Learn how to indicate that your employee is a closely held payee in Payroller

Learn how to indicate that your employee is a closely held payee in Payroller with our simple guide below.

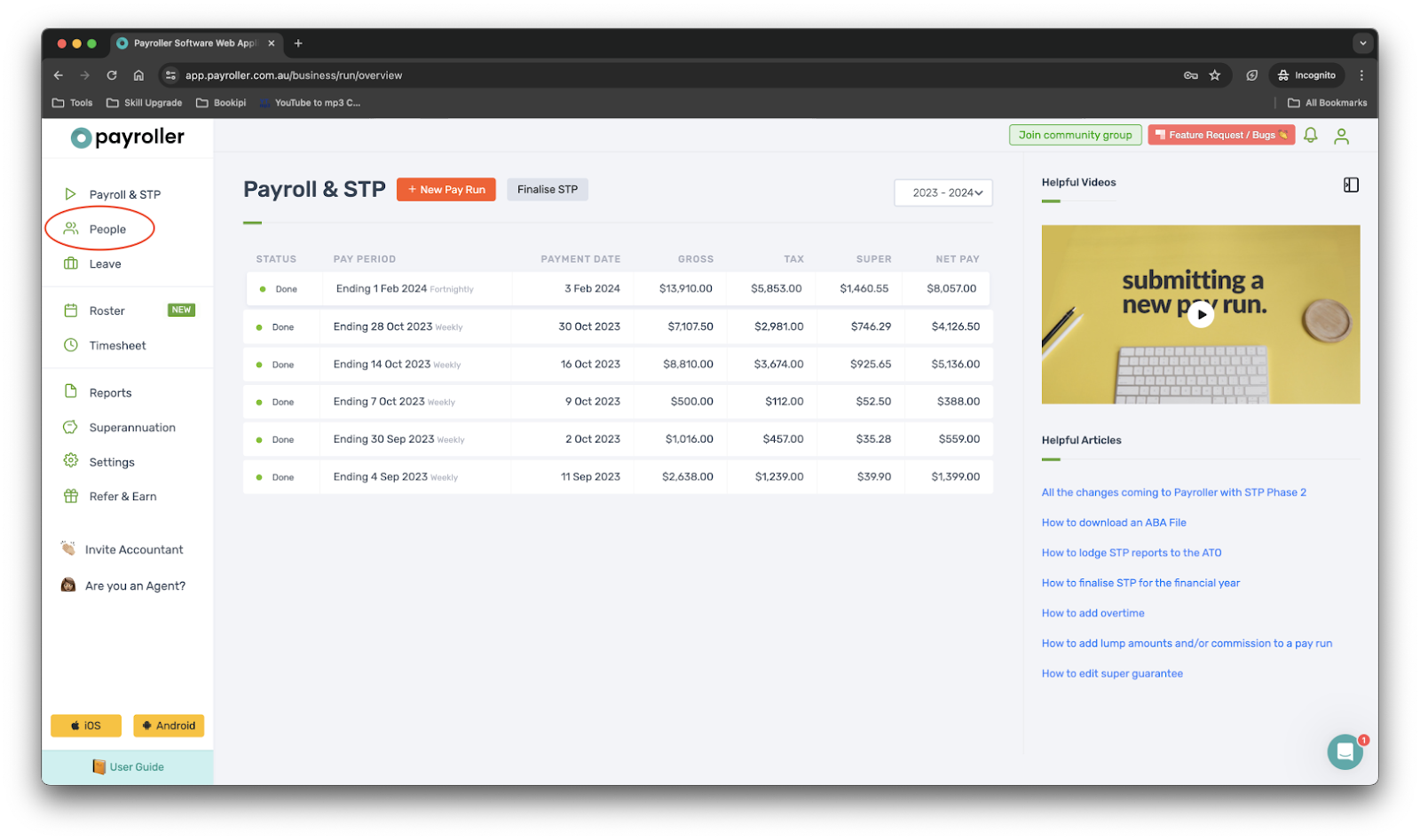

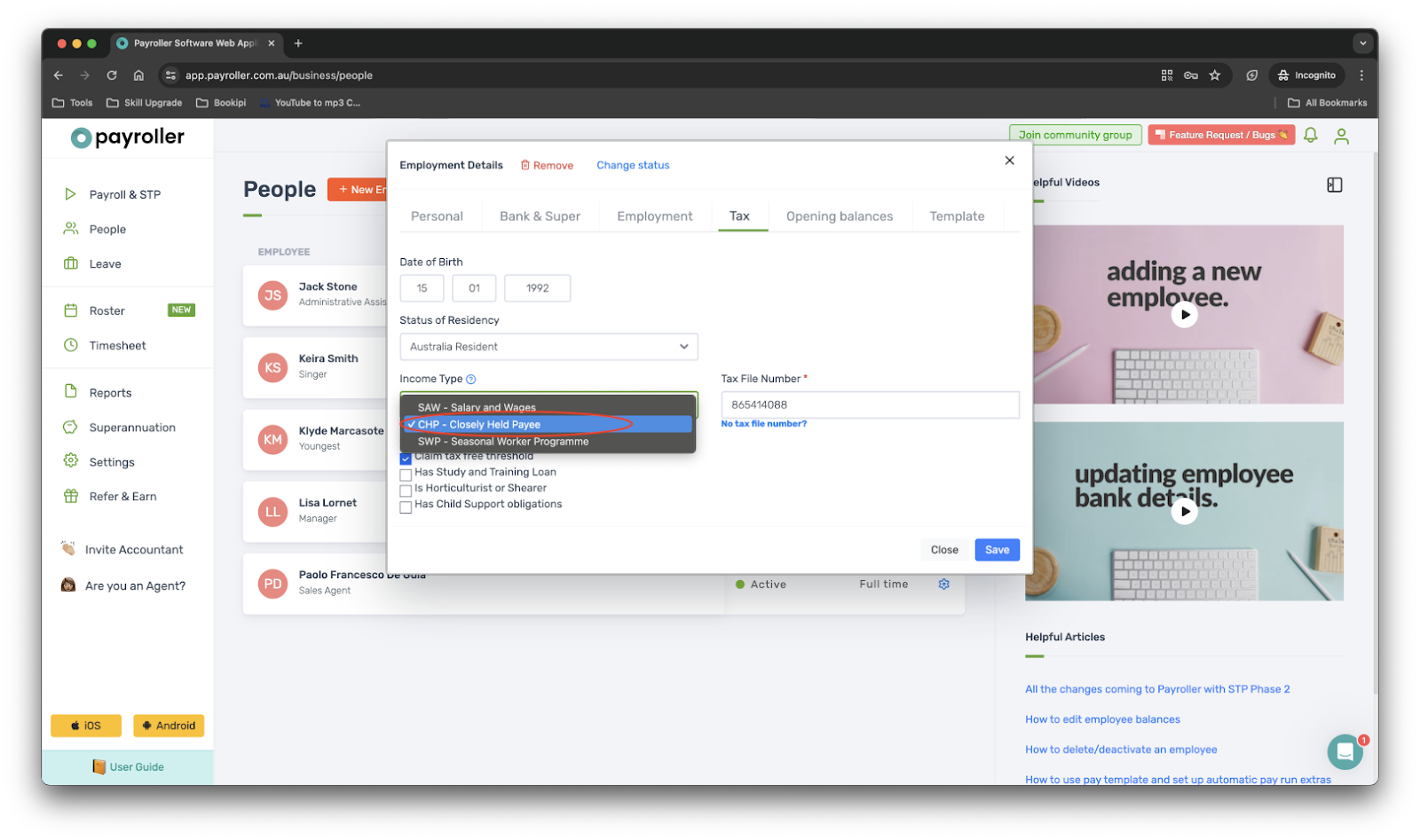

To indicate that your employee is a closely held payee:

Step 1: Select ‘People’.

