Payroll made accessible.

- 5 minute setup

- No credit card needed

- No contract period

Create your free account now.

*By clicking “Try For Free“, you agree to our terms of services and privacy policy.

Introducing Payroller, the ultimate payroll solution for bricklayers

Managing your business payroll is easy and hassle-free with Payroller.

Create your free account now.

Payroll made accessible

STP-approved by the Australian Tax Office (ATO)

Simplify and automate all your payroll and STP processes

Keep clear records of who’s been paid in real-time

ExcellentBased on 3027 reviews

Marika Martinez25 June 2024easy to use payroll system

Marika Martinez25 June 2024easy to use payroll system Karen Coatsworth28 May 2024easy to use once set up

Karen Coatsworth28 May 2024easy to use once set up Barry Howat16 May 2024Best app ever, works well very very easy to use recommend it for any one, Luv IT! Well done. Cheers Baz The Weed Terminator. Esperance WA.

Barry Howat16 May 2024Best app ever, works well very very easy to use recommend it for any one, Luv IT! Well done. Cheers Baz The Weed Terminator. Esperance WA.

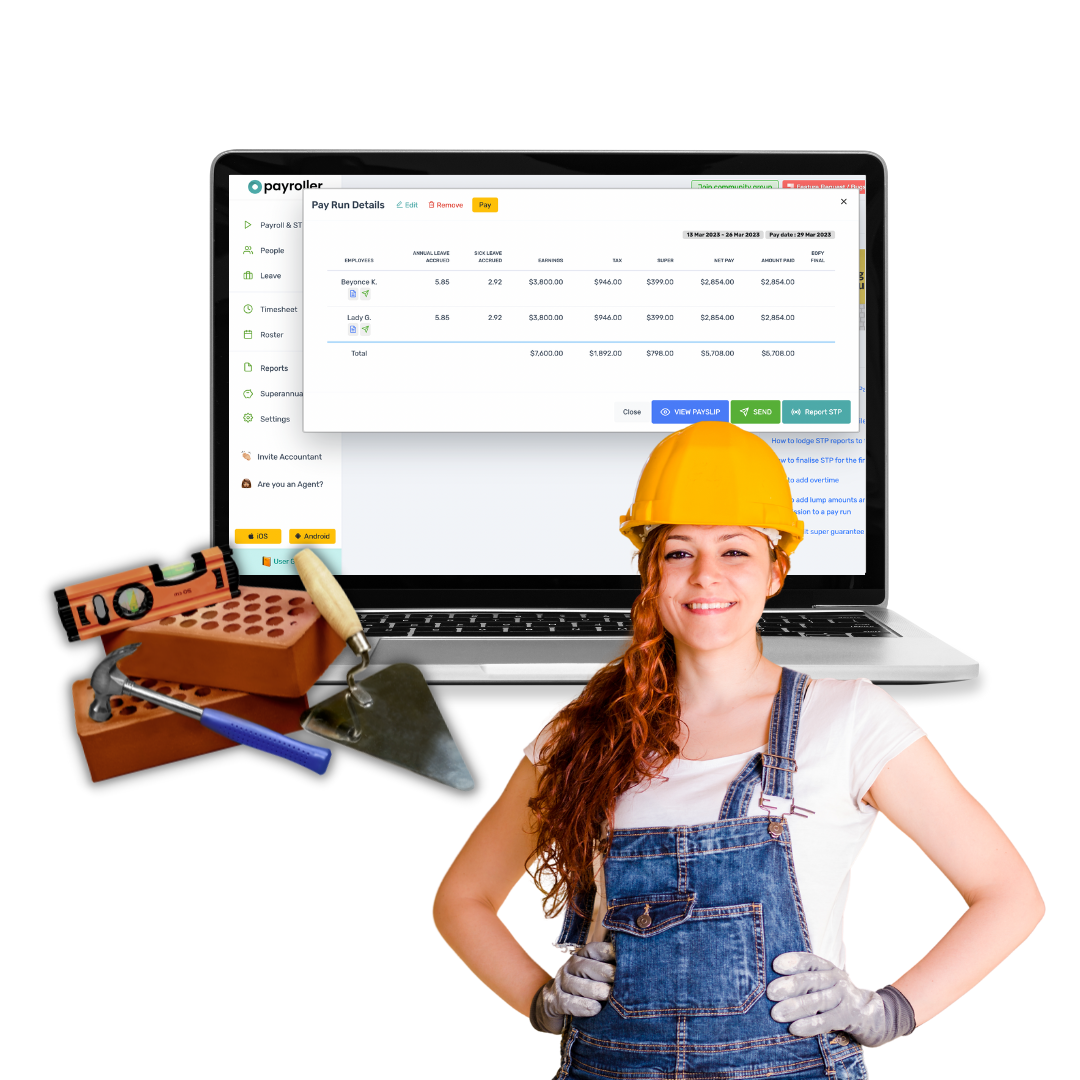

Get payroll right for your bricklayers in Australia. It’s easy to run payroll using Payroller’s automated calculations of pay, taxes, and leave for your workers.

It’s easy to set up casual, temporary, part-time and full-time employees using Payroller. As a bricklaying business you must consider applicable awards or enterprise agreements for your workers. Customise different pay, working hours, deductions, entitlements to suit individual worker needs using our simple single touch payroll (STP) system.

With Payroller, you can also meet Fair Work obligations by sending payslips to your staff straight from payroll.

Payroll made accessible.

Create your free account now.

*By clicking “Try For Free“, you agree to our terms of services and privacy policy.

Payroller is the smoothest Single Touch Payroll (STP) solution for busy bricklaying businesses. Add and manage employees’ details in your cloud-based Employer portal. Make and access payroll on any device including mobile app and web.

You can also make and edit work schedules and rosters for bricklayers and workers with Payroller. Improve communications with your employees when you invite your bricklayers to our free Employee mobile app. Connect employees to your business so they can accept rostered shifts, submit timesheets for your approval and view their payslips.

You can track your bricklayer and subcontractors’ work sites, working hours, and days off with Payroller.

Make and send Fair Work compliant payslips to your bricklayer employees straight from your business payroll. Payroller’s integrated payslip and payroll solution saves time. Focus instead on building your bricklaying business.

With Payroller, your bookkeeper or accountant gets instant and free access to your payroll via a dedicated Agent portal. Don’t waste time sending emails or exporting files for your tax agent.

