How to edit the super guarantee amount in a pay run with Payroller

Definition: The Super Guarantee is a super percentage that as an employer, you are required to pay into your employees’ super fund. In general, this is about 10.5% of the gross earnings.

Learn how to edit the Super Guarantee amount in a pay run with our simple guide below.

If you wish to permanently change the contribution rate for super for new pay runs please make sure to change this on the employee card under Contribution rate in the Bank & Super tab.

If you need to edit a pay run follow this guide.

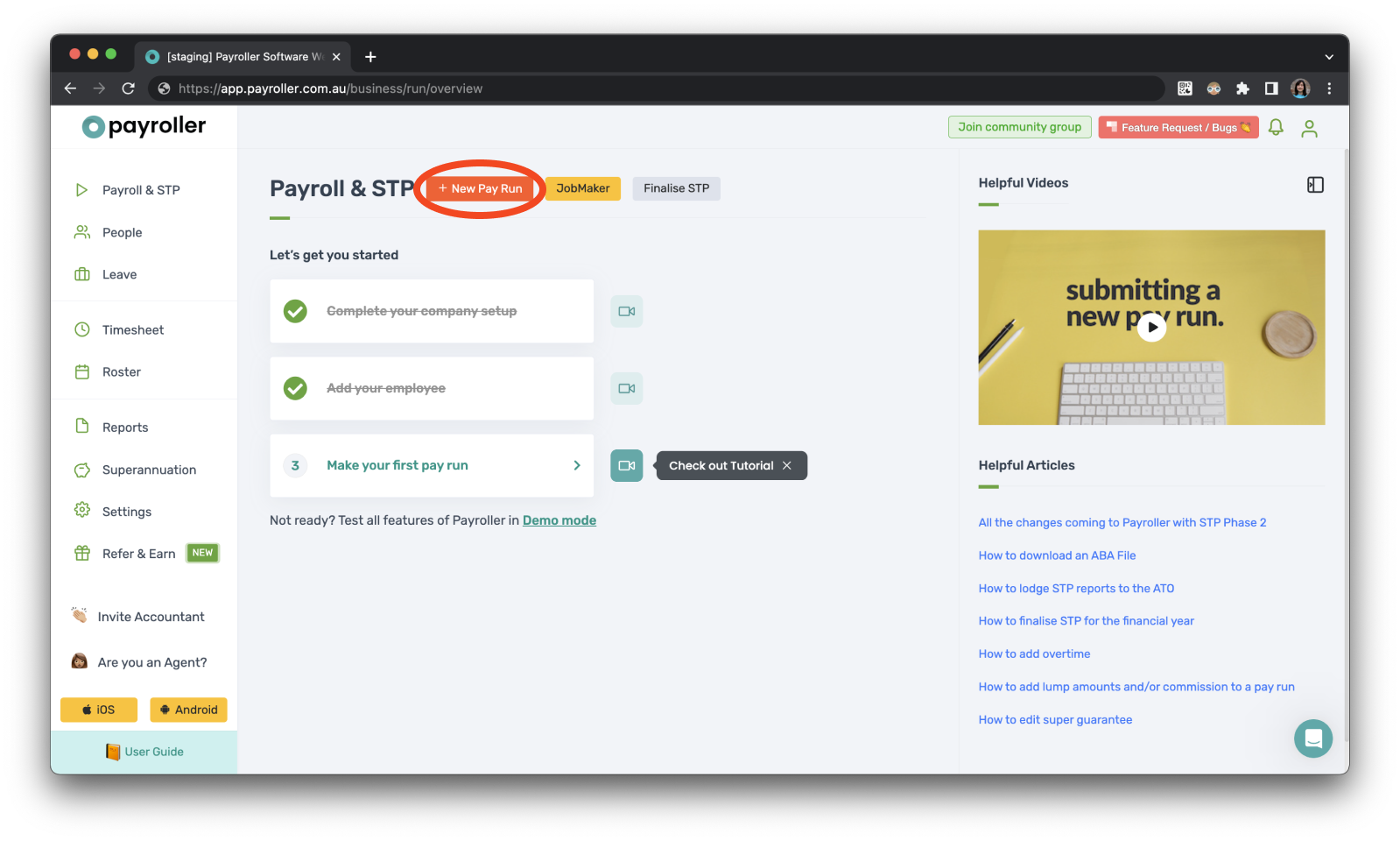

Step 1: Click on ‘+ New Pay Run’.