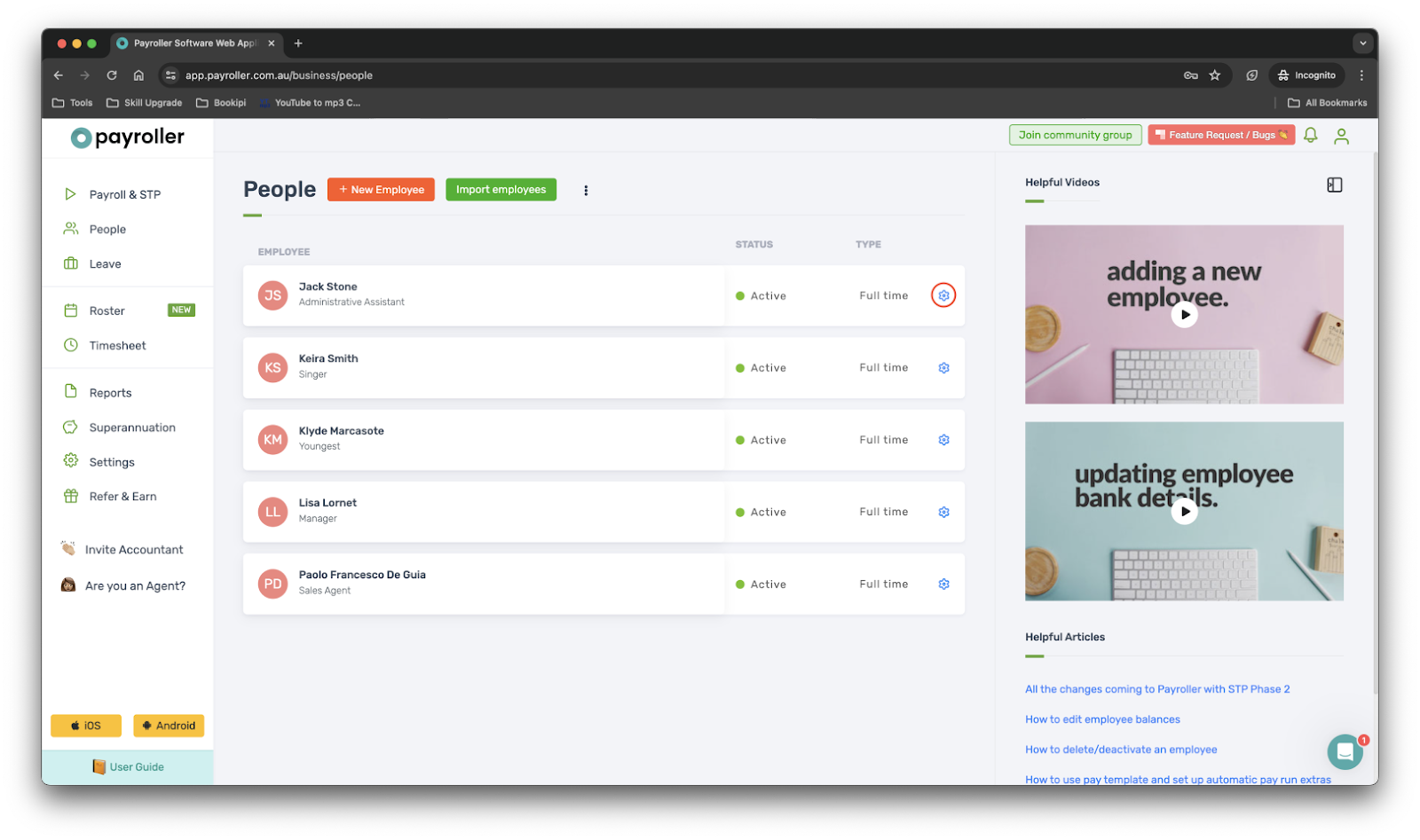

Step 2: Select the ‘settings wheel’ on your closely held employee.

