Learn how to set up a default super account for a new employee/ member in Payroller

Learn how to set up a default super account for a new employee/ member in Payroller with our simple guide below.

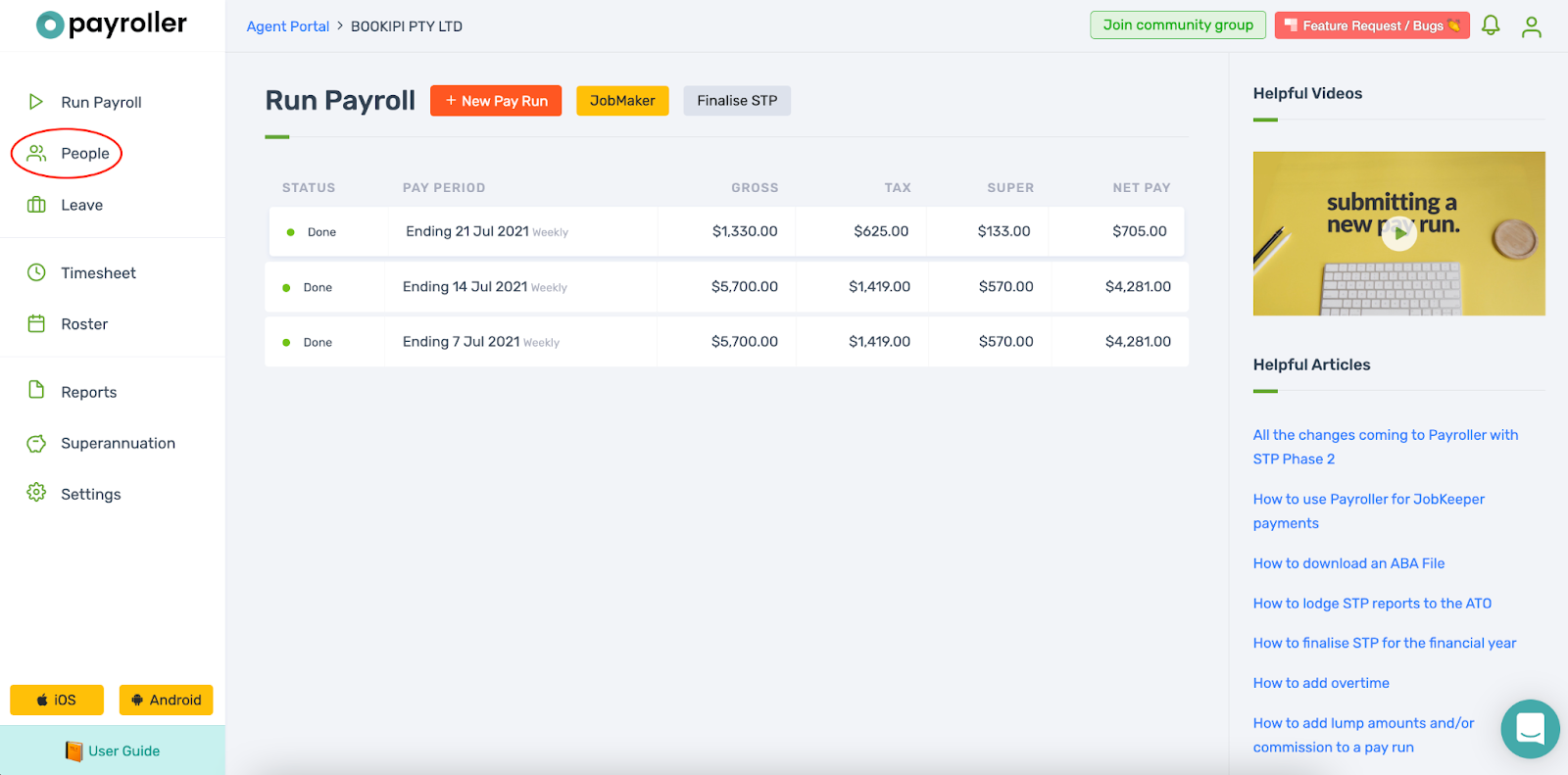

Click on ‘People’.