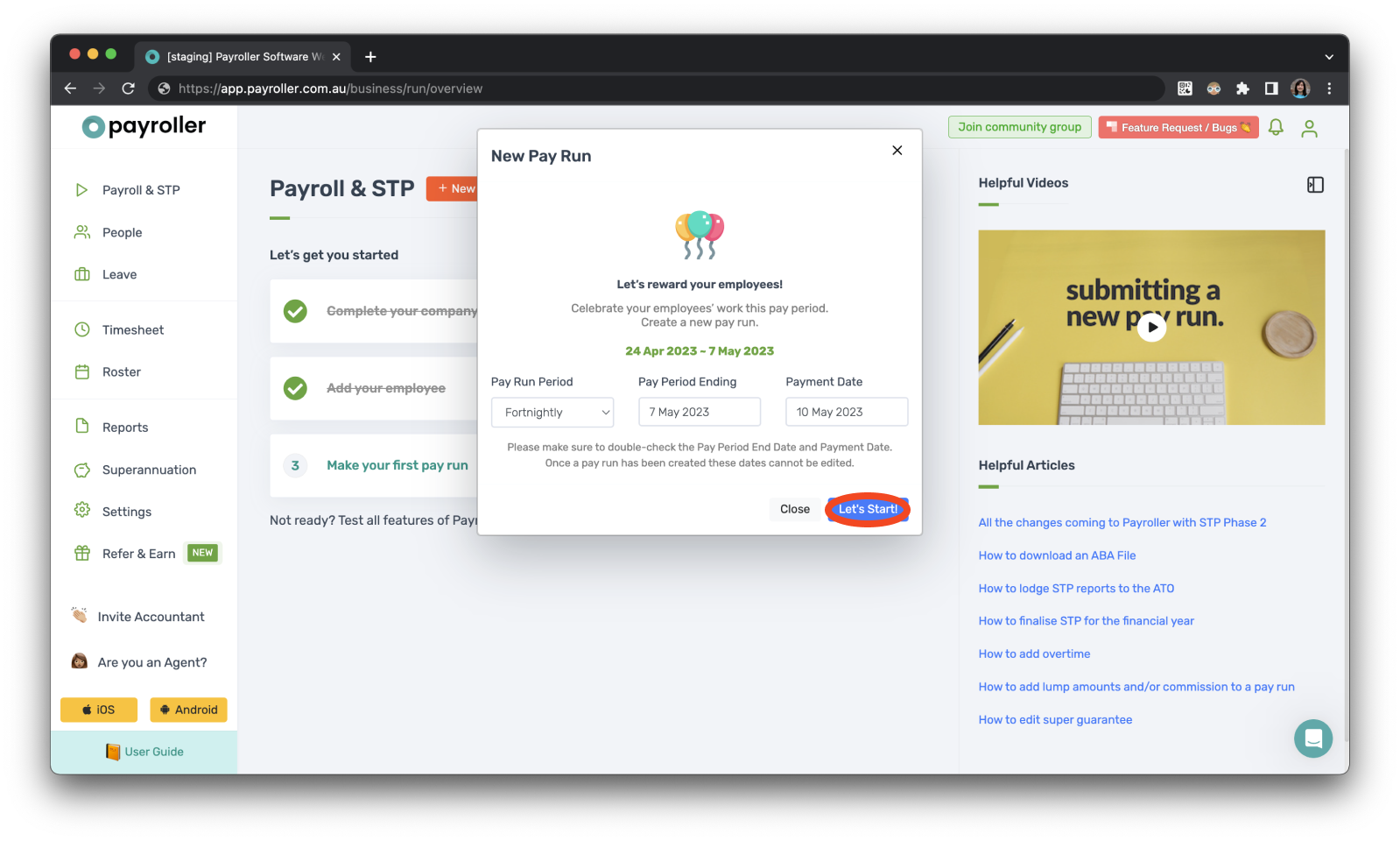

Step 2: Customise pay run details.