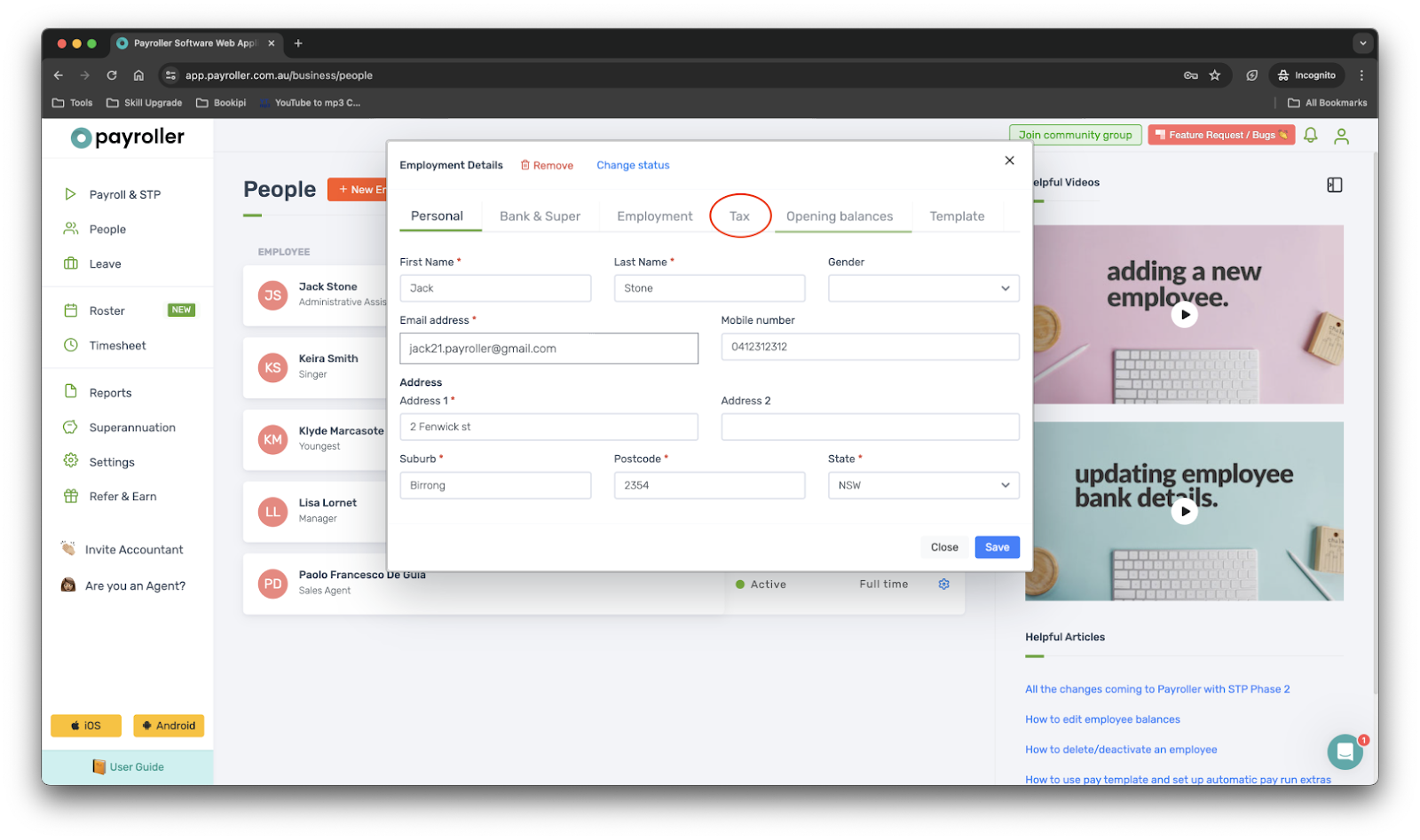

Step 3: Select ‘Tax’.