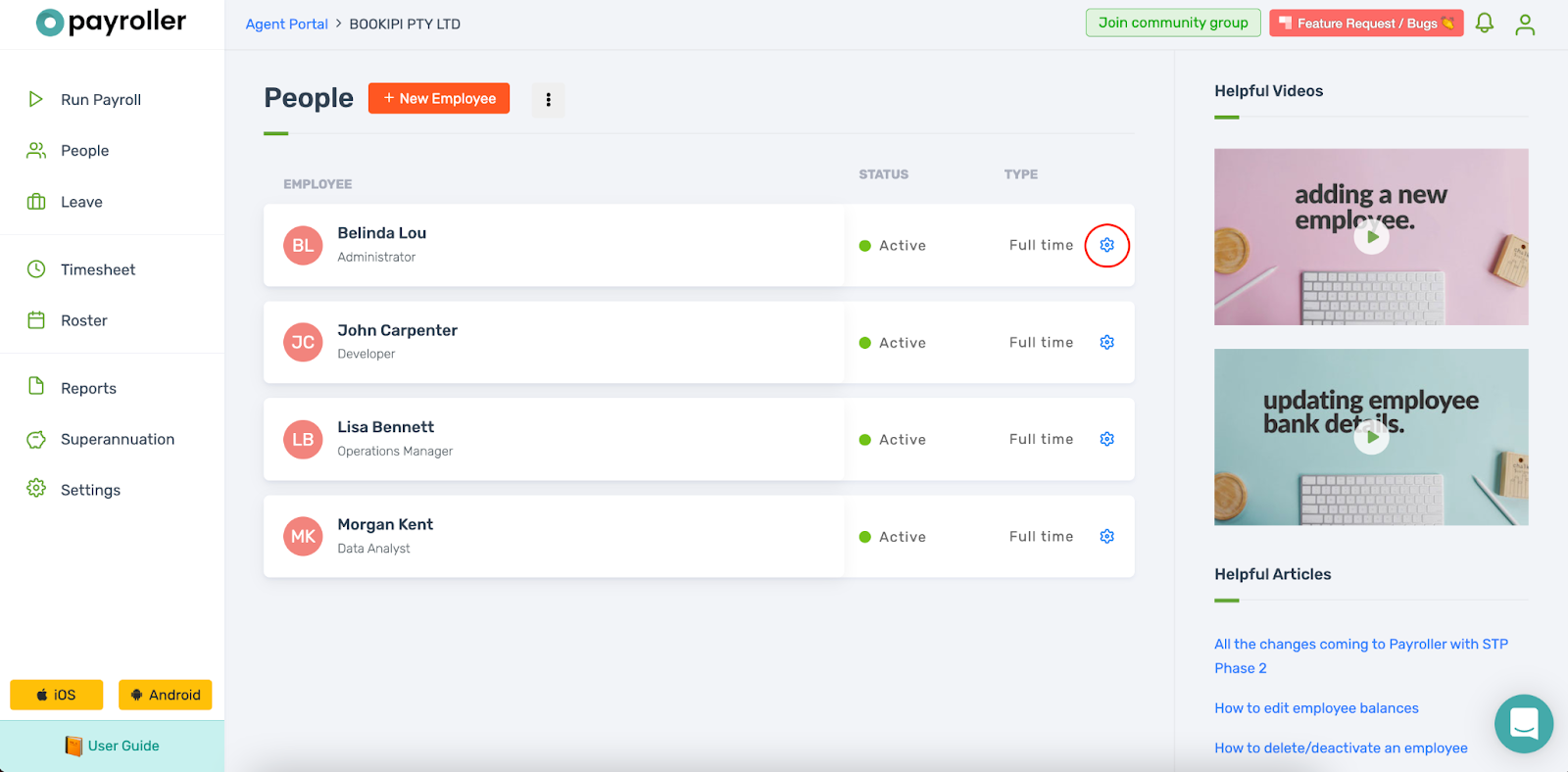

Select edit on the employee you would like to create a super account for.