Customise the Pay Run Period, the Pay Period Ending date, and the Payment Date, and select ‘Let’s Start!’

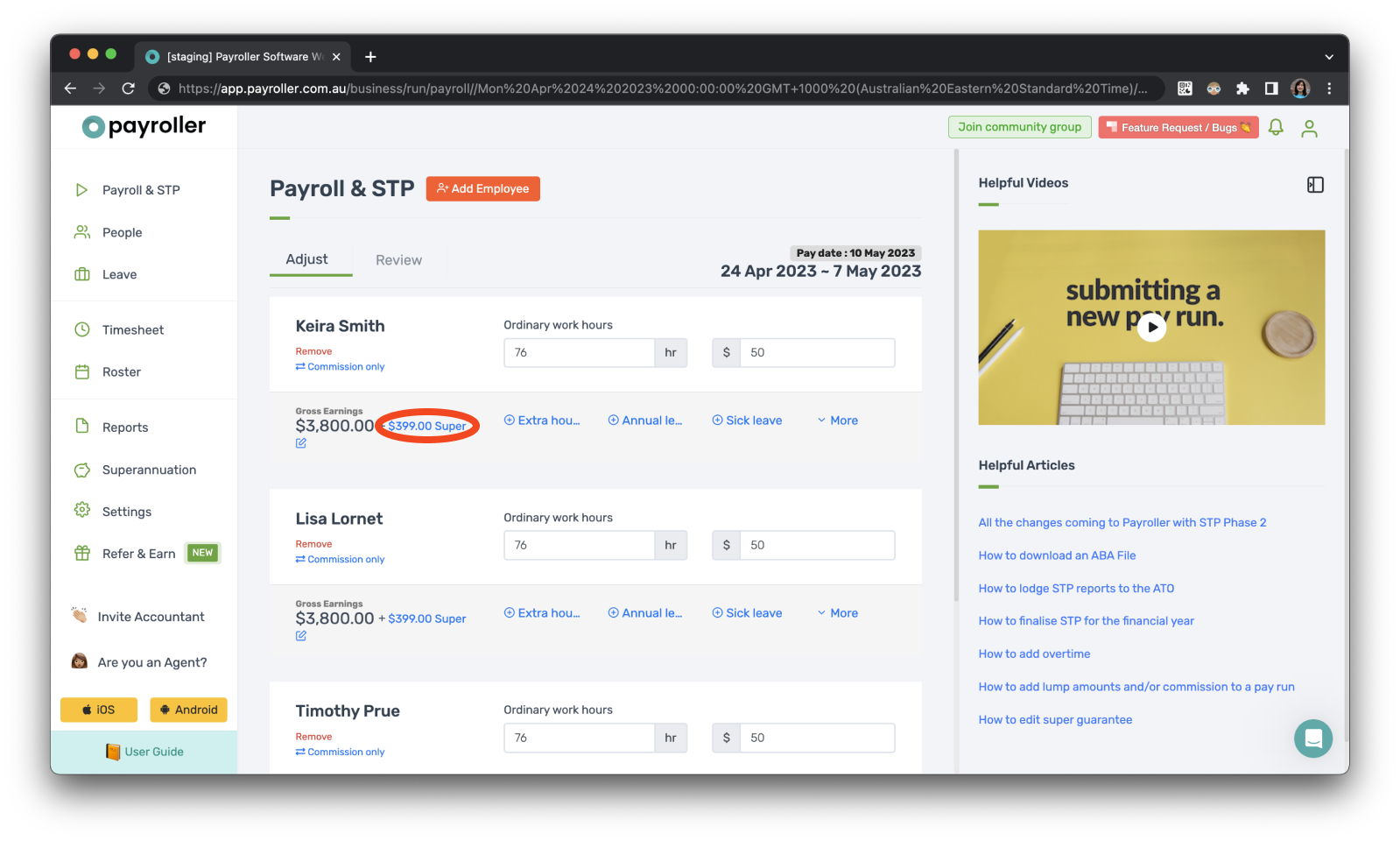

Step 3: Click on the super amount.