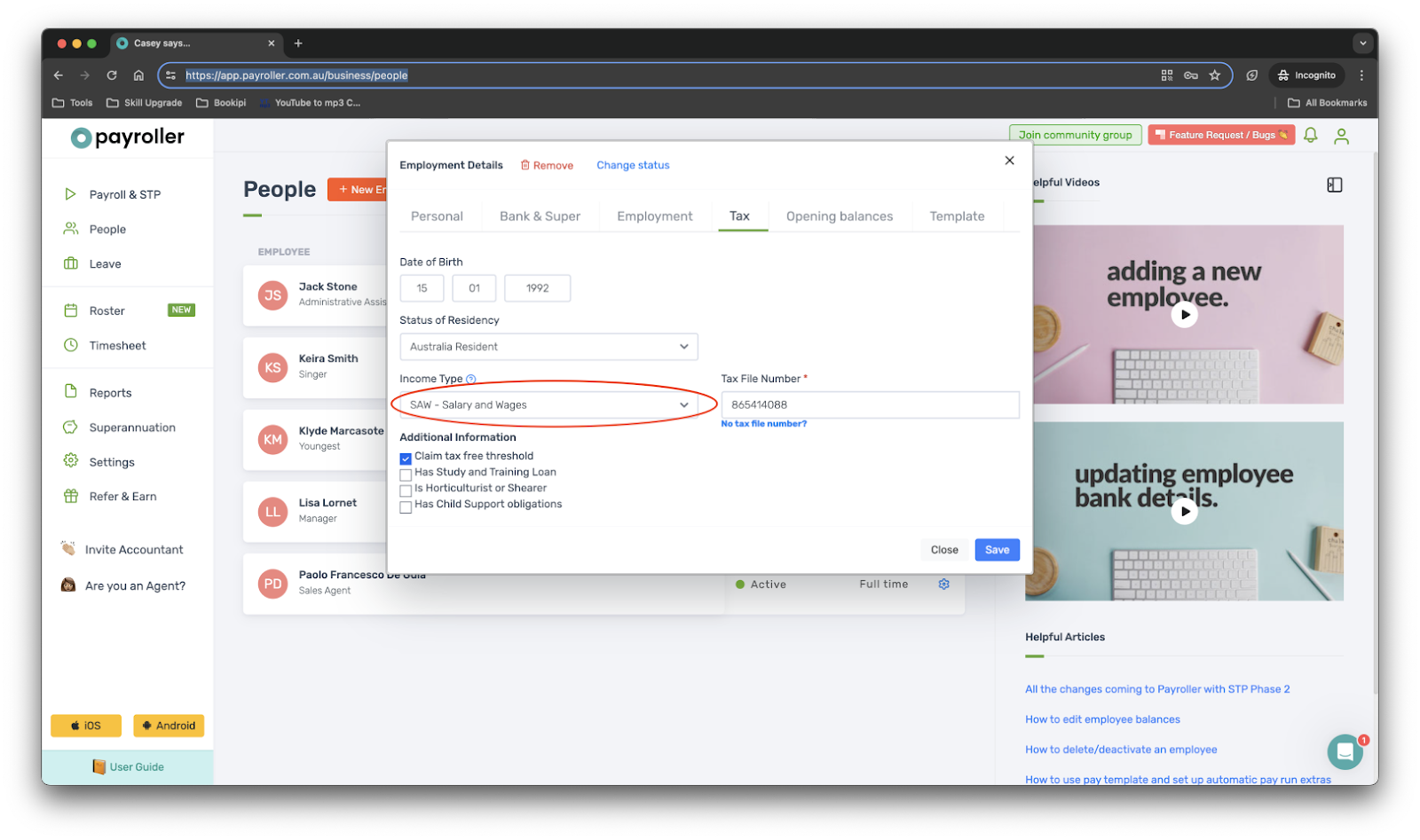

Step 4: Select the ‘Income Type’ dropdown menu.

Step 5: Select ‘Closely Held Payee’.