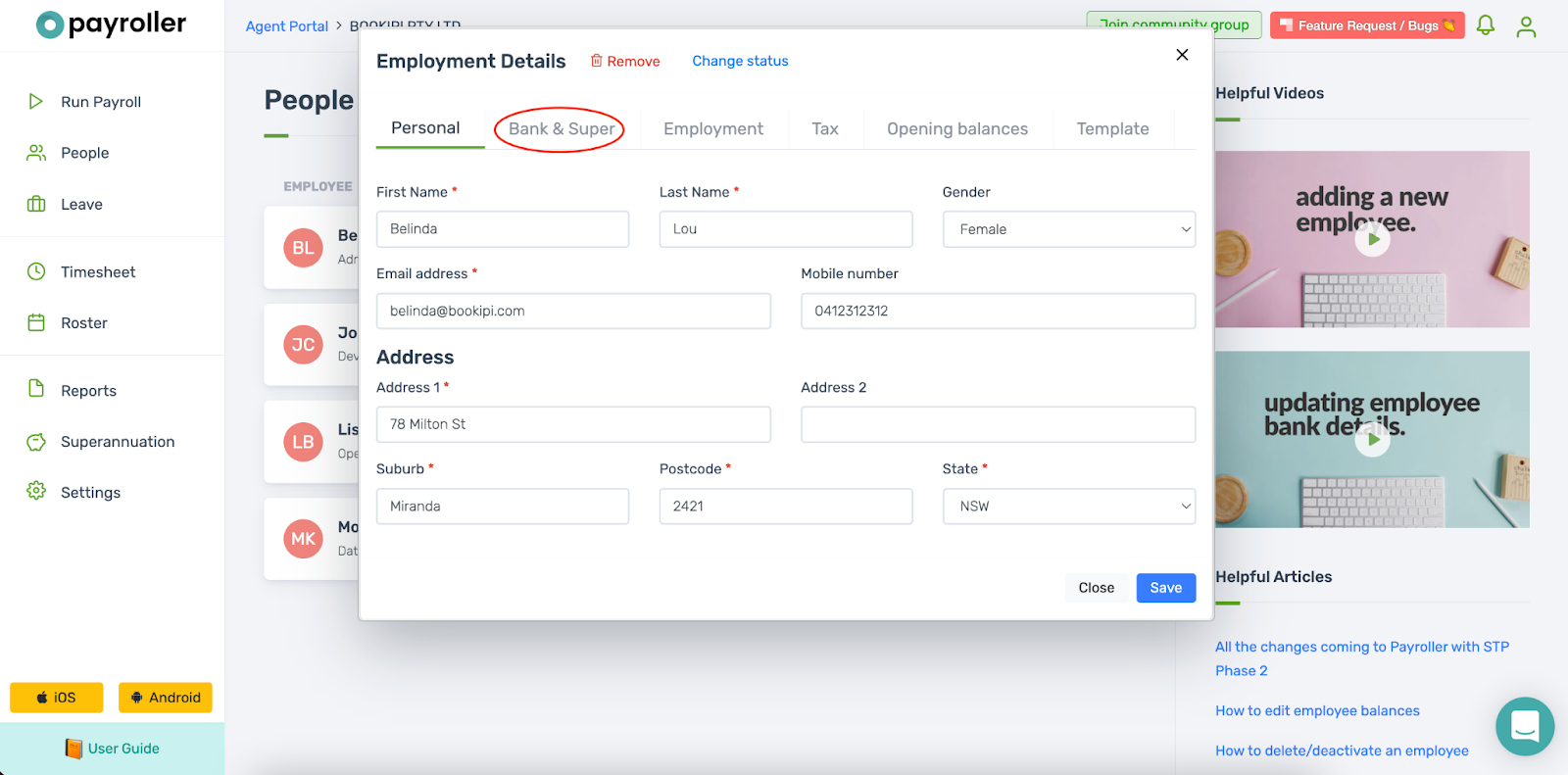