The super amount is written in blue.

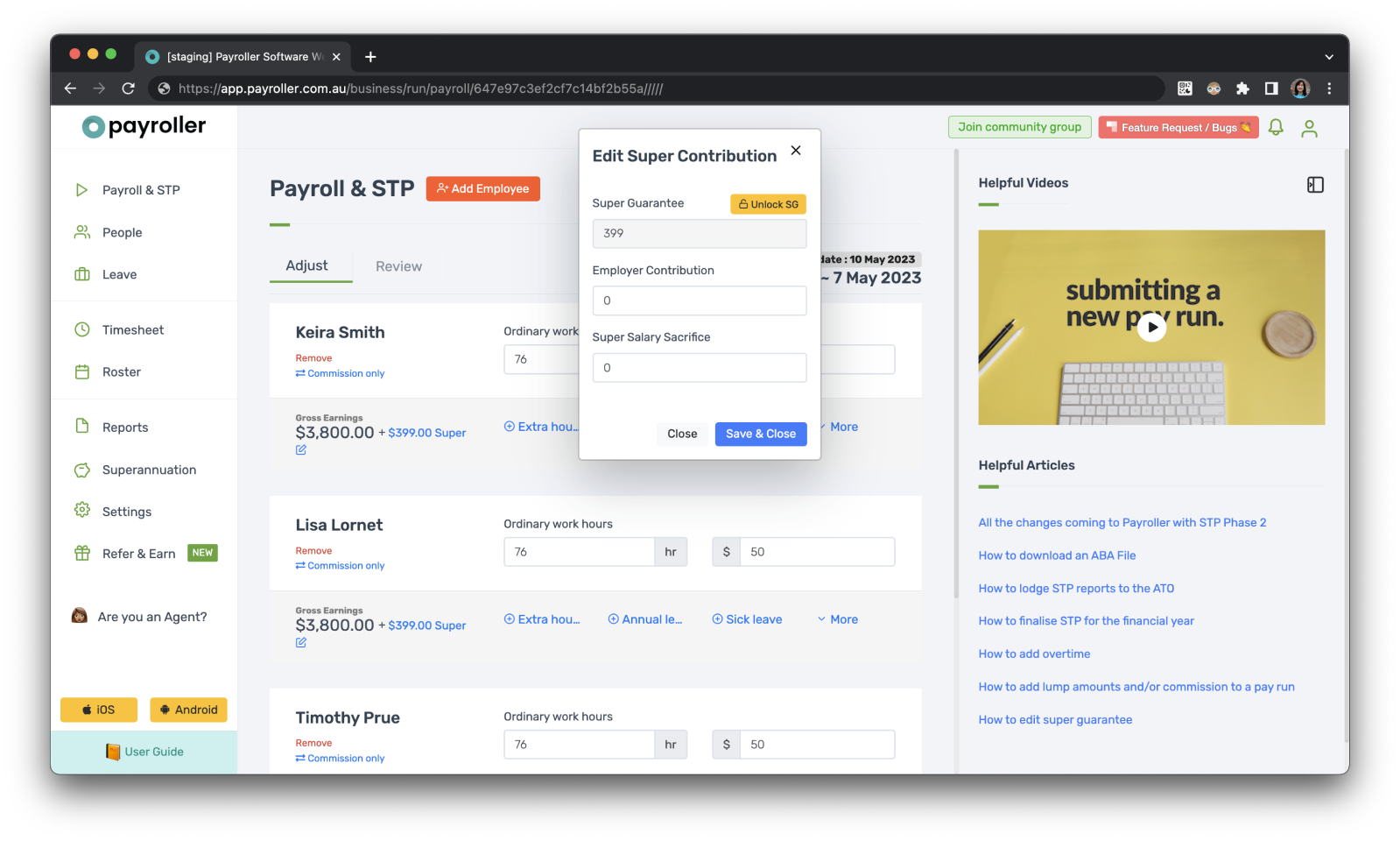

