What is a payroll report? Types, how-to & tips for Australian businesses

Payroll reports are like a window into your business’s financial health, especially regarding employee pay and government contributions. Navigating these reports can be tricky for those outside the payroll team. This guide aims to simplify your process.

Try Payroller today and say goodbye to payroll and STP headaches!

By clicking Try for Free, you agree to our terms of services and privacy policy.

What is a payroll report?

A payroll report is a document that summarises staff pay details for a specific period. They typically include the following information:

- Employee name

- Gross pay

- Deductions from tax and superannuation

- Net pay

- Pay date and period

These reports help maintain important records for legal, tax, and payroll compliance. You can also leverage data from payroll reports to improve how you run your business. Payroll reports are an excellent place to start if you want to analyse labour costs and track leave and overtime.

Employees also use these reports to see their earnings for tax purposes and loan applications.

When to create payroll reports

While the specific information might differ, payroll reports are similar regardless of frequency. Whether you need to create the following reports depends on how your business runs and pays its employees.

Weekly payroll reports

Businesses that need weekly payroll reports will typically have a weekly payroll schedule. This is a popular choice for employees on an hourly wage, such as in manufacturing and construction payroll. Because of the frequency of the reports, it’s easier to track overtime.

You may choose to have weekly payroll reports for internal reasons. This provides your finance team frequent chances to verify labour costs and keep the records clean, but this could be time-intensive. As a result, some businesses may opt for a biweekly payroll schedule instead.

Weekly reports are typically made at the end of the pay week. For example, if your business pay week runs from Monday to Sunday must create the reports on Friday or Monday of the following week.

Monthly payroll reports

These reports summarise the total payroll costs and employee payments for a calendar month. This means that a payroll report for February would need to be made on March 1st or shortly after, depending on processing time.

Monthly payroll reports can give you a more holistic view of your payroll expenses. You can use them to review broader staff cost trends and even compare between departments to make better financial decisions and future forecasts.

Quarterly payroll reports

Quarterly payroll reports are typically used for internal financial reporting, payroll tax, or benchmarking. They summarise payroll activity from the previous quarter (the past three months) and include details similar to other payroll reports but with a broader timeframe.

Depending on your internal reporting needs, you may create quarterly reports only at specific times within the year.

Annual payroll reports

Annual payroll reports summarise an employee’s total earnings and tax withheld for a whole financial year.

A payroll report for the entire financial year helps both businesses and employees. For businesses, it’s used to finalise payroll data, with superannuation and PAYG withholding, to the ATO. For employees, it’s used to complete their individual tax returns.

Annual payroll reports must be generated by the end of July, following June 30th. Payments made to employees outside of the regular pay cycle, such as commissions and bonuses, can be reported to the ATO in this way.

Managing your STP is easier with Payroller

Simplify employee management: Juggling payroll, benefits, and employee data? Let Payroller be your extra hand.

Sign up with Payroller today and share your payroll files on a regular basis with your accountant or bookkeeper. Visit our website to get started.

Types of payroll reports for Australian businesses

Payroll summary

A payroll summary is an annual report summarising an employee’s total earnings and tax withheld during a specific period. This standard payroll report provides data and insight on labour costs for budgeting reasons.

Tax filings

Tax filings drill down on tax withheld from employees’ wages. This isn’t a single report per se, but various filings to the ATO. Tax filings use data from payroll summaries and other financial documentation.

The following falls under tax filings:

- Pay As You Go (PAYG) Withholding reports: Reports tax withheld from employee salaries and wages throughout the year.

- Superannuation Guarantee (SG) lodgment: Reports superannuation contributions to employees’ super funds.

- Fringe Benefits Tax (FBT) return (if applicable): Reports taxable fringe benefits provided to employees.

Year-to-date (YTD) reports

These reports summarise payroll information for a specific period in a financial year (from July 31st to the current date). The timeframe is flexible for internal purposes, such as cost monitoring and forecasting.

