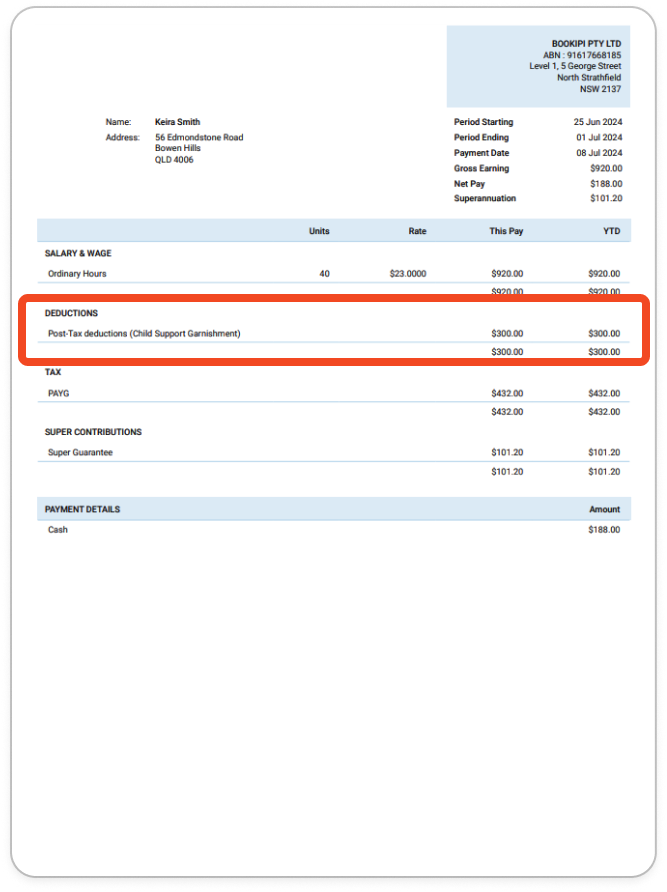

The employees’ payslips will now show this amount.

Discover more tutorials for using Payroller

Set up Single Touch Payroll (STP) with our simple user guides.

Learn everything you need to know about Single Touch Payroll (STP) and sign up to try Payroller for free today.

Access the full features of Payroller on all devices across both the web app and the mobile app. Read our Subscription FAQs.