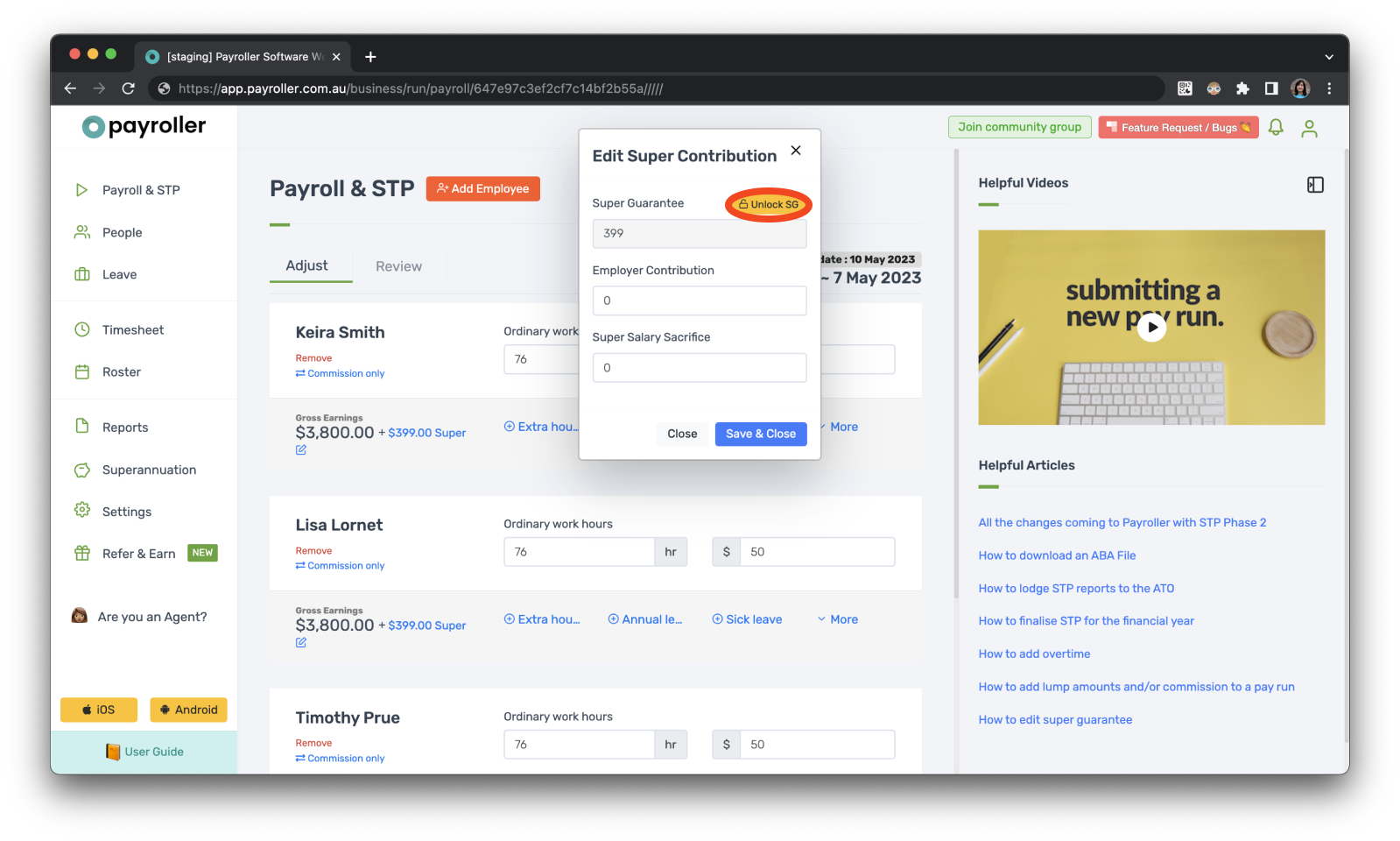

The following pop-up will appear.