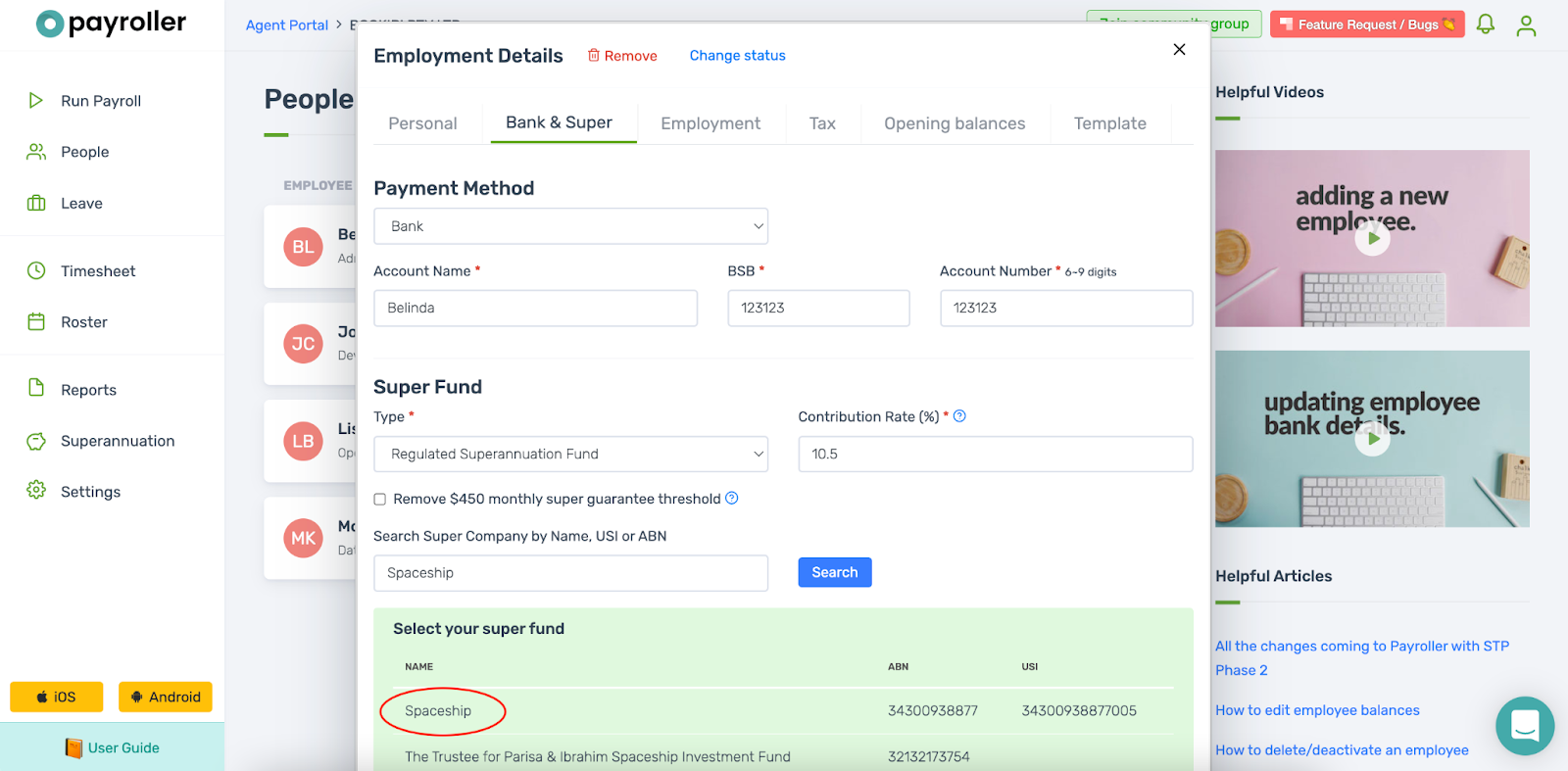

Select ‘Bank & Super’.

