What is JobMaker?

On 6 October 2020, as part of the 2020-21 Federal Budget, the Australian Government announced the JobMaker scheme.

The scheme is aimed at trying to get businesses to hire young job seekers.

Employers can apply for the scheme from 7 October 2020 to 6 October 2021.

If their employee(s) is eligible, they can claim JobMaker for a maximum of 12 months from their employment commencement date.

They will receive:

-

$200 per week for each eligible additional employee aged 16-29 years old

-

$100 per week for each eligible additional employee aged 30-35 years old

Registering for the JobMaker scheme

Eligible employers can register for JobMaker from 6 December 2020.

You do not need to be registered before you hire an eligible employee.

You must register for the scheme before the Claim period due date of the first JobMaker period they are claiming for.

You only need to register ONCE for the scheme but you will need to make a claim through your STP-enabled payroll software to prove that the employee has met the minimum hours requirements.

Payments will be made in arrears.

How to register for JobMaker

To register for JobMaker, employers must provide their:

-

baseline headcount

-

baseline payroll amount

-

contact details.

You can provide this information through:

-

ATO online services through myGov

-

the Business Portal using myGovID

-

your registered tax or BAS agent

You CANNOT register if any of the following apply to you. You:

-

do not have an active Australian Business Number (ABN)

-

had the Major Bank Levy imposed on you or a member of your consolidated group for any quarter on or before 30 September 2020

-

are an Australian government agency (as defined in the Income Tax Assessment Act 1997)

-

are a local governing body

-

are wholly owned by an Australian government agency or a local governing body

-

are a sovereign entity

-

are a company in liquidation or provisional liquidation

-

are an individual who has entered bankruptcy.

Key dates

Start of JobMaker scheme: 7 October 2020

- The JobMaker scheme starts on 7 October 2020.

- Employees hired from this date will be eligible for the JobMaker scheme.

- Claims can be made for eligible employees hired up until 6 October 2021.

- Employees hired on or after 7 October 2021 will not be eligible for the scheme.

Registrations open: 6 December 2020

- You can register your business for JobMaker from 6 December 2020.

- You only need to register once and you must register before you claim any payments.

- You must register before the due date of the Claim Period to be eligible for the specific JobMaker Period you are claiming.

JobMaker ends: 6 October 2022

The last JobMaker scheme will end on 6 October 2022

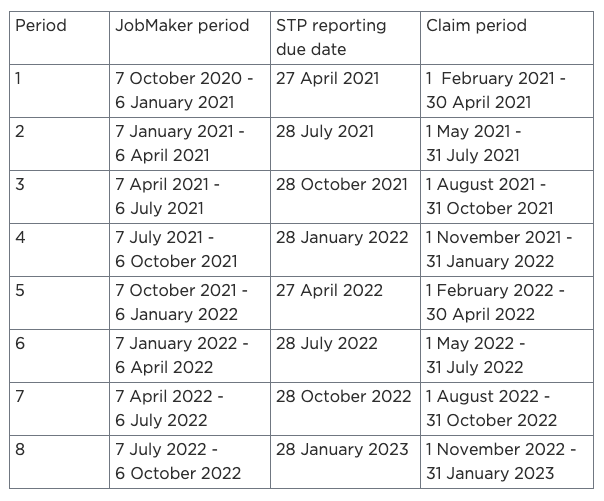

JobMaker claim periods

- If you hire an eligible employee during the JobMaker period, you can claim the payment from the start of the Claim period.

- You can only claim JobMaker if you are registered for the scheme and if your business meets the other eligibility requirements (this includes reporting through Single Touch Payroll).

- You can only claim JobMaker for that period up until the final day of the corresponding claim period.

STP reporting due dates

You must meet the STP reporting obligations for each JobMaker period you want to claim.

The reporting due date is three days before the end of the relevant Claim period.

You can see JobMaker periods, STP reporting due dates and Claim periods in the summary below:

For employers

If you hire new employees, you may be eligible to claim JobMaker.

If you and your employees meet the eligibility criteria, you can register and claim JobMaker payments for 12 months for each new job that goes to an eligible employee.