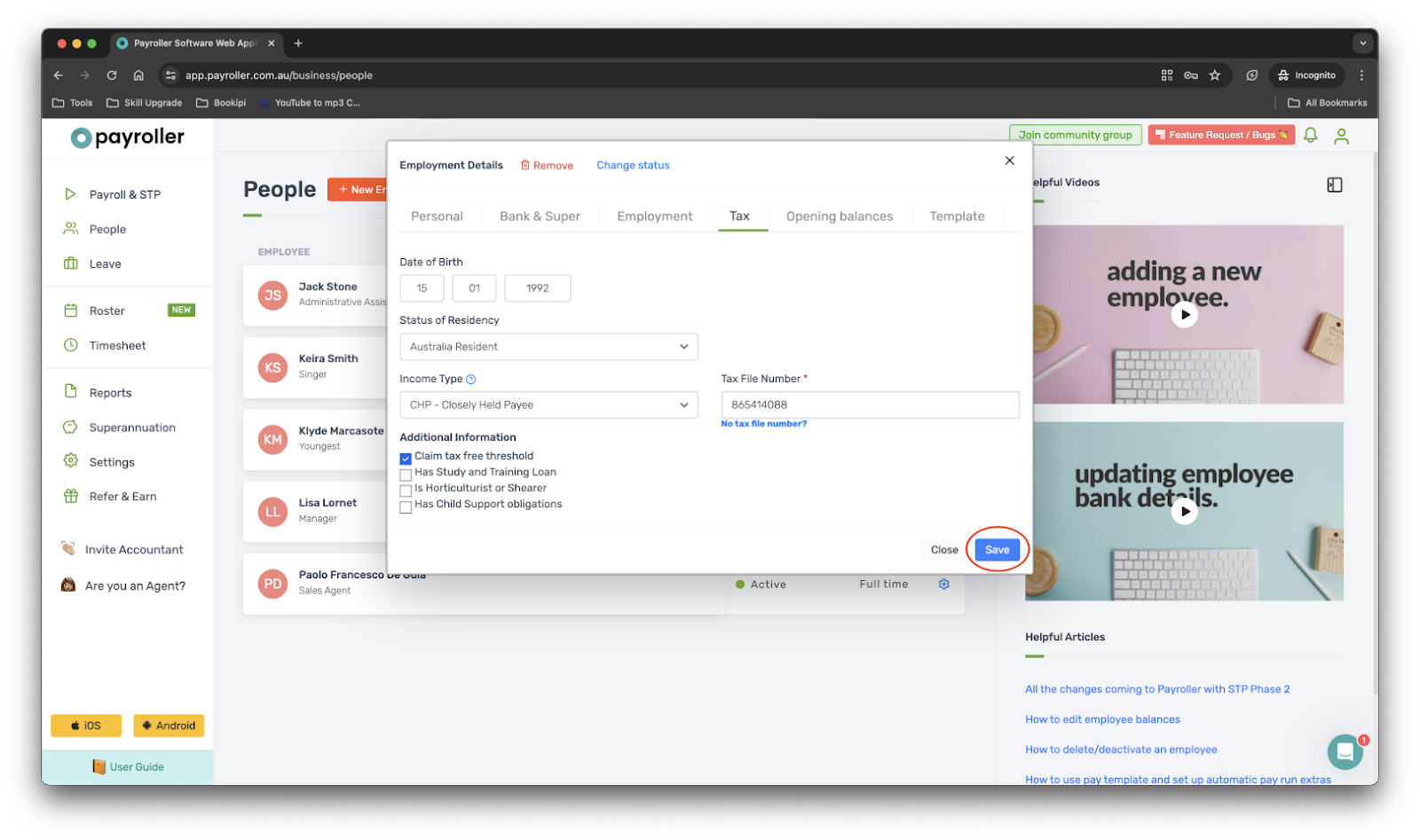

Step 6: Select ‘Save’ and ‘Close’.

You have now marked your employee as closely held.

Discover more tutorials for using Payroller

Set up Single Touch Payroll (STP) with our simple user guides.

Learn everything you need to know about Single Touch Payroll (STP) and sign up to try Payroller for free today.

Access the full features of Payroller on all devices across both the web app and the mobile app. Read our Subscription FAQs.