Here you can view and add or adjust Super Guarantee, Employer Contribution, and Super Salary Sacrifice amounts.

Step 4: If you need to edit the super guarantee, click on ‘Unlock SG’.

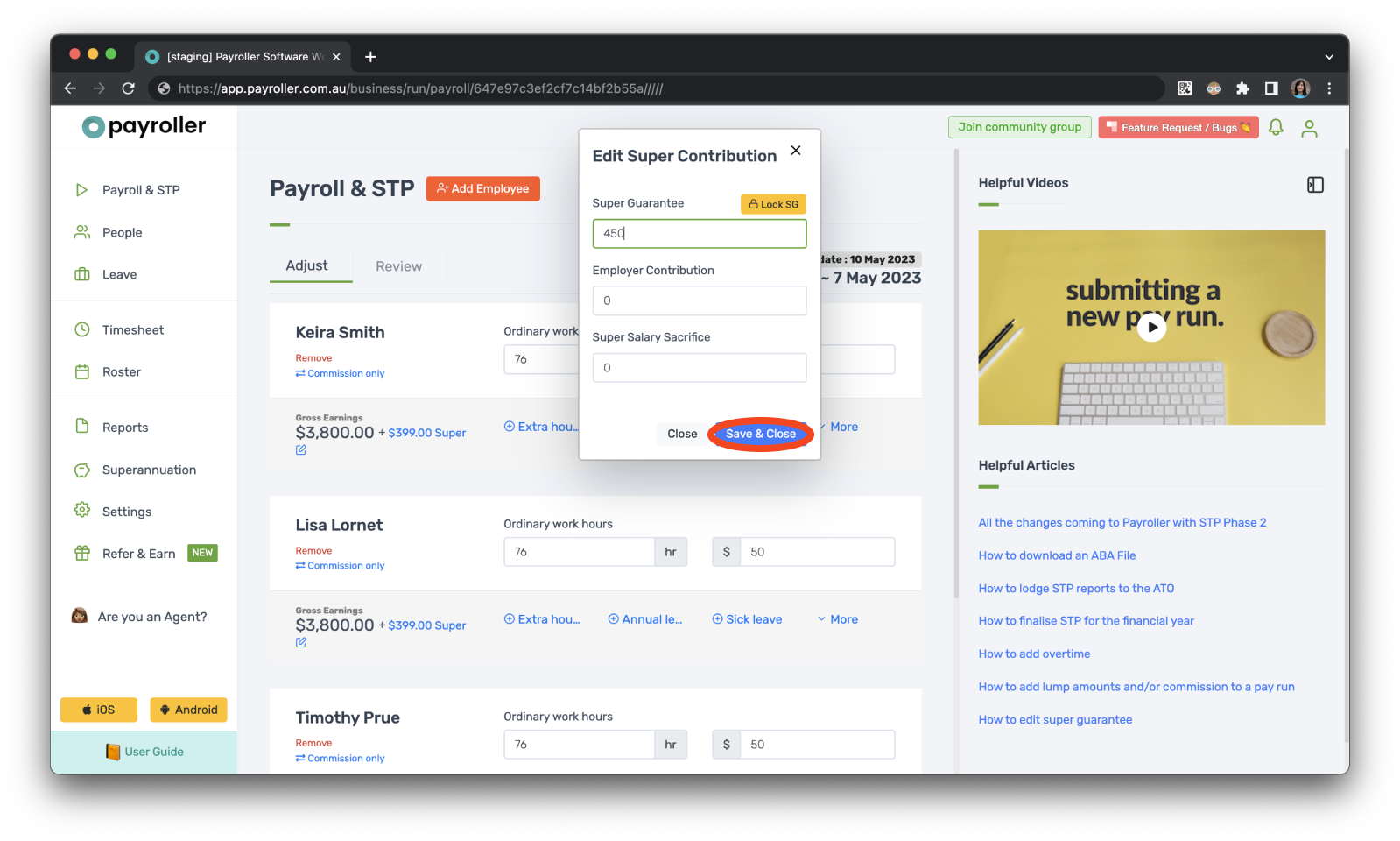

Step 5: Click ‘Save & close’ after making changes.