YTD reports are helpful for businesses that want to track their payroll expenses and compare them to projections.

Payroll cost analysis

A payroll cost analysis gives businesses a deeper analysis of payroll data. This is where businesses can review a breakdown of employees’ salaries, wages, benefits, taxes, and leave and absence patterns.

How to create a payroll summary report

Set a time period for the report

Decide on the timeframe you want to cover in the report. This could be a weekly, monthly, quarterly, or annual period. Ensure the chosen timeframe aligns with your specific needs, whether for internal monitoring, tax reporting, or employee pay verification.

Input employee information

Gather and list the necessary employee details in your chosen format (spreadsheet, payroll software). This typically includes:

- Employee name

- Tax File Number (TFN), if applicable

- Employee ID, optional

Add payroll data

Collect and input relevant payroll data for each employee: gross pay, tax deductions, and net pay. Under tax deductions, indicate the following:

- Tax withheld (PAYG): Amount deducted for income tax

- Superannuation contributions (SG): Employer and employee contributions to super funds

- Other deductions (if applicable): Salary sacrifice contributions, garnishee orders, etc.

Send the report

Sending payroll summary reports depends on the purpose of the report. Internal reports may be kept for record-keeping purposes or digitally shared with relevant team members when requested.

Payroll reports for every pay run are sent electronically to the ATO using the Single Touch Payroll (STP) system, as required by law.

Tips for creating ATO-compliant payroll reports

Use STP-enabled payroll software

STP requires employees to directly report employee salary and tax information to the ATO during every single pay run. You’ll need STP-approved payroll software, which sends the report to the ATO on your behalf.

STP apps make this process easier for businesses by automating the report creation process, following the standards set by the Australian government.

Automate processes and calculations

Automating tasks like data entry, calculations, and report generation can significantly improve efficiency and accuracy in payroll processing. Your finance team will spend less time on manual tasks and reduce errors and inaccuracies.

Submit reports on-time

Timely submission of payroll reports is crucial for compliance with Australian tax and superannuation regulations. Late lodgement of reports can attract significant penalties from the

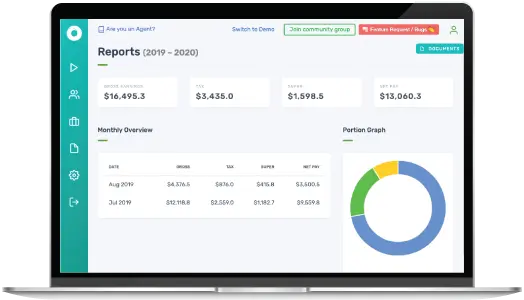

Run payroll and track staff costs with Payroller

Effective payroll reporting is essential for Australian businesses to ensure accurate record-keeping, timely employee payments, and compliance with various regulations by utilizing STP-enabled software, automating processes, and submitting reports on time.

The days of pouring over payroll records to ensure your money is going to the right place are over. With the proper payroll software, you can focus on activities to poise your business for success.

Frequently asked questions about payroll reports

In Australia, businesses are legally required to keep employment records for at least seven years after being created.

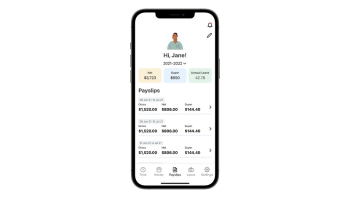

Payroll reports and payslips are different things. Payslips are individual statements for each employee, showing their gross pay, deductions, and net pay for a specific pay period. Payroll reports cover the same information for multiple employees.

STP (Single Touch Payroll) data is automatically reported to the ATO by your STP-enabled payroll software each time you pay your employees. This eliminates the need for separate end-of-month or end-of-year reports, streamlining the process and reducing the risk of errors.

It’s important to note that you are still responsible for ensuring the accuracy of the data reported through your STP software.

How does Payroller work?

Payroller is designed to make STP simple for small business employers.

Try Payroller for free as an Employer or accounting professional Agent

(accountant, bookkeeper or tax agent).