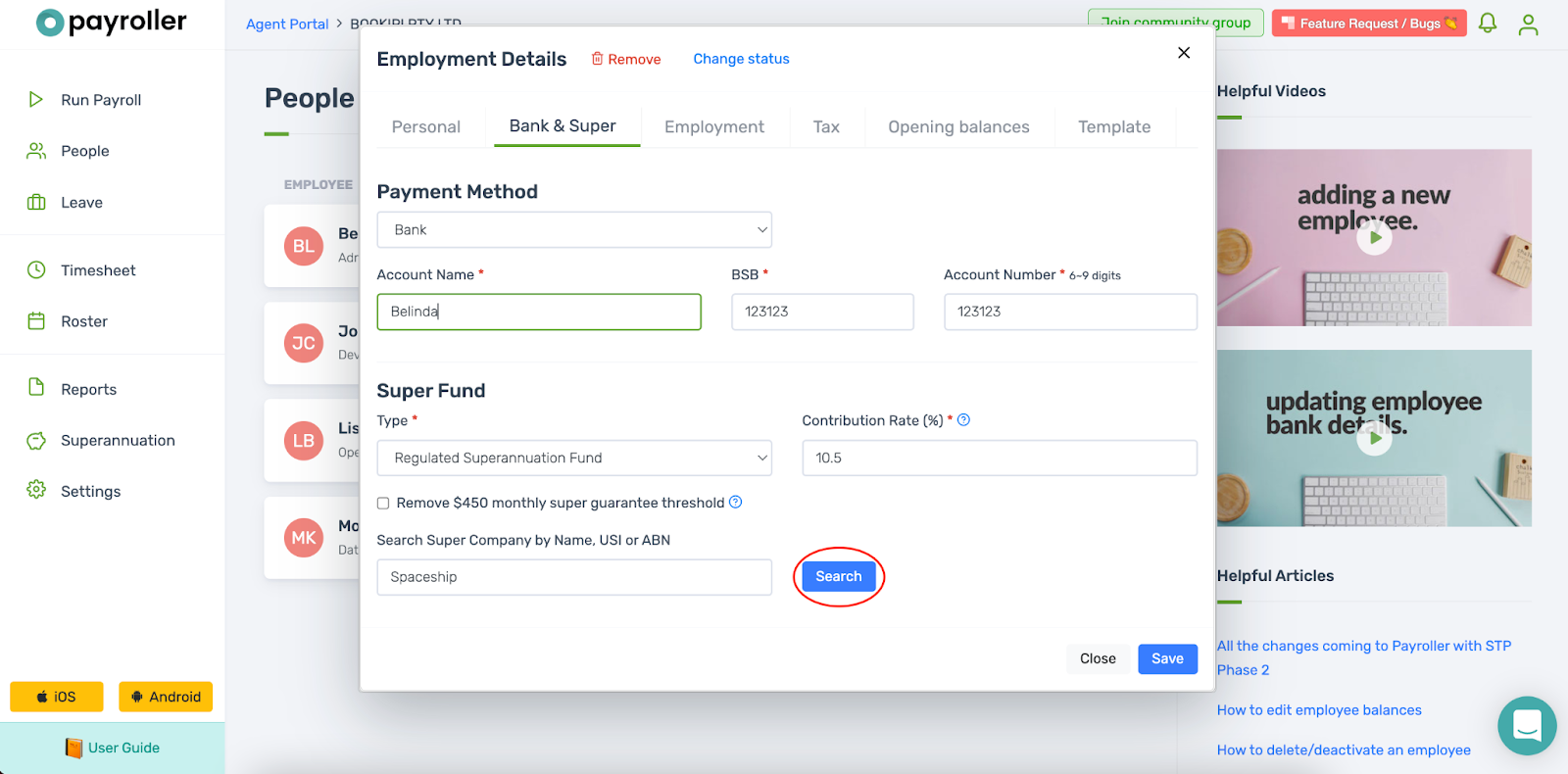

Enter the name of the super fund and click ‘Search’.

Select the correct super fund.