Use our automated payroll system to securely share your business’ payroll with your accountant. Sign up to Payroller to try the easiest payroll solution for bricklaying businesses in Australia for free.

“Try for free” allows you to discover if Payroller is the right software for you and your business before you commit to our platform. “Try for free” is cost and commitment-free and we do not require any credit card details to sign up. So give Payroller a try, it only takes a few minutes to get set up.

While the Payroller mobile app is completely free – fees will apply to use the Payroller web app, Xero integration, and to make super contributions through our integrated super clearing house (Beam).

Bricklaying businesses need payroll software with timesheet functionalities or integration to capture accurate working hours, including regular pay, overtime, and days worked on public holidays. The software should also calculate PAYG withholding tax, SG contributions, and relevant state payroll tax.

Reporting tools can also make tax time easier. Make sure the software you choose generates reports for taxes, superannuation, and payslips.

You can pay your bricklaying employees through a few different methods:

Employers and owners of bricklaying businesses need to look out for the following tax forms:

Payroll tax calculations depend on your state or territory and their payroll tax thresholds. If your business surpasses the threshold (e.g., $700,000 annually in Victoria), you’ll need to register for payroll tax and calculate the amount owed based on your total wages paid. Specific payroll tax rates and calculation methods vary by state/territory, so consulting a registered tax agent or the relevant state revenue office is recommended.

Payroller is an STP-enabled software that automatically submits payroll information to the Australian Taxation Office (ATO) – through a secure cloud network – whenever you perform a payrun. Payroller helps you to track, manage and record your payroll while safely sharing that information (and staying compliant) with the ATO.

As a truly one-stop payroll solution, you can manage staff roster, invite your accountant, bookkeeper or BAS agent and even make Super contribution (Beam) on Payroller.

Absolutely, you may share your account and even set different access permissions.

Only a few minutes. The majority of our customers get up and running within 15 minutes. If you do need more help in getting set up, simply reach out to our capable live agents and they will have you using Payroller like a seasoned user in no time. Check out our handy user guides.

Yes, Payroller is integrated with Xero. By connecting your Xero account to Payroller, you can easily export and share payroll information cross-platforms.

Payroll made accessible.

Create your free account now.

*By clicking “Try For Free“, you agree to our terms of services and privacy policy.