You will be able to edit the super guarantee as needed. If you’re satisfied with the amounts, click ‘Save & Close’.

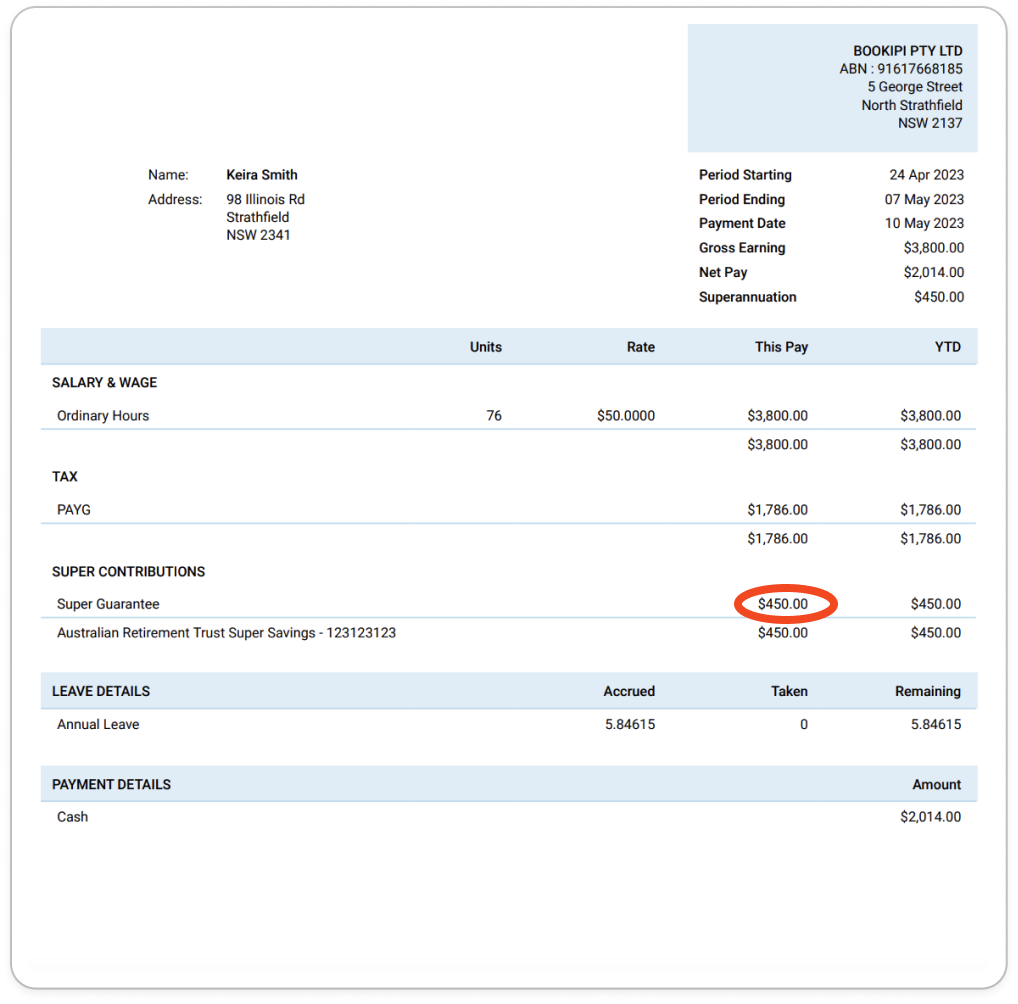

Once you have completed your pay run, Super Guarantee should now show on the employee payslip.

Learn how to make other changes to super contributions in Payroller with our simple guides below:

Discover more tutorials & get the most out of using Payroller

Learn more about easily creating and editing pay runs with our simple user guides.

Want access to all Payroller features on both web app and mobile app? Try Payroller for free and sign up for a Payroller subscription for synced payroll across all devices. Read our Subscription FAQs for more information.