Employer eligibility

For an employer to be eligible for JobMaker, the employer must:

-

have registered for the JobMaker scheme

-

either: operate a business in Australia – be a not-for-profit organisation operating in Australia – be a deductible gift recipient (DGR) endorsed either as a public fund or for a public fund you operated under the Overseas Aid Gift Deductibility Scheme (DGR item 9.1.1) or for developed country relief (DGR item 9.1.2)

-

have an Australian Business Number (ABN)

-

be registered for Pay As You Go (PAYG) withholding

-

have not claimed JobKeeper for a fortnight that started during the JobMaker period

-

be up-to-date with income tax and GST returns for the two years up to the end of the JobMaker period they are claiming

-

satisfy the payroll and headcount increase conditions

-

satisfy reporting requirements, including Single Touch Payroll (STP) reporting

An employer is ineligible for JobMaker if the employer:

-

had the Major Bank Levy imposed on the entity or a member of its consolidated group for any quarter on or before 30 September 2020

-

is an Australian government agency (as understood in the Income Tax Assessment Act 1997)

-

is a local governing body

-

us wholly owned by an Australian government agency or local governing body

-

is a company in liquidation or provisional liquidation

-

is an individual who has entered bankruptcy

-

is disqualified because the organisation terminated the employment or reduced the hours of work of an existing employee(s) for the purpose of receiving or increasing JobMaker payments

-

is a sovereign entity. This includes a body politic of a foreign country or a foreign government agency. Resident subsidiaries of a sovereign entity may be eligible employers if they satisfy the other eligibility criteria and are not ineligible due to any other exclusion. This is different from JobKeeper where resident subsidiaries were not eligible employers.

Terminating employment or reducing hours of existing employees

You will not be eligible or you will be disqualified if you artificially inflate your headcount or payroll by terminating or reducing the hours of existing employees to access or increase JobMaker payments.

If you are disqualified, you lose all JobMaker entitlements for:

-

any JobMaker period that ends after the termination or reduction in hours occurs

-

all subsequent periods

Generally, this does not apply to a termination or reduction in hours that the employee has volunteered for to better suit their needs or preferences.

However, if the employer is seen to be manipulating or coercing the employee into agreeing, this may be in the scope for disqualification.

JobMaker & other government payments

You cannot receive JobMaker if you received a JobKeeper payment for a fortnight that started during the JobMaker period.

To receive JobMaker you must not claim for any of the following wage subsidies for an employee:

-

Supporting Apprentices and Trainees Wage subsidy

-

Australian Apprentice Wage subsidy

-

Boosting the Apprenticeship Commencements Wage subsidy

-

Restart, Youth Bonus, Youth, Parents or Long-term Unemployed Wage Subsidies

STP reporting obligations

Once you are registered for the scheme, you meet the following reporting requirements to remain eligible and make a claim:

-

reporting specified information through STP

-

completing a claim form for each JobMaker period you are eligible for

Certain employee information must be reported through STP. You will not be able to claim JobMaker unless your STP reporting is up to date.

STP reporting is due three days before the end of the claim period.

The following must be reported through STP:

-

tax file number (TFN)

-

date of birth

-

full name

-

start date of employee (if occurring in the JobMaker period)

-

end date of employee (if occurring in the JobMaker period)

-

whether your employee met the hours required

You must also complete your claim through the ATO online services or the Business Portal every claim period.

You need to report:

-

your baseline payroll amount – this may be different from the amount provided in the registration form if the number of days in the period is different. If this is the case, you will need to submit an updated baseline payroll amount.

-

your total payroll amount for the JobMaker period

-

your headcount at the end of the JobMaker period

Information about who you are claiming for will be populated through STP.

You must make a claim within the claim period. If you miss the due date, any payment you were entitled to will expire and you will not be able to make another claim for these amounts.

Tax

All payments from JobMaker are assessable as ordinary income. The normal deductions apply for amounts your business pays to employees if they subsidised by JobMaker.

JobMaker amounts are not subject to GST and do not need to be included in your business activity statements (BAS).