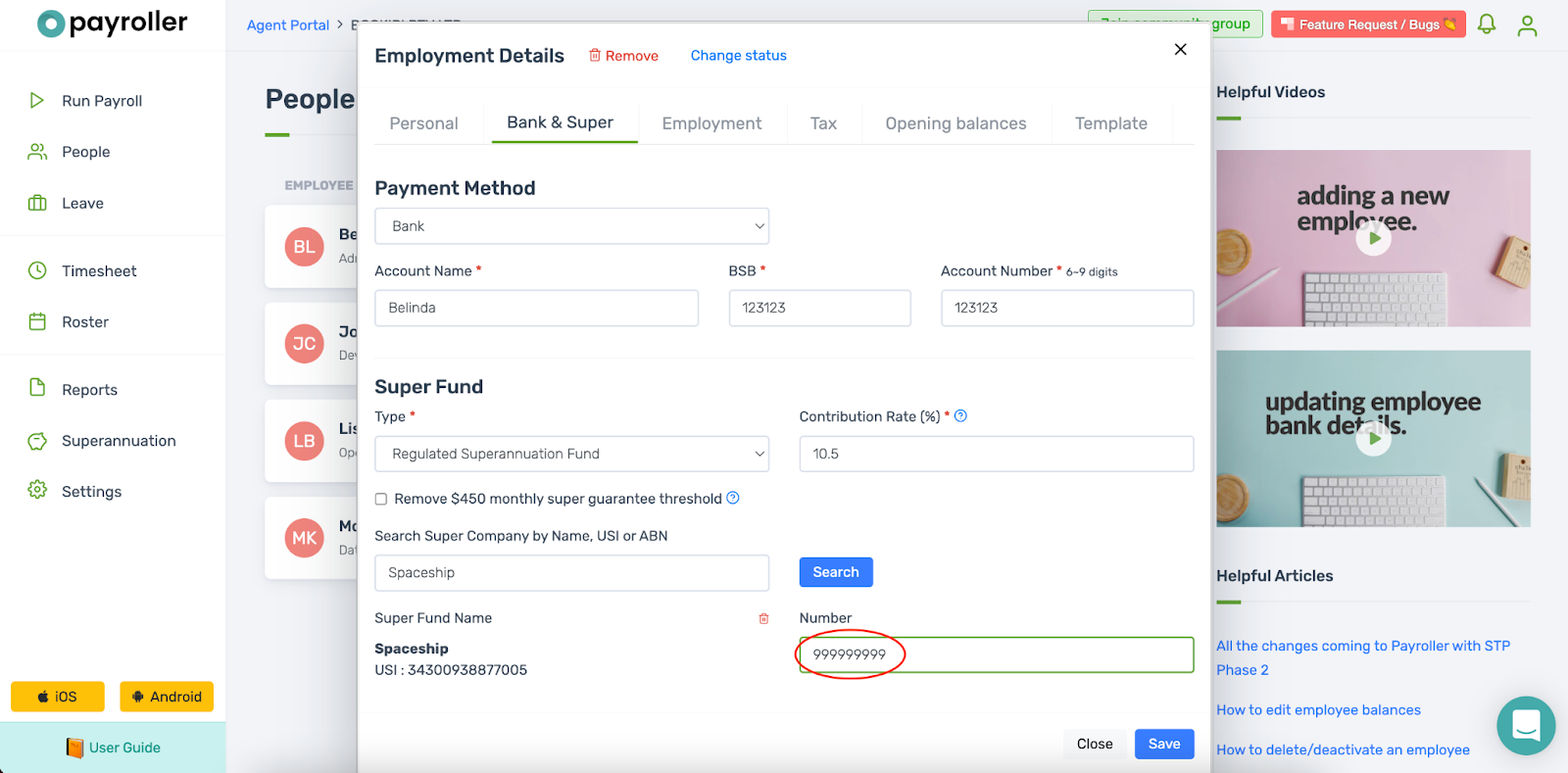

Enter the member number as nine 9’s (999999999).

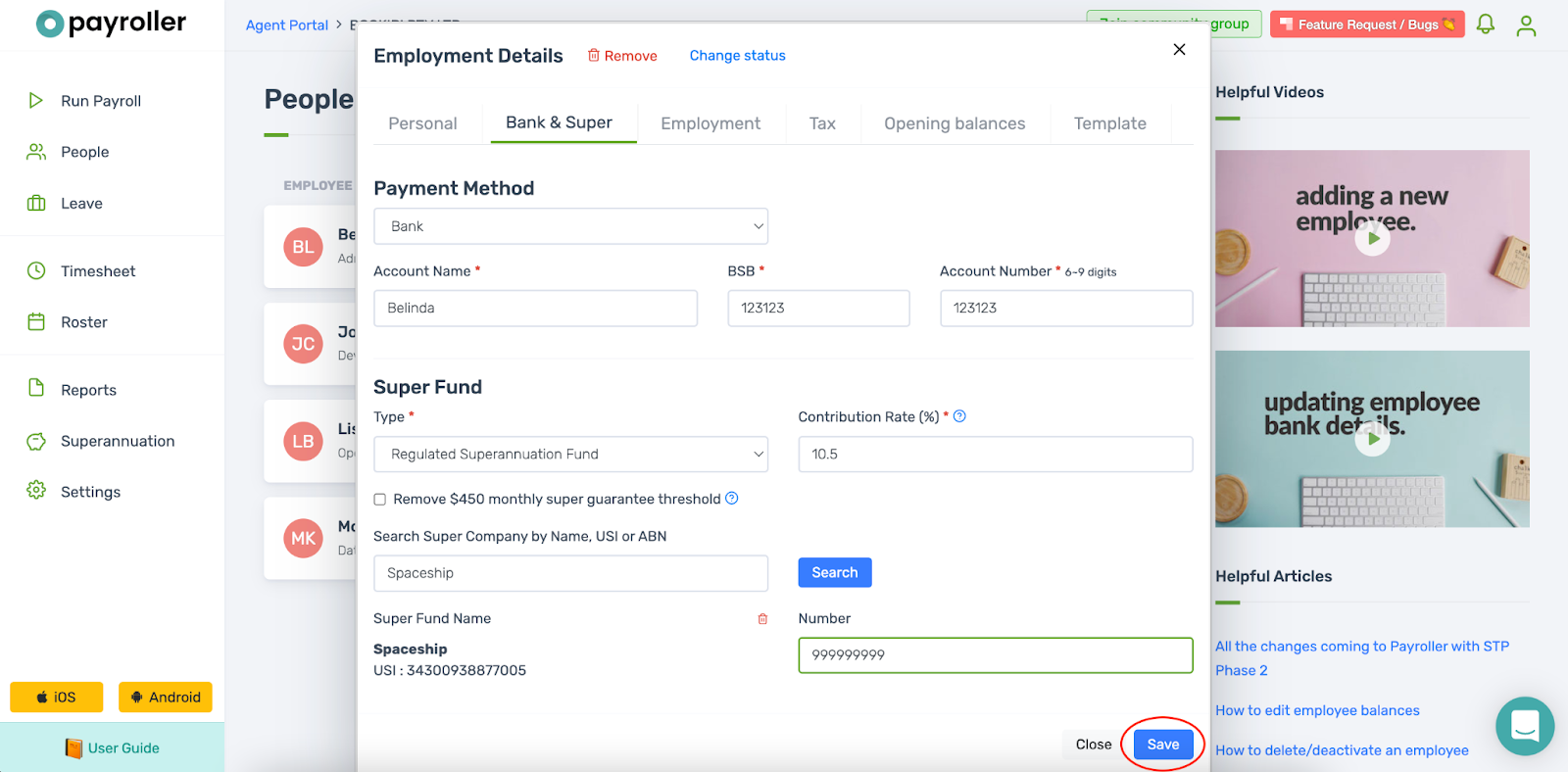

Click ‘Save’ to finish.

Finally submit a super batch through Superannuation and this will send a message to the superfund to create an account for the new member and will deposit the super they are owed into their new account. If this fails, you will be refunded the amount.

You will need to change the member number once the employee has received their new member number by email from the superfund.

For some superfunds, you will not be able to use this method. In this case, you will be refunded and you will need to contact the superfund to do this manually.

Discover more tutorials & get the most out of using Payroller

Try out Payroller for free. Learn how to create and submit a pay run.

You can also get a Payroller subscription that gives you access to all features via the web and mobile app. Read up on our Subscription FAQs.

Invite your accountant, bookkeeper or tax agent to help you run your business payroll with our guide.