Your eligible employees

Your new employees are eligible if they:

-

are an employee of the entity during the JobMaker period

-

are 16-35 years old when they commenced employment

-

began their employment on or after 7 October 2020 and before 7 October 2021

-

worked or were paid for an average of at least 20 hours per week they were employed in the JobMaker period

-

have completed a JobMake employee notice for the employer (and have not completed one for another current employer)

-

received one of the following payments for at least 28 consecutive days (or 2 fortnights) in the 84 days (or 6 fortnights) prior to starting employment:

-

JobSeeker Payment

-

Parenting Payment

-

Youth Allowance (except if you receiving the payment because you are completing full-time study or are a new apprentice)

-

The following employees are not eligible for JobMaker even if they satisfy some of the requirements:

-

Business participants: This includes sole traders, partners of a partnership, trustees and beneficiaries of trusts (that are not widely held unit trusts) and directors or shareholders of companies (that are not widely held).

-

Close associates:

-

If a business participant is an individual: Close associates include their spouse and relatives of the individual or their spouse (parent, grandparent, brother, sister, uncle, aunt, nephew, niece, lineal descendent or adopted child, or the spouse of one of the above).

-

If a business participant is not an individual: The business participants (who are individuals) and their relatives that are also not eligible include, partners of a trust, trustees and beneficiaries of trusts (that are not widely held unit trusts), directors or shareholders of companies (that are not widely held).

-

-

Widely held companies and unit trusts.

-

Employees who started current employment 12 months or more before the start of the period

-

Employees aged 36 years or older when they started employment

-

Employees aged 15 years or younger when they started employment but turn 16 after employment

-

Contractors

Minimum hours requirement

To be an eligible additional employee and receive JobMaker, an employee must do a minimum average 20 hours of work per week across each JobMaker period from the date they are employed.

This can include either the hours the employee is paid for or the number of hours worked.

- Hours paid includes paid overtime, paid leave and paid absences on public holidays but it does not include unpaid leave. This may work better if your workplaces paid employees on a hourly or similar basis.

- Hours worked is the number of hours worked plus any unpaid overtime, paid leave and paid absences on public holidays. This may work better if your workplace does not pay employees on a particular rate, i.e. salaried employees.

The minimum hours tests looks at the average hours worked across the JobMaker period not whether they did exactly 20 hours each week.

If your employee does not meet the minimum hours test for one JobMaker period, they will not be eligible for that period.

However, if they meet the minimum hours test in one of the following periods, they may be eligible for that period.

For employees

JobMaker is given to your employers to incentivise them to hire new young job seekers.

The payment is made to eligible employers for each eligible new employee they hire.

Your employer will then use this to subsidise the wage of the eligible new employees.

If you are eligible for JobMaker, you will not receive JobMaker on top of your salary, wages or other payment.

Your employer will pay your wages as they normally would and the paying of it will be subsidised for them.

What you need to do as an employee

If your employer wants to claim JobMaker, they will ask you to fill in a JobMaker employee notice.

Besides that, your employer is responsible for applying and managing the payments.

The employee notice will ask you to declare that you:

-

were aged between 16-29 or 30-35 years when you commenced employment

-

you received one of the following payments for at least 28 consecutive days (or two fortnights) in the 84 days (or six fortnights) before beginning your employment – JobSeeker Payment – Parenting Payment – Youth Allowance (except if you receiving the payment because you are completing full-time study or are a new apprentice)

-

have not filled in a JobMaker employee notice for another employer that you are also working for.

After completing this for your employer, they will take care of the rest.

You can incur penalties if you make a false claim in the declaration you give your employer.

To calculate the number of days you received income support, you can count the days that included a nil payment.

If you had a nil payment because you were on a nil rate period, a suspension that would generally be lifted or a waiting period, you can count these days.

Working for two employers

You cannot provide two notices to two employers if you work more than one job.

You can only give notice to a second employer if you are no longer working for the employer you gave notice to.

This applies even if your current employer chooses to stop participating in JobMaker.

You can only give notice to another employer if you

-

are no longer employed by the original employer you gave notice to

-

were eligible when you commenced employment with the other employer

Income support and JobMaker

You may still be eligible for income support if you need financial help while receiving a wage and your employer claims JobMaker.

If you are currently on income report, you must report all income that you get from your employer to Services Australia as you normally would.

The income you receive may affect your income support payments.

You do NOT need to report that your employer is claiming JobMaker as you do not receive this income.

Your employment income may affect your ability to claim income support payments or it could reduce the amount you receive.

If you don’t report the income, you might incur a debt you’ll have to repay or you may need to cancel your JobSeeker payment.